The Consumer in Focus

The week is coming to an end, and nothing has fundamentally changed. Questions about customs duties remain the same. We keep going in circles, living to the rhythm of the U.S. President’s press conferences. Peace in Ukraine and the strengthening of European defense remain highly relevant topics, but for now, they no longer seem to interest the markets much. Macroeconomics has largely taken a back seat, but we will return to it next week. As for yesterday’s session, the focus was primarily on a topic that had been largely set aside for some time: the consumer’s financial health. Before A few years ago, a lot of emphasis was placed on the fact that the American consumer was the engine of growth—without them, U.S. growth couldn’t be sustained, and the entire economy would suffer. In recent years, however, no one seems to care much about the consumer’s financial health anymore. Instead, the focus has shifted to the growth of new technologies, and what Joe American does with his money has become an afterthought. Right now, we know that the average American is taking on debt to finance their personal battle against inflation. They’re questioning whether it’s worth buying a home with mortgage rates so high—yet at the same time, homeownership remains the ultimate symbol of the “American Dream.” And more recently, Walmart’s earnings report yesterday suggested that Joe American is tightening his belt and starting to be more mindful of his spending. The world’s largest supermarket chain released mixed results, stating that customers are shifting more toward lower-margin products. Translation: they’re opting for cheaper goods. These “new consumption habits” have led Walmart’s management to anticipate potentially tougher quarters ahead. The stock took a hit, dropping over 6%, and the entire retail sector suffered as investors started to wonder if things were better in the past and whether retail sales might become a problem in the coming months. This sounds worrying at first glance, but fortunately, Wall Street has an incredible ability to separate the wheat from the chaff and find a silver lining in bad news. Pressure, but Not Too Much Walmart’s announcement wasn’t great, especially considering that consumer spending may be weakening. That’s why the market was under slight pressure yesterday, and the S&P 500 failed—this time—to close at an all-time high. A wave of fear started creeping into the indices, adding a new layer of concern alongside tariffs, DeepSeek, and the fact that the Magnificent Seven can no longer lead the charge. But the panic didn’t last long. Analysts quickly stepped in to reassure the market and prevent a major pullback. From another perspective, one could argue that “if consumers change their spending habits,” inflation might ease, paving the way for a more favorable outlook on interest rates. Additionally, analysts reminded us that Walmart is a conservative company—when they say the next quarter “won’t be easy,” it’s more about preparing investors “just in case” rather than signaling a crisis. Walmart has never been one to release overly optimistic forecasts. The result? The damage was contained, but the Dow Jones still lost 1%—after all, Walmart is part of the index, meaning one-thirtieth of it fell by 6.5% in a single session. That kind of drop is bound to have an impact. End of the Week and Tariffs In Europe, the discussion around tariffs continued. Trump’s announcements regarding cars and semiconductors put pressure on certain segments of European indices, but overall, the damage wasn’t too bad, and the selling pressure felt on Wednesday eased significantly. The CAC 40 even managed to close in positive territory—just barely, but still in the green. Europe, however, seems unsure of where to focus its attention. On one hand, there are tariffs, though for now, there’s no need to panic too much. On the other, hopes for peace in Ukraine could give the markets a boost. On that note, it’s amusing to observe that February 24 will mark three years since Russian forces entered Ukraine, and yet the markets have climbed 60% since then—62% for the DAX, 41% for the CAC, and 68% for the Nasdaq. And now we’re being told: “If the war in Ukraine ends, it will be a relief for the markets, which will regain momentum and feel less pressure.” Well, that’s for sure—60% gains in three years, and the end of the war will supposedly make us feel even better about the bull market. Basically, if there had been no war in Ukraine, the DAX would be at 55,000, the CAC 40 above 15,000, and I don’t even want to think about tech stocks. I’m being sarcastic, of course—but I didn’t start it. In any case, the good news is that hopes for peace are acting as support for European markets, which are already looking forward to better days, while assuming the tariff situation will sort itself out. In summary, the markets remained solid yesterday—slightly down, but still resilient. Meanwhile—and I know I keep mentioning him—one person who never misses an opportunity to stay in the spotlight is Macron. He has made Ukraine his number one topic in every possible way. He no longer governs France (and Bayrou doesn’t either—he has other issues), but he lives solely for and through Ukraine. With summits every 48 hours, interviews, and social media appearances, he’s everywhere. It’s a convenient way to distract from other matters—and to remind Trump that he exists. Most recently, he has proposed launching a large-scale loan to support Ukraine, which will surely solve everything. Asian Markets This morning, most Asian markets were in the green, some more than others. The usual concerns about tariffs and high U.S. interest rates linger—though the U.S. doesn’t seem to care and keeps pushing higher. Meanwhile, Japan is barely inching forward with a 0.2% gain, China is up nearly 0.9%, but today’s gold medal goes to Hong Kong, where the Hang Seng Index soared over 3% thanks to Alibaba’s stellar earnings. Turns out, consumers aren’t doing too badly—it’s just a different kind of spending, in

