Markets, Morphine & Magic Chips

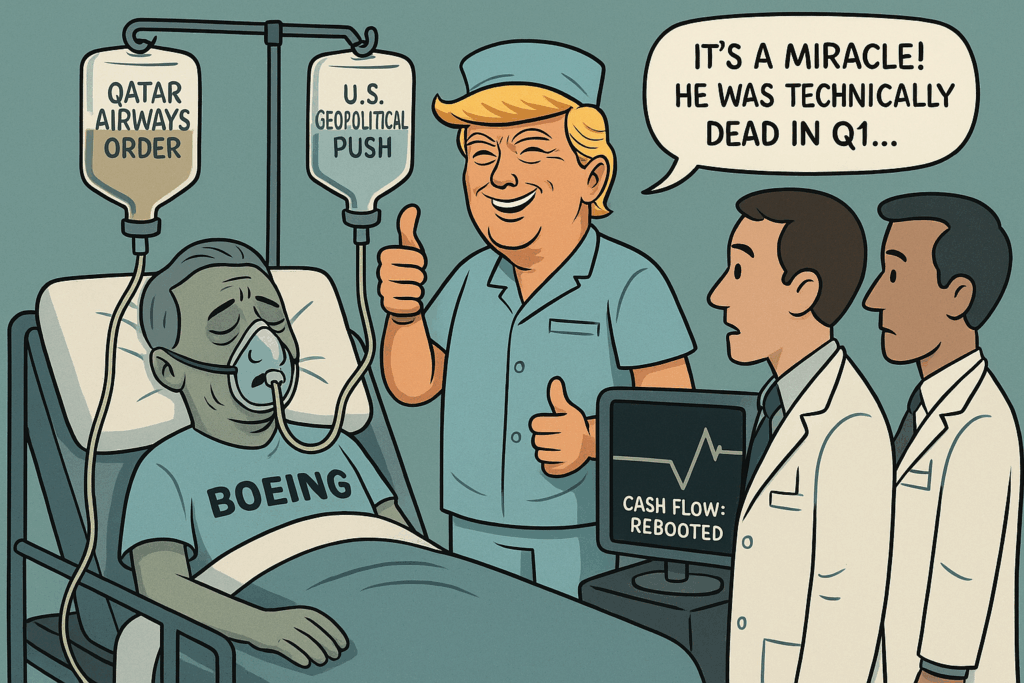

Markets are rising, the economy is slowing, interest rates are screaming for help—and no one cares. Why is no one paying attention? Well, because Trump postponed his economic weapons of mass destruction against Europe. Nothing has been resolved, but we’re celebrating the delay—classy behavior from the world champions of short-term vision. While we wait for Nvidia’s earnings tonight and the PCE inflation report on Friday, the stock market is running on narrative life support. Artificial euphoria and smoky hopes for some mysterious economic miracle. Meanwhile, as the indices throw a party, bonds are groaning, debt is overflowing, and the US Treasury is trying to fiddle with the rules to calm long-term yields. It’s all stand-up comedy, empty words, and wishful thinking. In short, we’re living in the illusion of stability… with Nvidia as the final judge. At least until tomorrow night, when it’ll already be time to move on. Honestly, doesn’t it feel like we’re living in a stage play, and none of this is real? We’re in a theatrical farce of markets, geopolitics, and monetary policy. The script is always the same, and it feels like we’ve seen the episode before and already know how it ends. Like Netflix messing up the order of its series, and we’re stuck watching entire seasons out of sequence, trying to make sense of it all as we go. In the current never-ending episode: Donald Trump threatens, markets panic, Trump backs down, markets rejoice… Boom—two days of rally on a non-event, a mere deadline postponement that resolves absolutely nothing. The stock market now runs on tariff-induced dopamine, addicted to unpredictability, clinging to every Trump tweet or wink. And this week, the ride started again: the 50% tariffs on European goods, initially set for June 1, are postponed to July 9. A simple “we’ll see later” that was enough to spark widespread euphoria in the markets following the start of a “love story” between Trump and von der Pfizer. We don’t celebrate economic results anymore—we celebrate the postponement of chaos. It really feels like we’re going in circles. I feel like I’m rewriting yesterday’s column, except this time it’s the Americans who benefited from Sunday night’s announcements. Can’t wait to get back to actual facts instead of operating based on the lyrical outbursts of the Pied Piper in the White House. Over to New YorkOn Tuesday, Wall Street soared. +741 points for the Dow Jones, +2.05% for the S&P 500, +2.47% for the Nasdaq. Investors, still hungover from the extended Memorial Day weekend barbecues, rushed into stocks as if Trump had just signed a global economic peace treaty, dropped the tariff strategy, opened U.S. borders to everyone, and found a cure for cancer between Monday night and Tuesday morning. But let me be clear: this rebound is built on sand. Because in reality, nothing has been resolved. Trade negotiations with Europe are still deadlocked. Trump just offered a tactical pause, a tax carrot, and the illusion that we’re all buddies. Meanwhile, the global economy is holding its breath—not a matter of “if,” but “when” the next hammer blow will fall. We all know he’s going to pull something else—probably with China. We know full well the American President isn’t going to just “magically” move on and forget about the topic. He’s going to strike again—at someone or something, or both. And that’s the current paradox: markets are celebrating sanction delays as if they were massive economic stimulus packages or long-term solutions, while macro fundamentals are screaming instability. Right now, all indices are on life support and we refuse to see the risk in favor of hoping for a miracle. Everything hangs on expectations. Expectations of data, speeches, political or tech miracles. And it’s precisely this buildup of expectations that makes the situation both unstable and hypnotic. The Day After YesterdayLet’s not kid ourselves—yesterday, the U.S. was in full party mode to celebrate the postponement of the tariffs to July 9. It’s not a guarantee—it’s a sugar cube to make the Europeans think we’re friends. But behind the scenes, Trump’s got his fingers crossed, and at the first opportunity, he’ll hit us again. But no matter. Now that yesterday’s session is behind us, the celebrations are over, and the S&P 500 is just 3.6% from its all-time high, we can “RE-focus” on this week’s expectations. Two crucial milestones ahead—and when I say crucial, I mean it in ALL CAPS and bold font. First: Nvidia’s earnings tonight. Then: the PCE inflation report on Friday. Two events that will be revealing. Because despite the festive start to the week, the backdrop remains blurry. Like my screen in the morning when I’ve left my glasses at the restaurant and have to set Word to Arial 25 to see anything. The economy is slowing, long-term yields remain high—yes, they dipped slightly, but they’re still too high—debt is exploding, yet we keep buying. Because we hope AI will solve everything. Because we hope Trump will negotiate with kindness and goodwill. And above all, we buy because we have no choice. The hype must be maintained with more hype, or else it’s no fun. In Europe, since we already cheered the “July 9 deals” on Monday, we didn’t move while waiting for more info. Understandable. Paris stagnated to digest Monday’s nice rise. Frankfurt clung to its records, but with trading volume at historic lows. It’s like everyone is on pause, ready to react, but with zero conviction for now. In Switzerland, the SMI gained +0.06%, helped by Richemont (+1%) and booming watch exports to the U.S. (+149%)—let’s just hope Trump didn’t see that number, or he might slap a special tax on Swiss watchmakers who don’t manufacture in the U.S. In summary, a strong recovery day in New York, and a maximum boredom session in Europe because no one knows what to do—and ON TOP OF THAT, tomorrow is Ascension Day. The Noose is TighteningWhile stock indices play musical chairs, the real game is happening in the trenches of

