Wait and Seethe

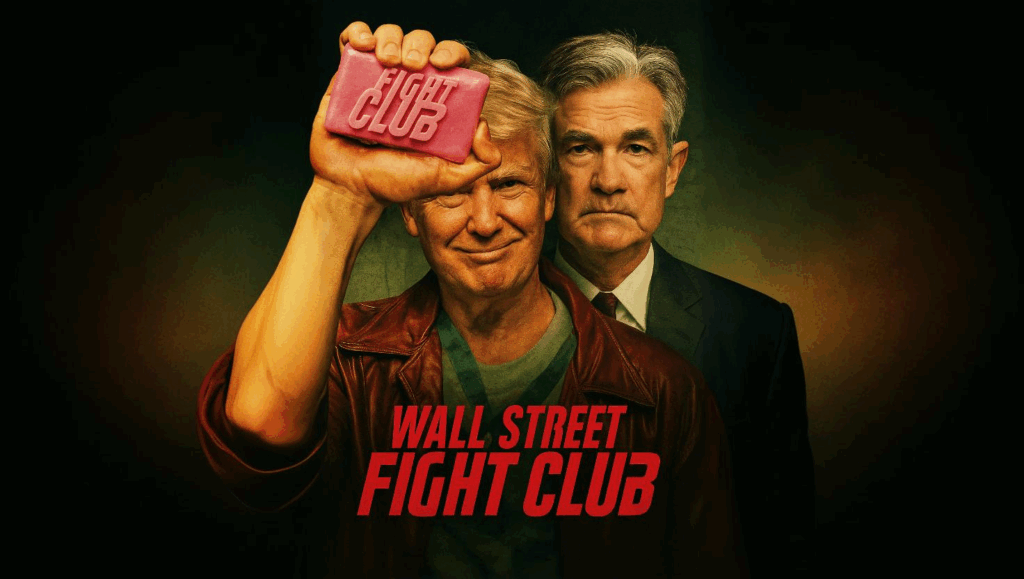

Last night, everyone was hanging on Jerome Powell’s every word. Well, “hanging”… so to speak. Because in reality, everyone had known for three days already that he wasn’t going to do anything, say anything, or especially change anything. But hey, we’re human—and not just any humans, humans who want to invest, get very rich, and never work again—so we always hope that this time, something decisive will happen. Something that will change everything forever and show us the way. Well. It’s not happening this time either. Still no rate cut, still no hike, just… more fog. The Fed has kept rates unchanged for the third time in a row. Still between 4.25% and 4.5%, that same old monetary corridor in which Powell walks his colleagues—and us—around. A bit like a dog on a leash, not really knowing where we’re going. The real question is: does he know where he’s going? And after last night—if we still had any doubts—we’re pretty much sure that he doesn’t know any more than we do and that he’s waiting for a clear and definitive signal from the economy to move forward. Except the economy is currently taking hits without really knowing where it’s heading—or where it’s supposed to go. So why didn’t Powell cut rates last night? One reason, always the same—except this time, it’s even bigger: uncertainty. Translation: we still haven’t figured out what Trump is doing with his tariffs, but we need to say it diplomatically, otherwise the gentleman might get angry. He’s not exactly thrilled with the job we’re doing, so it would be dumb to piss him off even more. In its statement, the Fed noted that “the risks of a return of inflation and a rebound in unemployment have increased.” We’d tend to call that potential stagflation. But they’re more diplomatic and call it “a slight deterioration of the economic outlook.” Clearly, they’ve mastered the art of understatement. Something I haven’t. The geopolitical-economic stroke of genius And here comes Donald Trump, the only man capable of tanking an economy by tweeting from anywhere in the world—and at any time. Powell more or less implied it. Still, we know that his new waves of tariffs—which remain as vague and uncertain as ever—are also potentially huge. Result: American companies went panic-buying on imports, which inflated the trade deficit by +14% — and tanked Q1 GDP. Well played. It’s not the only reason for the NON-CUT in rates, but it’s definitely a central one. Meanwhile, what’s Powell doing? He’s “waiting to see.” Wait and see, 2025 edition. It’s not even flying blind anymore—it’s navigating by the stars. One could imagine Powell walking around with a sextant trying to figure out what to do with rates, but since we’re in the fog, it’s hard to see any stars. A press conference full of conditionals In his press conference, Powell said things. Lots of things. Too many things. But if we had to sum it all up, here’s the gist: he said “we don’t know. We’ll see. And most importantly, we don’t want to screw it up.” Okay, he clearly didn’t say it like that. At least not with those exact words—but that’s basically what it means. The guy’s in a tunnel with no light for miles and not a glimmer on either end. Honestly, even if he wanted to turn back, it’s not even certain he’d find the exit. Basically, Trump’s tariffs could very well “delay the decrease in inflation by a year.” And so—mechanically—“delay the rate cuts by a year too.” But that’s not certain. But it’s possible. But we’ll see. But maybe not. Yes, I agree with you, that’s not the clearest press release ever, but it really shows that he has absolutely no idea what’s going on, yet still had to say something without looking completely lost. He sounds like a teenager explaining to his parents why he didn’t do his homework—and that, in any case, it’s not his fault. Oh, and he also threw in a line that was clearly aimed at his parents—uh, I mean—clearly aimed at Trump, because he took the time to explain that the Fed cannot be preemptive. In other words: “we can’t act before it’s too late—can’t act in anticipation—because we have no idea what’s going on.” We have no idea where the economy is headed in general and inflation in particular. We can’t “make plans” because we don’t even know what kind of mess this economy is going to end up in with all this tariff chaos. Powell vs. Trump: The Silent Duel What was fascinating about last night’s statement is that Powell didn’t mention Trump once. He only referred to “uncertainty surrounding trade policy,” “tariffs,” and “unstable external conditions.” The President must have loved being considered an “unstable external condition.” Still, even though Powell never mentioned Trump by name, everyone understood the message loud and clear — saying nothing and naming no one is a powerful way to emphasize that the Fed remains independent and isn’t here to please the current hysterical President. Trump has been hounding Powell for months to lower rates. He’s threatened (implicitly) to fire him. He calls him incompetent, a “loser,” a traitor to the nation. And Powell, stoic, replies: “I don’t see any reason to request a meeting with a president. That’s not part of my job.” Classy. Cold. Clinical. And probably boiling inside. Meanwhile, Trump is likely smashing Oval Office furniture in a fit of rage. What now? So, what should we take away from all this? Well, the Fed is still projecting two rate cuts this year, according to the dot plot. But that was before the return of tariffs. Before the exploding deficit. Before the economy started coughing. Before inflation pretended to slow down while secretly preparing a comeback — especially if iPhone prices double and Chinese-made Barbies are sold at Beluga caviar prices. So let’s be clear: these two cuts are “highly conditional.” If Trump keeps shaking the economy like a snow

Market’s Temperature Today?