Market Highs,Zero Thrill

The Law of Maximum Boredom Yes, okay, the S&P and the Nasdaq 100 are at all-time highs. The American benchmark index is breaking records for the second consecutive session. This should make us happy and have us popping champagne. Yet, we still feel profoundly bored. Not to say that we’re “bored out of our minds,” as the younger generation might put it. This morning, I have the feeling that we’re in an interstellar void of news. There’s nothing new, just rehashing the same stories we already know. We’re going in circles over tariffs that serve every purpose and none at the same time, and we no longer know what to think about war or peace in Ukraine. It’s dragging on. Sleep or Invest, That Is the Question When you do the job I do, it’s important for things to happen—profit warnings, panic crises, doubts about one theme or another, like the arrival of DeepSeek the other day. It’s crucial for tension to be at its peak, for volatility to be under pressure, and for at least some part of the wonderful world of investing to be in doubt. The problem is that, for the past few days, we’ve fallen into some kind of “space-time vortex,” giving the impression that nothing is happening. It feels like we’re in a parallel world where it’s hard to find arguments to go up or down. Sure, as I mentioned in the introduction, the S&P 500 is at an all-time high, and European indices have never been in better shape—well, except for yesterday. But there are very few pieces of news with the potential to be a real game-changer. Even though people are more or less convinced that “everything is going just fine,” it still feels like we’re running out of fuel to go higher, while at the same time, we can’t find any real reasons to go lower. This morning, I feel stuck in the middle of nowhere. Sure, things are happening here and there—Intel speculation, Palantir getting hammered because the CEO changed shareholder pact rules to allow himself to cash out part of his shares and pocket $1.2 billion. That, plus the fact that the Pentagon’s budget—a major Palantir client—is about to get a haircut. There are also some upgrades and downgrades making waves, like Jefferies’ upgrade on STM yesterday in Europe, which sent the stock soaring by nearly 8%. Or Bumble’s questionable numbers and terrible forecasts that sent its stock plunging 30%, making traders realize the stock has lost 92% of its value since its February 2021 IPO. And then there’s Etsy, which tanked 10% for missing the quarter from analysts’ perspective. But overall, nothing is making the market vibrate. You either have to be on the right stocks, or you’re bored out of your mind. The stock market just isn’t interesting anymore. At least, for now. Ukraine and Tariffs Of course, you might say, “But there’s plenty going on with tariffs, and that should shake things up! And what about Ukraine?” Yes, that’s true. But ever since the first tariff shock two weeks ago and the immediate reversal via border agreements with Canada and Mexico, we’ve understood that this is just a diplomatic bargaining tool. Before a wave of tariffs has any real impact on the U.S. economy, it will take a long time—if it even happens at all. As for Ukraine, it’s mostly a political and geopolitical chess game between Europeans and Americans. Trump wants to rebuild ties with Russia, while Europe wants to maintain its legitimacy in the conflict. Not to mention that this allows them to justify their military spending like never before—taking their cut along the way without anyone saying a word because, “you understand, war is at our doorstep.” So, the markets are stuck in a sort of cocoon—unable to rise much further because we’re already sky-high and valuations aren’t exactly cheap, but also unable to drop significantly because the U.S. economy remains strong. Europe will recover once the war ends, and all it takes is China kicking back into gear to align everyone. In short, we’re floating in the middle of nowhere—except at an extremely high altitude—and no one knows what to do, or rather, no one dares to do anything. On top of that, we’re in that awkward, quiet week—the one between the end of earnings season and the start of a new wave of macroeconomic data. A week where most of the companies reporting results don’t interest anyone anymore. There aren’t any significant economic figures, and since the arrival of Trump 2.0, no one cares about macroeconomics anyway—he’ll just multiply the loaves and walk on water. The usual generic arguments for buying or selling don’t excite anyone anymore. I’d say it’s too quiet, and I don’t really like that much, because I prefer when it’s a bit more or less not so calm. Anyway… Yesterday, U.S. markets closed at an all-time high, while Europe took a beating—with experts unable to agree on why. Some blame tensions over Ukraine, yet those same tensions fueled the rally the day before because of increased defense spending. Others point to interest rate worries, but European stock markets usually don’t care much about movements in the Bund or the OAT. To put things into perspective, the last time I mentioned the Bund or the OAT in my market commentaries was during the Greek crisis at the beginning of the last decade. So, maybe European markets deflated simply because they had risen too fast, too high, and too strongly—only to realize there’s no solid justification for such gains. Suddenly, trading in this environment becomes incredibly dull, and it might just be easier to reduce positions and come back next week when Nvidia releases its earnings—so we can finally talk about AI again. Because let’s be honest—the only thing that has truly excited us in recent months is Artificial Intelligence. Not Trump’s tie color, Musk’s latest child, or which U.S. football team won the Super Bowl. We need to

Modest records But Still

If we only look at the numbers, yesterday’s session wasn’t particularly memorable. The same themes as Monday’s session were repeated: defense was in the spotlight – once again – and tech enjoyed itself once more. But as for the rest – for now – the indices remain on the defensive. At all-time highs almost everywhere, but still on the defensive. Otherwise, there’s talk of peace talks that please everyone except the Europeans, discussions about investments in defense, rumors of Intel being acquired, and once again, debates about tariffs. And the Germans are feeling hopeful about next week. Like Yesterday, But Not as Good The Americans were back, but it didn’t change much in the end. As I mentioned yesterday, the S&P 500 closed at an all-time high, erasing the previous record from January 23. But it was a struggle, as just a few seconds before the close, it wasn’t quite there yet. To be fair, there hasn’t been much exciting news since the long weekend. Yes, Intel went wild, having its best session in five years with another 16% increase. We know Broadcom and TSM are circling around the semiconductor giant, although nothing concrete has come out yet. Meanwhile, in AI, Super Micro soared once again. The company has been on a tear since it got “more or less” back on track, and its recovery is impressive, although it’s still far from historic highs and will have to get through Nvidia’s earnings release next week. Speaking of Nvidia, the company has almost fully recovered from the DeepSeek incident. Even though yesterday wasn’t its best day, the stock remains strong and well-supported. However, with its quarterly report coming on February 26, expectations are high, and any disappointment could be costly given its current valuation. Meanwhile, U.S. markets were focused on two things: peace talks in Saudi Arabia – with Rubio and his team meeting Lavrov and his – and Trump’s declaration that he’ll likely meet with Putin before the end of February. Say what you want, but Trump seems to move faster and more effectively in talks with Putin than any G-20 member has in the past three years. The List The other hot topic for investors yesterday was the release of portfolio holdings from major investment moguls. Without listing everything, here are some key takeaways: Warren Buffett continues to reduce exposure to banks and fully exited his position in Ulta Beauty but increased holdings in Occidental Petroleum, Verisign, Sirius, and Domino’s. Terry Smith added Medpace and Doximity but significantly reduced other investments, reflecting a strategy similar to Buffett’s. David Tepper increased his tech exposure, while Bill Ackman made few changes, except for boosting positions in Brookfield and Nike while cutting back on Chipotle and Hilton. Overall, most managers didn’t make any drastic changes, sticking to their core strategies. If we dig deeper, it seems no one wants to go against the current bullish trend, but there are doubts about what lies ahead. With Trump in power, Powell refusing to lower rates, and inflation staying stubbornly high, 2025 could still hold plenty of surprises. In Europe, All Eyes on Germany In Europe, the focus remained on defense stocks. People might prefer to call them “defense sector stocks” because it sounds more politically correct, but in the end, it’s still about weapons. Right now, as Macron appears eager to join the UK in Ukraine, the rest of Europe continues to strengthen its defenses – funded by taxpayers, of course. Yesterday, the mood remained the same as the previous day, driven by defense spending and a military-like rally. The CAC 40 couldn’t close at an all-time high, but the CAC Global Return did, thanks to reinvested dividends, which supposedly allows France to compare itself to Germany’s DAX. Speaking of the DAX, it also closed at a record high, supported by defense stocks, the war in Ukraine, and a much better-than-expected ZEW economic sentiment index. Hope for a Right-Wing Government (But Not Too Much) The ZEW is an index that measures investor sentiment in Germany – it now also exists for the whole of EUROPE. In practice, financial experts are asked whether they are optimistic or pessimistic about the German economy in the coming months. Personally, no one’s ever asked me, but I must be too amateur for that. To put it simply: If the index is high, it means the future looks bright. But on the other hand, if the index drops, it signals “troubles ahead.” Yesterday, it was expected to be at 19.90, but it came out at 26, and last month it was just above 10. The reason for this “return of confidence in the future” clearly lies in this weekend’s elections, as there is hope for a shift to the right and a government that would (or will) provide a bit more support for the economy, as Scholz is expected to be ousted. The only thing worrying observers is the rise of the far-right. In Summary Yesterday was good because records were broken; it was good if you were invested in the arms sector, and it was even better if you had Intel and SMCI bought three weeks ago in your portfolio. As for today, we’re back to the topic of tariffs, because honestly, it’s been a while since we last talked about it. This morning, if you look at Asian markets, you’ll see that the automotive sector is under pressure. The Nikkei is down 0.3%, the Hang Seng is down 0.5%, and Shanghai is up 0.5%. But if you dig into the index components, you’ll see that car manufacturers aren’t celebrating. Don’t look for bad results, lowered guidance, or a flat tire – the reason lies on the other side of the Atlantic. The Return of the Prophet Yes, as I mentioned yesterday morning, Donald Trump was scheduled to speak last night. And he did. In doing so, he announced the upcoming implementation of 25% tariffs on car imports and around 25% on drug imports, with a gradual

