Week Of All Dangers – Or We Don’t Care At All

I’m not going to repeat how long I’ve been doing this job, because it sounds a bit like the old trader who repeats himself and tells the same story over and over. But one thing is certain, when I take my eyes off my MAC and go on vacation for a few days, something spectacular always happens. It wasn’t a surprise to hear Trump ranting again about tariffs or getting into a spat with some foreign leader, but let’s just say we felt a quick gust of doubt sweep across the markets. The rescue might come from employment or from Greed and Fear. Anyway, we’re going to have a good laugh. And it all started last night. Putting the church back in the middle of the village When you’ve disconnected for a week, it’s never easy to get back behind the wheel and find things to talk about on Monday morning. Especially when you’ve spent the week in the fog and the whiteout, trying to avoid unknown skiers passing you on their skis, popping up out of nowhere. But still, with the current news, it’s not difficult to find things to say from the first hour of Monday. In fact, I even started writing my column on Sunday evening to make sure I didn’t miss anything. First off, one thing seems very clear to me – for the moment, we are in “geopolitics and that’s it” mode. We really don’t care much about what’s happening on the fundamental side. The only thing that interests us is knowing who Trump and Vance are going to get into a fight with in the next 24 hours, and which country will get hit with tariffs. Then, of course, there’s the crisis between the US and Europe, which is triggering a shopping spree in the armament sector for the past two weeks. The shopping spree was once again pushed forward this weekend after European leaders decided to spend an unimaginable amount of money on weapons, while half of that sum could have solved world hunger and addressed the needs of the most disadvantaged in Europe. But apparently, according to the warmongers who govern us, it’s way more fun to buy tanks and missiles to kill anything that dares cross the border west of Ukraine. What’s particularly interesting to note is that these weapons are mainly being bought from the Americans. It’s the shepherd’s answer to the shepherdess: “You’re being nasty with Volodimir, so as punishment, we’re going to buy lots of missiles to protect ourselves from your buddy Vlad the Impaler.” I don’t know about you, but I have the feeling they’re treating us like fools, and in the meantime, we’re distracted, and we’re not looking at the mess some of the big countries in the Union are in – especially regarding their domestic policies. But in the end, we don’t care. So, geopolitics is our friend and keeps us busy. Then, of course, there’s the economy, which sometimes takes the spotlight again. Last week, on the last trading day of February, we even got an economic number that really saved our backs. If we remember the CPI figures published two weeks ago, we had good reasons to fear that the PCE numbers, which were to be released on Friday, wouldn’t be good – maybe even worse: worrying. But here’s where the beauty of global markets lies: according to the US Department of Commerce, inflation slowed down in January in the US to 2.5% year-over-year, down from 2.6% the previous month, in line with expectations after several consecutive accelerations. Yes, the PCE is less bad than the CPI. Turns out, inflation is a fake problem; you just have to look at it from the right angle. If you eat nails or screws instead of eggs, meat, and regular food, you won’t even feel the inflation. If you live under a bridge, you won’t pay rent, and you won’t feel the real estate prices hitting your wallet. And to top it off, since you’re living under a bridge, you don’t have a car, so no worries about gas prices. All that to say, when we were worried about the CPI two weeks ago, there was really no reason for that, since the PCE fixed everything last Friday. Again, I sometimes feel like we’re being treated like fools, but since I’m the only one, I’m going to start believing that it’s the one who speaks who is… Aside from that, these EXCELLENT PCE NUMBERS that fully reassure us about inflation will need to be confirmed by the job numbers, to see if the economy is fully aligned in the right direction so that the FED can FINALLY do its job and lower rates as it should, so the bull market can get back on track. And that’s perfect because, as for the employment numbers, the upcoming week is going to be packed: JOLTS, ADP, and NFP – we won’t be spared. But at least, by the end of the week, we’ll know whether Friday’s rebound was a “fake bounce” or if it was something more important and that the contrary indicators, “GREED AND FEAR,” were right to show us that people were way too scared of a downturn. Yes, because for the past few years, CNN has developed an index that shows us that THE MORE WE FEAR, the more it rebounds, and THE MORE WE’RE TOUGH GUYS who fear nothing, the more we get destroyed. And right now, this index is telling us that we have super, mega, crazy fear. So, it can only go up. Normally. And then, I was thinking: the economy and finance are truly magical! No, because if I remember correctly—two weeks ago, we were saying: “BUT, BUT, if inflation is high and growth is sluggish, we’re heading toward STAGFLATION!!! OH MY GOD!!!” Whereas since the PCE on Friday, if the employment numbers show strong engagement, we’re going to say: “BUT, BUT, if inflation calms down AS THE PCE SHOWS