As I start writing this morning column before 5 a.m., one question keeps nagging me: how many times do we use the word Trump in a day? I’m realizing that finding a headline each morning without “TRUMP” in it is becoming extremely difficult. The next four years are going to feel very long. That aside, yesterday the markets continued to gently slide as we all wait for the Fed. Nothing new there. But there’s movement on the tariff front—and we now have a new war on our hands. India attacked Pakistan, though Wall Street couldn’t care less. A new war no one cares aboutLooking at U.S. futures this morning, it’s clear that the wonderful world of finance is far more focused on the soundbites from the American President than on the outbreak of a potentially terrifying new war—especially considering both involved countries are part of the fashionable little club known for having nuclear weapons. Yes, early this Wednesday morning, India launched targeted strikes on “terrorist” infrastructure in Pakistan and Kashmir. This was in response to a deadly terrorist attack in India last month, which killed 26 people. According to India’s Defense Ministry, nine sites were hit, but no Pakistani military installations were targeted. New Delhi insists the operation was “measured, targeted, and non-escalatory”—a way to strike hard without tipping the powder keg. Non-escalatory… let’s hope the Pakistanis understand the nuance. I mention this because it’s geopolitically significant and we should be keeping an eye on it—even if Trump hogs the spotlight almost every day. Yesterday, the President brought back the topic of the trade war. He met with Canadian Prime Minister Carney, and absolutely nothing came out of it. At least they didn’t get into a fistfight and there’s no MMA bout scheduled anytime soon. In short, the tension level of the Carney vs. Trump meeting never reached that of the Zelensky session, but Carney did make it clear that Canada is not for sale, while Trump insisted the U.S. doesn’t need anything from Canada other than friendship. So: no progress, no deal, nothing. Maybe that’s why the markets didn’t climb yesterday—negotiations are going nowhere, and the 90-day moratorium is already well underway. Just 62 days left, and don’t expect any extensions from the U.S. The return of “light” tensionsThis return of trade tensions—even in “light,” aspartame-filled form—still pushed global markets into the red. On Wall Street, the Dow Jones dropped 0.9%, the Nasdaq 0.8%, and the S&P 0.7%. In Germany, the Chancellor had to be elected twice. No one was really spared. By the end of the session, the talk was whether the recent “rally” would last, or if we’re just seeing a bounce within a broader bear market. All the confidence built up in recent days suddenly seemed extinguished and tinged with depression. The wait-and-see mode ahead of tonight’s Fed decision isn’t helping investors loosen up. The real question is what happens after Powell speaks. Because we all know he’ll basically say he has no clue what’s going on and prefers to wait until things are clearer. Translation: “We’re not touching anything for now, and we’ll see if Trump keeps stirring the pot.” Which is highly likely. On the macro side, the figure of the day was the trade deficit: up 14% in March to over $140 billion—a new record. Don’t look for complex economic explanations: this is pure panic buying, as companies scrambled to import goods before Trump’s new tariffs jack up the prices. It’s not macroeconomics; it’s panic shopping. Meanwhile, the EU is threatening to retaliate with €100 billion in tariffs on American products “if ongoing trade talks don’t yield satisfactory results for the Union.” The scene is set: it’s Trade War – Season 2, with less and less diplomacy, a big bucket of popcorn, and a supersized Coke to make it through. It’s all happening in the after-hours!In summary, at the U.S. close we were down because of stalled trade negotiations, nervous about the growing budget deficit, and stuck in wait-and-speculate mode ahead of the Fed. And then, after the close, things started moving. The U.S. and China announced they’ll officially resume trade talks this weekend in Switzerland, with the goal of de-escalating tariff tensions. Phew! We all remember—yes, we do—when Trump imposed tariffs as high as 145% on Chinese products, prompting a 125% counterstrike from Beijing. Treasury Secretary Scott Bessent admitted those tariff levels are “unsustainable,” but claims they give the U.S. a strategic edge in negotiations. On the Chinese side, they’re demanding sincere, concrete gestures and are rejecting any deal reached under pressure or blackmail. So far, markets have reacted positively to the announcement—no need to wonder why futures are up this morning. Still, uncertainty remains high as long as Trump keeps blowing hot and cold. On top of the trade talk momentum, Trump tossed out another wildcard with a mysterious statement. He said he’ll make a “very, very important” and “groundbreaking” announcement before his Middle East trip from May 13 to 16. Of course, he didn’t say what it’s about, only that it won’t be related to trade—but to “something very positive.” As Coluche once said: “When you know so little, better to just shut up”—never has that made more sense. In conclusion, the market is stuck in concrete shoes. It’s waiting to hear Powell say he’s powerless, and then it’ll wait again—hoping for a miracle out of some hotel in Switzerland. Beijing injects, Trump surtaxes, and the world holds its breathThis morning—alongside the Swiss talks—China announced fresh economic support measures to offset the impact of Trump’s tariffs. Beijing plans to cut interest rates, reduce bank reserve requirements, and inject funding into industries, innovation, and services. As a result, Chinese indices are up 0.5%, Hong Kong gained 1.5%, and Japan is doing absolutely nothing. Gold is trading at $3,393, and Bitcoin around $96,600. As for oil, there was a technical rebound driven by hopes tied to the trade talks and strong U.S. gasoline demand heading into summer. Add to that a