Silence, Cash Flows

A Monday without the Americans, and everything feels deserted? Hmm, not quite. Yes, the U.S. markets were closed for President’s Day, but we still felt Trump’s presence everywhere. Things are heating up in Europe—Macron is acting like the leader of the continent, testing the waters for his next job in two years. Meetings are being held to discuss war and peace, and the numbers are being crunched to see how much should be spent in the coming months to “strengthen militarily” and protect against the big bad Putin, who is expected to march straight down the Champs-Élysées. Meanwhile, Europe keeps rising. A day in blue with stars shining in our eyes In the absence of the Americans—and while Trump was doing laps at Daytona in his official car—European markets focused on the war in Ukraine and how they could be involved in the peace agreements. We won’t get into politics in this column, but let’s just say that ever since Trump 2.0, everything has accelerated. The new American President is shaking things up with a force we’ve never seen before. And since his arrival, the prospect of peace in Ukraine has never seemed so strong. The problem is that his working method is more akin to an Abrams tank division crushing everything in its path rather than a delicate diplomatic approach featuring petits fours and Ferrero Rochers to wrap up the ambassador’s dinner. Naturally, Europe’s first line of defense isn’t taking this lightly. JD Vance’s speech in Munich last week didn’t go unnoticed, and several ministers across the political spectrum are on the verge of a nervous breakdown because their competence and authority have been called into question. But the one who took it the worst? French President Emmanuel Macron. Given the size of his ego, there was no way he was going to let that slide. So, France organized an emergency meeting with “part of” Europe, since they didn’t think it was necessary to invite the rest—another ego-driven move. However, the only leader on the continent who has never been elected by anyone was, of course, present. No matter. In the end, France got to puff out its chest, and Macron declared that the Europeans would be involved in the peace process alongside the Americans and the Russians (and maybe the Ukrainians). And, of course, it would be a great time to strengthen their defense lines—to show that theirs is bigger than the neighbor’s. Their defense, of course. In the process, discussions also turned to military budgets and NATO funding needs. We won’t dive into the details, as this is a financial column, after all. But the key takeaway is that between 8:00 AM and 10:00 PM yesterday, everyone managed to convince or self-convince themselves that spending, spending, and more spending on weaponry was the way forward. Suddenly, we all became die-hard fans of defense and arms. Yesterday was THE DAY for the defense sector—or rather, let’s be honest—the war industry. Building Peace Through War We are truly living in strange times. This morning, as I read the recap of what happened yesterday in the European markets, I was simply stunned by the overwhelming sense of disconnect from reality displayed by the world’s politicians. Each of them is off in their own corner, polishing their image, criticizing the negotiations set up by the Russians and the Americans—all while shamelessly bootlicking Trump. I wonder at what point we, the citizens, will start realizing that we are being governed by clowns. But let’s move on. What really matters for financial markets is that the global discussions aimed at bringing peace to Ukraine are triggering the largest wave of military spending in decades. Yesterday, Thales surged by 7.83%, Dassault was up 6.49%, and the DAX closed 1.26% higher, driven by Rheinmetall’s explosive 14% gain and Renk Group’s 18% increase—all fueled by the “potential increase in defense spending among European countries.” Saab also climbed 16%, while BAE Systems gained 9%. The defense sector is in a full-blown frenzy. But the funniest part? If you focus on the trend, you’ll notice that for the past five years, these stocks have done nothing but rise. And now, over the last two days, it’s no longer just an upward climb—it’s a vertical explosion. What’s ironic is that not too long ago, ESG investing was being pushed hard. We were told that putting money into the “bad companies” was wrong and that we should instead invest in the “good companies” that respected human life, nature, and the bees. And now? BAM!!! European governments—who are all financially drowning, by the way—have magically found billions to hand over to the “bad companies” to buy tanks, rifles, ammunition, missiles, fighter jets, chemical weapons, and bombs. And all this? To protect us from the Russians, who are supposedly going to come storming into European capitals in the coming years. And suddenly—POOF! Abracadabra! No one is out here preaching about investing in bees or locally grown organic tomatoes anymore. Suddenly, principles go out the window—as long as it drives the markets higher and brings in cash. I’m not shocked, really. I just realize that all the grand speeches about responsible investing and the “blacklisting” of certain “bad companies” are just a load of nonsense. Even governments don’t care. In fact, especially governments don’t care. Who Cares? It’s Going Up! Anyway, all this to say that yesterday, the Americans weren’t around, but we still managed to rally—thanks to NATO, thanks to the war that’s supposedly ending, and thanks to the Russian and American diplomats who flew off to Saudi Arabia to find a way to start talking again. After two years of giving each other the silent treatment, they now have to figure out who gets custody of the kids and how much child support needs to be paid—which, in geopolitical terms, translates to: “Who gets to keep Europe, and who gets the contracts to rebuild Ukraine?” Only after settling that can they start discussing actual peace in Ukraine. To sum up