The Bishop’s Move

Trump behaves like the absolute master of a chess game in which he dictates the rules. But one must not forget the famous bishop’s diagonal. Is the king mad, or should we look for the king’s fool? While waiting for an answer, the markets experienced strong declines last night and this morning. And what about Bitcoin? While waiting for an answer, the master of the game disrupts European markets In Europe, the consumer confidence index came in at -13.6 in February, as expected, compared to -14.2 in January. But it was mostly Trump’s impact on tariffs that weighed down the markets. The CAC 40 lost 0.51% to 8,102 points, and the Euro Stoxx 50 dropped 1.12% to 5,465 points. The DAX fell 1.2%, while the FTSE 100 gained 0.28%. Ferrari took a hit, losing nearly 8% after Exor, the Agnelli family’s holding company, announced the sale of around 4% of its shares. Meanwhile, in England, Rolls-Royce (a defense-linked stock) soared by 16% after raising its annual targets and announcing a dividend payout. In Switzerland, the SMI closed down 0.65%. Roche (-0.5%) and Nestlé (-0.6%) weighed on the index. Swiss Re, however, reported strong 2024 results. However, first-quarter 2025 earnings will be impacted by the wildfires in California. As expected from an insurer, premium prices will continue to rise. Swiss Re surprised positively with a higher-than-expected dividend and a smaller-than-anticipated impact from the Los Angeles wildfires. Meanwhile, the Swiss Confederation’s president expressed confidence that Trump’s retaliatory measures against the EU would not affect Switzerland. An interesting certainty in a completely unstable world where the U.S. Secretary of Health may take decisions that could impact Swiss pharmaceutical exports to the U.S., which account for 40% of total export value. In the European bond market, a slight easing is underway, with French OATs down 1.5 basis points to 3.14% and German Bunds down 2.5 basis points to 2.415%. Across the Channel, Gilts remain stable at around 4.564%. In the United States Economic figures in the U.S. continue to follow a familiar pattern. Jobless claims increased more than expected last week, while another report reaffirmed that economic growth slowed in the fourth quarter. Today, new data on personal consumption expenditures will be released. The U.S. yield curve inversion deepened on Thursday, with three-month Treasuries (4.33%) yielding more than ten-year bonds (4.27%). The Dollar Index, which measures the greenback against a basket of currencies, rose by 0.72% to 107.23, marking its biggest daily gain since December 18. The euro fell 0.74%, heading for its sharpest drop since January 2, trading at $1.0405. The Canadian dollar weakened by 0.69% against the U.S. dollar to 1.44 CAD, while the Mexican peso lost 0.12%, reaching 20.464 per U.S. dollar. Spot gold fell 0.1% to $2,874.69 per ounce, down 2% for the week so far. Silver rose 0.4% to $31.37 per ounce, platinum firmed by 0.3% to $951.95, and palladium gained 0.1% to $920.34. Commodities, except oil, are also suffering Brent crude futures rose by $1.43, or 2%, to $73.90 per barrel. WTI crude futures increased by $1.46, or 2.1%, to $70.08 per barrel. Three-month copper on the London Metal Exchange (LME) edged down 0.1% and was down 1.9% for the week. Among other metals, LME aluminum rose 0.08%, tin gained 0.2%, LME zinc fell 0.2%, nickel dropped 0.6%, and lead declined by 0.2%. Corn fell by 12-1/2 cents to $4.81 per bushel after hitting its lowest level since February 3. Wheat lost 16-3/4 cents to $5.63 per bushel, marking its lowest point since February 4. Soybeans dropped 4 cents to $10.37-1/4 per bushel. And Trump continues playing chess… On Thursday, Donald Trump told Keir Starmer that a minerals agreement was the only security guarantee Ukraine needed against Russia. He also pretended not to remember calling Ukrainian President Volodymyr Zelensky a “dictator” last week. Thus, the U.S. position remains unchanged: no discussion of peacekeeping forces before an agreement is signed between Russia and Ukraine. And just like that, Trump keeps the upper hand… This morning in Asia Japan’s Nikkei dropped 2.4% at the start of trading, while South Korea’s Kospi lost 1.8%, and Australia’s benchmark index slipped 0.9%. Chinese stocks performed relatively better, with the Hang Seng down 1% and the CSI 300 falling 0.3%. Bitcoin was last down over 5% on the day, trading at $79,666—falling below $80,000 for the first time since November 11. Ether followed the trend, dropping nearly 6% to $2,149.38, hovering around its lowest level since January 2024. “Because the people are ignorant of the higher interests of the State, lies are a legitimate political instrument: ‘The good prince must be a great simulator and dissimulator.’” — Machiavelli Thomas Veillet Financial Columnist

