Mayday – Mayday

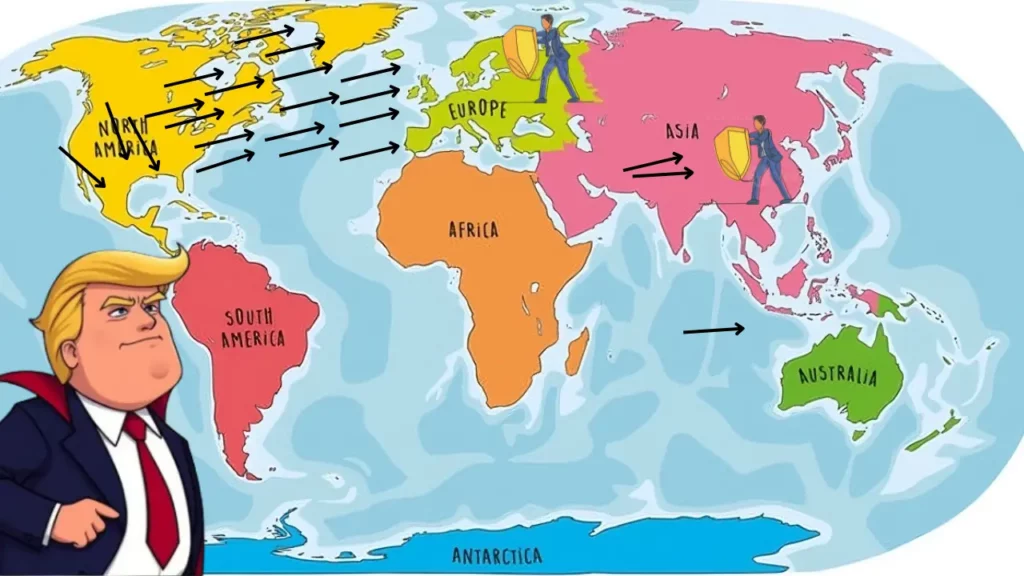

A Worldwide Shockwave from U.S. TariffsThe global stock market is experiencing one of its most turbulent days in recent years, as fears of a full-scale trade war take center stage. The spark? A sweeping move by U.S. President Donald Trump to impose fresh tariffs ranging from 10% to 50% on a wide range of imported goods. This unexpected decision has created shockwaves across international markets, stoking fears of supply chain disruptions, retaliatory measures, and a potential slowdown in global economic activity. Investors worldwide are reacting with panic, pulling back from equities and rushing toward traditional safe-haven assets. This coordinated selloff has affected all major indices and regions, starting with Asia and rippling through Europe and the U.S. Asian Markets: Panic Selling Hits HardMarkets in Asia opened the week with deep losses, reflecting the nervousness surrounding trade uncertainty. Japan’s Nikkei 225 plunged nearly 9%, its worst single-day performance since 2020, driven largely by the collapse of bank and tech stocks. The Topix bank index fell as much as 17.3%, signaling systemic worries. Meanwhile, Hong Kong’s Hang Seng Index recorded a historic drop of almost 12%, the steepest since the 2008 global financial crisis. Taiwan’s Taiex shed 9.7%, nearing a 35-year record low. These sharp declines were accompanied by losses of 5–7% across Shanghai, Singapore, and South Korea. The sentiment in Asia is clear: the region is bracing for serious economic fallout, especially among export-driven economies vulnerable to U.S. policy shifts. European Equities Dive on Trade War FearsAs markets opened in Europe, investor sentiment remained gripped by fear. The pan-European STOXX 600 tumbled 5.8%, dragged down by autos, banks, and industrials. Germany’s DAX fell 0.7% despite a relatively resilient economic outlook, with German automakers particularly exposed due to the 25% U.S. import tariff on foreign vehicles and auto parts. France’s CAC 40 and Italy’s FTSE MIB were also in the red, losing between 2% and 4%. The overall atmosphere in Europe is one of vulnerability. Companies reliant on cross-border trade are now under pressure, and the likelihood of retaliatory tariffs from the EU is growing. Investors are also watching how central banks may respond in the coming weeks to provide stimulus or policy clarity. U.S. Market Futures Paint a Gloomy PictureAlthough Wall Street hasn’t opened yet, futures are flashing red across the board. Dow Jones Industrial Average futures are pointing to a potential 1,600-point drop, while S&P 500 futures are down more than 3%. Nasdaq futures have slid nearly 4%, as technology companies brace for the impact of higher component costs and weakened demand overseas. These moves follow Friday’s already shaky close, where indexes ended lower on speculation that Trump’s administration was preparing to escalate trade tensions. The fear now is not only immediate profit loss due to tariffs but also a broader dent in consumer confidence and business investment. Analysts warn that if the selloff accelerates during U.S. market hours, circuit breakers might be triggered. Energy, Oil, and Middle East Currencies SlammedThe turbulence hasn’t spared commodity or emerging markets either. Oil prices have plunged below $60 per barrel, with Brent crude shedding nearly 15% over five days. This has hit the Middle East hard, where local stock markets tumbled across the board—Dubai dropped nearly 6%, Abu Dhabi fell 4%, and Saudi Arabia’s Tadawul Index lost over 6% as Aramco shares sank more than 5%. These nations face a dual crisis: reduced export earnings due to falling oil and increased economic pressure from weakened demand in global trade. Currencies like the Saudi riyal and UAE dirham, though pegged to the dollar, are facing capital flight pressures. With energy stocks sinking and budget deficits looming, regional governments may be forced to cut public spending or borrow heavily. Investors Rush to Gold While Outlook Remains UncertainIn the face of mounting uncertainty, investors are seeking refuge in gold, which has now surpassed $3,000 per ounce for the first time ever. Treasury bonds and the U.S. dollar have also seen modest gains, as traders reduce risk exposure. Financial institutions like Goldman Sachs and JPMorgan have already revised global growth forecasts downward, warning of potential recessionary scenarios if trade tensions persist. The next few days will be critical as the world watches for responses from major central banks and policymakers. Meanwhile, markets remain in high alert. For investors, it’s a time to proceed with caution, reassess risk, and prepare for further volatility. Whether this is a short-lived panic or the beginning of a prolonged downturn depends heavily on geopolitical developments—and whether diplomacy can prevail. A Rush to Washington: Countries Seek Direct Talks with Trump, Dividing EuropeAs the U.S. trade war intensifies, countries from across the globe are scrambling to negotiate directly with President Trump in hopes of securing exemptions from the newly imposed tariffs. Leaders from Asia, including Japan, South Korea, and India, have all made their way to the White House to discuss the potential impact of U.S. tariffs on their economies and to seek relief from the sweeping trade measures. Japan, in particular, has expressed concern over the heavy toll on its automotive industry, while South Korea is looking for leniency on steel tariffs. In contrast, China’s attempts to reach a resolution have been met with skepticism, as U.S.-China relations remain at a boiling point. Meanwhile, Europe is experiencing its own form of fragmentation. While some EU countries, such as Germany, are pushing for a united front in resisting the tariffs, others have taken a more self-serving approach. Italy, for example, has been quietly negotiating with the U.S. on a separate trade deal to protect its industries, while countries like France and Spain are voicing concerns over the EU’s inability to act cohesively. This division within Europe has weakened the EU’s negotiating position, as member states prioritize their own national interests over collective action. As a result, the global trade landscape is becoming increasingly fractured, with countries seeking individual agreements that undermine the possibility of a unified response to the U.S. tariffs. The Role of Emerging Markets: Economic Strain and Currency InstabilityEmerging