Tariffs? Bring It On

The past week has been spectacular. Spectacular because we have learned that we are no longer afraid of tariffs, no longer afraid of inflation, and with each passing day, we convince ourselves that artificial intelligence is the solution to all our problems. Not to mention that peace in Ukraine is just around the corner and that Trump is a fantastic accelerator of processes. As for the markets, performance has been decent—Europe keeps climbing, while the U.S. is stalling at record highs. And this Monday, the States are closed. So why did we even show up? Like a Monday Mondays are never easy—coming to work is never simple, and getting back in front of the screens after the weekend is even harder. But it’s even more complicated when you have to come back to the office, knowing that the Americans are busy celebrating their Presidents and that their markets are closed. You know volumes will be lousy, and it’s likely to be too quiet. Yet, since the start of the year, all we’ve been hearing is that Europe is cheap, so we should buy. So maybe, this Monday without the Americans will be more exciting than usual—because Europe is cheap. Honestly, I have no idea, but one thing is certain: with Trump returning to power, the divide between Europe and the U.S. has never been more pronounced. So, we’ll give European markets a chance in the absence of the Americans and hope that—who knows—since it’s a holiday over there, Trump might take the opportunity to rest, stay silent, and say nothing. Then again, the guy hasn’t stopped since January 26, and it feels like he never sleeps. The Americans used to have a President who seemed to be sleeping all the time, and now, with Trump 2.0, it feels like he never does. Tariffs and Inflation So, we’ll start the week gently, with low volumes, waiting to see what the market’s concerns will be. Given this sluggish start to the penultimate week of February, we’ll likely focus on the FOMC Meeting Minutes coming out Wednesday night—just to see if we missed anything from Powell’s closing speech. Though, to be fair, in his testimony before Congress last week, he already repeated the same thing. In short, the Minutes should be a non-event since we already know almost everything. But since there’s not much else to chew on, we’ll pretend it’s important. And since we have (too much) time this morning, we might as well ask ourselves how and why inflation went so unnoticed last week. There was actually reason to be concerned. We hadn’t seen it above 3% for more than eight months, the figure was well above expectations, and it’s clear that interest rates aren’t stopping prices from rising again. This immediately raises questions about the Fed’s next moves. Questions Because if inflation is rising while rates haven’t moved for weeks, we can ask ourselves: (a) Is inflation climbing because rates aren’t high enough to stop people from borrowing and spending recklessly—especially since the economy is doing well and some Americans clearly still have money to spend? Or (b), could this inflationary situation eventually push the Fed back to the “hawkish” side, forcing them to RAISE rates again? I know that’s not the narrative we’ve been sold since October 2023, but let’s face it—right now, inflation is no longer falling. Quite the opposite. Yet, last week, the market didn’t flinch. In fact, the market doesn’t seem to care about inflation figures at all. After all, tariffs are no longer a concern, and Trump—the “dove of peace”—is supposedly about to end the war right under the noses of European leaders, who have poured half their GDP into Ukraine over the past three years. When faced with such thrilling and disruptive news, it’s easy to forget the pesky issue of rising inflation. Plus, the media does a great job of reassuring us that, yes, inflation is climbing, but hey, it’s not that bad—so there’s no need to panic. In reality, just when we thought we had buried inflation six feet under, it’s coming back stronger—more resilient than a zombie in The Walking Dead. And last week, we learned five essential things about why it refuses to die and return to Powell’s sacred 2% target. Just Another Monday Mondays are never easy—it’s never simple to get back to work, to sit in front of the screens again after the weekend. But it’s even harder when you know that the Americans are busy celebrating their Presidents, meaning their markets are closed, volumes will be terrible, and everything is likely to be way too quiet. Still, I don’t know, but since the beginning of the year, everyone keeps saying that Europe is cheap, so we should buy. Maybe this time, this Monday without the Americans will be more exciting than usual—because Europe is cheap. Honestly, I have no idea. But one thing is certain: with Trump back in power, the gap between Europe and the USA has never been wider. So, let’s give European markets a chance in the absence of the Americans and tell ourselves that—who knows—since it’s a holiday over there, maybe Trump will take the opportunity to rest, stay silent, and say nothing. Then again, the guy hasn’t stopped since January 26, and it feels like he never sleeps. The Americans used to have a president who seemed to be sleeping all the time, and now, with Trump 2.0, it feels like he never sleeps at all. Tariffs and Inflation So, we’re starting the week slowly, with low trading volumes, waiting to see what the market’s concerns will be. Given this awkward start to the second-to-last week of February, we will likely focus on the FOMC Meeting Minutes coming out Wednesday night—to check if we missed anything after Powell’s closing speech. Although, since his congressional testimony last week was just a repetition of the same message, the Minutes are probably going to be a total non-event. We already know almost everything. But