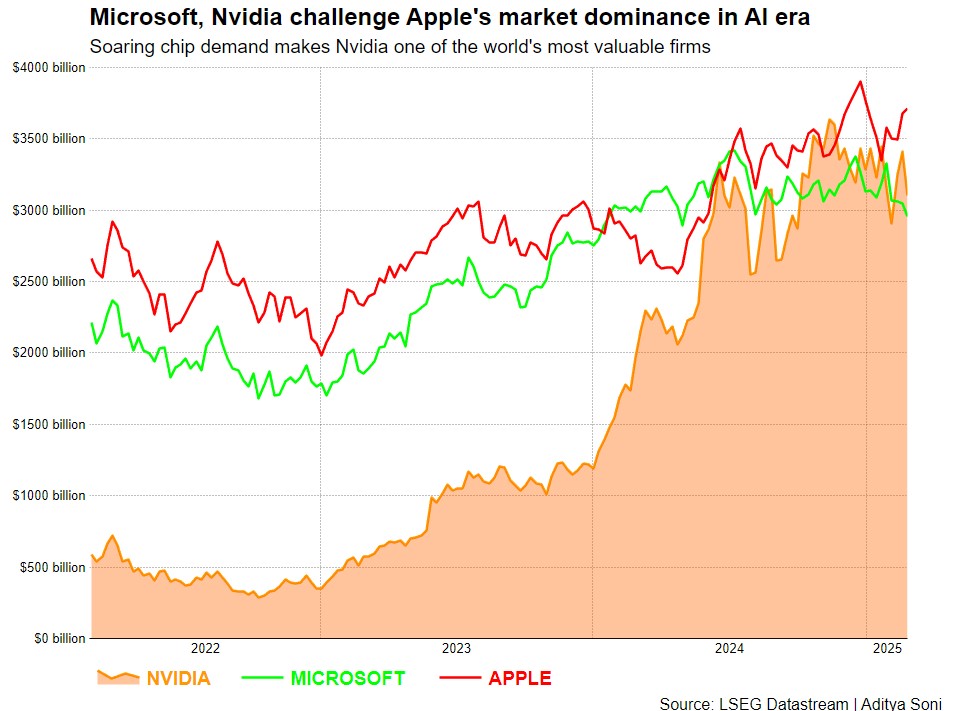

Microsoft and Nvidia Challenge Apple’s Dominance in the AI Era

The growing demand for chips has made Nvidia one of the most valuable companies in the world, solidifying its place as a leader in the AI-driven technological revolution. However, the emergence of low-cost AI models, such as those from #DeepSeek, has triggered concerns that spending on Nvidia’s high-end chips could decline. These fears have caused a massive drop of over half a trillion dollars in Nvidia’s stock value in just one day. These worries were further intensified by reports suggesting that Microsoft was reducing its leasing of certain data centers. The stock performance of the “Magnificent Seven,” which includes Nvidia, has dropped from their 2024 highs, with a decline of more than 11% for the Roundhill Magnificent Seven ETF. Despite strong performance in the past two years, Nvidia is seeing slower revenue growth due to tough comparisons with the previous year. However, its continued leadership status and massive investments from tech giants like Meta ensure that demand for its high-end chips remains strong. Since the launch of #ChatGPT in late 2022, the “Magnificent Seven” companies have collectively added $11 trillion in market capitalization, with $2.7 trillion of that coming from Nvidia alone, making it the second most valuable company in the world. Over the last five years, Nvidia’s stock has surged by an astonishing 1,800%, while the entire “Magnificent Seven” has tripled, far outpacing the S&P 500’s 65% growth. Nvidia’s Continued Innovation: Nvidia has been a leader in AI chip design for years, but it faces growing competition as other companies, such as AMD and Intel, intensify their efforts to create AI-specific processors. However, Nvidia’s GPUs, like the A100 and H100 series, remain industry standards for high-performance AI applications. The company’s dominance in the gaming and data center markets also gives it a diversified revenue stream, which supports long-term growth. Nvidia’s continued focus on developing GPUs for AI, machine learning, and autonomous driving could allow it to maintain its competitive edge in the industry. Microsoft’s AI Push: Microsoft’s role as a cloud service provider is significant in the AI space. The company’s Azure cloud platform is heavily integrated with Nvidia’s GPUs, enabling enterprises to scale their AI capabilities. Microsoft has made strategic acquisitions in AI, such as its purchase of OpenAI, the creator of ChatGPT. Microsoft’s AI strategy also includes software products like Microsoft 365 and its integration with AI to enhance productivity tools, making it a strong player in both consumer and enterprise markets. Apple’s Position in AI: While Apple is not as heavily involved in AI-focused infrastructure as Nvidia and Microsoft, its investment in machine learning and AI integration in consumer products like the iPhone, iPad, and Mac is growing. The company continues to expand its AI capabilities in its chips, like the M1 and M2, optimizing machine learning performance on the device level. Apple’s strategy of focusing on consumer-driven AI could allow it to remain competitive, but without making the same kind of heavy investments in data centers and AI infrastructure that Nvidia and Microsoft are pursuing, it might lag behind in the enterprise AI space. The Impact of Generative AI: With the rise of generative AI, such as OpenAI’s models like GPT-3 and GPT-4, the demand for more computing power is skyrocketing. Nvidia’s hardware is central to the development of these models, and the company’s partnerships with AI research labs and cloud providers position it to benefit from this trend. As generative AI technologies expand into industries like healthcare, finance, and entertainment, Nvidia is expected to play a major role in supplying the computational power needed to bring these innovations to life. Challenges in the Chip Market: The global semiconductor market is experiencing a supply-demand imbalance. While Nvidia’s chips are in high demand for AI, gaming, and data center applications, global supply chain disruptions and geopolitical tensions could potentially threaten Nvidia’s growth. Additionally, the shift towards AI could lead to an oversupply of certain types of chips while diminishing the demand for traditional processors. Nvidia will need to remain agile and adapt to these changing market dynamics to stay ahead of competitors. Investment Trends in AI and Tech Stocks: Investors are increasingly bullish on companies with strong AI capabilities, and this is reflected in the market capitalization of Nvidia, Microsoft, and Apple. With AI set to be a driving force in technology over the next decade, stocks in this sector could see continued growth, but investors should be mindful of market volatility and the risks of overvaluation. Analysts predict that Nvidia’s stock could continue to rise due to its pivotal role in the AI ecosystem. However, some caution that there may be short-term setbacks as the company faces increased competition and fluctuations in demand for high-end chips. Have a nice day! Philippe Thomas Ceo Soleyam

Money has no smell

Any reference to the AI-generated photo showing Trump kissing both of Musk’s right feet would be purely coincidental… But it’s mainly the weak U.S. economic data and Tesla’s sales that are dragging down the market, while European stocks are holding up. What about the Trump effect? The Conference Board’s Consumer Confidence Index came in at 98.3 in February, down from 105.3 in January (revised from 104.1). The expected figure was 102.7. This marks the sharpest monthly decline since August 2021.” When consumers are asked about their situation in six months, we see that their outlook on the business environment has become negative. Pessimism regarding the labor market outlook has worsened, and consumers are less optimistic about their income prospects. And Tesla is suffering from a tarnished image… The Musk effect… Tesla saw its sales in the EU, the UK, and the European Economic Area drop by 45.2% year-on-year in January 2025. In contrast, the Chinese company SAIC Motors saw its sales increase by 36.8% over the same period… while awaiting the rise in customs duties promised by Europeans. According to ACEA statistics, in January 2025, sales of new battery electric vehicles rose by 34%, reaching a market share of 15%. Three of the four largest markets in the region, which together account for 64% of all battery electric car registrations, saw strong double-digit growth: Germany (+53.5%), Belgium (+37.2%), and the Netherlands (+28.2%), while France saw a slight decline of -0.5%. Sales of hybrid and gasoline cars dropped by 8.5% and 18.9%, respectively. New Car Registrations by Manufacturer for the EU, EFTA, and UK Markets. A Brief Look at the Financial Markets European markets reacted relatively modestly, with the exception of the CAC 40. The Paris stock exchange lost 0.49%, while the DAX fell by 0.13%, and in London, the FTSE 100 gained 0.11%. The EuroStoxx 50 index closed down by 0.17%, the FTSEurofirst 300 rose by 0.14%, and the Stoxx 600 gained 0.13%. The hardest-hit sector was technology, suffering from Trump’s comments on semiconductors and China. STMicroelectronics dropped by 2.2%, ASML by 2.3%, and ASMI by 2.9%. In Switzerland, the SMI finished up 0.55%, thanks to the strong performance of Novartis (+2.4%), good results from Lindt (+2.0%), and Nestlé (+1.4%). Tech stocks weighed on the U.S. market. While the Dow Jones gained 0.37%, the S&P 500 fell by 0.47%, and the Nasdaq dropped by 1.35%. Nvidia lost 2.8% ahead of its highly anticipated quarterly earnings release, while press reports indicated that the U.S. administration intends to further restrict semiconductor exports to China. Zoom Communications declined by 8.5% after issuing a disappointing annual forecast. Bond Market German 10-year Bunds eased slightly to 2.455% (-1.5 basis points), while the French OAT for the same maturity dropped by 2.2 basis points to 3.198%, resulting in a narrowing spread to 74 basis points. U.S. Treasury yields came under pressure due to bets on a Federal Reserve easing, with the benchmark 10-year yield falling to a two-month low of 4.283%. The 2-year yield decreased by 1 basis point to 4.086%, and the 30-year yield stood at 4.565%. The Dollar’s Struggles The dollar is suffering from this situation. The Dollar Index dropped by 0.25% to 0.30%, while the Euro strengthened by 0.4% to 1.0510 USD, the Pound rose by 0.35%, the Swiss Franc gained 0.50%, and the Yen climbed by 0.4%. Precious Metals Spot gold was up by 0.1% at 2,918.01 dollars per ounce. Silver remained stable at 31.74 dollars per ounce, platinum fell by 0.3% to 964.00 dollars, and palladium rose by 0.3% to 930.73 dollars. Commodities Oil prices dropped significantly, with Brent falling by 2.45% to 72.95 dollars per barrel, and West Texas Intermediate (WTI) declining by 2.55% to 68.90 dollars. Wheat followed corn’s downward trend as weather threats to northern hemisphere winter crops eased, while soybean futures were mixed in a volatile market. Bitcoin’s price fell by 6% to 88,333.09 dollars, according to Coin Metrics. Earlier, it had dropped to 85,899.99 dollars, its lowest level since November. The plunge in Bitcoin triggered a wave of liquidations, forcing traders to sell their assets at market prices to settle their debts. Centralized exchanges recorded 697.6 million dollars in long liquidations in the last 24 hours, according to CoinGlass. The Trump effect fades… This Morning in Asia The MSCI Asia-Pacific index excluding Japan rose by 0.63% on Wednesday, boosted by a rally in Chinese markets. The Hang Seng index surged by more than 2%, the Hang Seng Tech index gained 2.7%, and the CSI300 index of large-cap stocks rose by 0.54%, while the Shanghai Composite index gained 0.7%. On the other hand, the Nikkei dropped by 1.15%. Oil prices regained some color, with Brent up by 0.34% and WTI rising by 0.35%. Copper prices in London climbed on Wednesday, following a weak dollar after U.S. President Donald Trump ordered an investigation into potential new tariffs on copper imports, aimed at boosting U.S. production of the metal. Three-month copper on the London Metal Exchange (LME) rose by 0.6%. Among other metals, LME aluminum fell by 0.06%, LME zinc added 0.2%, nickel rose by 0.3%, lead gained 0.4%, and tin dropped by 0.6%. Have a nice day – See you tomorrow! Thomas Veillet Financial Columnist