Bear Market Is Here

Alright. This morning, let’s try to keep it simple. I’ll try to avoid giving you a detailed summary of what happened, since you already know, and anyway, you probably already have an opinion and don’t need mine. But still, we have to go back over the fact that we just had one hell of a shitty session. Yes, I know: “one hell of a shitty session” isn’t exactly polite language, but at this point in the bloodbath, it’s hard to open a thesaurus and find a phrase like: “the session wasn’t particularly pleasant from a mathematical point of view.” No, the session was crap, and it’s probably not over. Not Historical, But Almost So Trump reignited the trade war, lashing out at the entire world and apparently even managing to impose tariffs on uninhabited islands, just in case seagulls start producing semiconductors. This “declaration” of war triggered a tsunami on global stock markets. Yesterday, there were no survivors—everyone rushed for the lifeboats in full-on “my portfolio first, women and children later, if there’s still room” mode. The S&P 500 lost 4.8%, marking its worst day since June 2020. The Nasdaq took a 6% hit and basically got stomped on, dragged through the mud afterward. The Russell 2000 plunged 6.5% and officially entered Bear Market territory. The SOX (Philadelphia Semiconductor Index) got wiped out, dropping nearly 10%—9.88% to be exact—and at this point, we can’t even call it a Bear Market anymore, because the index is down 34% since July 2024. That’s a crash. The only thing missing is the speed of execution. But the SOX!!! The SOX, which has been THE Leading Indicator for tech markets for years, our compass in the storm, our North Star in the night. The SOX is now in a state that means nothing. Or rather, it does mean something: it means that nobody will ever buy cutting-edge technology again. It means nobody will ever need semiconductors again—for phones, laptops, autonomous cars, dishwashers that tell you when they’re done rinsing, PlayStations to brighten our weekends, or even better: nobody will need chips to build Texas-sized data centers to run Artificial Intelligence and Quantum Computing. If you’re wondering whether we’ve lost our minds, stop thinking. You’re absolutely right. The market is in full-on delusion, just like we were in full-on delusion when we were gaining 2% every day for days on end just because Jerome (Powell) might one day lower interest rates. Exaggeration, extension—breathe, relax… Markets are fascinating creatures. Fascinating because we’re capable of getting hyped up on flaky theories and buying anything at any price, as long as there’s a fitting narrative to go along with it and two or three people to tell us the story by the fireplace at night. Just as we’re capable of selling everything (like yesterday), using the exact same narrative we’ve been fed for months—just flipped the other way. What I’m trying to say is: we’re now experiencing the same kind of exaggeration we saw on the way up. Except this time, we’re living it on the way down. And it’s fascinating that we’re able to get just as carried away—in the exact opposite direction. On February 19, 2025—exactly 44 days ago—the Nasdaq 100 was at 22,222. Yesterday, we closed the session at 18,521. That’s 16.6% lower and 9% below the 200-day moving average. And yet, in between, macro data hasn’t really changed—interest rates haven’t moved, there hasn’t been any major earnings release—except Nvidia (which we’re not even talking about anymore, thankfully, since the stock is down 34% since late January). So even though nothing concrete happened—apart from tariffs—markets literally collapsed. It’s the Apocalypse, and the mood is almost dramatic. People are comparing this to 2008, wondering what the hell the Fed is doing this time, and it feels like we’re on the edge of panic. No Volatility? Looking at year-to-date performance, the Dow Jones is down 4.7%, the S&P 500 is down 8.25%, and the Nasdaq: 14%. Over in Europe, Spain is still up 13%, the DAX is up 9%, and even Switzerland is up 5.8%. And yet, when you listen to the market chatter, the commentary from everyone and the nervousness of some investors, it feels like we’re inching closer to a panic zone. Contrarian indicators tell us that people have rarely been this bearish, the Fear & Greed Index is at 8, and the inventors of the index are probably wondering if they can invent negative values—like, can we go below zero? Everything points to an end-of-the-world vibe, panic knocking at the door. And yet, the VIX—the fear index—is only at 30%. For those who like parallels: last August, when Japan almost collapsed in our hands, the VIX shot up to 65%. In 2008, it hit 96%. And now, while Trump floods us with dumb tariffs and picks fights with the whole planet—making Ursula von der Leyen seem almost likable in her role as “fierce protector of Europe”—volatility is struggling to even reach 30%. It’s like there’s some missing piece of information. Something we just can’t seem to factor into our thinking. Maybe deep down we don’t want to believe that what Trump is doing is truly, completely stupid. We want to believe it’s not possible—that the guy must have some semi-rational strategy behind it and that he can’t really be that dumb. Even though that’s EXACTLY what the FABULOUS European politicians—all nearly flawless—have been repeating on loop for the last 24 hours. And Yet And yet, it’s a fact. Trump is trying something against the advice of the rest of the world, and for now, everyone thinks he’s going to crash and burn, and that he’s a complete idiot. But from the market’s perspective, it feels like we’re still clinging to something invisible—a separate force telling us we’ll pull through. Because honestly, since 2008, we’ve seen market miracles flip trends like pancakes. And this lack of volatility might be a sign that we’re expecting some kind of miracle to save the SOX