Bull Market Strength

I was away for a day. JUST ONE DAY. And yet, that was enough to (almost) push all-time highs everywhere and, most importantly, bring back exaggerated optimism from all sides. However, if we base ourselves on the macroeconomic data we’ve had to digest over the past 72 hours, there’s certainly reason to raise an eyebrow when comparing performance to economic reality! But actually: NO! No, because the great thing about finance and the fascinating world of investment is that it’s not economic reality that matters—it’s how we make it say what we want! The Facts Are Here But let’s start at the beginning. The beginning of economic reality. What we’ve known since Wednesday, and especially since yesterday, is that inflation is picking up again. Wednesday’s CPI came in at 3%—above expectations—and yesterday’s PPI also exceeded expectations. And if we look ahead to next month, we can already assume that CPI won’t be going down, because PPI comes before CPI. In simple terms: if PPI is strong, since it represents production prices, and production comes before consumption, it’s easy to see that if producers are paying more to produce and don’t want to cut into their margins, then ultimately, the consumer (you and me) will end up footing the bill—probably within the next month. So, no matter how we spin it—whether we say it gently while tossing rose petals in the air, or write it in pastel colors with soft background music—the reality is this: inflation is rising again. And if inflation is rising again, then the prospect of lower U.S. interest rates is becoming more science fiction than a realistic economic objective that could be integrated into a so-called “Global Macro” investment strategy (if we want to sound fancy). Beyond that, the economic data from recent days suggests that Powell won’t feel the need to change his tone much. His message essentially remains: “There’s no urgency to cut rates.” This is worrying, because the narrative of the past 18 months has been based on a simple equation:“Inflation is falling → Powell will cut rates → Consumers will have more money → People will rush to Walmart and Apple → BUY the market, especially Apple and Walmart.” Now, if inflation starts rising again, that theory becomes MUCH weaker. But hey, no need to panic! In the wonderful world of investing, we always find a rational explanation to justify our actions. And to maintain our permanent Bull Market, the solution is simple: we just need to INTERPRET things the right way. A New Era Until Tuesday morning, the main concern was ensuring that inflation was under control and slowly returning to 2%—as planned by the Fed—so that interest rates could decline accordingly. But after the latest data, it’s become clear that 2% inflation isn’t happening anytime soon, not this year, and probably not even in 2026. So, we’re left with three investment strategy alternatives: Panic—realize that inflation is no longer “transitory” and is completely out of control, leading us all to financial doom. Rationalization—convince the masses that a strong economy comes with strong inflation, that growth doesn’t happen without inflation, and that a little inflation never hurt anyone. (Some might even argue that the Fed should raise its inflation target by 1.5%.) If we accept this, then everything we’ve believed for the past 18 months is BS. Smoke and Mirrors—probably the easiest solution, and the one currently in play. Maybe with a bit of option #2 mixed in. Because let’s be honest—did you see what happened yesterday? Markets soared because Trump announced his new tariff reciprocity strategy—essentially, he plans to tax foreign countries the same way they’ve been taxing the U.S. for years. But here’s the catch: this will take time, analysis, and reflection. Meaning tariffs won’t be implemented anytime soon, so there’s nothing to worry about. Inflation won’t be “boosted” by tariffs (and anyway, who cares about inflation? We’re too busy finding reasons to ignore it). On top of that, markets decided yesterday that Trump’s tariff plan is about as threatening as a barking dog with a muzzle, locked in a cage made of adamantium bars. Admission Awareness of customs duties might not have been enough to boost the market—especially since we’d been saying the same thing for over a week. So, we had to load the boat with something more captivating, something more motivating. What better than to discreetly announce that Trump and Putin are expected to meet in Saudi Arabia to resolve the war issue? A brief statement, whose source is unknown, was enough to make us feel completely relieved that the war might soon come to an end. Of course, not everyone is pleased—starting with Zelensky, who isn’t even sure he’ll get a stool in the negotiation room. Nor are European politicians, who find themselves instantly ejected from the discussions. Just look at Gabriel Attal’s messages—he holds no government position but already acts like an elected president, displaying his outrage like a war leader meant to strike fear into Russia and the US. Anyway, that’s not the topic here, but I couldn’t resist mentioning how pathetic he and his peers are. From a market perspective, you give them a little breathing room by no longer talking about inflation (even though you’ve been drumming it into their ears—I say ears to stay polite—for four years), you tell them a beautiful fairy tale with colorful characters about the war in Ukraine, you neatly package the customs duty story by saying that AFTER ALL, IT’S NOT THAT BAD (especially since no one cares about inflation! Yes, yes, I just told you)… And in the end, you have the S&P 500 closing ALMOST at an all-time high. The DAX is at an all-time high. The CAC is ALMOST at an all-time high. The SMI is ALMOST at an all-time high, and the SOX is still stuck in its lateral range, refusing to break out. Everything is fine in the best of all possible worlds, and it’s all thanks to Trump! And