Spot the mistake

The stock markets wavered based on corporate earnings results but also on Trump’s statements about tariffs. More importantly, the press conference with Trump and Macron… the former is keeping his cards close to his chest, while the latter is getting lost in dubious rhetoric. The holiday season is a great time for entertainment, and here are a few riddles: Trump/Putin. Who is the puppet?Trump/Silicon Valley. Who is the strongest?1940/2003. Who is history’s fool? Answers: During the third 2016 presidential debate between Democrat Hillary Clinton and Republican Donald Trump, Trump expressed his willingness to restore normal relations with Vladimir Putin. “That’s because he’d rather have a puppet as President of the United States,” the Democrat retorted. Thiel and Musk founded PayPal, and Thiel also co-founded Palantir Technologies. In 2007, Fortune magazine used the term “PayPal Mafia” to describe 13 highly influential figures in the tech world. These individuals supported Trump. So, Trump may be the strongman of the moment, but Silicon Valley will be the long-term winner. On May 10, 1940, German troops attacked Holland and Belgium despite both countries’ neutral status. Later, the armistice with France was signed, and Hitler demonstrated that a new order would now reign over the French capital, which would have to live on “German time.” On March 20, 2003, a coalition led by the United States, with allies like the United Kingdom and Spain, invaded Iraq after U.S. intelligence claimed Saddam Hussein possessed weapons of mass destruction. We know how that turned out… The fool is Europe, which—except for France—endorsed Bush’s decision. In conclusion, we can hypothesize that Europe finds itself in the position of a boxer practicing the art of dodging against a Mike Tyson, who will eventually land a violent blow and win by knockout. Note: Trump and Macron’s press conference will likely roll off Putin like water off a duck’s back. We’ll see today and later in the week when the British Prime Minister meets with Trump what the latter will write on his website… Overnight, the UN Security Council adopted a U.S.-backed resolution calling for a swift peace in Ukraine, with Russia’s support, but without any reference to the country’s territorial integrity. The four EU countries (France, Slovenia, Greece, Denmark) and the UK abstained. Meanwhile, in the markets… European stock markets closed lower on Monday, except for Frankfurt. The CAC 40 lost 0.78%, the DAX gained 0.60%, and in London, the FTSE 100 remained flat. The EuroStoxx 50 fell 0.42%, the FTSEurofirst 300 dropped 0.12%, and the Stoxx 600 declined 0.10%. German defense companies Rheinmetall, Hensoldt, and Renk rose between 3% and 6.4%, boosted by expectations of increased military spending after Sunday’s conservative victory. In contrast, electrical equipment suppliers involved in data center construction (Siemens Energy, Schneider Electric, and ABB) lost between 4% and 7% after Microsoft secured U.S. AI data center leasing contracts. In Switzerland, the SMI ended up 0.04%. Notably, Nestlé performed well (+3.2%) after Goldman Sachs raised its price target to CHF 93. The American investment bank may be positioning itself as the orchestrator of a potential spin-off or sale of Nestlé’s Water division. In the U.S., Trump’s statements on tariffs imposed on Canada and Mexico sent a chill through the markets. The Dow Jones edged up 0.08%. However, the Nasdaq fell 1.21%, and the broader S&P 500 lost 0.50%. Chinese tech giant Alibaba’s stock plummeted more than 10% in New York on Monday after announcing plans to invest €50 billion “over the next three years” in artificial intelligence (AI) and cloud computing. Data analytics company Palantir also tumbled more than 10%, marking its fourth consecutive decline after the U.S. Department of Defense announced a budget review. Nvidia also fell (-3.09%) ahead of its quarterly earnings report, which investors will closely watch on Wednesday. In the bond market, German Bunds fluctuated before settling at 2.489%. French OATs followed suit, closing at 3.224%. Further south, Italian BTPs remained stable at around 3.555%, while Spanish bonos rose +2.5bps to 3.164%. In the UK, Gilts continued to decline (+1.5bps) to 4.626%. Meanwhile, the yield on U.S. 10-year Treasuries eased to 4.40% from 4.43% on Friday. In currency markets, the euro’s recent gains vanished, bringing the currency back to its level from the start of the week, trading at $1.0461. The U.S. dollar rebounded from its lowest point in two and a half months against major peers, reaching 106.75. In commodities, spot gold remained largely unchanged at $2,950.39 per ounce, about $6 below its all-time high of $2,956.15. Spot silver rose 0.3% to $32.45 per ounce. Platinum held steady at $966, while palladium fell 0.4% to $936.25. Commodities Lagging… Except for Oil Chicago Board of Trade wheat futures closed lower on Monday due to weakness in corn and soybeans, along with reduced concerns about weather conditions for winter wheat crops in the Northern Hemisphere, traders reported. Three-month copper on the London Metal Exchange (LME) fell 0.3%. Among other metals, LME aluminum dropped 0.8%, zinc lost 0.5%, nickel declined 0.3% to $15,395, tin fell 0.3%, while lead gained 0.1%. Brent crude rose 0.2% to $74.93 per barrel, while U.S. crude climbed 0.3% to $70.92 per barrel. This Morning in Asia The broadest MSCI index of Asia-Pacific stocks outside Japan fell 1.3%. Japan’s Nikkei returned from a holiday with a 0.9% drop. Hong Kong’s Hang Seng Index tumbled 2.3%, extending Monday’s losses after U.S. President Donald Trump signed an order restricting Chinese investments in strategic sectors such as semiconductors, AI, and aerospace. Chinese blue-chip stocks fell 0.9%. Have a nice day, see you tomorrow! Thomas Veillet Financial Columnist