America’s New National Sport

This morning, the markets are bleeding. Not just a post-FOMC hangover red. No. A full-blown bloodbath.U.S. futures are pointing to a 3% drop at the open. Japan is down more than 3%. Hong Kong is down 2.3%. And European markets are about to be hit ice-cold at the opening bell. The only exception? China, strangely calm. Maybe because they already know what their next move will be. LIBERATION OR DETONATION? It’s official: Trump just pressed the button. What was supposed to be “Liberation Day” turned into a tariff tsunami—an economic shock of unprecedented magnitude since… let’s say 2008. And even that might be an understatement. It all started last night, in the White House gardens. Trump, microphone in hand, in full crusader mode, unveiled his plan: open, aggressive, and massive economic warfare. A “protectionist crusade,” as he called it, to bring back American industrial greatness—even if it blows up the entire global economy. The method? Simple, brutal, and very Trumpian: A universal 10% tariff on ALL imported goods into the U.S. “Reciprocal” surcharges ranging from 20% to 49% for countries with which the U.S. has a trade deficit. And just like that, here come the condemned nations: 🇨🇳 China: 34% (up to 54% with fentanyl-related surcharges)🇻🇳 Vietnam: 46%🇰🇭 Cambodia: 49% → World record!🇹🇼 Taiwan: 32% (except for semiconductors—lucky break!)🇮🇳 India: 26%🇧🇩 Bangladesh: 37%🇮🇩 Indonesia: 32%🇪🇺 European Union: 20%🇨🇭 Switzerland: 31% – Shouldn’t have let go of banking secrecy.“These are bargain tariffs,” Trump declared. “We’re making them pay half of what they charge us.” Sure, buddy. THE SEMICONDUCTOR SCARE: SAVED—FOR NOW The 32% tariff on Taiwan sent shockwaves through the tech industry. Nvidia, AMD, Qualcomm, Apple… all of them rely on TSMC, the mega-factory that produces 90% of the world’s most advanced chips. Panic? Absolutely. Then, a last-minute reversal: The White House clarified that semiconductors are excluded. Relief? Not really. Stocks still tanked: Nvidia: 4.3% TSMC: 6.6% AMD: 4.4% Because at the end of the day, the real poison isn’t the tariff—it’s instability. And in an industry where timing is measured in nanoseconds and margins in micro-dollars, instability is a nightmare. WHO PAYS THE BILL? Spoiler: Everyone. But some will feel the pain much sooner than others. Apple: 7%. Dell: 5%. They manufacture in China and Taiwan. Do the math. U.S. retailers: Lululemon 11%, Gap 8.4%, Walmart 5%, Target 5.5%. Why? Because clothing, shoes, and accessories come from heavily tariffed countries. Brewers: 25% tariff on aluminum cans. Even drinking a Corona is now a political act. Green energy: Sunrun 5.6%, GE Vernova 4.6%. Components are imported. And now, they cost a fortune. Private equity: Blackstone, KKR, Apollo—all down. Why? If the Fed can’t cut rates due to imported inflation, their entire business model collapses. Farmers: China retaliated immediately with tariffs on soybeans and corn. If Beijing ramps up the pressure, U.S. agriculture could be crushed. The irony? Trump’s own voter base will take the hardest hit. THE PERFECT RECIPE FOR A RECESSION The formula is frighteningly simple: Soaring prices A Fed trapped between inflation and slowdown Supply chains in ruins Consumer spending under pressure Now add a dash of geopolitical chaos, shake violently, and voilà: a Made-in-Trump recession.If you think I’m exaggerating, the Atlanta Fed already predicts a GDP contraction for Q1. And that doesn’t even factor in the full impact of the tariff wave. RESHORING? LOL So, will this bring factories back to America? Sure. But let’s be realistic: Manufacturing in the U.S. costs more. It takes longer. And it mostly hires… robots. So, no, we won’t see 10,000 blue-collar workers heading back to factories like it’s 1954. Maybe 12 engineers and a robot dog, if we’re lucky. For now, the world is splintering. There are no friends anymore, just rivals. Europe is screaming. China is plotting its counterattack. India is growling. The era of “every man for himself” is here.The 1990-2020 globalization model? Dead.What we’re witnessing is a paradigm shift—and it’s brutal. IN CONCLUSION: TRUMP DIDN’T PRESS A BUTTON, HE THREW A GRENADE. What he launched last night isn’t just a tariff plan. It’s a total redefinition of the global economic rules.He shoved international trade into a blender, hit the power button, and served it back to us with a pink umbrella and a lemon slice, saying:“Bon appétit, folks. It’s this or nothing.” AND NOW? Jerome Powell (Fed chair) is watching the storm arrive armed with a bucket and a spoon. The markets are in full panic mode. Algos are screaming. Investors are running for cover. And us? We’re getting shaken like it’s 2008 all over again. We’re officially in a correction zone. Just a few steps away from a bear market. The magic number? 4,950 on the S&P 500. Drop below that, and we’re in bear territory. AND ELON? Meanwhile, Elon Musk just announced he’s leaving the government to focus on Tesla—which is great timing because Tesla’s delivery numbers were catastrophic yesterday. The stock plunged 6% on the report. Rebounded 10% on Musk’s departure from DOGE. Dropped another 5% after-hours thanks to Trump’s tariffs. It’s a rollercoaster—and you better have a strong stomach. BOTTOM LINE? IT’S STILL RED. Futures are still down 2.8%—a drop we haven’t seen since COVID or Lehman’s collapse. Have a great day, and see you tomorrow—hopefully with more perspective as we brace for the Non-Farm Payrolls together! “Be Fearful When Others Are Greedy. Be Greedy When Others Are Fearful” Warren Buffet Thomas Veillet Financial Columnist