Inflation at the Center

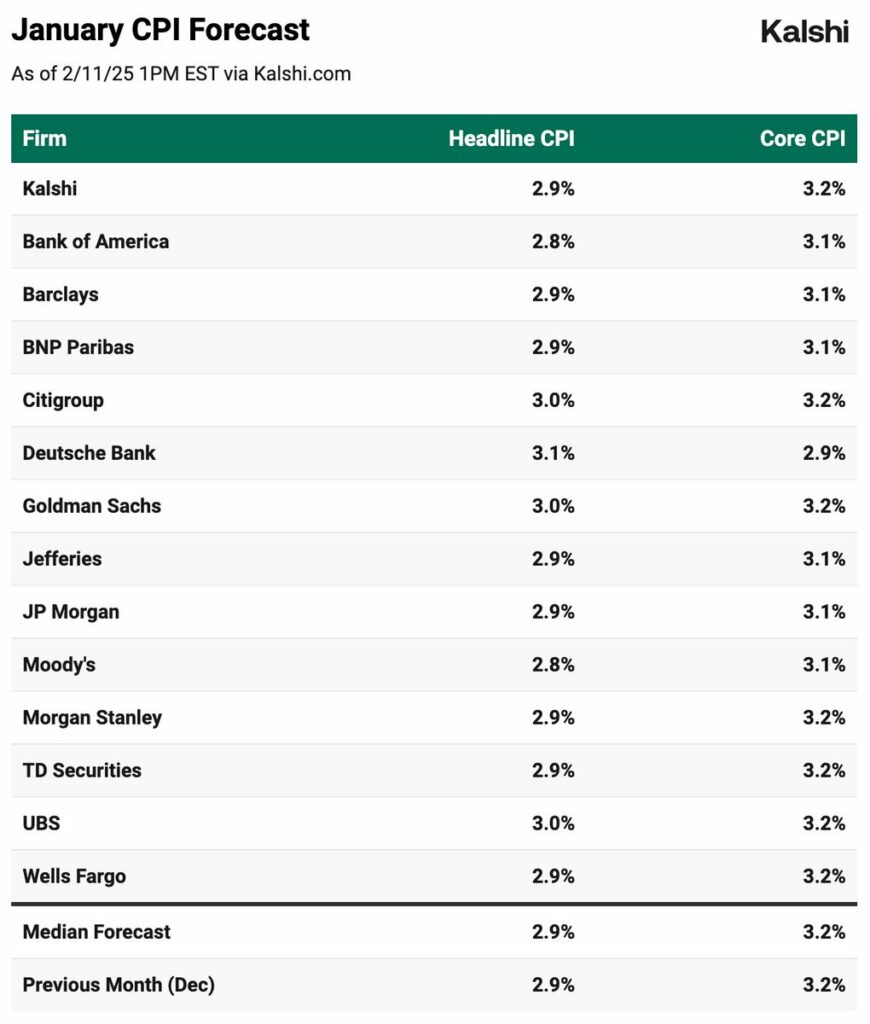

The U.S. markets ending in the middle of nowhere, Europe still being considered “cheap” by market participants, the DAX surpassing 22,000 for the first time in its HISTORY, and Powell confirming that there’s no rush to cut rates. This Tuesday, February 11, was another day following the same patterns as the past few days: an intense obsession with ARTIFICIAL INTELLIGENCE, tariffs dominating most conversations—along with Trump, Musk, and Vance. And in the end, Powell telling us nothing new, except that nothing has changed. Now, we’ll have to see if inflation will be a wake-up call for all of us. From the Beginning Since Donald Trump became the 47th President of the United States, we have been living to the rhythm of his explosive announcements. Since January 27, the world has been rocked by the declarations of a President whom some consider completely insane, while others believe he is bringing order to the world. It’s hard to take a side—especially since no one is asking us to. Nevertheless, we have to live with it. From now on, steel and aluminum will be taxed at 25%, starting in mid-March. This is no longer a surprise, and we have already been dealing with it for two sessions. The market, for its part, seems to be handling it reasonably well. However, the real question remains: how long can we ignore the actual consequences of these tariff increases, and what will be the next announcement? Who will be the next to take a hit? For now, global indices seem immune. The performance of U.S. indices on Tuesday was unremarkable—we remain stuck in a sideways trading range, whether on the S&P 500, the Nasdaq, or the SOX. The only difference between these three indices is that the SOX has been stuck for much longer. It’s difficult to choose a direction when valuations are extremely high, yet shorting the market would be madness while the White House disruptor runs around telling everyone who will listen that he is going to restore America’s greatness, give every citizen a job, a home, and money—and, in a masterstroke, do it all without causing inflation to rise, or perhaps even lowering it. Looking Forward to Tomorrow (Well, Today) Yesterday’s session revolved around Trump’s statements, which no longer seem to scare anyone (for now). Beyond that, the market continued to hype artificial intelligence (thanks to the Paris summit), and as usual, investors kept buying into Germany and France because they’re cheap and breaking records daily. There was also time to analyze Coca-Cola’s earnings while waiting for Jerome Powell’s testimony before the nation’s top authorities. As for Coca-Cola, it outperformed market expectations, and Coca Zero sales pleasantly surprised investors. The stock had faced a tough previous quarter, but it looks like that’s behind them now. The share closed up nearly 5%, leaving behind a massive gap that may need to be filled someday—but let’s not spoil the celebration. As usual, Coca-Cola is a trend stock that should be bought when no one wants it anymore because, no matter what people say, it sells worldwide, and in the end, the bulls always win with Coca. One of the other central themes of Tuesday was, of course, Jerome Powell’s testimony before the Senate Banking Committee. According to its chairman, the Fed has no reason to rush into cutting rates. He argued that the economy is “generally strong,” with a low unemployment rate, which does not justify immediate action. Not to mention that inflation remains above the Fed’s 2% target, which has existed since the dawn of time. The world’s top central banker explained to politicians—who spent the day questioning him about the new Trump administration—that he does not engage in politics. His job is to manage a real economy without worrying about his interviewers’ electoral concerns. He stated that the economy is broadly strong, has made significant progress toward its objectives, and that the Fed has absolutely no reason to rush into monetary policy adjustments. Notably, he specified “ADJUST” and not cut or raise rates—an intelligent way to keep a backdoor open just in case. His words were more or less, if not exactly, the SAME as those from the Fed’s January meeting. In conclusion, Powell told the committee members and the rest of the world that “further rate cuts would depend on a MORE SIGNIFICANT decline in inflation AND the health of the labor market.” As for the labor market, there’s nothing to complain about (for now)—it remains strong. As for inflation, conveniently, it will be released this afternoon at 2:30 PM. Amusingly, Powell carefully avoided commenting on Trump’s new retaliatory measures and their potential impact on inflation—and, by extension, on a possible rate cut. Inflation as the Target So, as you’ve probably figured out, this Wednesday will be all about inflation—unless Trump or someone else decides to crash the party with a spectacular announcement. I don’t know, maybe a 25% tariff on Europe and 50% on France because Manu Macron didn’t greet Vice President Vance at the top of the Élysée Palace steps. Or maybe Musk announcing that he wants to buy Ford just to get their V8 engines and put them in Tesla S models to “Make American Automobiles Great Again.” Or Zuckerberg declaring that he wants to buy Hawaii and Nvidia because Meta has just logged its 17th consecutive day of gains. Lately, macroeconomic fundamentals have often been pushed aside because people were too busy with other things. Remember last Friday’s job numbers? They generated about as much interest in the financial community as I have in the reproduction of clams on the southern coasts of New Zealand. Regardless, this afternoon we’ll find out what inflation has done over the past 12 months and whether it has finally decided to come home, heading toward 2%. Looking at market expectations, CPI is expected to come in at 2.9%, and Core CPI (which only includes the stuff that’s doing well) is forecast at 3.2%. For our personal knowledge, it’s worth noting that