Resting…no more gifts

A Friday full of surprises: Macron wants to go give Trump a few lessons, U.S. consumer confidence somewhat shaken, and anticipation for the elections in Germany. Consumer Confidence, Macron, and Trump Are on a Boat… Guess Who’s Drowning? The economic and political news has been surprising. The University of Michigan’s Consumer Confidence Index fell to 64.7 from 71.7 in January, marking a 10% drop in a month and nearly 16% over the year. The index is now even lower than the preliminary estimate (67.8), which, when published on February 7, had already depressed the markets as it was well below expectations. Regarding his meeting with Donald Trump in Washington, Emmanuel Macron, the self-proclaimed Sun King, is set to offer some advice to Emperor Trump: “I’m going to tell him: you can’t be weak in front of President Putin—that’s not you, that’s not your brand. How can you then be credible in front of China if you’re weak against Putin?” He added, “If you let Ukraine fall to Putin, Russia will become unstoppable for the Europeans.” Meanwhile, European leaders are acting like Switzerland’s president, who has read Trump’s book (an important detail), meaning they are “waiting to see.” A small piece of advice… read Machiavelli. One last thing before we go: maintaining Ukraine’s access to Starlink, owned by SpaceX, was reportedly discussed between U.S. and Ukrainian officials after Ukrainian President Volodymyr Zelensky rejected an initial proposal from U.S. Treasury Secretary Scott Bessent, sources said. Financial markets remain more sensitive to economic data, and the latest U.S. figures had a visible impact: the Dow Jones dropped 1.69%, the Nasdaq plunged 2.20%, and the broader S&P 500 index fell 1.71%. Semiconductor giant Nvidia lost 4.05%, while Microsoft fell 1.90%, Amazon declined 2.83%, Tesla dropped 4.68%, and Alphabet lost 2.71%. Meanwhile, in the crypto world, while the U.S. financial watchdog decided to drop charges against Coinbase, Bybit, one of the world’s largest cryptocurrency exchanges, announced that a hacker had taken control of an Ethereum wallet and transferred $1.4 billion to an unidentified address. In Europe, markets were in another world. The CAC 40 closed up 0.39%, the British FTSE ended nearly flat with a 0.04% decline, while Germany’s DAX finished down 0.23%. The EuroStoxx 50 closed 0.19% higher, the FTSEurofirst 300 gained 0.47%, and the Stoxx 600 added 0.49%. In Switzerland, the SMI rose 1.10%, boosted by heavyweights like Nestlé (+3.4%), Roche (+1.1%), and Novartis (+1.5%). Bond yields also fluctuated, with Germany’s 10-year Bund yield dropping 6.9 basis points to 2.4640%, while the two-year yield fell 5.0 basis points to 2.1010%. U.S. Treasury yields also declined, with the 10-year yield down 4.3 basis points to 4.4565% and the two-year falling 2.1 basis points to 4.2448%. By late morning, the dollar remained stable against the yen at 149.58 yen. It has fallen in five of the last six weeks, losing 1.8% this week. The yen has gained about 3.2% so far in February. A quarter-point rate hike is not fully priced in until September, though interest rate markets have factored in a slight possibility of an increase as early as May. Meanwhile, the euro fell after a series of economic activity surveys showed a sharp contraction in early February in France and a slight improvement in Germany—historically the two key drivers of eurozone growth. Gold and Commodities Decline, Except for Wheat Spot gold lost 0.3% to $2,930.85. The bullion gained about 1.7% last week after reaching a record high of $2,954.69 on Thursday. Spot silver was down 0.6%, palladium fell 0.9%, and platinum lost 1%. Oil prices declined on Friday but were still heading toward a positive weekly close amid supply chain disruptions in Russia and a potential rebound in demand from China and the United States. Brent crude dropped 1.96% to $74.98 per barrel, while U.S. crude fell 2.06% to $70.99 per barrel. Soybeans closed down 5-3/4 cents after hitting their highest level since February 11. Over the week, the contract advanced by 0.4%. Chicago Board of Trade wheat futures ended higher on Friday due to short covering and buying by commodity funds, traders said. German Elections… The Christian Democrats secured the largest share of votes (29%) in the German legislative elections, but the sharp rise of the far-right party Alternative für Deutschland (21%) is likely to complicate the formation of a government tasked with providing a European response to growing global threats. DAX futures rose 1.1%, while the euro gained 0.5% to $1.0516 and appears poised to test its January high of $1.0535. This Morning in Asia Liquidity was reduced due to a public holiday in Tokyo, and the MSCI index of Asia-Pacific stocks outside Japan declined by 0.2%. Chinese blue-chip stocks fell by 0.1%, but Hong Kong stocks strengthened by 0.2%, extending their recent bullish run driven by the technology sector. Have a nice day and see you tomorrow! Thomas Veillet Financial Columnist