Jurassic Fed

I’m not going to go as far as to say we preferred the days when Trump was firing off social media posts every five minutes, but there’s definitely a middle ground. A balance between total market madness and days like yesterday where we spend most of our time twiddling our thumbs, waiting for the Fed, and reminiscing about Warren Buffett’s career. Volatility keeps falling, and the famous “Greed and Fear” investor sentiment indicator is leaning more and more toward “greed.” Just a month ago, on April 2, we were terrified, and now confidence has come roaring back. Investors have this incredible ability to change their minds in an instant—it’s astounding. The Day’s Big Thought First, let’s note that U.S. markets ended their streak of consecutive gains yesterday—capping it at nine straight sessions. Monday, May 5 wasn’t exactly a “sell-off” day either, but it was clearly a time for some profit-taking ahead of the Fed’s upcoming decision. Most economists and strategists from Wall Street came out of the woodwork trying to put into words what we’re expecting from the Fed—and especially from Jerome Powell. So let’s give it a shot and break things down. Right now, we’re facing two major scenarios. The first one is Donald Trump’s vision. The controversial and often-contested White House boss has his own unique view of the economy. No one really knows where he gets his information from, but according to him, inflation doesn’t exist—it’s all in our heads. BLS data? Fake. PCE data? Also fake. And honestly, on that note, I don’t totally blame him—since I’ve long thought the clowns at the BLS are… well, the word’s right there in the name. So, Trump believes there’s no inflation and that the economy is slowing because of the trade war (a bit) and what Biden left behind (a lot, if you ask Trump). His only viable strategy: slash interest rates drastically to revive the economy. Problem solved. Except That… The second scenario is the one grounded a little more in reality—Jerome Powell’s perspective. The Fed Chair knows that inflation isn’t dead. It’s been temporarily put into a sort of artificial coma, but a wild reawakening isn’t off the table, and that could really hurt consumers. Historically, Powell has always believed it’s easier to restart a recession-hit economy than to contain runaway inflation. And based on current economic numbers—which show some undeniable deterioration, although we’re not in panic mode yet—he’s holding back. Tariffs haven’t fully hit consumer prices yet, and Powell prefers a “wait and see” approach over rushing into a decision. Here’s what we do know: The April jobs report was deemed “solid,” which doesn’t confirm the fears from Q1’s slowdown. I don’t totally agree with that take, but it’s enough for Powell to feel there’s no urgent need to act. The Fed is in “wait-and-see” mode facing a complex picture: inflation that may be rising, slowing growth, and a shaky job market. Economists call that stagflation. It’s a real headache. The Fed should not cut rates until inflation—possibly driven by tariffs—hits a clear peak. Ideally, we’d also need to see weakness in the labor market before the Fed considers moving, because a premature rate cut could make stagflation worse instead of solving it. Jerome Powell will speak on Wednesday right after the Fed meeting. He’ll likely repeat the key points from his April 16 speech: “No rush. Inflation remains our top priority.” The issue, of course, is that Trump doesn’t agree with this approach. And he won’t hesitate to say so during Wednesday night’s speech. That’s where market uncertainty is really coming from—it’s not about the Fed’s decision per se, but rather how angry Trump might get and what kind of outburst he’ll unleash. That’s what’s making traders a little skittish and taking some money off the table ahead of the Fed announcement. Still, it’s hard to call this true uncertainty when 98.7% of respondents believe Powell won’t move rates. At best, he might start doing something by July—and even that’s up in the air. So it looks like we’ll stay in this limbo of indecision, waiting for Powell’s speech and Trump’s fireworks. In Europe Back in Europe, the picture was mixed. Switzerland and France slipped, dragged down by pre-Fed jitters, while Germany rose again—chasing new records set in March. Apparently, Frankfurt is in a mood of pure optimism, and nothing seems capable of stopping the DAX now that hopes are up for a diplomatic resolution on tariffs. Meanwhile, rumors were flying that Shell might be buying BP, and UBS just struck a deal with U.S. authorities over old tax evasion issues dating back to Credit Suisse. Final price tag: $511 million. All in all, markets didn’t pick a clear direction, as everyone’s waiting to see what kind of drama will unfold between the Fed and Trump. Let’s be honest—we don’t really care what the Fed will do or say. What everyone wants to know is: how mad will Trump get, and what might he say or do live on stage? One final note: there was surprisingly little talk about tariffs and China trade talks—probably because of a public holiday over there. Still, it’s strange how markets have totally priced in the tariff situation since that 90-day moratorium was announced. No one seems to believe that the talks might fail or that a real trade war could break out. Peace has returned to the markets—for now. Let’s hope it lasts. Asian Markets Wearing a Forced Smile This Tuesday morning, Asian stock markets were generally up, led by China, which seems to have found a bit of optimism—or at least a grim smile—thanks to renewed hopes of restarting trade talks with the U.S. Again. Nothing concrete yet, but at this point, just talking about talking is considered bullish. Investors are also digesting the latest Chinese service sector data, kind of like how you choke down fried rice after three days of monetary junk food—you’re not sure it’s good, but you pretend it is. China’s up