Markets on a Tinder Date

I’m not sure that without the weekend’s about-face, scripted by Donald Trump, the Old Continent’s markets would have experienced such a day. The good news is that I can turn it over in my head in every way; we’ll never know what would have happened if Trump had slammed the door on Ursula von Pfizer. One thing is certain: the week’s opening was joyful and bullish. The DAX crossed 24,000 once again, and the increased tariffs are just a bad memory. Yet, this is when things are really going to heat up — real negotiations will have to start, and we need to stop relying on hypothetical postponements to push the market up. A Monday in the Sun Yesterday, the markets returned from the weekend like someone coming back from three days in Ibiza: a bit dazed, not very clear-headed, but relieved not to find a corpse on the lawn.The corpse on the lawn being the tariffs. And all thanks to whom? Thank you, Donald. Since our memory is short, let’s recall that on Friday, the markets took a hard hit because of tariffs. Trump had decided to restart his trade war with Europe, like a Netflix series the writers can’t find a proper ending for. Then, on Sunday, just before happy hour, boom: strategic turnaround! Sanctions postponed to July 9. A month and a half of reprieve, or illusion, depending on how you see it. On Monday, European markets suddenly bounced back. As if everyone said, “False alarm! Pack up the panic, we’re back for another round.” The DAX climbed, the CAC followed, the Swiss fired up their fondue burners, and across Europe, joy was quite contagious. Of course, US and UK markets were closed for Memorial Day, so volume was as lively as a rainy Sunday in the Creuse region. But that didn’t stop US futures from strutting around with promising gains, just to make it look like everything’s fine. Really? Is Everything Fine? But let’s be honest: you can’t seriously judge a session without the Americans. It’s like judging a concert without the singer. So the real session, the one that counts, is today. And it starts with a simple question: how far will the “Trump model” go?Yes, because now we know the routine. He threatens, he scares, markets dive. Then he backs down, and everyone starts buying again as if nothing happened. Maybe even more than before, even though nothing fundamental has changed — it’s just relief that makes the rebound twice as strong — because everyone wants to believe everything is settled and that we’re all brothers. Or all Americans, depending on how you look at it. It’s become a classic. And over time, this pattern even makes some speculators happy: they bet on the about-face before it happens. They play Trump like quarterly earnings of a semiconductor company or employment figures calculated on an abacus by the guys at the BLS who haven’t yet sobered up from the long weekend. But beware, June could be eventful. Because real negotiations will inevitably start now. And any disagreement between Europe and the US — or the US and China — or even the US and the US, will make indices shiver as if Powell had quit and handed his job to Britney Spears. And above all, we’re not safe from another Trump reversal. The US President has shown he’s as stable as Macron and his partner squabbling with punches while getting off the plane. And as steady as a Cessna caught in a summer cumulus full of hail. The boss of the United States has shown multiple times in recent weeks that he can’t hold a position for more than 10 days. If nothing changes in that timeframe, he’s capable of ruining everything just to throw a tantrum. When you see last Friday’s reaction to Europe, you really fear what might happen in a few days with China if NEGOTIATIONS don’t progress. And right now, it’s not with the info we’re getting that you can get excited, thinking it will be a party in three days because everything will be fixed. We have two huge egos clashing, and it would be miraculous if Trump and Xi could solve everything on the first try. And what do you think would happen if Trump did the same thing to China as he did with Europe? Yeah, I don’t really want to know either. But one thing I’m sure of: it will leave marks on global markets. Even if today — in Europe — we’re swimming in the joy of having gotten our moratorium back, not a day more. Nothing is settled, and it’s better not to sell the panda’s skin before killing it. Back Above 12,300 Meanwhile, in Switzerland, they’re not pretending either. The SMI has bounced back, comfortably above 12,300 points. We’re breathing easier here too. But without forgetting the storm could return anytime. Because yes, Trump backed down. But stepping back is also taking momentum… And the Nestlé Waters trial, referred back to the Nancy criminal court for illegal dumping of waste in the Vosges, was postponed to November, partly because of the large number of witnesses, and maybe also because for now, it’s better not to rock a French government that’s looked like a mess for a long time, with everyone running to replace Macron. Today, eyes will turn to Germany for consumer morale, Paris for inflation, and the United States for… everything else. Especially household confidence, which will say a lot about the American economic mood. We’re eager to see what comes out, given the recent weakness in American morale. After several negative figures, whether Trump has managed to raise his compatriots’ motivation remains uncertain, but one thing is sure: we can no longer do without him and his outspoken interventions. Otherwise, frankly, I wouldn’t know what to say in my columns. And this week will also be the big moment of truth for NVIDIA. If the AI superstar disappoints, it won’t just