The Consumer in Focus

The week is coming to an end, and nothing has fundamentally changed. Questions about customs duties remain the same. We keep going in circles, living to the rhythm of the U.S. President’s press conferences. Peace in Ukraine and the strengthening of European defense remain highly relevant topics, but for now, they no longer seem to interest the markets much. Macroeconomics has largely taken a back seat, but we will return to it next week. As for yesterday’s session, the focus was primarily on a topic that had been largely set aside for some time: the consumer’s financial health. Before A few years ago, a lot of emphasis was placed on the fact that the American consumer was the engine of growth—without them, U.S. growth couldn’t be sustained, and the entire economy would suffer. In recent years, however, no one seems to care much about the consumer’s financial health anymore. Instead, the focus has shifted to the growth of new technologies, and what Joe American does with his money has become an afterthought. Right now, we know that the average American is taking on debt to finance their personal battle against inflation. They’re questioning whether it’s worth buying a home with mortgage rates so high—yet at the same time, homeownership remains the ultimate symbol of the “American Dream.” And more recently, Walmart’s earnings report yesterday suggested that Joe American is tightening his belt and starting to be more mindful of his spending. The world’s largest supermarket chain released mixed results, stating that customers are shifting more toward lower-margin products. Translation: they’re opting for cheaper goods. These “new consumption habits” have led Walmart’s management to anticipate potentially tougher quarters ahead. The stock took a hit, dropping over 6%, and the entire retail sector suffered as investors started to wonder if things were better in the past and whether retail sales might become a problem in the coming months. This sounds worrying at first glance, but fortunately, Wall Street has an incredible ability to separate the wheat from the chaff and find a silver lining in bad news. Pressure, but Not Too Much Walmart’s announcement wasn’t great, especially considering that consumer spending may be weakening. That’s why the market was under slight pressure yesterday, and the S&P 500 failed—this time—to close at an all-time high. A wave of fear started creeping into the indices, adding a new layer of concern alongside tariffs, DeepSeek, and the fact that the Magnificent Seven can no longer lead the charge. But the panic didn’t last long. Analysts quickly stepped in to reassure the market and prevent a major pullback. From another perspective, one could argue that “if consumers change their spending habits,” inflation might ease, paving the way for a more favorable outlook on interest rates. Additionally, analysts reminded us that Walmart is a conservative company—when they say the next quarter “won’t be easy,” it’s more about preparing investors “just in case” rather than signaling a crisis. Walmart has never been one to release overly optimistic forecasts. The result? The damage was contained, but the Dow Jones still lost 1%—after all, Walmart is part of the index, meaning one-thirtieth of it fell by 6.5% in a single session. That kind of drop is bound to have an impact. End of the Week and Tariffs In Europe, the discussion around tariffs continued. Trump’s announcements regarding cars and semiconductors put pressure on certain segments of European indices, but overall, the damage wasn’t too bad, and the selling pressure felt on Wednesday eased significantly. The CAC 40 even managed to close in positive territory—just barely, but still in the green. Europe, however, seems unsure of where to focus its attention. On one hand, there are tariffs, though for now, there’s no need to panic too much. On the other, hopes for peace in Ukraine could give the markets a boost. On that note, it’s amusing to observe that February 24 will mark three years since Russian forces entered Ukraine, and yet the markets have climbed 60% since then—62% for the DAX, 41% for the CAC, and 68% for the Nasdaq. And now we’re being told: “If the war in Ukraine ends, it will be a relief for the markets, which will regain momentum and feel less pressure.” Well, that’s for sure—60% gains in three years, and the end of the war will supposedly make us feel even better about the bull market. Basically, if there had been no war in Ukraine, the DAX would be at 55,000, the CAC 40 above 15,000, and I don’t even want to think about tech stocks. I’m being sarcastic, of course—but I didn’t start it. In any case, the good news is that hopes for peace are acting as support for European markets, which are already looking forward to better days, while assuming the tariff situation will sort itself out. In summary, the markets remained solid yesterday—slightly down, but still resilient. Meanwhile—and I know I keep mentioning him—one person who never misses an opportunity to stay in the spotlight is Macron. He has made Ukraine his number one topic in every possible way. He no longer governs France (and Bayrou doesn’t either—he has other issues), but he lives solely for and through Ukraine. With summits every 48 hours, interviews, and social media appearances, he’s everywhere. It’s a convenient way to distract from other matters—and to remind Trump that he exists. Most recently, he has proposed launching a large-scale loan to support Ukraine, which will surely solve everything. Asian Markets This morning, most Asian markets were in the green, some more than others. The usual concerns about tariffs and high U.S. interest rates linger—though the U.S. doesn’t seem to care and keeps pushing higher. Meanwhile, Japan is barely inching forward with a 0.2% gain, China is up nearly 0.9%, but today’s gold medal goes to Hong Kong, where the Hang Seng Index soared over 3% thanks to Alibaba’s stellar earnings. Turns out, consumers aren’t doing too badly—it’s just a different kind of spending, in