Buffett Retired

The stock markets have been in great shape for the past two weeks. Trump hasn’t said “too much crap,” and as a result, things aren’t going too badly. There’s hope for a way out of the crisis with China, and quarterly earnings aren’t too bad. Of course, it’s all a matter of interpretation, but all in all, it’s going okay. Last week’s economic data was awful – but luckily, Friday’s employment figures saved the day because they were “BETTER THAN EXPECTED.” Even if we need to say that with caution, because the revisions were terrible, and next month won’t be as fun. The First Consequences in June Not so fun, because according to experts, we’ll start to feel the effects of tariffs. We all know the value of “experts’” opinions, but it’s something to cling to and a reason to stay cautious over the next month. That said, there’s no need to panic just yet since employment isn’t our biggest worry – we’ve got plenty of other things to digest first. Things like the upcoming FED meeting, Powell’s decision not to cut rates, and the inevitable wrath of the American President, who won’t miss a chance to throw sweet words at his Federal Reserve Chairman. But first, let’s go back to last Friday’s employment numbers. I’m sure you spent your entire weekend analyzing the Bureau of Labor Statistics report, but just to get our week started on the right foot, here’s a quick summary: the US economy added 177,000 jobs in April – that’s 42,000 more than expected. If we try to stay as optimistic as the market has been for the past two weeks; employment is holding up, investors are breathing easier, and Trump is shouting from the rooftops that everything is fine, that we’re in a “transition,” and that “prices are falling” (we’d love to see that on the shelves, not just in statisticians’ theories). The unemployment rate remains at 4.2%, and the markets loved it. The Power of Forgetting Markets loved it, but I still think they’ve forgotten a bit too quickly that during the last week of April, we had bad numbers from ADP, bad Jobless Claims, bad JOLTS data, weak GDP, and an inflation rate that’s no longer rising… But all of that was forgotten because expectations were beaten by 42,000 jobs… EVERYTHING ELSE WAS FORGOTTEN – this market shows an almost indestructible resilience – sometimes. Still, let’s remember a few things about the NFPs: For now, layoffs remain rare – I repeat, “FOR NOW” Wage growth is slowing down (+0.2% in April) The chances of a Fed rate cut are collapsing – only a 1.3% chance of a cut this Wednesday – according to the latest polls – but we’ll get back to that The February and March revisions are horrendous – a total of 58,000 jobs were removed from the previous two months… AND WE’RE ALL EXCITED about 42,000 more in April – we’re really forgiving!!! Long-term unemployment is rising, with 23.5% of unemployed people out of work for more than 27 weeks And to top it all off, more and more Americans are working multiple jobs to get by – not to mention the rising number of supervised parking lots where people can sleep in their cars. In short, the labor market is standing – but on a thread. The sectors that have been hiring for the past two years – government, healthcare, education, hospitality – are all under pressure. Plus, federal spending is declining, tourism is down (-12% foreign visitors in March), flight tickets to the US have never been so cheap, consumer spending is down, as is consumer confidence. And the trade war is still ongoing – there’s hope, but it’s still here. But everything’s fine because last Friday, the S&P 500 closed higher for the 9th time in a row! The Week Ahead Whatever you think, the market is doing relatively well because it seems to have accepted that Trump doesn’t have only hostile intentions toward it, and maybe – just maybe – the Chinese and Americans will end up vacationing together. But better book those flights quickly, because the risk of empty shelves all over the US is rising fast – ideally, we’d like the situation to improve before the end of the month. And that’s being optimistic. But before looking 30 days ahead, let’s talk about what’s happening in three days. On Wednesday night, Jerome Powell will announce that he’s doing nothing with the rates – that’s what experts say, with a 98.7% chance that the Fed Chair stands firm and doesn’t move the rates, stating he wants to “first see the impact of tariffs on the economy,” because you can’t just cut rates wildly without risking reigniting inflation. How that will be received depends on Powell’s speech – if he’s very DOVISH and hints he’ll align with Trump’s wishes as early as next month, it should go smoothly. But if he stays vague or appears HAWKISH and focused more on inflation than economic stimulus, markets won’t like it. And one thing is certain – if rates stay unchanged Wednesday night: Trump will roast him using every tool at his disposal, and I bet we’ll start hearing talk of Powell being fired for “gross misconduct.” In short: rates likely won’t fall, and the Trump-Powell showdown is set for a new round. Warren Steps Down Over the next three days, we’ll have plenty of time to dig into this topic. But THE BIG NEWS THIS WEEKEND was Warren Buffett officially handing over the reins to his successor: Greg ABEL. At the very end of his 60th annual general meeting, Warren Buffett – now 94 years old – announced he was stepping down from leading Berkshire Hathaway. Even Greg Abel himself didn’t know the moment had come. This marks the end of an era: the era of the Oracle of Omaha, builder of a $1.2 trillion conglomerate. At age 62, Abel headed Berkshire’s energy division and gradually earned

Next Please!

In the absence of the Europeans, U.S. indices seized the opportunity to notch their eighth consecutive session of gains. The Nasdaq even closed higher than its level on April 2. The infamous LIBERATION DAY has been erased from the records, and once again the recovery is spectacular. One might wonder how long this can last: rebounding massively while all the economic indicators are pointing toward a recession surely has to come at a cost someday—unless the market knows more than it’s letting on, as if it’s anticipating something from China and something from the Fed. The Jobless Claims released yesterday showed an increase in unemployment filings, the ISM index showed a greater contraction than last month—but it didn’t matter because it was a “less bad” contraction than economists had expected—phew, dignity preserved. Add to that Wednesday’s numbers, and you don’t need to be an astrophysicist to understand that the economy is holding its breath and it’s getting really tough. This afternoon we’ll get the U.S. employment numbers, with the market expecting 133,000 job creations versus 228,000 last month. The unemployment rate is expected to remain unchanged at 4.2%. But watch out for revisions—don’t forget that the Bureau of Labor Statistics has an IQ well below average and often manages to botch the numbers spectacularly. But beyond expectations, it’s clear that the market seems to be heading in a direction completely opposite to what logic would dictate. In a normal world, if you had an avalanche of economic data like we’ve seen this week, everyone would panic, fearing that recession is right around the corner and we’re all going to die in terrible agony. But here we are, not living in a normal world. The U.S. is run by a guy who likes to conduct real-time economic experiments and who changes his mind as often as he changes shirts—depending on yesterday’s golf score—and ever since he took office, we’ve been strapped into a rollercoaster for the next four years. In this environment, the market can no longer operate rationally. Rates or vice grip? Today, economic figures that point toward a recession no longer scare anyone, because the only takeaway is that THE FED WILL HAVE TO CUT RATES AND THAT’S THAT! Never forget that we’re in a market that feeds on rate cuts and dovish comments from the Fed. Never forget that between October 2023 and September 2024, we saw indices rise by 40% purely on expectations that the Fed WOULD CUT rates—40% gains on hopes, before finally getting one actual cut. Right now, we’re watching the U.S. economy slowly crumble before our eyes, and the only thing people can say is: “GREAT, the Fed is going to have to cut rates.” I’m beginning to think this relationship between the stock market and the Fed’s interest rates is becoming toxic. Anyway, yesterday, while Europe was closed to “celebrate” LABOR by doing nothing, the U.S. once again closed higher—despite economic data that continues to scream bloody murder. Still, even though rate cut hopes remain high, eyes were elsewhere yesterday. They were on Microsoft and Meta. These two tech behemoths delivered stellar earnings, and investors focused on this good news, which pushed Microsoft up more than 7% and Meta more than 4%. Microsoft even regained the title of “world’s most valuable company.” Then, toward the end of the session, EVEN THOUGH THERE WAS NO NEWS, NO TWEET, NO OFFICIAL RELEASE, the market suddenly dipped sharply—still finishing in the green, but less so. And this, just before the earnings releases from Amazon and Apple, which—as you may have guessed—were not great. We’re not quite there yet, but these market moves based on nothing at the end of the session, which just “happen” to anticipate good or bad after-hours earnings, are starting to feel a little weird. But apparently, no one’s bothered, so why not take advantage? In summary:We had another solid session of gains in the U.S.—while Europe was closed. The end of the session was a bit spoiled by a strange sell-off, followed by lukewarm earnings from Apple and Amazon, all amidst an economy that seems to be gradually falling apart, and McDonald’s publishing quarterly results that suggest even THEY are seeing customers think twice before ordering a Double Big Mac. And it’s not because of cholesterol—it’s because of money!!! But it doesn’t matter, because the Fed is going to cut rates. Let’s not ruin the party—let’s save that topic for next week! All Quiet on the Eastern FrontThis morning in Asia, China is closed for Labor Day too. Except it’s not quite the same celebration as ours—although beating up protesters seems to be just as popular with the authorities over there. The Nikkei is up 0.68% and Hong Kong is jumping 1.51%, thanks to THE NEWS OF THE DAY, which suggests—and I quote: “China is evaluating a U.S. proposal for dialogue on tariffs.” And just like that, China peeks out of its den to say it’s “considering the advances” from the U.S. to resume trade negotiations. Translation: Washington has been knocking at the door for days, and Beijing is like, “We’ll see if we bother answering… or not.” According to the Chinese Ministry of Commerce—which never drops this kind of line by accident—the Americans have made several attempts to reconnect “through the appropriate channels,” hoping to talk tariffs. So now, everyone’s holding their breath because if the world’s two biggest economies seriously get back to talking, that might finally ease this never-ending trade war that’s been messing up everyone’s lives and really starting to sour the mood at the G20 table. But for now, we’re still in “strategic reflection” mode on China’s side, which means nothing will happen this weekend—except maybe a vague statement or a nasty tweet (or both). But markets are so desperate for a reconciliation that they’ll jump at the slightest diplomatic smile. Even if it’s fake. Even if it’s photoshopped. Futures are already taking off this morning. Then there’s the other big news of the day:

Workers’ Day – AI Continues

Between Soft Recession and AI on Steroids, Welcome to 2025 The American economy is in the gutter – this is no surprise, but as of yesterday, it’s confirmed. In fact, Trump even released a statement saying that it’s all Biden’s fault and that we need to be patient. BUT, ultimately, none of what was published yesterday is a surprise. It’s almost like a plan unfolding smoothly, allowing the Fed to finally lower interest rates and save the economy. In fact, when you see what happened yesterday, you can conclude two things: either the market is already anticipating a glorious return of the U.S., or some people were better informed than others about Microsoft and Meta’s numbers… Let’s start from the beginningYesterday, Europe discovered something that seemed unthinkable or unimaginable: the economy of the Old Continent is growing. Yes, I know, it might sound like an episode from The Twilight Zone. And yet, yesterday Europe released its GDP, and while the ECONOMISTS WHO KNOW expected a soft growth of 0.2%, it came in at 0.4%. So, we went from “soft growth” to “growth, period.” It’s a small difference, but it’s enough to make investors change their mind. At least for the next 12 hours. No, because yesterday morning, I bet my hand that – even if you looked hard – you’d never find a “finance expert” who would say: “Yeah, I’m buying the market this morning because I’m betting on European growth.” Not even me. And especially not me. In fact, I still don’t believe it, and I wonder if the numbers released yesterday were picked out of a hat and no one actually calculated anything. When you see that TotalEnergies reported a 18% decline in profits for the first quarter – with profits at $4.2 billion – hurt by falling oil prices and margins, despite higher production. When you see that Stellantis reports a 14% decline in quarterly revenues and SUSPENDS its 2025 forecasts due to tariffs and a total lack of visibility, and when you see that Airbus is begging the U.S. to remove tariffs on planes, and when you see that unemployment is exploding in France, and that car manufacturers have been and will be massacred by Trump, it’s hard to believe that Europe has had a stellar three months and that the economy is growing. Unless the billions being handed out weekly to Ukraine are included in the growth calculation – unless it’s future arms sales forecasts that are boosting the economy. Europe Believes, and Believes in Itself, It’s IncredibleRegardless, Europe finished up. Not a huge surge, but an increase that acknowledges that the region’s growth was “a bit” better than expected and a rise that respects the fact that some think “Europe is a safe haven for investors.” I don’t know who said that, but I read it this morning and thought the guy was very bold. No, because you have to dare… Saying that Europe is a “safe haven” when Trump has it in his sights economically and Putin has it in his sights altogether – if we believe the ramblings of the donkeys who make up the French government – it seems incredible to think that Europe could be the first place that comes to mind when you don’t know where to hide. Anyway, I’m not going to contradict the people who know and hold the great wisdom of the financial world, so yesterday, European markets went up because growth was better than expected all over Europe. The DAX rose 0.32%, France hit a half percent rise in full euphoria, and Switzerland jumped 0.42%. If the SMI rose 0.42%, it wasn’t because of UBS, since Switzerland’s ONLY AND LARGEST BANK WITH THE BLESSING of the FINMA and the Federal Council, published a first-quarter report “much better than expected,” but in a still explosive context. Net profit was down 4% year-on-year, at $1.7 billion, but exceeded expectations thanks to an ultra-light tax rate – thanks, guys – revenues fell slightly, costs rose, stock buybacks continued, but clients brought in less cash, with $39 billion in net new money this year compared to $48 billion last year. The digestion of Credit Suisse is “going less badly than expected,” but the big unknown remains Swiss regulation, which could kill stock buyback ambitions. In summary: UBS is performing DESPITE EVERYTHING, but remains stuck between its ambitions and the post-CS stress of a country that finds its largest bank a little too big for its mountains (sometimes). And the American Economy Stalls, While Trump’s Plan Moves ForwardWhile we were delighting in Europe’s growth, the Americans started publishing THEIR economic numbers. The numbers that were “supposed to change everything” yesterday morning. I don’t know if you still remember. So we got THREE IMPORTANT NUMBERS: ADP Employment numbers GDP PCE I’ll warn you right away, the balance is not great, I suppose you’ve seen it, but what’s most interesting is what we can draw from it as a conclusion. So, the ADP employment numbers were expected at 114,000. It came out at 62,000. Not only is this far below expectations, but it’s also in freefall compared to 147,000 last month. There’s nothing more to say, except that it’s a clear sign of slowdown on the employment front in the U.S. This could weigh even more on the dollar and the Fed’s patience. A number that’s not pleasant, just two days before the NFP. The U.S. GDP contracted by 0.3% in the first quarter, whereas economists were expecting an increase. Why? A flood of imports to anticipate Trump’s tariffs. Result: record trade deficit, forecast failures, and markets tanking as if it were a surprise. Some are already shouting “moderate recession,” while others remind us that it’s Trump himself who messed things up. It’s the first time in three years that the number is negative. But for now, it’s still being explained as a temporary factor… Temporary, but Trump still let loose on social media, saying: “This is Biden’s stock market,