Trumped Again

The week is off to a smooth start, the Americans are firing up the barbecue for Memorial Day, and the rest of the world will be orphaned from Wall Street for a few hours. Just before heading off for the weekend, Trump left us a few things to deal with. A new round of tariffs against Europe because negotiations aren’t moving fast enough. And a 25% tax hike for Apple, which refuses to manufacture in the USA. The only sad thing is that none of this had much impact on the markets, since Trump already backtracked on Europe, and nobody really believes his threats anymore—they never go all the way. EuropeAll weekend, I told myself: “Hey, you’ll be able to start your column by saying: new trade war with Europe, the moratorium explodes in less than three minutes.” But nope. We didn’t even have time to get properly scared because Trump slapped those tariffs on Friday night, and in Europe, we were practically already on weekend mode. And as of last night, the President had already spoken with Ursula von der What’s-Her-Name, who came begging for a bit more time to negotiate. Trump granted her his grace and blessing until July 9th. Yay. Back to square one, but now we’ll have to actually negotiate. Yes, because even if Trump did another one of his classic 180-degree flips in less than 48 hours, it’s clear that these “90-day moratoriums” mostly depend on the mood of the White House tenant. If I were the Chinese, I’d get moving and make progress in the right direction, because seeing Trump’s tantrums, it’s obvious the moratorium offered to China will never last the full 90 days. Either they’ll find a solution before that, and it’ll be wrapped up, or things won’t go fast enough for Trump, and he’ll handle it his way. To put it simply, we went home Friday thinking things might heat up in Europe at the start of the week. And then we didn’t even have time to get scared because apparently, the day is going to start with a bang—we FOUND AN AGREEMENT!!! Well, let’s not cry victory just yet, because it’s still only a 30-day delay and nothing says Trump won’t get mad again in the meantime and flip-flop once more. Still, for now, Europe seems happy, and the first day of the week without the Americans should go smoothly. As for Apple, the stock lost 3% Friday evening, but since the weekend isn’t over in the US, we can’t rule out that the two parties might strike a deal between burgers and hot dogs later today. In any case, one thing’s for sure: the market maintains a hyper short-term view, since it’s impossible to plan ahead due to the mental volatility of our leaders—Trump in particular. Tomorrow will be another day. Until then, we’re flying solo and waiting to see where it all leads, all while knowing Trump never takes a day off and could easily throw a surprise announcement into the mix on one topic or another. The Japanese bond market under close watchOne of this week’s likely key topics will be bonds. It’s a part of the market we often set aside because it’s not the most exciting thing, and nobody ever got rich buying 30-year bonds, but let’s just say something is happening that deserves our attention. And these “things” might be the early signs of a new crisis that won’t be fixable with a bit of backpedaling—“I tax you, you tax me, I untax you, you re-tax me”—this time it might be more complicated. Last week we saw that the 20-year US Treasury auction went badly and people are starting to doubt the future of American debt. But the American problem might not be top of the podium in today’s ranking of global financial worries. No, the immediate danger might come from Japan. In Japan, the 40-year bond yield has turned into an unmanageable tornado. Last week, nobody wanted to buy the debt, and the yield shot up to 3.15%. This was something that paid 1.3% just two years ago and was near zero during the pandemic. We’re starting to think there’s a major problem. The Bank of Japan holds 52% of the country’s debt, and the debt-to-GDP ratio is at levels that make the US look like a model of fiscal responsibility. Japan’s debt is at 260% of GDP, compared to 130% in the US. But the issue isn’t just about that. Japan also faces a host of other problems, like inflation arriving at full speed—the CPI was announced at 3.6% last week, food prices are rising, and real wages are falling. No need to dig further: the country is sliding into recession. And when we look at 40-year bonds, over $500 BILLION of “safe and sound” investments have taken a 20% hit in just six weeks. A 20% drop on a product that’s supposed to be the conservative part of a family man’s portfolio. Don’t expect me to say this won’t have any consequences. For those who forgot, last summer during the Carry Trade crisis, the VIX hit a top of 65%, and the Nikkei lost 28% between July 11 and August 5. Just imagine if the Japanese debt crisis intensifies. If you want some context, I suggest looking into the 2010–2012 European debt crisis, especially Greece. Let’s hope this is just a false alarm. But looking at the state of Japan’s economic numbers, it’s hard to believe things will end well under these conditions. In Asia This Morning…This morning, Asia woke up with a hangover. Once again, it’s the Trump effect with his tariffs on Europe. Then, true to his style—”I threaten, I backtrack, I negotiate, I congratulate myself”—he postponed everything to July. As a result, Asian markets are all tangled up. While most markets were treading water, Japan pulled off a third consecutive day of gains, driven by rumors of new trade talks with the Americans—talks that won’t do