Markets Tumble

In March 2025, the S&P 500 index declined by 5.7%, marking its worst monthly performance since December 2022. This decline was primarily driven by escalating fears of a global trade war, following President Donald Trump’s announcement of new tariffs targeting aluminum, steel, automobiles, and all goods from China. These measures heightened concerns about a potential recession in the United States, prompting analysts, including those at Goldman Sachs, to increase the probability of a recession to 35% within the next year. Despite a slight rebound of 0.55% in the last trading session of March, the S&P 500 closed the month at 5,850.31 points, down from 6,207.54 points at the end of February. The Nasdaq-100 index experienced a significant decline of 8.2% in March, also recording its worst monthly performance since December 2022. The technology sector was particularly affected by the trade tensions, with major tech stocks experiencing substantial losses. For instance, Nvidia’s shares plunged by 6% on March 27, contributing to a monthly decline of over 13%. Tesla’s stock also tumbled by 5.6% on the same day, adding to its monthly losses. The Nasdaq Composite index closed at 17,889.01 points on March 27, reflecting the broader impact on technology stocks. The Dow Jones Industrial Average (DJIA) fell by 5.28% in March, closing the month at 42,001.76 points, down from 44,544.66 points at the end of January 2025. This decline was largely attributed to the implementation of 25% tariffs on imports from Canada and Mexico, announced by President Trump to take effect on April 2, 2025. These tariffs intensified fears of a global trade war, leading to significant market volatility. Despite a 1% rebound during the last session of March, the DJIA’s gains were insufficient to offset the month’s accumulated losses. The tariffs also had a pronounced impact on specific sectors; for example, major U.S. automakers like Ford and General Motors experienced significant stock declines due to their reliance on supply chains in Mexico and Canada. In summary, the major U.S. stock indices experienced significant declines in March 2025, reflecting investor concerns over escalating trade tensions and an uncertain economic outlook. The technology and automotive sectors were notably affected, with substantial losses in major companies’ stock values. These developments underscore the growing fears of a potential recession in the United States. Have a nice day! Philippe Thomas Financial Columnist