100 days

The Dow Jones just racked up its sixth straight winning session. Investors are still waiting for more clarity on tariffs, and yesterday, Lutnick hinted that the first “deal” had been signed with a country. We don’t know which one yet — rumors suggest India — but whatever, it was enough to push the indexes higher during the final hours of trading. Meanwhile, volatility has dropped below 25%, fear is fading, and so is interest in the markets. For now, we’re all just waiting for “Super Wednesday,” which is supposed to change everything — and will probably end up being just another ordinary Wednesday. Another Day of Waiting To be honest, yesterday’s session wasn’t anything special. Even though there was plenty to keep an eye on, we basically spent the whole day waiting for “the number” that would make our hearts race. Or an announcement that would stir things up again. Apart from Lutnick’s vague and unclear statement and Trump’s speech about his 100 days in office, we’re not much further along than before. European indices ended the day in mixed fashion, and the word that came up the most was: WAIT. The only economic numbers released once again showed that consumer confidence is shaky — but hey, it was less bad than feared. In the US, the figure came in slightly below expectations, which somehow comforted the markets. Same story in Europe — Germany’s numbers were also less bad, which was good enough. We also got the JOLTS data — expected to show 7.49 million job openings, but came in 300,000 short. No big deal, we’ll take it. Because once again, we’ve activated our strategy that helps us not panic anymore. That strategy we’ll call the “multi-level expectation method” — which helps us spin any number, no matter how crappy, into something digestible. Take the JOLTS data. The market’s “official” expectation is 7.49 million job openings. It comes in 300,000 under. But that’s okay! Because — when you ask an economist for a forecast, they never give you the real number. They give you the official number, while secretly keeping a completely different number in their head. Sounds stupid, I know — but there’s logic to it: it lets them claim they weren’t wrong, just that they didn’t reveal their real expectation. It’s Dumb, I Know… This might sound idiotic — and honestly, it kind of is — but that’s how the game works. You’ve got the public consensus — the one printed in the press and that we, poor mortals, use to judge whether a data point is “good” or “bad.” And then there’s the “hidden consensus,” which acts as a safety net. Like with JOLTS: the number came in under expectations, but hey — the real expectations were lower anyway, so it’s all “less bad,” and how nice to have a phantom number no one knows about so we can reassure ourselves that employment isn’t so terrible, and confidence is in the dumps, but — hey — it could’ve been worse! So after this grand exercise in economic interpretation, investors figured they might as well wait for tomorrow. And since “tomorrow” is now today, that’s not too long to wait. So we shifted focus to quarterly earnings, which came out yesterday, and without diving into all the details, we can basically sort the reporting companies into two categories: – Those with a vision for the future or who dare say that tariffs are manageable– And those who have zero visibility, stuck in a fog so thick it feels like a sci-fi movie Unsurprisingly, most fall into the second category. In the first group, you’ve got Coca-Cola, posting strong results and saying the future is totally manageable. On the flip side, UPS is in the tunnel — reporting revenue declines, feeling the brunt of the tariffs, and announcing 20,000 layoffs. Snap is clueless about its direction but thinks the road ahead will be long and bumpy. Same with Super-Micro, whose major client — possibly Nvidia — might be ditching them. Both stocks tanked after hours. So when it comes to earnings, there’s a bit of everything, as usual. Visibility sucks, the future looks cloudy, and things would be a lot simpler if we just got some clarity on those damned tariffs that are starting to really get on everyone’s nerves… The 101st Day So yes, everyone is waiting to see what happens TODAY — because it seems that now that we’ve branded this Wednesday as SUPER WEDNESDAY, we’re supposed to wake up in a different world tomorrow. You know how it goes: every time we await a big inflation or jobs report, we say, “This time, we’ll REALLY understand things better!” And then the number comes out, and it’s total nonsense, changing absolutely nothing. Well, this Wednesday might be just like that — boring as hell and a massive non-event. But it’s already begun. This morning, the Chinese announced their economy is starting to cough — and it’s not just from Beijing smog. The number dropped this morning: Manufacturing PMI at 49.0 Below 50. That means contraction. And it’s the lowest level in two years. We could pretend to be shocked — but really, no. When you spend your days in a tariff war with the US, your factories slow down, and Xi Jinping is trying to do diplomacy while tightening things up internally — of course your economy starts sputtering. So here we have it: the first big red flashing warning light on the global economic dashboard, likely triggered by Donald’s trade policies. Can’t wait to see what the US GDP says later today. Trump on Tour And yesterday also marked Trump’s 100th day in office. He celebrated in Detroit, claiming his record was FABULOUS — even though, market-wise, it’s the worst since Nixon 50 years ago — and that the future looked rosy on the tax front, even though no one has a clue how he’ll do it, but everything’s great (according to TRUMP himself), even