My name is Bond, Market Bond

My name is Bond, Market Bond Have you noticed? No, I mean: “Have you noticed that for a week now no one’s talking about CUSTOMS DUTIES anymore (or almost)?” That for a week, we’ve all become bond market experts and that it’s becoming a full-blown obsession? Have you noticed how, every time yields rise a bit too much, everyone starts clutching their cheeks and screaming: “Oh my God, oh my God,” just because we suddenly realized that U.S. debt – well, it just keeps rising… and now we’re shocked that governments show no intention of paying it back. How could they do this to us? I admit I’m fascinated by how we went from trade wars to debt explosion in less time than it takes to say “DEFAULT.” Well, when I say “fascinated,” it’s mostly to sound sophisticated and pretend I’m shocked. But what’s really worth noting is that ever since no one wanted to lend to the Japanese earlier this week – and then again with the U.S. 20-year two days ago – we’ve seen a kind of rare awakening in the magical world of global economics. A sudden realization making us ask how the hell we got here and how we managed to see NOTHING COMING! So let me put the Treasury auction right back in the center of the village: countries’ debts have been blowing up for a long time – okay, not here in Switzerland, because we don’t want to make a fuss and we’re terrified of not being able to repay – but for the rest of the world, it’s a madhouse. And in this madhouse, you’ve got Japan and the U.S. Sure, we know Bruno Le Maire wrecked things with France’s debt and now gives lessons on how to crush the Russian economy – but with a debt-to-GDP ratio over 113%, France is still a lightweight compared to the U.S. or Japan – the all-time world champ. Then suddenly, while we were busy calculating the impact of tariffs on inflation and how that could influence Jerome Powell’s key rates – all while updating the countdown on the 90-day moratorium of the “rest of the world” and realizing that July 9 is almost tomorrow – everyone suddenly focused on THE DEBT, the AUCTIONS, and the fact that nobody wants to lend to anyone anymore. And then, one burning question BRUTALLY took center stage: HOW DID POLITICIANS let the debt get this high and – bonus question – WHY aren’t they doing anything to reduce it??? Because, quite frankly, they don’t care!The answer is incredibly simple and supremely logical: “THEY JUST DON’T GIVE A DAMN!!!” They care as much as they do about their first bribe, and it hasn’t kept them up at night for ages. I mean, come on – take Trump. When he came into office, U.S. debt was around $19 trillion. By the time he left – or was kicked out (according to him) – it was at $22 trillion. Today, after four years of a senile guy remote-controlled by the White House staff, we’re now at $36.883 trillion. And at the speed the US DEBT CLOCK is spinning, we’ll hit $37 trillion any second now. Bottom line: in under 4 years, Trump will be gone and it won’t be his problem anymore. And that’s how it is for all politicians: they want power and want the public to think they’re brilliant. But no one has ever entered government saying: “Let’s tighten our belts and make budget cuts to save money.” You have to admit it’s way easier when you can just grab the taxpayer’s credit card and buy champagne for all your ministers. So let’s get real and stop acting like shocked virgins: “Politicians around the world couldn’t care less about national debt. They know that in a few months or years, they’ll be out, and chances are – they’ll be cashing in a pension to do nothing for the rest of their lives…” That’s doneSo. That said, we have to admit that SUDDENLY, over the past week, it seems like “The People” who lend money to governments all woke up – not for a Danette – but to voice their anger and say they’re getting tired of throwing cash around and seeing no effort to change. And good for them. But sadly, this won’t change how politicians manage debt. I’ll say it again: “THEY DON’T CARE” – and if you want proof, just look at what happened in the U.S. On Wednesday night, markets got crushed because nobody wanted to lend at 20 years for less than 5% – basically a giant red flag: “Guys, you’re out of control and it’s starting to show.” And then, just 24 hours later – Congress approves a tax cut plan that will cost between $2 and $4 trillion over 10 years – THEY’RE NOT EVEN SURE HOW MUCH IT’LL COST… So if you still think politicians care about debt after that, you must really believe in these “so-called elites who govern us.” That said, we are definitely reaching a pivot point – a kind of critical zone. The infamous “above 5% on the 20-year” or “above 4.5% on the 10-year.” Basically, the takeaway is that at these yield levels, equities struggle to compete with bonds and it’s harder to push the S&P500 up by 1,000 points a month or the DAX by 5,000… The legitimate fear now is realizing that if yields keep rising BECAUSE NOBODY WANTS TO LEND ANYMORE, it’ll quickly become very difficult for stock markets to perform. That doesn’t mean it’ll be easier doing just bonds – it mostly means that part of the system is seriously malfunctioning. And – if I may reuse the Japanese Prime Minister’s analogy the other day, who said Japan’s situation is worse than Greece’s – I can already tell you that if we get Greek-style swings like in the 2011 debt crisis but with Japan, we better start stockpiling anti-nausea pills… No panic

Moody’s Mood Swings

Yesterday, New York Faced a Truth We’d Been Ignoring Yesterday, New York came to terms with something that had been visible for a while, but we preferred to ignore it to keep climbing without asking questions. The return to reality was brutal, as the U.S. market took a massive beating — and for once, it wasn’t due to tariffs or an offhand comment from Donald Trump. Yesterday, the U.S. stock market got slammed, hard — the kind of blow you don’t see coming… or maybe you do see it coming but hope it misses you. Except this time, it didn’t miss. And this morning, the 20-year Treasury suddenly became our worst enemy. Europe and the Time Lag (Again) Going back briefly to what happened yesterday before the auction of U.S. Treasury bonds, it’s worth noting that Europe didn’t do much in an otherwise cautious week that’s short on economic data. Germany still managed to notch a third consecutive all-time high at the close, showing its uncanny ability to focus only on the good news. Since the rebound in April, the DAX has been wearing blinders and sees only the glass half full with every piece of news. We ignore what’s not going well under the assumption that things will improve someday, especially with the new government printing money in the Bundesrat’s basement. On the other hand, anything that even remotely resembles good news gets amplified and flaunted to encourage investors. This morning’s open might be less cheerful, but yesterday, when the Americans started to catch wind of the 20-year Treasury issue, the Europeans had already packed up and gone home, proud of a job well done. France closed down 0.4%, the DAX managed to gain 0.36%, and Switzerland slipped 0.22%, dragged down by Julius Baer, who once again blew up the bank — with 130 million francs in net losses due to toxic loans and a moldy mortgage portfolio. No link this time to their ex-BFF René Benko from Austria, but the stock still dropped nearly 5%. And because bad news never comes alone, the bank is now describing this as a “transition year” — translation: it’s going to be long, painful, and probably not very profitable. Meanwhile, in Ukraine, with no peace deal in sight and everyone dragging their feet, European military budgets are soaring like it’s the Cold War all over again. With Macron playing a hybrid of Napoleon and General de Gaulle, French defense stocks are enjoying the ride: Thales, Dassault Aviation, and Dassault Systèmes are all climbing steadily. But the ECB is starting to cough. Yesterday, Lagarde’s team warned that we should probably be careful not to spend recklessly. Because spending like crazy without economic growth is the perfect recipe for a debt spiral. And when it comes to debt in Europe, a few countries are already hanging by a thread. We’ll talk more about that — maybe not today, but it’s not going away. For now, it’s time to focus on the new star of the day: the 20-year U.S. Treasury. The Forgotten One Usually, nobody talks about it. The 20-year Treasury is the ugly duckling of the magical world of bonds. Not as popular as the 10-year, not as majestic as the 30-year. It hangs out in the playground corner with its hands in its pockets, hoping to be invited to play with the big kids. But yesterday, it decided to play. And since it wasn’t used to it, not only did it not ask for permission, but it also broke everyone’s toys. Indeed, while Wall Street was cruising not far from all-time highs, daydreaming about a time when China and the U.S. might go on vacation together, the U.S. government chose the spring vibe to try and sell $16 billion worth of these famous 20-year bonds. And then… SUDDENLY… nobody wanted them. Or rather, to get buyers, they had to promise a 5.047% yield — breaking through the psychologically critical 5% barrier. That’s when everything went off the rails. Quick Lesson on Rates for Dummies (But Not Too Much)Before diving back into the current market narrative, let’s take a quick educational detour — “finance for those who want to understand” style. Even for me, a refresher won’t hurt. SO: the yield on a Treasury bond is like a promo offer to lure in buyers. The higher the yield, the more interest you’ll get. But if the government has to offer a higher rate than usual, it means one very simple thing: investors aren’t interested. And to get them moving and finally buying, you have to pay them more. In the wonderful world of finance, when yields go up, bond prices go down. It’s a love story gone wrong: yields and prices just can’t rise together. It’s a dysfunctional couple. So yesterday, when the 20-year yield shot past 5%, the entire bond market panicked. And when the bond market panics, equities usually don’t hold up for long. Domino Effect, Tsunami, and a Chill Down the SpineAs soon as the auction ended, the reaction was immediate. The 10-year yield jumped to 4.595%, and the 30-year surged to 5.089% — its highest level since last October. Imagine the poor guy who bought bonds last week at 4.5% — must feel like paying full price for an iPhone the day before the new model comes out, and this one even makes coffee. But this isn’t just technical stuff. A 5% yield on a 20- or 30-year bond sends a message — almost a distress signal. It means investors now demand a “risk premium” to lend long-term to the U.S. government. And why, you ask? Because, let’s be honest, America lives on credit. More than ever. Between Congress planning to pile on another $3.3 trillion in debt with tax cuts and a budget that includes no real spending cuts, markets are starting to wonder: who’s going to pay the bill? It’s not a new question, but yesterday’s signal was loud and clear — investors want more