Market Highs,Zero Thrill

The Law of Maximum Boredom Yes, okay, the S&P and the Nasdaq 100 are at all-time highs. The American benchmark index is breaking records for the second consecutive session. This should make us happy and have us popping champagne. Yet, we still feel profoundly bored. Not to say that we’re “bored out of our minds,” as the younger generation might put it. This morning, I have the feeling that we’re in an interstellar void of news. There’s nothing new, just rehashing the same stories we already know. We’re going in circles over tariffs that serve every purpose and none at the same time, and we no longer know what to think about war or peace in Ukraine. It’s dragging on. Sleep or Invest, That Is the Question When you do the job I do, it’s important for things to happen—profit warnings, panic crises, doubts about one theme or another, like the arrival of DeepSeek the other day. It’s crucial for tension to be at its peak, for volatility to be under pressure, and for at least some part of the wonderful world of investing to be in doubt. The problem is that, for the past few days, we’ve fallen into some kind of “space-time vortex,” giving the impression that nothing is happening. It feels like we’re in a parallel world where it’s hard to find arguments to go up or down. Sure, as I mentioned in the introduction, the S&P 500 is at an all-time high, and European indices have never been in better shape—well, except for yesterday. But there are very few pieces of news with the potential to be a real game-changer. Even though people are more or less convinced that “everything is going just fine,” it still feels like we’re running out of fuel to go higher, while at the same time, we can’t find any real reasons to go lower. This morning, I feel stuck in the middle of nowhere. Sure, things are happening here and there—Intel speculation, Palantir getting hammered because the CEO changed shareholder pact rules to allow himself to cash out part of his shares and pocket $1.2 billion. That, plus the fact that the Pentagon’s budget—a major Palantir client—is about to get a haircut. There are also some upgrades and downgrades making waves, like Jefferies’ upgrade on STM yesterday in Europe, which sent the stock soaring by nearly 8%. Or Bumble’s questionable numbers and terrible forecasts that sent its stock plunging 30%, making traders realize the stock has lost 92% of its value since its February 2021 IPO. And then there’s Etsy, which tanked 10% for missing the quarter from analysts’ perspective. But overall, nothing is making the market vibrate. You either have to be on the right stocks, or you’re bored out of your mind. The stock market just isn’t interesting anymore. At least, for now. Ukraine and Tariffs Of course, you might say, “But there’s plenty going on with tariffs, and that should shake things up! And what about Ukraine?” Yes, that’s true. But ever since the first tariff shock two weeks ago and the immediate reversal via border agreements with Canada and Mexico, we’ve understood that this is just a diplomatic bargaining tool. Before a wave of tariffs has any real impact on the U.S. economy, it will take a long time—if it even happens at all. As for Ukraine, it’s mostly a political and geopolitical chess game between Europeans and Americans. Trump wants to rebuild ties with Russia, while Europe wants to maintain its legitimacy in the conflict. Not to mention that this allows them to justify their military spending like never before—taking their cut along the way without anyone saying a word because, “you understand, war is at our doorstep.” So, the markets are stuck in a sort of cocoon—unable to rise much further because we’re already sky-high and valuations aren’t exactly cheap, but also unable to drop significantly because the U.S. economy remains strong. Europe will recover once the war ends, and all it takes is China kicking back into gear to align everyone. In short, we’re floating in the middle of nowhere—except at an extremely high altitude—and no one knows what to do, or rather, no one dares to do anything. On top of that, we’re in that awkward, quiet week—the one between the end of earnings season and the start of a new wave of macroeconomic data. A week where most of the companies reporting results don’t interest anyone anymore. There aren’t any significant economic figures, and since the arrival of Trump 2.0, no one cares about macroeconomics anyway—he’ll just multiply the loaves and walk on water. The usual generic arguments for buying or selling don’t excite anyone anymore. I’d say it’s too quiet, and I don’t really like that much, because I prefer when it’s a bit more or less not so calm. Anyway… Yesterday, U.S. markets closed at an all-time high, while Europe took a beating—with experts unable to agree on why. Some blame tensions over Ukraine, yet those same tensions fueled the rally the day before because of increased defense spending. Others point to interest rate worries, but European stock markets usually don’t care much about movements in the Bund or the OAT. To put things into perspective, the last time I mentioned the Bund or the OAT in my market commentaries was during the Greek crisis at the beginning of the last decade. So, maybe European markets deflated simply because they had risen too fast, too high, and too strongly—only to realize there’s no solid justification for such gains. Suddenly, trading in this environment becomes incredibly dull, and it might just be easier to reduce positions and come back next week when Nvidia releases its earnings—so we can finally talk about AI again. Because let’s be honest—the only thing that has truly excited us in recent months is Artificial Intelligence. Not Trump’s tie color, Musk’s latest child, or which U.S. football team won the Super Bowl. We need to

Modest records But Still

If we only look at the numbers, yesterday’s session wasn’t particularly memorable. The same themes as Monday’s session were repeated: defense was in the spotlight – once again – and tech enjoyed itself once more. But as for the rest – for now – the indices remain on the defensive. At all-time highs almost everywhere, but still on the defensive. Otherwise, there’s talk of peace talks that please everyone except the Europeans, discussions about investments in defense, rumors of Intel being acquired, and once again, debates about tariffs. And the Germans are feeling hopeful about next week. Like Yesterday, But Not as Good The Americans were back, but it didn’t change much in the end. As I mentioned yesterday, the S&P 500 closed at an all-time high, erasing the previous record from January 23. But it was a struggle, as just a few seconds before the close, it wasn’t quite there yet. To be fair, there hasn’t been much exciting news since the long weekend. Yes, Intel went wild, having its best session in five years with another 16% increase. We know Broadcom and TSM are circling around the semiconductor giant, although nothing concrete has come out yet. Meanwhile, in AI, Super Micro soared once again. The company has been on a tear since it got “more or less” back on track, and its recovery is impressive, although it’s still far from historic highs and will have to get through Nvidia’s earnings release next week. Speaking of Nvidia, the company has almost fully recovered from the DeepSeek incident. Even though yesterday wasn’t its best day, the stock remains strong and well-supported. However, with its quarterly report coming on February 26, expectations are high, and any disappointment could be costly given its current valuation. Meanwhile, U.S. markets were focused on two things: peace talks in Saudi Arabia – with Rubio and his team meeting Lavrov and his – and Trump’s declaration that he’ll likely meet with Putin before the end of February. Say what you want, but Trump seems to move faster and more effectively in talks with Putin than any G-20 member has in the past three years. The List The other hot topic for investors yesterday was the release of portfolio holdings from major investment moguls. Without listing everything, here are some key takeaways: Warren Buffett continues to reduce exposure to banks and fully exited his position in Ulta Beauty but increased holdings in Occidental Petroleum, Verisign, Sirius, and Domino’s. Terry Smith added Medpace and Doximity but significantly reduced other investments, reflecting a strategy similar to Buffett’s. David Tepper increased his tech exposure, while Bill Ackman made few changes, except for boosting positions in Brookfield and Nike while cutting back on Chipotle and Hilton. Overall, most managers didn’t make any drastic changes, sticking to their core strategies. If we dig deeper, it seems no one wants to go against the current bullish trend, but there are doubts about what lies ahead. With Trump in power, Powell refusing to lower rates, and inflation staying stubbornly high, 2025 could still hold plenty of surprises. In Europe, All Eyes on Germany In Europe, the focus remained on defense stocks. People might prefer to call them “defense sector stocks” because it sounds more politically correct, but in the end, it’s still about weapons. Right now, as Macron appears eager to join the UK in Ukraine, the rest of Europe continues to strengthen its defenses – funded by taxpayers, of course. Yesterday, the mood remained the same as the previous day, driven by defense spending and a military-like rally. The CAC 40 couldn’t close at an all-time high, but the CAC Global Return did, thanks to reinvested dividends, which supposedly allows France to compare itself to Germany’s DAX. Speaking of the DAX, it also closed at a record high, supported by defense stocks, the war in Ukraine, and a much better-than-expected ZEW economic sentiment index. Hope for a Right-Wing Government (But Not Too Much) The ZEW is an index that measures investor sentiment in Germany – it now also exists for the whole of EUROPE. In practice, financial experts are asked whether they are optimistic or pessimistic about the German economy in the coming months. Personally, no one’s ever asked me, but I must be too amateur for that. To put it simply: If the index is high, it means the future looks bright. But on the other hand, if the index drops, it signals “troubles ahead.” Yesterday, it was expected to be at 19.90, but it came out at 26, and last month it was just above 10. The reason for this “return of confidence in the future” clearly lies in this weekend’s elections, as there is hope for a shift to the right and a government that would (or will) provide a bit more support for the economy, as Scholz is expected to be ousted. The only thing worrying observers is the rise of the far-right. In Summary Yesterday was good because records were broken; it was good if you were invested in the arms sector, and it was even better if you had Intel and SMCI bought three weeks ago in your portfolio. As for today, we’re back to the topic of tariffs, because honestly, it’s been a while since we last talked about it. This morning, if you look at Asian markets, you’ll see that the automotive sector is under pressure. The Nikkei is down 0.3%, the Hang Seng is down 0.5%, and Shanghai is up 0.5%. But if you dig into the index components, you’ll see that car manufacturers aren’t celebrating. Don’t look for bad results, lowered guidance, or a flat tire – the reason lies on the other side of the Atlantic. The Return of the Prophet Yes, as I mentioned yesterday morning, Donald Trump was scheduled to speak last night. And he did. In doing so, he announced the upcoming implementation of 25% tariffs on car imports and around 25% on drug imports, with a gradual