First Rule – No Rules

Yesterday’s session was one that basically served no purpose — none at all if you look at the fact that the indexes barely moved. Which, frankly, is a change compared to what we lived through during the first 100 days of Donald Trump. Honestly, it seems like investors are “almost happy” that nothing is happening, simply because they’re exhausted by the heavy uncertainty of recent months. We’re like the guy falling from a 150-story building who, as he passes each floor, keeps saying: “So far, so good.” To keep it simple: as long as Trump doesn’t mess things up with some new drama, we can manage what we know We allow ourselves to thinkWe can handle what we know — even if what we know isn’t much, since the promises around the talks with China are totally vague. Trump recently said he spoke with Xi Jinping, but according to official Chinese sources, Trump’s statements are complete nonsense. Then again, we all know how much trust to place in a politician who says “I’m not aware of anything” (ask Bayrou). But when a Chinese politician says “I’m not aware of anything”, it’s even worse. That said, even though we know “officially nothing was discussed”, we all know that doesn’t mean “nothing was actually discussed.” As my philosophical master Coluche once said:“Those in authorized circles allow themselves to believe that a secret agreement MIGHT be made.”And he added:“First off, you and I are not part of those ‘authorized circles.’ Then there’s the secret agreement — which clearly means we’ll never know anything about it. And finally, there’s the conditional tense: MIGHT — so it’s not even certain!” Even though that comedy bit is nearly 50 years old, it hasn’t aged a day. We don’t know what’s actually going on — and for all we know, the deal on tariffs between China and the U.S. might already be signed, and they’re just waiting for the right moment to announce it. That could also be the reason nobody dares to sell the market anymore. Well… we also don’t dare to buy it either, because we have no idea what’s coming in the next four days. And SURPRISE — it all starts today… The Kind of Paralysis That Feels Good Let me return to my guy falling from the 150th floor. I’m insisting on this because the similarities are just too perfect not to mention. You see, when you fall from a building, it’s not the fall that hurts — it’s the landing. While you’re falling, there’s no pain. You could even do stuff — like read a book. Not War and Peace — that might be a bit long — but you could get through the first chapter. What really hurts is going from 230 kilometers per hour to a dead stop. And, yeah, the concrete hurts too. But mostly the hitting-it-at-230 part. Well, that’s where we are: still in free fall. We’re just hoping that, by some stroke of luck, firefighters will have placed one of those giant inflatable cushions like in the movies — and that everything will be fine. We are exactly there. Global markets have bounced back since Trump — after causing panic — started playing it cool again: He stopped attacking Powell He showed a softer, more diplomatic tone with China As of yesterday, he seems more flexible on car tariffs And we know the 90-day moratorium (a bit less now, maybe 70 days left if my math’s right) is only meant to bring countries to the negotiating table and wrap things up with a Hollywood happy ending three days before the deadline… The markets have recovered, and everything should be fine. Except that now, we’re heading into a week from hell, and no one has the guts to take a single bet right before an avalanche of economic data and earnings reports. So you can understand why the Dow Jones didn’t move much yesterday — up 0.28%. The S&P 500 showed even less motivation with a 0.06% gain, and the Nasdaq did worse, dropping 0.10%. In Europe, things weren’t any better: France rose 0.5%, the DAX was sluggish at +0.13%, and our good old SMI stood out from the rest of the world with a 0.72% gain. As one “expert” said last night: “We are in a climate of cautious optimism, despite the uncertainty surrounding U.S. trade policy and its effects on the global economy.” Yeah, I know, that doesn’t mean much — but “cautious optimism” still sounds better than “panic pessimism.” So, if we take a bit of distance from what happened yesterday — which was somewhere between almost nothing and absolutely nothing — the feeling is that the market is slowly rebuilding a sense of stability and calm, trying hard to forget that volatility can still spike 85% faster than you can say: “Lehman Brothers just went bankrupt.” Would you like a summarized version of this for quick sharing or publication? Let’s Not Get Carried Away Even though the indices were in the light green zone yesterday with a level of frustration close to the maximum – and yet nobody seemed scared – I believe we shouldn’t get too carried away and must keep our heads cool. Let’s try to take stock before the avalanche of data – consumer confidence, JOLTS, GDP, PCE, employment figures – all topped off with quarterly reports from part of the Magnificent Seven, crashes down on us. Right now, it’s a bit like trying to play Jenga without shaking and without pulling out the one block that brings the whole tower down. Here’s where we stand: the talks are dragging on and the economic bill is coming due – you can tell some Americans are starting to clench and are genuinely scared to go shopping. For now, voices like Scott Bessent’s are whispering in Trump’s ear, telling him to stay calm. The problem is, that may not last. Trump is as patient as a hungry Labrador, and it wouldn’t

Hold My Beer, Wall Street

The week ahead is likely to be spectacular once again. And even if it turns out to be less volatile than usual — if by any chance it’s less volatile than usual — there will still be an avalanche of events for us to digest. As always, we’ll be talking about “trade deals” based on whatever information the White House decides to give us. But on top of that, we’ll have to deal with a mountain of quarterly earnings reports from major names like Apple, Microsoft, Amazon, and Meta leading the charge. Not to mention the perfect combo of PCE, GDP, ISM numbers, and even employment data. By next Monday, we might even be looking at the Fed with a whole new perspective. A Very Quiet Trump I’ll admit, I don’t keep official statistics, but it feels like this Monday morning is the first calm Monday since Trump returned to power. A very relative calm, since futures are still down 0.6% because everyone’s “stressed” about the week ahead and it’s tempting to reduce risk with so many deadlines looming.However, it’s worth noting one thing: Trump didn’t drop any bombshells over the weekend, and the main topic on his side remains tariffs with China. The President hinted that he had been in contact with Xi Jinping, but Scott Bessent stated that he “didn’t know” whether Trump had actually spoken with his Chinese counterpart. Basically, we’re being fed little treats to make us believe crazy things are happening in the tariff negotiations, but at the same time, since neither Trump nor China confirms any talks, you get the feeling they’re just stringing us along. In any case, Trump was quieter than usual this weekend, even if plenty must have been discussed during the Pope’s funeral in Rome. One thing’s certain — according to Bessent again — several countries are in talks with the U.S. to find a way out of the tariff situation, and several announcements could be made this week.That’s just perfect, because we really didn’t have much to deal with these next few days, and if, on top of Apple, Microsoft, and friends’ earnings, we also get a few signed agreements between the U.S. and Vietnam or New Zealand, it’ll spice things up a bit.And who knows — maybe Trump will pull off a miracle with China using his left hand while solving the Ukraine war with his right. The Fed and Supply Chains Besides everything we need to analyze this week, there are two more things we should keep an eye on.First, the supply chain issue. Over the past few hours, we’ve started hearing from some U.S. business leaders who are getting worried about what’s coming. As long as no agreement is reached with China, goods can no longer be imported from there, and some experts estimate that if no deal is struck by mid-May, we could face massive stock shortages on certain Chinese products.Just last week, several container ships didn’t set sail because of prohibitive tariffs (Chinese cargo shipments to the U.S. have plunged 60%).For now, there’s no immediate fire, but this could become an obsessive topic in the days ahead. Not to be underestimated. Because if we end up with a “COVID, season 2” kind of vibe in stores — with shortages, layoffs in transportation, logistics, and retail — it’s going to look like Black Friday… without anything to sell.And we’re already almost in May, so there’s no time to waste. Also, if you remember last week, there was talk of Powell possibly getting ousted from the Fed. Things settled at the last minute, but in that political-fiction scenario, Kevin Warsh was imagined as the new Caliph in place of the Caliph.Well, guess what — Warsh spoke this weekend, and he seems very angry with Powell.We don’t know if it’s frustration from not getting the job or if he’s keeping pressure on the Fed at Trump’s request, but his speech was relatively “violent.”According to Warsh, the Fed talks way too much, meddles in everything, and is far too cozy with politicians who are draining the U.S. Treasury. In short, Warsh wants to bring the Fed back to the old-school style: “Shut up, do your job, protect the dollar’s value, and stop acting like a superhero.” Back in the day, Fed bosses (Paul Volcker, Alan Blinder, & Co.) used to smoke cigars to avoid answering questions and refused to talk economics with journalists. Today, between press conferences, 2% inflation targets, and detailed economic forecasts, it’s become Disneyland in the Fed’s hallways and on CNBC.For Warsh, that’s unacceptable.He thinks Bernanke, Yellen, and Powell turned the Fed into a public debate club, and that this overexposure is partly why inflation spun out of control like a runaway barbecue after COVID.He also blames Powell for letting public deficits run wild: “Okay to help during the pandemic, but afterwards, the tap should have been turned off — not organize a budgetary rave party.”Warsh’s conclusion: the Fed shot itself in the foot, and it’s time for a strategic reset — no frills, no standing ovations, and no telling life stories on TV every two weeks.He didn’t even give his opinion on rates or inflation — because, true to his philosophy, he believes the Fed shouldn’t be announcing its plans at all. The Week Ahead As I mentioned at the beginning of this column, beyond Trump’s antics around the world, we’re facing a very busy week in terms of economic data.Nothing surprising for a typical earnings season.But since we’re not in typical times, we’re going to have to ask ourselves a few questions because depending on what comes out, we might quickly have to revise our expectations about “what the Fed will do” — especially since the Fed meets next week. Anyway, just looking at the economic calendar and using a little imagination, we could easily spin up a political-economic fiction scenario. Let’s just take things step by step.It all starts Tuesday.We’ll get the JOLTS report and Consumer Confidence numbers.It wouldn’t be surprising