Breaking Snooze

Trump didn’t post anything on “X” or Truth Social calling Powell an idiot. The Fed officials who spoke yesterday DID NOT say it would be easy to cut rates this year. They didn’t say it would be easy to raise them either. No number came out showing inflation is plummeting or that employment is in bad shape. Tesla didn’t unveil a gas-powered car to revolutionize the sector, and Apple is still selling the iPhone 16 as if it’s a revolution. And Israel might be preparing to bomb Iran — but no one seems to care. Yesterday was boring. Nothing I must confess that in my job as a “stock market columnist and financial explainer” — yes, yes, it’s a real job apparently — some days are easier than others. I have to admit that when Trump appears on TV to call Powell an idiot and says he’ll replace him with one of his buddies who worked in finance back in the day, or when the same TRUMP posts on social media that he’s going to hike tariffs on China by 885%, it’s much easier to write a column explaining what’s going on. On the other hand, on days like yesterday, when the only thing we can say is that “we’re experiencing a CONSOLIDATION phase because markets have rallied quite a bit over the past two weeks,” I’ll admit, the first thing that comes to mind is crawling back into bed and waiting for Trump to lose it over someone, something, or preferably a whole country — like China — just so something happens. Something spectacular. So that volatility shoots back over 30% and we get some action. Because yesterday, except for the fact that the Germans ONCE AGAIN managed to hit record highs and EVEN closed above 24,000 points for the first time in their history — and justified it because of, and I quote: “hope for a resolution to global trade disputes triggered by Donald Trump, a solid earnings season, and a multi-billion euro stimulus package from the German government, as well as expectations of a rate cut in the eurozone” — not much happened. And honestly, regarding Germany, those ETF-buying excuses are a bit stale, if not outright reheated. And it’s not just in Germany that markets went up for those same reasons that are well past their expiration date. This narrative of “taking everything that’s not terrible and could maybe get better in six months, and buying based on that” also helped France flirt with 8,000 — but not break through — and pushed Switzerland above 12,400. But not in the US In the US, it was a different story. All indices ended in the red without any real reason to sell everything. Trump didn’t really go off on anyone; he’s just doing standard American politics, trying to push Congress to cut taxes to make life a little easier for some families. But he didn’t give any update on China, nor on his plans for the war in Ukraine or that giant parking lot he’s planning to build in Gaza. I think yesterday was an “off day” for Donald Trump, and since we’re not used to that, nothing “sexy” happened in global markets. Yes, because — as you’ve probably realized — since late January, financial markets have stopped functioning based on the usual three pillars: macroeconomics, corporate earnings, and geopolitics. NO. Since the end of January — maybe even a bit earlier — we’ve been operating almost exclusively on GEOPOLITICS, and sometimes — dare I say it — solely on Donald Trump’s statements. And then, when there’s really nothing to say on the geopolitical front, we shift back to macro. And when there’s nothing to say on the macro side, we shift to quarterly earnings. And when we’re in a week where macro news boils down to nothing — like the German PPI coming in at -0.6% vs. -0.3% expected — I won’t lie, NOBODY GIVES A DAMN, and it’s certainly not the reason you’re going to break your kid’s piggy bank to buy Rheinmetall stock. Long story short: yesterday was boring on a world-class level, and when boredom hits that hard, it’s even harder the next day for guys like me who are supposed to tell you something that might, just might, make your morning more interesting — especially when there’s absolutely nothing to say except that global indices moved up in Europe for reasons we already know and that US indices dipped for the first time in six sessions, for reasons we’ve already heard for three weeks straight. MEH! In conclusion, yesterday the global markets in the wonderful world of finance ended mixed and were in CONSOLIDATION mode. Now let me tell you: “consolidation” is an absolutely fabulous term. It means the market has gone up a lot — sometimes for questionable fundamental reasons — and now we’re struggling to find motivation to keep buying. Because saying for 8 sessions in a row that we should buy because things might go well with China is starting to sound like reheated pasta leftovers from Sunday night — just because we don’t know what else to cook. And it’s exactly at that very moment that someone trots out the term “consolidation.” And this term works for pretty much anything in financial markets. Well, it works for everything when we don’t know what to say anymore and struggle to justify why the S&P lost 0.38% yesterday, even though absolutely nothing changed in the macroeconomic-geopolitical-Trump-financial environment. If you bought the market on Monday because China might work out or because inflation could turn out to be less bad than expected OR simply because you didn’t care about the US debt downgrade, you could’ve easily kept buying yesterday. Or just done nothing. But since US markets slipped a bit, we needed a justification. And that’s why, after nearly two pages of hot air, I’m finally giving you THE REASON for a slight dip in US markets and a slight