Silence, Cash Flows

A Monday without the Americans, and everything feels deserted? Hmm, not quite. Yes, the U.S. markets were closed for President’s Day, but we still felt Trump’s presence everywhere. Things are heating up in Europe—Macron is acting like the leader of the continent, testing the waters for his next job in two years. Meetings are being held to discuss war and peace, and the numbers are being crunched to see how much should be spent in the coming months to “strengthen militarily” and protect against the big bad Putin, who is expected to march straight down the Champs-Élysées. Meanwhile, Europe keeps rising. A day in blue with stars shining in our eyes In the absence of the Americans—and while Trump was doing laps at Daytona in his official car—European markets focused on the war in Ukraine and how they could be involved in the peace agreements. We won’t get into politics in this column, but let’s just say that ever since Trump 2.0, everything has accelerated. The new American President is shaking things up with a force we’ve never seen before. And since his arrival, the prospect of peace in Ukraine has never seemed so strong. The problem is that his working method is more akin to an Abrams tank division crushing everything in its path rather than a delicate diplomatic approach featuring petits fours and Ferrero Rochers to wrap up the ambassador’s dinner. Naturally, Europe’s first line of defense isn’t taking this lightly. JD Vance’s speech in Munich last week didn’t go unnoticed, and several ministers across the political spectrum are on the verge of a nervous breakdown because their competence and authority have been called into question. But the one who took it the worst? French President Emmanuel Macron. Given the size of his ego, there was no way he was going to let that slide. So, France organized an emergency meeting with “part of” Europe, since they didn’t think it was necessary to invite the rest—another ego-driven move. However, the only leader on the continent who has never been elected by anyone was, of course, present. No matter. In the end, France got to puff out its chest, and Macron declared that the Europeans would be involved in the peace process alongside the Americans and the Russians (and maybe the Ukrainians). And, of course, it would be a great time to strengthen their defense lines—to show that theirs is bigger than the neighbor’s. Their defense, of course. In the process, discussions also turned to military budgets and NATO funding needs. We won’t dive into the details, as this is a financial column, after all. But the key takeaway is that between 8:00 AM and 10:00 PM yesterday, everyone managed to convince or self-convince themselves that spending, spending, and more spending on weaponry was the way forward. Suddenly, we all became die-hard fans of defense and arms. Yesterday was THE DAY for the defense sector—or rather, let’s be honest—the war industry. Building Peace Through War We are truly living in strange times. This morning, as I read the recap of what happened yesterday in the European markets, I was simply stunned by the overwhelming sense of disconnect from reality displayed by the world’s politicians. Each of them is off in their own corner, polishing their image, criticizing the negotiations set up by the Russians and the Americans—all while shamelessly bootlicking Trump. I wonder at what point we, the citizens, will start realizing that we are being governed by clowns. But let’s move on. What really matters for financial markets is that the global discussions aimed at bringing peace to Ukraine are triggering the largest wave of military spending in decades. Yesterday, Thales surged by 7.83%, Dassault was up 6.49%, and the DAX closed 1.26% higher, driven by Rheinmetall’s explosive 14% gain and Renk Group’s 18% increase—all fueled by the “potential increase in defense spending among European countries.” Saab also climbed 16%, while BAE Systems gained 9%. The defense sector is in a full-blown frenzy. But the funniest part? If you focus on the trend, you’ll notice that for the past five years, these stocks have done nothing but rise. And now, over the last two days, it’s no longer just an upward climb—it’s a vertical explosion. What’s ironic is that not too long ago, ESG investing was being pushed hard. We were told that putting money into the “bad companies” was wrong and that we should instead invest in the “good companies” that respected human life, nature, and the bees. And now? BAM!!! European governments—who are all financially drowning, by the way—have magically found billions to hand over to the “bad companies” to buy tanks, rifles, ammunition, missiles, fighter jets, chemical weapons, and bombs. And all this? To protect us from the Russians, who are supposedly going to come storming into European capitals in the coming years. And suddenly—POOF! Abracadabra! No one is out here preaching about investing in bees or locally grown organic tomatoes anymore. Suddenly, principles go out the window—as long as it drives the markets higher and brings in cash. I’m not shocked, really. I just realize that all the grand speeches about responsible investing and the “blacklisting” of certain “bad companies” are just a load of nonsense. Even governments don’t care. In fact, especially governments don’t care. Who Cares? It’s Going Up! Anyway, all this to say that yesterday, the Americans weren’t around, but we still managed to rally—thanks to NATO, thanks to the war that’s supposedly ending, and thanks to the Russian and American diplomats who flew off to Saudi Arabia to find a way to start talking again. After two years of giving each other the silent treatment, they now have to figure out who gets custody of the kids and how much child support needs to be paid—which, in geopolitical terms, translates to: “Who gets to keep Europe, and who gets the contracts to rebuild Ukraine?” Only after settling that can they start discussing actual peace in Ukraine. To sum up