The Show Must Go On

Let’s not lie to ourselves—we can tell ourselves whatever we want about yesterday’s session, but fundamentally, we were just filling the time with deep reflections on the state of the economy, just to keep our minds occupied until the announcement of the tariff rates, which will take place at 4:00 PM New York time this evening. In the meantime, we tried to get through Tuesday pretending to be interested in other things, knowing full well that we wouldn’t learn anything new about customs duties. The result was quite interesting: Europe was rising because the economy was slightly improving and the numbers were “less bad,” while the U.S. markets were rising simply because something had to happen. A Macro Day to Keep Up Appearances So, we spent a session trying to keep up appearances while waiting to learn more. To be honest, if you focus on everything that happened yesterday, there was a mountain of macroeconomic data that gave us a real opportunity to reflect on the current global economic situation. But we also had to ask ourselves whether it was really worth discussing, since we all know that, depending on what Trump says later today, anything could happen. Well, “anything could happen” is a bit of an overstatement, since, according to “options experts,” the bets placed for tonight expect a movement of about ±2% on U.S. indices. Honestly, after 10 days of excitement for a 2% move, I wonder if I should have just gone back on vacation. In any case, yesterday’s session was “pretty good” in Europe. A bit more hesitant in the U.S., but we still ended up in the green—except for the Dow Jones. But the Dow Jones had an excuse because Johnson & Johnson got hammered again by a judge over its talc cancer lawsuit. The judge rejected yet another financial settlement proposal from the American company. This was the third time Johnson & Johnson tried to use one of its subsidiaries to take all the liability and use bankruptcy proceedings to pay out around $9 billion to victims. Apparently, the court found procedural flaws in the case, and Johnson & Johnson lost 7.5% during the session. The company also announced that it was withdrawing its proposals and the $9 billion settlement fund, opting instead to fight in court. In other words, the victims are nowhere near seeing a dime. So, the Dow Jones was down. And initially, I wanted to talk about macroeconomics. So, the Macro… Yesterday in Europe, the DAX gained 1.7%, France rose by 1.10% but remained far from the 8,000-point mark. Meanwhile, Switzerland had a 0.7% increase, but the 13,000-point target still seemed out of reach. But the main topic of the session—used to mask the waiting game—was economic reports. The CPI was released in Europe, coming in at 2.2%, exactly in line with expectations and 0.1% LOWER than last month. This suggested that “life is getting cheaper and that the European Union is managing things brilliantly.” Of course, we prefer not to mention how much prices have risen over the past five years—because then the 0.1% variation would make you roll on the floor laughing! But in the meantime, it gave politicians an opportunity to show how great their work is and to imagine that, under these conditions, Madame Lagarde would have no choice but to continue easing monetary policy to please her dear investor subjects. Following these figures, which once again prove that inflation is perfectly under control in the eurozone, thanks to our oh-so-competent leaders… Let me pause here—does my sarcasm come across clearly? No, seriously, I AM BEING SARCASTIC. The number is better than last month, but given the overall state of the economy, there’s really nothing to brag about. But hey, we needed something to keep us busy while waiting for tonight. Alright, back to where I left off: “thanks to our oh-so-competent leaders”… So, following these figures that once again prove that inflation is perfectly under control in the eurozone, thanks to our oh-so-competent leaders, we also got the Manufacturing PMI numbers from Germany and France. In France, the number came in at 48.5—well below expectations since finance experts were hoping for 48.9. However, it was still considered GOOD because it was “less bad” than the previous month, which stood at 45.8. Same story in Germany: the figure came in at 48.3—0.1 below expectations but “less bad” than last month’s 46.5. Considering the amount of money that has been injected into the defense sector over the past three weeks, this “less bad” outcome was the least we could expect. That said, every time I hear economic figures being described as “good” because they are “less bad,” I can’t help but think that maybe we should just shut up and talk about something else. I don’t know… maybe tariffs? Anyway, Europeans gained yesterday because things were “less bad”—all while waiting to find out how much they’ll have to pay to export Dacias to the U.S. The Macro from Over There Across the Atlantic, the market wasn’t exactly in great shape, but in the end, the Nasdaq and S&P 500 still managed to close higher, putting an end to a losing streak of a few days. There was a lot of focus on tariffs, but since we don’t know much beyond the announcement time, the market had to shift its attention elsewhere. Yesterday, that meant looking at the JOLTS report and the ISM Manufacturing PMI. The JOLTS number came in weaker than expected at 7.568 million, and it was also lower than last month’s figure. However, the wonderful world of finance didn’t seem too bothered, still wanting to believe that the U.S. job market is doing just fine. So, in the end, JOLTS had no real impact on the market. Then came the ISM Manufacturing PMI, which printed at 49. Expectations were at 49.5, and last month’s figure was 50.3. This means the U.S. economy is, once again, contracting based on this data. So, if we focus