U.S. Downgraded by Moody’s

We are definitely living in remarkable times. In just a few weeks, we’ve gone from panic over rates, the anxiety of exploding inflation, to a certain calm that tells us that, after all, things will be fine because everyone believes it’s just a matter of time; Trump will strike a deal with China. Within 85 days. And since then, nothing scares the market anymore. The President has brought back billions of cash Made in the Middle East, inflation seems to be slowing down, and all that remains is to survive Moody’s downgrade — but at the same time, since when has a rating agency ever been right about a downgrade? Apart from never? The Friday Night NewsLast Friday, Moody’s downgraded the U.S. debt. Yes, again. And this time, it’s serious: from AAA to Aa1. Translation: according to the last of the three major agencies still pretending to believe in it, the United States is no longer top-notch when it comes to sovereign debt. You’d admit that’s moderately unsurprising — what’s more surprising is remembering that the US still had a triple-A rating somewhere. The biggest question we want to ask is: Why now? Well, simply because the Moody’s folks finally understood what everyone already knew since 2009: America spends more than it earns, and on top of that, Trump wants to cut taxes. If that passes, it would add 4 trillion dollars to the deficit over the next 10 years. All this without any concrete plan to balance the books, except selling MAGA hats or begging in Doha. Moody’s points out that under these conditions, the United States will no longer be able to maintain an interest payment ratio comparable to other AAA-rated countries. Well yeah, as the saying goes, “the pitcher goes so often to the well that it finally breaks.” But the most interesting thing about this — aside from futures opening down nearly 1% on Sunday night — is that we generally forget that these rating agencies like Moody’s, S&P, or Fitch have the particularity of downgrading debts when no one believes in them anymore for quite some time. These guys just make an assessment of the situation at instant “T” and have absolutely no pretension of predicting the future. You should never take a debt downgrade as a forecast, but rather as a present-day observation or an alert message that we’re starting to have our feet in the water. And when you dive into 150 years of financial and macroeconomic analysis history, you quickly realize that THOSE WHO CLAIM TO PREDICT THE FUTURE are about right only half the time — about as reliable as someone flipping a coin for their future. So those who only “observe” and ring the alarm bell aren’t much better. And in Trump’s administration, they got that very well. Let the show begin.We got that because Trump has already reacted by implying that the Moody’s people just don’t like him personally and that it’s all a personal thing. Scott Bessent, the new Treasury Secretary (who is still a former hedge fund manager and actually knows what he’s talking about), came out of hiding this Sunday morning while you were going to get your bread and in an interview on NBC, the guy served us a punchline worthy of a New York stand-up comedy night, saying: “Rating agencies are lagging indicators.” And BAM!!! Take that, Moody’s. So the idea is that they rate what we already knew, but six months late. And it’s TRUE, it’s not the first time this kind of thing happens. There was even a time when we started thinking that when a rating agency downgraded something, it should be taken as a buy signal — a signal that the worst is behind us. It’s like calling the firefighters when the house is already in ashes and telling them to check the smoke detector. So we spent the weekend waiting for Sunday night futures to open, to see if Moody’s downgrade would spoil the party of the American indices that are euphoric since Trump reached out to the Chinese and unlocked the tariff issue. Yes, because while Moody’s was doing its calculations, last week the S&P500 closed 6.5% higher than on April 2nd, the cursed day when we foolishly thought we were all going to die. The SOX is 14% higher and Nvidia is 23% higher. So yes, I confirm to you, futures opened in the hole on Sunday night. At the time of writing — that is 5:31 AM — futures are down 0.96%. It feels like a slap at the open. But at the same time, what’s new in this story??? Are you honestly surprised? Moody’s is the last of the big three agencies to remove the Triple A, and do you really think no one expected this? That it’s a surprise??? What’s happening today is nothing but a big announcement effect, and in 48 hours, we’ll have moved on. I’m not a fan of Scott Bessent — to be honest, before he joined Team Trump, I didn’t even know he existed. But I have to say I agree with him: rating agencies are lagging indicators and should be given the credit they deserve. Which is to come after the rain to tell us that water is wet and fire burns. So yes, with exploding debt, a runaway deficit, a trade war far from settled, and a President playing Monopoly with taxes, it’s starting to smell strongly like an unstable scenario. But, without being pro-Trump, you have to recognize that despite all we can blame him for, he’s not the only one who got the US into this mess, so maybe we should give him the benefit of the doubt before crying wolf. But at the same time, rating agencies only know how to do one thing: cry wolf when everyone has known for months that the wolves are among us and that man is a wolf to man… Whoa, I’m getting carried away. So