Negotiation Arsenal

Don’t give a damn. It’s official. The market no longer gives a damn about tariffs. For now, indices around the world are signaling that “everyone understands this is a weapon of mass negotiation” and that as long as there are no real implementations and we can’t measure the economic impact, we’ll keep buying the rest of the market. The “threats to tax everyone” from Friday night sent a chill over the weekend, but we made up for it on Monday as if the import tariffs on metals were just a bluff. A bluff that Trump still went ahead and signed into effect as executive orders last night. Not Selling The market finds itself in a very strange situation. We know that the President wants to assert his power over the rest of the world and “make America great again.” To do so, he first has to clash with allies, and these disputes could lead to trade wars—never good for economies. These wars could trigger inflation spikes and fears of declining consumer spending. Yet despite these concerns and the fact that we know Trump is completely unpredictable, capable of doing anything at any moment, the market keeps buying as long as there’s no CONCRETE action. That’s essentially the message the market is sending: “Dear President, you want to raise tariffs left and right and pick fights with everyone? We’re fine with that!” Even though deep down, we’d also like to say, “Go on, I dare you!” And so, as long as there are no REAL tariffs being enforced (apparently, the 10% against China doesn’t count in Wall Street’s mind), buyers refuse to give up on the rally. They see an opportunity to scoop up tech and AI stocks if the current bullish wave continues. Monday’s gains weren’t sky-high, but once again, investors turned their attention to AI and the Magnificent Seven—because when you don’t know what to buy, you might as well grab the biggest names that, at worst, will form the foundations of the future World Company. Yes, the gains weren’t spectacular, but everything was in the green—except Tesla. Meanwhile, Nvidia kept climbing, adding another 3% for the sixth consecutive session. And we have to mention Meta, which gained just 0.4%—not exactly mind-blowing—but it marked its 16th straight session of gains! I don’t have the stats on hand, but even ChatGPT couldn’t find another company that’s strung together 16 sessions of consecutive gains. Not even Nvidia. Trump’s Tactics No Longer Scare Anyone—Until They Do If we needed more proof of the market’s bipolar nature, just look at the commentary. Before the close, markets were rising, and analysts were calm, saying tariffs were just a negotiation tool. But right after the close, when news broke that Trump had actually signed off on those tariffs, futures immediately gave up half the day’s gains. Stuck in Concrete In short, we know what we’re doing, we’re confident in many things—but that confidence is fragile and could vanish in an instant. As I write this, futures are down 0.3%—for whatever that’s worth at 5 AM Geneva time. One thing is clear—just look at the charts of the S&P 500 and Nasdaq 100—markets are stuck in a period of uncertainty. We know valuations aren’t cheap. We know the Fed will be calling the shots in the coming weeks. We know Wednesday’s inflation data could be a key factor in guiding the Fed’s next moves. But until things become clearer, investors are hesitant to push the market higher. Because let’s be honest—if we break through all-time highs on the S&P 500, we’re launching into a new bullish wave that could blow the roof off. For Now, No Clear Direction At the moment, it’s clear that we’re struggling to tip definitively to one side or the other. The final decision date doesn’t seem too far off, but pinpointing it on the calendar isn’t easy. So for now, we’re living day by day—or rather, from one Trump statement to the next—waiting for news that might show us the way. Maybe it will come in the form of tomorrow’s CPI report or Nvidia’s earnings in 15 days. Who knows? Last Friday, we saw that economic figures have very little impact at the moment. The words and declarations of the White House resident carry too much weight, and we never know how things will end. If they ever do. Europe In Europe, we’re in the same mood, with two additional factors: Factor one: European stock valuations are lower, meaning we can play the “catch-up effect.” Factor two: The AI Summit in Paris, featuring the fabulous, exuberant, excellent—no, let’s say the EXTRAORDINARY Emmanuel Macron, President of all French people, acting as a top-tier salesman. And since artificial intelligence is undeniably cool, it’s even cooler when Europe hosts big events and looks stronger than others. So, we might as well ride the wave, push for 8,000 on the CAC, and close at record highs on the DAX. Simply put, for now, Europe is surfing the momentum. Since no one dares—or really wants—to sell, and since quarterly earnings aren’t bad, we’ll keep going with the flow for a little while longer. Rest of the World As for the rest of the world, Asian indices are practically doing nothing this morning, as if they’re waiting to gauge the perception of tariffs before taking any risks. Even if we think we “understand everything,” there’s always a chance of an uncontrolled slip-up due to a sudden reinterpretation of what we thought we knew. You follow? No? Because even I got lost there. Anyway, Asia is in wait-and-see mode. Gold is at $2,944, heading toward $3,000, and oil is at $72.55, because oil always rises when geopolitical tensions start looming on the horizon. As for risk appetite, Bitcoin is doing nothing, hovering around $97,700, much like the markets—stuck in relative stagnation, waiting for the fog to lift and the sun to shine again. Today’s Market Stories To be perfectly honest, if we focus solely on the indices,

Customs duties & Ai

Last week began with the topic of customs duties and ended with the same topic—since Trump had more or less hinted that he was going to announce new tariffs against just about everyone. And guess what? It’s not over yet, because last night—just before the Super Bowl—Trump doubled down by announcing a 25% tariff on all steel and aluminum imports. Since the announcement, futures have started rising again, as this is seen as good news for making America Great Again. The Central Focus To be honest with you, we still don’t know who’s next on the list to be hit with tariffs. We have a few ideas—somewhere between India and Europe—but one thing is certain: the central axis driving the markets right now is clearly Donald Trump. In fact, I even wonder if he ever gets a chance to sleep, because ever since he took office in the U.S., it feels like he’s always there, always present, and the moment you take your eyes off the screen for more than three minutes—BAM!—he’s back with something new. One day it’s $500 billion in AI, the next it’s fighting fentanyl by taxing Canada and Mexico, then it’s the return of plastic straws, the desire to dismantle wind turbines, or even buying Greenland. In short, he’s never out of ideas, and when it comes to tariffs, he still has a long list of countries to tax and industries to crush. As for the market and us, the participants, we’re going to have to get used to it—because he’s here to stay for quite a while. And the most telling thing about Trump’s omnipresence is that he overshadows everything. Absolutely everything. Whether we’re talking about macroeconomics or quarterly earnings, all it takes is for Trump to post something on X, and suddenly, the focus shifts. Take last Friday, for example—U.S. employment numbers were released. You’d probably agree with me that this has been an obsession of ours for at least 24 months now. If I recall what’s been happening since January 2023, we’ve been fixated on whether employment might slow due to high interest rates, which could, in turn, be seen as the first step toward a recession. I know we in this industry have the memory of a goldfish, but you’d still acknowledge that Non-Farm Payrolls have been a fixture on our calendars every first Friday of the month, right? Well, ever since Trump has been back, it seems like that’s taken a backseat. The employment numbers were also released last Friday—it was actually the most important economic figure of the week. That said, the numbers weren’t particularly revealing: in January, the U.S. added 143,000 jobs, down from 307,000 in December and below expectations of 169,000. But—EUREKA, GOOD NEWS—the unemployment rate fell to 4%! The takeaway from these employment figures is that the good cancels out the bad, leaving no clear indication about the future of interest rates. However, one thing is almost certain: rates will not be cut in March, and anyone still believing otherwise should probably seek professional help. But the real issue isn’t whether these numbers are good or bad—the real issue is that no one gives a damn! Everyone is completely hypnotized by the statements and grandstanding from the White House. This week, the U.S. CPI numbers will be released, and it feels like nobody cares because all attention is on Trump, Trump, and more Trump. Then again, it’s not exactly surprising that he’s taking up so much space (to avoid saying ALL the space). If we remember the period from January 20, 2017, to January 20, 2021, we were bombarded with aflurry of tweets, dramatic twists, and a stock market that danced to the rhythm of White House announcements. It was like a real-life Netflix series. And guess what? We’re in for four more seasons! Honestly, I think I need to take a Xanax and stop getting worked up about this because we’re just at the beginning of the story. And if he manages to secure another term, well, the fun has only just begun. For now, one thing is clear: if you’re an aluminum or steel exporter to the U.S., you’re probably having aterrible morning. There’s still a slim hope that Trump is only doing this to get something in return, and if you hand it over within 12 minutes, he might be magnanimous with you—but still, it’s not looking good. AI, Always AI… On another note, the other big topic at the start of this week is one we’ve beenhearing about for months. Yes, you guessed it—ARTIFICIAL INTELLIGENCE. I know, it’s not very original, but hey, I don’t make the news! And honestly, when I look at global headlines, I’m fascinated by howmuch we’re willing to invest in Artificial Intelligence while seemingly neglecting investment in human intelligence. Just look at the sheer number of idiots multiplying at an alarming rate. But that’s another debate that would take way too long! Let’s at least acknowledge that the brilliant President Macron—the French guide, the beacon of intelligence in the Hexagon—has just announced that France will invest €109 billion in artificial intelligence. I’m not entirely sure, and I don’t have the exact figures, but I highly doubt that national education spending is anywhere close to that. Not to mention the irony of France signing blank checks for AI while its deficit is skyrocketing, and the government has no idea how to make it to the end of the month. Nevertheless, AI investment is now the “other big market obsession.” Speaking of which, I want to quickly revisit an interesting and quickly forgotten event: just two weeks ago, we started a Monday much like today, except the markets took a nosedive after a new app topped the Apple Store charts. This app, called DeepSeek, was supposedly about to put us all in trouble for at least two days. The issue with DeepSeek wasn’t so much that this AI was more powerful than ChatGPT. The real problem was that it was