Liberation Day or Judgment Day

The week started in the red, as expected. However, not everyone was in the red—Americans still managed to pull off one of their signature REVERSALS. The shift from panic mode to “time to buy the dip” was brutally violent (once again). While Europe was licking its wounds, waiting for “Liberation Day,” the U.S. markets made a full 180-degree turn, closing with the biggest “recovery day” seen in three years. And all of this just 48 hours before an announcement of biblical proportions regarding tariffs. In summary, this is either the biggest scam of the century or an act of genius. We’re Asking Questions but Finding No Answers The hardest part of all this is understanding WHY the market suddenly flipped after hitting rock bottom. The European plunge isn’t much of a mystery—everyone understands that Europeans are terrified of the potential announcements from Donald Trump, given that they’re on the front lines. But in the U.S., considering the sheer fear hanging over Wall Street on Sunday night and Monday morning, it’s hard to justify a rebound of this magnitude. Sure, one could argue that since the indices tested new short-term lows and technical breakdowns didn’t trigger massive sell-offs—AND it was also the last day of the quarter, with many taking the opportunity to clean up their portfolios and take profits on shorts—this could explain part of it. But the theory that “we’ve seen capitulation, so now I’m buying” seems a bit far-fetched. Yet, it’s out there—I read it this morning. The issue is that calling it capitulation when the VIX peaks at 24.80% seems premature. Still, the fact remains that after hitting a low of 5,486—just a few points below the psychological and technical support level of 5,500 on the S&P 500—we bounced back as if it were already the day after Liberation Day, and as if Trump had ALREADY walked back his decisions. End of the Quarter Even though the U.S. market’s positive close caught many off guard, it doesn’t change the fact that this quarter was rough. The S&P 500 has lost 4.6% since January 1st, making this the worst quarter since early 2022. And yet, we had such HIGH HOPES at the start of the year with Trump’s return. But those hopes were quickly crushed by his enthusiastic use of tariffs. Add to that a consumer base that’s starting to lose confidence—some even doubting everything. Throw in fears over Trump’s protectionist policies, and soon you’ll see strategists talking about stagflation or recession. I’m not making this up—read the Wall Street Journal, MarketWatch, or Barron’s, and you’ll find plenty of references to these scenarios. Just a short while ago, bringing up either of those terms would have gotten you sent straight to a psych ward. It’s clear that investors, analysts, strategists, and even the guy fetching their coffee all have moods that shift faster than tariff rumors. The only thing left to hold onto is historical market data. And historically, “in general,” when we have a terrible first quarter, the second quarter is “generally” better. That’s reassuring. We know finance isn’t an exact science, but still, it’s comforting. And in times of uncertainty, we all need a little reassurance—even if it only lasts three minutes. Yesterday Again So we witnessed a textbook REVERSAL, going from “we’re all going to die by Wednesday” to “but if we don’t, this is the buying opportunity of a lifetime.” Let’s be real—when the Nasdaq drops 15% in six weeks, that’s a lot of bad news priced in. We already know the economy is slowing down. We know the job market isn’t great (even if no one likes to admit it). We know the fight against inflation isn’t ending anytime soon. And we know that if the Fed cuts rates three times this year, that would be like paradise. Some are even betting on a recession or stagflation. So unless Trump slaps 100% tariffs on the entire planet, we can assume the market has already priced in most of the bad news. The proof? It even anticipated the post-tariff-announcement rebound before Wednesday’s announcement. Let’s hope it holds. However, it’s still worth mentioning three events that have nothing to do with Tariffs: Several analysts are getting anxious as the release of Tesla’s delivery figures approaches. With just two days to go before the Q1 delivery report, analysts are revising their estimates downward. Between tariffs weighing on imported parts, controversies surrounding Musk, and the booming sales of “I bought a Tesla before Musk lost his mind” stickers—not to mention plunging sales in Germany and France—there’s reason to worry. Yesterday, Stifel slashed its delivery forecasts by 23%, with Baird and Wedbush following suit. Even the most bullish of bulls, Dan Ives, is expecting a “very soft” quarter. Yet, all remain “positive in the medium term,” as if searching for a glimmer of hope in the headlights. The consensus is at 377,000 cars delivered, but the market would be happy with just “360,000.” Any lower, and Musk’s seat might start heating up. The stock is down 37% since January 1st, with an average price target of $358—offering a potential 40% upside, but it takes guts. Today, though, fear is taking over. Meanwhile, Musk continues to walk the tightrope between visionary genius and political liability. There’s also drama in the biotech sector, as Peter Marks, director of the FDA’s Center for Biologics Evaluation and Research, is reportedly about to be shown the door. Marks had supported programs that accelerated the development of treatments for rare diseases and gene therapies during his tenure and played a key role in the development of COVID-19 vaccines. Without his backing, the entire biotech sector went into panic mode. Moderna took a 9% hit on the news and didn’t even benefit from the market rebound. This is yet another ripple effect of Trump’s policies, no doubt. And then, a little IPO excitement: Newsmax, the fourth-highest-rated cable news channel in the U.S. and somewhat conservative in the Trumpian vein, went public yesterday. Priced at