Wall Street Chokes on Coffee

Let’s call it like it is – the markets are impressive. I must admit, I’ve been spending my late nights commenting on the markets for quite a while now, and this isn’t the first time I’m impressed. I’m often amazed by the stupidity of certain reactions, and also by how investors blindly follow the herd without asking a single question. But here we are, early spring, and just a month after nearly getting the chop, I’m once again blown away by how, only six weeks after panicking over their retirement in 20 years, the average investor has already forgotten everything. Memory wipedIn short, the markets are amazing. The DAX is close to all-time highs – like, every day – and it’s all thanks to the arms industry. Not to mention the new German chancellor stepping up to say he wants to have the MOST POWERFUL ARMY IN EUROPE. So yeah, I don’t know, but let’s just say it’s barely been two months since they were let off the leash – a leash that’s been held tight since June 6, 1944 – and they’re already aiming for European domination again. Is that good news? Who knows. Doesn’t matter – Rheinmetall is soaring, and everyone’s happy. But I digress. My point was: markets are strong. They refuse to fall, even though last night the Magnificent Seven were under pressure, and the volume of puts bought on the sector – just 24 hours before the triple witching – was abnormally high. No big deal – the indices aren’t giving up even one percent, and the S&P500 posted its fourth straight day of gains, while United Healthcare logged its fourth straight day of losses and its fourth consecutive month down. Meanwhile, the Nasdaq closed in the red for the first time in seven sessions. Exciting, huh? Oh, and we’re talking real moves here: the S&P gained 0.41% while Sir Nasdaq retreated a dignified 0.18%. Why? The Magnificent Seven deflated for various reasons. Meta’s AI engine is delayed. Amazon, Microsoft, and Google? Some hedge fund manager announced he was dumping all his positions in them – and a couple others. Apple? Because Tim Cook’s getting his ears boxed on Truth Social by the American President. Interestingly, Trump went after Cook, not Powell, for once. Yet after Powell’s speech – as useless as a bikini at the North Pole in December – there would’ve been plenty to say. But no, Trump probably remembered the saying: An apple a day keeps the doctor away. But only if you throw it hard enough… Apple, the Indians, and the $3,500 iPhoneDonald Trump – we all know – wants an iPhone “Made in America”. And clearly, he’s had it with Tim Cook saying: “Yes, but no.” Lately, it’s become clear that Apple plans to manufacture most iPhones in India. And that’s making Trump fume – which he made very clear yesterday from Qatar. The problem is, building an iPhone in the U.S. would mean charging about $3,500 per unit. Let’s just say even hardcore Apple fans would say, “No thanks”… or start selling kidneys. Apple promised $500 billion in investment in the U.S. and 20,000 jobs… but mostly tech positions, not assembly line work. So, reshoring production sounds nice on paper, but even Cook admits that moving production out of China (to India or Vietnam) will already cost $900 million more this quarter. In short: Apple CAN’T DO WHAT TRUMP WANTS, but that doesn’t stop the President from picking a new scapegoat. Next thing you know, he’ll slap 150% tariffs on Indian exports to force Apple to come home. Apple was down 0.9% yesterday – not enough to make you jump out of bed and grab a Nokia 6210 – but it sure looks like a new trade war front is opening in California.Trump wants to “bring America back” with home-made iPhones. Cook? He just wants to protect his margins. And caught in the middle: an iPhone that might soon cost as much as a Harley. And Powell spoke.While the markets held on with their wild optimism, we also had a mountain of macro data to digest. But before diving into the fabulous world of inflation and retail sales, we have to talk about Jerome Powell’s speech. We’ve been waiting four days for it – time to get it over with. Let’s start with the most important part: Powell said ABSOLUTELY NOTHING that moved the markets one way or the other. Honestly, if Powell were a drug, he’d be Lexomil. If he were an animal, he’d be a sloth – a monkey that doesn’t move but clings to branches so tightly he can sleep without falling. If Powell were a car, he’d be a Renault Zoe – the dullest car of its generation. The Fed chief pulled out his crystal ball, and what he sees isn’t reassuring: we’re entering an era of more volatile inflation, harder to control. The economic environment has changed since 2020, so the Fed needs to change too. Higher rates, less QE, more turbulence. He also says monetary policy needs to be clearer and more symmetrical – reacting when inflation rises and when it falls too low. Yep, I warned you – boring and not even one step forward on rate cuts. Trump was probably fuming on Air Force One, likely ready to smash his iPhone to the floor. Until he remembered it’ll cost $3,500 in six months.Bottom line – reading between the lines: the Fed is preparing for a messier world, and it won’t just lower rates to please the markets. The good news for Powell? He’s only got a year left in this mess. Unless Trump finds a reason to fire him and replace him with Warsh. The Macro FogAlongside Powell, we got buried in economic data. Starting with PPI – which dropped 0.5% in April, but the “core” rose 0.4%. Translation: prices are creeping back up, and the first signs of Trump-and-Tariff inflation are starting to show. But markets smiled and moved

Old Dogs, New Tricks

This midweek session won’t go down as the sexiest trading day of the year. We’re all just waiting for real data to sink our teeth into—only to draw half-baked conclusions that will be forgotten in 30 minutes anyway. And even if no one dares to say it out loud, everyone’s waiting for Powell tonight, hoping he drops a little line that could potentially become a legendary quote in the investment world. The happiness hormone injection we got from the China story seems to be wearing off a bit, but one thing is almost certain: the manic phase of early April is archived and forgotten—it’s the return of FOMO and AI. Nothing Spectacular Performance-Wise If we strictly go by market performance, there’s nothing here to lose sleep over. In Europe, markets went into pause mode due to a lack of motivation and the absence of any clear catalysts. The “tariff truce” effect with China seems to have run its course for now, and since earnings season is also wrapping up, investors are clearly looking for new reasons to stay engaged. The CAC 40 fell by 0.47%, the DAX by a similar amount, and Switzerland slid gently by 0.27%. Apparently, if we want our mojo back, we’ll need something tangible on the trade deal front—especially with Europe. The luxury sector tumbled because there’s still no clarity from China or the U.S., and the moratorium ends in 87 days. L’Oréal, Kering, and LVMH took a hit. In Switzerland, pharma stocks are still reacting to Trump’s statements, Geberit soared following an upgrade, Sanofi is investing billions in the U.S. hoping to soften up Uncle Donald, and in Germany, Bayer collapsed amid a U.S. health controversy, while Eon managed to stay afloat and Porsche confirmed its targets. In short: European markets are in “wait mode,” desperately looking for a good piece of news that still hasn’t arrived. In the U.S., it was a mixed bag with the Dow Jones slightly down, mainly because of United Health Care once again. The S&P 500 edged up by 0.1%, and the Nasdaq is officially back with a 0.7% jump—its sixth consecutive gain—and an internal explosion driven by artificial intelligence. Yes, that thing we hadn’t talked about since February because we were too busy panicking over the end of the world via incoming tariffs. The same thing we were ready to sell our grandmothers for, just to buy Nvidia at $155 on January 8 without blinking. The same thing that made us suicidal on April 7, 2025, when it dropped to $86.65. Well, AI is back, and NO ONE is afraid anymore! If we look at indexes, the Nasdaq is up 28% in just 5 weeks. That’s 35 days, nearly 1% per day—clearly, FOMO is back, and semiconductors are going nuts, as if they’d just found a vaccine for every disease in the world simultaneously. The Top 50 The AI and semiconductor sectors were clearly the stars of the show in New York, while Trump was flashing his checkbook in the Middle East, tech companies went wild and kept riding the wave—a wave that keeps gaining momentum. In the day’s top headlines, Super Micro Computer soared +16% after a mega $20 billion deal with the Saudis at DataVolt. Yes, the Saudis again. I’ll spare you the deal’s nitty-gritty, but basically, SMCI will accelerate the delivery of everything needed to supercharge MBS’s AI ambitions. The stock’s performance over two sessions is now up 34%—thanks to upgrades and that insane deal, Super Micro is back. Or at least it looks that way. AMD also announced a $6 billion share buyback, and everything else followed: Nvidia jumped over 4%, ARM climbed over 5%, Applied Digital gained 6.6%, and Intel flopped by 4.6%—as if they missed the train, though the real reason is simply that their new chips aren’t selling well. Meanwhile, we’ve noticed that the S&P 500, Nasdaq, and SOX are all above their 200-day moving averages, and the Dow Jones would be too if UNH weren’t messing up the index’s weighting. Being above that long-term trendline is reassuring for investors, even though Goldman Sachs is playing it cautiously, staying a bit in cash while waiting for real trade deals—not just feel-good moratorium headlines. Meanwhile, the Fed keeps muddying the waters. Vice Chair Jefferson said that “inflation could pick up again because of tariffs” and that there’s still “a lot of uncertainty” about the trajectory—which basically means he doesn’t know and can’t say anything meaningful. And yet, between the lines, we can infer that rate cuts are not coming tomorrow. Not even tonight during Powell’s much-anticipated speech. The Squeeze And then there’s something less talked about: U.S. interest rates are in full turmoil—and it’s not just about the numbers. It reflects a market full of doubt, a Fed in delay mode, and an economic environment under high pressure. While volatility has calmed down, FOMO is back in charge, and “Greed and Fear” has gone full Gordon Gekko mode—because, well, “Greed is good”—interest rates are sending a different message. Right now, the U.S. 10-year yield is flirting with 4.54%, the 2-year is over 4%, and the 30-year is nearing 4.94%. This yield curve—steeper than the climb up Alpe d’Huez—shows that investors are demanding a premium for long-term lending. Which tends to indicate they expect persistent inflation and economic uncertainty. Not quite the same signal the VIX is giving off. No matter what anyone says, inflation remains a major concern—even though it’s dropped to 2.3%. The reason? Once again, it’s the fear of tariffs that could complicate the Fed’s job. Clearly, the bond market isn’t seeing things the same way as the stock or crypto markets. We saw it again yesterday with Jefferson’s comments. Given this situation, the Fed is adopting a wait-and-see stance. The key rate is being held steady between 4.25% and 4.5%. EXPERTS are now oscillating between hope and caution. Expected rate cuts are pushed further into the year—maybe—and will depend on how inflation and growth evolve. In short,