Free Entrance

On April 30, Donald Trump will celebrate his 100th day in the White House. The first assessments are starting to come out, and there’s a lot of talk about the number of Executive Orders he has signed — currently sitting at 137 — and that’s clearly better than his predecessors. However, what really matters to us as investors is that the President has created an unprecedented mess in the global stock markets. Things seem to be settling a bit in the last few days, and the rebound is, for now, SPECTACULAR. But confidence has been replaced by doubt, and we’re still walking on eggshells. Even if markets are regaining some color, caution is still the order of the day. Surgical precisionIt’s never easy to know “why the market goes up or why the market goes down.” Sometimes it’s due to minor things, sometimes it’s very clear and obvious — but right now, since nothing has been the same since January 26, it’s a mix of many factors that drive the extremely violent movements of global markets, especially the U.S. ones. And yet, amid the avalanche of news flooding us daily for the past three months, there is one common denominator: Donald Trump.Donald Trump, who could also be described as a “multiplier of volatility,” or a “stress emancipator,” or even a “mass producer of tariffs.” But we wouldn’t be fully accurate in our analysis if we didn’t also acknowledge Trump’s HUGE contribution to green energy — since by flipping his position every 24 hours, he’s generating enough electricity to power Washington for the next 12 years. Yesterday again, it was nearly impossible to find a SINGLE news story where Trump’s “brand” wasn’t stamped in capital letters.Sure, one of the main reasons for the recent rally is still the Champions League-level backpedaling on Chinese tariffs and the whole Jerome Powell situation, but beyond that, it seems like every company releasing earnings right now is mentioning the issue of tariffs — both in their current results and in their hesitant forecasts for the months to come. So let’s try to unpack yesterday’s session. I say “try,” because right now it feels like unless I keep it simple and go straight to the point, we’re going to need 18 pages and a one-hour podcast to cover it all.So let’s start from the beginning. The guy says “let’s start from the beginning” after a whole page of verbal diatribe about Trump. We’re not out of the woods yet. Markets are happy, and so are the Americans (well, maybe)First, the numbers. Yesterday, European markets were pleased by Powell’s comeback and the “easing” announced by Scott Bessent regarding China — not to mention Trump’s comments saying they were going to “be nice” to the Chinese.If we dig a little deeper, some economists are starting to say that in this trade war, the Americans actually have more to lose. It’s not by much — maybe two cargo ships of soybeans and a load of semiconductors — but still.Yesterday, Europeans were relieved and could FINALLY focus on their quarterly earnings. In the “quarterly results buffet” category, Dassault Systèmes kicked things off in depressed mode: net profit down 8.8%, 2025 margin revised downward, and BAM! -5%.Thales followed with weak order intake, resulting in a 4% drop after flirting with -5% at the open — surprising, as it was one of the darlings of European rearmament, now seemingly fizzling out.Kering continues to slide, with sales plummeting 14% and the tone becoming as upbeat as a rainy November day in Brest. We talked about it yesterday.Worldline got a real smackdown: -11.43% after losing a major contract and reporting gloomy revenue figures.Luckily, Renault came to the rescue with a +4.4% boost thanks to strong EV sales — I almost bought an electric Alpine yesterday.And Orange did its job quietly with international growth and a gentle +0.36%. In Switzerland, there was joy over Roche’s results, cautious optimism at Nestlé, solid happiness at Kühne + Nagel, and a boom for Belimo and Galderma.Vontobel posted a positive performance for Q1 despite political uncertainty and rising volatility. Assets under management increased, but the stock wasn’t rewarded — it dropped 3.3%. At the end of this crazy day where the word “uncertainty” was used an incalculable number of times (thank you Mr. Trump), the DAX was up 0.47%, France advanced 0.27%, and our good old Swiss SMI gained almost 1%, nearing the 12,000 mark.But you could still feel a sort of uneasy sensation in the European markets — that stomach-churning feeling. Not the one you get after eating six dozen bad oysters that hitchhiked from Arcachon, no! More like the one where, deep down, you just know that as soon as you turn your back, Donald Trump is going to mess things up again. But no!Well, for once, we were wrong.Europe ended slightly higher, wondering whether the China/Powell dynamic would be enough to keep the U.S. afloat through the close and whether Trump would unleash one of his trademark statements. And he didn’t. Or rather, he did — but not in the way we feared. Basically, just minutes after the European close, the S&P 500 started rising a little faster, despite a complete lack of news.Absolutely nothing was happening.Everyone was watching the S&P rise and thinking, “Hmm, why is this going up???”And then suddenly, Trump announced that “discussions had begun with the Chinese.”After weeks of mutual attacks via random percentages, the two giants finally agreed to talk it out in front of a therapist.The indices skyrocketed, ending the day with a bang, and the Philadelphia Semiconductor Index went nuts, soaring 5.63%.It has rebounded 24% from its lows but still needs to climb another 40% to reach all-time highs. That’s how badly it got battered these past eight months.But now, if “talks begin” and they all end up being best friends forever, it’s going to be a party. But the story doesn’t stop at the close — that would be way too simple — no, because we love