Emergency Landing Position

Turbulence ahead! Let’s not overthink it this Monday morning—it’s clear that things are going to get rough. The Nikkei is already down 4% in “preparation” for Donald Trump’s so-called “Liberation Day” set for this Wednesday. If we’re already taking hits like this three days before the event, I don’t even want to imagine how we’ll end the week! And let’s not forget the tariff drama—on top of that, it’s the first week of April, which means employment data is coming. In short, if you’ve never been inside a washing machine during the spin cycle, now’s your chance to experience it. THIS IS THE WEEK! Since Trump’s inauguration, we’ve been living in total uncertainty, and it’s becoming unbearable. CNN’s Greed and Fear indicator is still deep in the EXTREME FEAR zone, and volatility—the so-called fear index—seems ready to surge at full speed. And looking at everything ahead this week, there’s little hope that things will get any better. Markets hate uncertainty, and they’re about to get their fill! Trump has already started stirring things up over the weekend, and futures are down 0.8% as of 5 AM. Japan is collapsing, and even China’s strong industrial growth numbers—the highest in a year, proving that the government’s stimulus measures are working—aren’t enough to ease market tensions in this chaotic period. The reality is, if China’s growth is picking up and Trump slaps them with a 50% tariff on their exports, things won’t be heading in the right direction! Over the weekend, the U.S. President made several statements. First, he’s picking a fight with Putin. Putin isn’t complying with Trump’s demands on Ukraine, so Trump declared he was “really angry” with the Russian President and might retaliate with massive tariffs on Russian oil. Oil barrels that, technically, aren’t supposed to be exported anyway—but let’s move on. The so-called bromance between these two “presidents for life” seems to be cracking. And yes, I say “presidents for life” because Trump also hinted this weekend that he’s already considering a third term. Given the chaos he’s stirred up in just two months, if he also plans to change the Constitution to stay another seven years and ten months, we’re in for a wild ride. But that’s not all! He’s also clashing with Zelensky over rare earth minerals, meaning the much-promised peace in Ukraine is already fading into oblivion. And that’s still not all!!! Trump also lashed out at foreign automakers threatening to raise prices. The White House chief bluntly responded that he “doesn’t give a damn” and that if foreign cars became too expensive, Americans would simply buy American cars—after all, there are plenty of them available… Meanwhile, the U.S. is meddling in French labor laws, telling companies doing business with America not to “favor inclusion” in their hiring. And to top off the weekend’s news cycle, Trump announced that the U.S. will take control of Greenland, not entirely ruling out the use of force if necessary. But hey, we’re safe because France’s foreign affairs clown, Jean-Noël Barrot, declared that “France will not allow it!” I don’t know about you, but Barrot, with his angry wide eyes, is terrifying. All of this to say: Trump is ramping up pressure everywhere, just three days before a historic moment for tariffs. If you haven’t been lost deep in the Andes mountains, you should know that this Wednesday, the Reciprocity Tariffs will be announced, which could severely impact inflation and consumer spending—already battered over the past five years. This fear is weighing heavily on the markets, as we saw again last Friday when U.S. indices got slaughtered after the PCE came in hotter than expected and personal consumption expenditures also slumped. You didn’t need a PhD in market analysis to see that indices are downright terrified about what might happen on Wednesday. And when you look at where the S&P 500 and Nasdaq closed, it’s already clear: this will be the week of make or break. Because here’s the thing about the wonderful world of finance: we always try to “anticipate.” And looking at where we stand today, we’ve already priced in a ton of economic trouble. The Nasdaq is down 14% from its February highs, and if we break last Friday’s closing levels this week, talks of an inevitable Bear Market will start flooding in—officially triggered once we cross the 20% decline threshold. But if we survive this week—given that we’ve already priced in a mountain of bad news—we might be able to hold onto the fact that April is historically a strong month for global markets. In April, Don’t Shed a Thread As March wraps up with a “sell everything and figure it out later” vibe, many investors are wondering whether April—historically one of the best months for U.S. stocks—will live up to its reputation. More importantly, is this a real buying opportunity or just a dead cat bounce? According to the Stock Trader’s Almanac (yes, it still exists, but we usually only pull it out when we’re REALLY desperate), since 1971, April has been the second-best month for Wall Street, even in post-election years. So, on paper, April smells like a rebound. But the market, well, it has a peculiar sense of humor. Sentiment Check: Not Exactly a Party Let’s be honest, investor sentiment isn’t great: individual investors are ultra-bearish. But for contrarians (like myself), that’s actually good news! That said, the AAII sentiment index… Quick educational interlude: AAII stands for American Association of Individual Investors. It’s basically an American association representing retail investors—people investing their own money (not fund managers or professionals). Their most famous metric is the Sentiment Survey, a weekly poll asking members if they’re bullish (optimistic), bearish (pessimistic), or neutral on the markets over the next six months. …Well, according to the AAII, over 50% of respondents have been expecting the market to drop for five straight weeks. Historically, when everyone is this scared, it’s often the moment things turn around. Ahhh, contrarian mindset, gotta love it! I bet Lorraine Goumot on

Ubisoft & Tencent Subsidiary

What Will Change… Ubisoft recently announced the creation of a new subsidiary dedicated to its major franchises, such as Assassin’s Creed, Far Cry, and Tom Clancy’s Rainbow Six, with a strategic investment of €1.16 billion from the Chinese giant Tencent. This transaction values the new entity at €4 billion, highlighting the importance of Ubisoft’s licenses and their long-term economic potential. Ubisoft specifies that this subsidiary will focus on developing evergreen and multiplatform gaming ecosystems. This means the publisher aims to extend the lifespan of its franchises through a business model based on frequent updates, enriched multiplayer experiences, free-to-play games, and increased integration of social features. This strategy aims to maximize player engagement and diversify revenue sources, a shift toward more sustainable models in the face of increasing competition in the gaming space. From a financial perspective, this transaction strengthens Ubisoft’s balance sheet and enhances its investment capabilities, potentially preventing it from becoming a takeover target. This move comes after a period of uncertainty for the publisher, including disappointing sales of certain titles and speculation surrounding a potential sale of the company. Additionally, Bloomberg reported that Tencent was even considering taking Ubisoft private in collaboration with the Guillemot family, the company’s founders, a plan that could further reshape the publisher’s structure. This strategic repositioning allows Ubisoft to adapt to market developments, where player expectations are rapidly evolving. The focus on the quality of single-player narrative experiences and the expansion of multiplayer modes reflects a desire to strengthen the appeal of its games in the face of increasingly fierce competition, particularly as other publishers have already embraced this model of live-service games. Tencent’s investment in this new Ubisoft subsidiary marks a key step in the French publisher’s restructuring. This partnership could provide Ubisoft with additional financial and technological resources to develop its flagship franchises while further expanding into the Chinese market. Tencent’s influence may also help Ubisoft navigate the complex regulatory environment in China, where gaming content is subject to strict censorship laws. Moreover, Tencent’s deep understanding of local market dynamics and its established relationships with regulators could open new opportunities for Ubisoft’s games in China, traditionally a challenging market for foreign publishers. While Tencent’s influence is sure to bring financial and technological benefits, there may be concerns about the extent to which the publisher will maintain its creative autonomy. As a company known for its strong narrative-driven titles, Ubisoft will need to carefully balance its creative vision with the demands of the evolving gaming landscape, which increasingly leans toward multiplayer-focused, monetization-heavy models. The direction of Ubisoft’s games in the coming years may reveal the true extent of this new strategic partnership and its impact on the company’s long-term identity. Have a nice day! Thomas Veillet Financial Columnist