Abbeus Papam! U.K.-Trade Deal Blessing

Do You Remember That Distant Time When the Fed Meeting Mattered for Markets? That time when we thought Powell’s words could actually impact investor decisions? Well, that was just over 36 hours ago. But don’t worry, we’ve moved on—because since yesterday morning, tariffs have taken center stage again. Or rather, the negotiations surrounding them. The British got “their deal,” and Trump said it was time to BUY STOCKS—what more could you ask for? The Fed has been forgotten. The whole issue of rates—and the fact that the Fed doesn’t want to cut them for reasons we’ve already discussed extensively in these morning notes—had absolutely no impact on the markets yesterday. Simply because we’ve already moved on. And what we’ve moved on to is THE FIRST SIGNED DEAL on tariffs. The Brits are taking the spotlight and have sparked a wave of optimism across global markets. Risk appetite is back, and people are talking again about a potential return to the bullish trend we had before the day of LIBERATION. Of course, we still got the usual comment from Donald Trump about Jerome Powell. The President made a remark that needs no comment—he said: “The Bank of England cut rates. China cut rates. Everyone’s cutting rates except him. I don’t know, we’ll see what happens. It’s a shame. I call him ‘Too Late’. Too Late Powell, that’s his little nickname. And it’s really a shame, it’s ridiculous… he’s always late. But in this case, it won’t really matter, because our country is so strong and our economy is so powerful that it won’t really make a difference.” So there you have it. “Too Late Powell” is an idiot, according to Trump. And VP JD Vance piled on, saying the Fed Chair is a “nice guy” but wrong about pretty much everything. Clearly, relations between the White House and the Fed are at an all-time high. Time will tell who was right about inflation and rate cuts, but one thing is clear: the market doesn’t care anymore. Rates too high or too low—it’s not the issue. All the market wants is to forget about tariffs and move on, and the deal announced yesterday was a signal that everything “might get fixed” faster than expected. God Save the King Some may say it’s a bit premature to find so much optimism in this first “deal,” but the market doesn’t care and it was enough to reignite the rally. Donald Trump pulled out the very first trade deal, and it’s the United Kingdom that gets the honor of being the first under the Trump era to “seal a deal.” The market, allergic to uncertainty and addicted to good news, reacted like a trader on amphetamines: the S&P 500 jumped by +1.2%. All because Trump said it was a “REALLY good deal for both countries.” But behind the fireworks, you have to check what’s actually in the box… and it’s more like a McDonald’s Happy Meal toy: fun, but not life-changing. In fact, by the end of the session, the euphoria had faded—because the more people read the details, the more it felt like a slapdash arrangement. Still, it was enough to get people believing that maybe, just maybe, there’s a way out of the tariff crisis. In concrete terms, the UK will import more U.S. beef, ethanol, and machinery. In return, the U.S. will slightly ease tariffs on British steel and cars. But beware: the 10% base tariff announced in April remains in place. So basically: one step forward and two steps standing still. The cherry on top? The Brits will buy $10 billion worth of Boeing planes. Trump announced this deal like he had just saved America from nuclear war, and according to him, it’s a full, comprehensive agreement. And just the first of many. Then came one of his trademark punchlines: “You better go buy some stocks now because the U.S. economy is going to explode.” Even Warren Buffet must have raised an eyebrow. But the worst part is, the markets listened. When the President tells you to buy, you buy. Period. If you want to play geopolitical critic, you could easily say there’s nothing dazzling about the deal—but it does show that solutions can be found, and that’s all the market wants right now. What About China? Trump used the moment to tease his next big move: “very substantial” discussions with China this weekend. Asked whether tariffs could be lowered, Trump replied they couldn’t get any higher. So we can assume that if things go well this weekend in Switzerland, the President might “make a gesture.” It’s pure speculation, but that’s more than enough for the wonderful world of finance—which after all, managed to rally for nearly a year just on the hope that the Fed might cut rates eventually. Right now, U.S. tariffs on Chinese goods are up to 145%, while China is slapping a modest 125% on U.S. imports. The atmosphere is more Rocky IV than a friendly diplomatic brunch. Trump wants China to open its markets more to American products. He even added: “Trade can bring greater friendship with China.” That’s Trump in peace & love mode… to be taken with a grain of salt. In Conclusion This deal with the UK is mostly a warm-up. The real fight is with China. And even if Trump wants to rack up bilateral deals, the UK is not China. The stakes are low: UK–U.S. trade is fairly balanced, so this won’t fix America’s trade deficit. But it gave Trump the chance to put on a show, boost the stock market, and play his favorite role: the deal maker. Asia Rides the Tailwind Friday morning Chinese trade figures showed a slight improvement in the April trade balance. Exports dropped to 8.1% from 12.4% the month prior, but beat expectations, which were at 1.9%. Meanwhile, imports only dropped by 0.2%, versus 4.3% before, and beat forecasts of a 5.9% decline. These numbers indicated some resilience in both domestic and foreign demand