AI is booming

“Full house” day on the financial markets. While we started the week on Monday morning under the reign of terror of customs duties, we are now ending it on a high note, even though—once again—Amazon’s cloud numbers weren’t enough to satisfy investors. Everything else is “almost” perfect, and nothing seems to be stopping the markets. The DAX is back at an all-time high, the CAC is above 8,000 points again, earnings are generally strong—and if some stocks are down, it’s more psychological than fundamental. And above all, tons of money are pouring into AI!!! Europe Has Understood As General De Gaulle once said, “I have understood you!” Well, the European stock markets are no different—except they have understood Trump. As a result, they have received a boost, and nothing seems able to stop them. Looking back to the start of the week: we were on the verge of a panic attack at the mere thought of Trump slapping unbearable tariffs on us. The anxiety was suffocating. By Tuesday, we felt somewhat relieved to see that if we complied with the American President’s demands, tariffs could actually be renegotiated. The decline in markets stopped, but there was still fear that after Mexico, Canada, and China, Europe might be next on his list. Then, as the days passed and Trump seemed preoccupied with other matters—such as banning transgender athletes from women’s competitions and, incidentally, from their locker rooms—we started to wonder, “Maybe he has forgotten about Europe.” Of course, it was difficult to fully believe that. But yesterday, we found a new “buying motivation.” We began to convince ourselves that Trump didn’t actually have bad intentions toward us—he was merely using tariffs as a “threat” to accelerate negotiations on certain issues. So we thought, “Even if he does start attacking Europe with tariffs, it will be resolved in no time because we’ll just negotiate quickly.” Now, the real challenge is getting the dozens of European MPs in Brussels—who do absolutely nothing all day when they’re actually in Brussels—to reach an agreement. But once that happens, the issue will be settled. In short, we started to believe that tariffs were just political posturing and that a solution would be found anyway. On top of that, strong earnings reports from SocGen, ArcelorMittal, and Siemens Healthineers fueled optimism, making for an absolutely fantastic day. SocGen surged so dramatically that, for a moment, it almost seemed like Jérôme Kerviel had returned to trade for them. And in France, there was a collective sigh of relief for having a budget. Magic Assembly Yes, it’s quite absurd from an outsider’s perspective. The center-right government, led by Bayrou, managed to push through a budget by sheer force. The entire political and economic world agrees that this budget is an absolute disaster and that next year will be even worse, as everything intended for long-term development has been shelved. Yet, everyone is somehow pleased because at least there is a budget. Still, it’s just a band-aid solution, and the backlash could be massive. When you repaint the facade of a crumbling house, the paint won’t hold the walls together. But never mind. France has a budget, SocGen is soaring, and nothing seems to be able to stop the CAC 40, which is just a hair away from its all-time highs. Meanwhile, Bayrou even managed to erase the dissolution of the CAC 40 tables. In the U.S., investors hesitated on which direction to take. Many stocks that had reported earnings the previous day were struggling, and the big question was whether Amazon could save the market by the end of the session. Yet, as the day progressed, the indices gravitated toward their usual favorite direction: upward. Once again, AI giants led the charge, and everyone reassured themselves that Google would still pour mountains of cash into AI—just like Microsoft and Meta—which was great news for Nvidia, which continued to rebound, and Palantir, which gained another 10%. Palantir, by the way, is at valuation levels that are downright scary (it’s currently trading at 65 times its revenue—I’ll just leave that here, but it’s huge). However, that didn’t seem to concern anyone. By the end of the day, Ford was still declining, the Dow Jones flirted with all-time highs, and Nikola—the former electric vehicle darling—filed for bankruptcy. Meanwhile, traders turned their focus to the upcoming Non-Farm Payrolls (NFP) report, due this afternoon. For the record, the Jobless Claims report came in stronger than expected, but again, that wasn’t the day’s concern. The market was simply looking for a reason to rise. NFPs: A No-Brainer? Speaking of Non-Farm Payrolls (NFP)—expected at 169,000—everyone seems fairly confident. The big question is: What will be considered a “good” number this afternoon? The only consensus so far is that the unemployment rate should stay at 4.1%. But when it comes to job creation, things get tricky. If the number comes in higher than expected, that means the economy is strong, which could be a reason not to cut interest rates. In other words, too much good news could be bad news for rate-cut expectations from the Federal Reserve. On the flip side, if job creation falls below expectations, it would signal economic weakness—but markets could spin it positively, hoping that the White House’s “savior” will fix everything in the coming months. In short, a bad jobs report might actually be better for markets. One thing is certain: the interpretation of today’s NFP data will be highly psychological. And that’s what traders will be focusing on. For now, the takeaway is simple: this market refuses to fall, and as long as there’s an excuse to stay optimistic, we’ll keep climbing—until we can’t anymore.” Asia Leads the Way This morning, China and Hong Kong are up by 1.4%. The reason has nothing to do with tariffs—Trump still hasn’t spoken with Xi Jinping (unless I’m mistaken)—and market players are instead jumping on the Artificial Intelligence theme in China. It’s also possible that Amazon has something to do with this (I’ll