Eager for Liberation

In the world of finance, we always struggle to view the global economic picture in a truly “holistic” way. We are much better at focusing on a few key points while neglecting most of the rest. Often, our attention is on employment, inflation, and economic growth. That has been our main concern for months. But right now, we have found a new obsession, a new battle horse that has managed to overshadow everything else. Yes, you guessed it—since the inauguration, Donald Trump’s new dance partner, TARIFFS, has taken center stage. And yesterday, it got even worse. Inflation Adjustment I’m going to ask you for something superhuman as an investor: try to remember the past five years. COVID, monetary injections, government support, then the onset of inflation. Inflation that was under control and temporary. Oh wait, no—not temporary and not under control at all. So, we need to raise interest rates—AND FAST—to slow it down. Eventually, it works, but employment and economic growth seem to start feeling the consequences. And then Trump gets elected. He arrives at the White House while our main concerns are the CPI—which refuses to drop—the PPI—which is doing the same—and the labor market, which has been struggling for months, with numbers constantly being revised downward, seemingly calculated with a children’s abacus at the Bureau of Labor Statistics. And let’s not forget the PCE, THE FED’S FAVORITE MEASURE FOR ASSESSING INFLATION. For nearly a year, we’ve been living week by week, moving forward step by step, from one economic figure that is supposed to change everything to another economic figure that is supposed to change things even more than the last one that was already supposed to change everything. And all this while waiting for the NEXT economic figure that will REALLY be the one to determine the fate of the U.S. economy. And, by extension, the rest of the world. Let’s be honest—you know I’m right. And then, during the U.S. elections, we asked ourselves about tariffs—tariffs that could increase overall prices and give inflation another boost. We wondered whether cutting taxes to stimulate the economy might also have an inflationary effect. And to each of these questions, the market and experts brushed them off, saying, “NO, NO, that shouldn’t have that much of an impact.” Yet, for the past two weeks, we’ve started to ADMIT that, yes, tariffs could end up having a real impact on inflation. Because, as crazy as it sounds, if a company faces higher raw material costs due to tariffs, it might pass those costs onto consumers. It could also reduce its margins and make less money to ease the burden on consumers. That’s a fact. But at the same time, that’s not exactly in their best interest—because, well, money. Disinterest All this to say that we’ve been living in an inflationary world for five years. And while rate hikes have helped slow inflation somewhat, real prices have increased by nearly 30% over that period. But not your salary. Not your income. Not your company’s performance—at least, not for most people. Inflation and our battle against it are truly important and should be our top concern. Just like today’s PCE report. See where I’m going with this? No? Well, then let me continue. This afternoon, the PCE report will be released, and under normal circumstances—I mean, REALLY NORMAL, with three extra “A’s” and four extra “L’s”—this number should be on everyone’s radar, especially in the wonderful world of finance. But apparently—if you read the media—no one gives a damn anymore, because EVERYONE, without exception, is obsessing only about the tariffs set to be announced on April 2, the so-called “Liberation Day.” You know, those RECIPROCITY TARIFFS meant to put every country on equal footing with America, which is about to become GREAT AGAIN. Curiously, that’s the only thing anyone cares about now. And yet, given Trump’s ability to change his mind, flip-flop, double down before flip-flopping again, and then change his mind once more, betting everything on April 2’s tariff announcements being final and non-negotiable seems completely utopian, wouldn’t you agree? In fact, more than just utopian—it would be stupid to believe this is where it ends. The Decision-Making Skills of a Rotten Mussel And yet, when you take the time to read and listen to what’s being said about the markets, no one talks about inflation anymore. No one talks about economic growth. No one even dares to mention the slowing job market. Of course not—because we’re too busy analyzing the potential impact of tariffs that might be announced on April 2, that might be final, but that might also be complete nonsense and change 212 times before they’re actually implemented. We all know this. You know it. The bankers know it. The politicians know it. Even Donald Trump knows it. And yet, despite all that, we’re obsessing over something that might happen—with consequences that are difficult to predict—while completely ignoring the numbers that have haunted our nights for the past five years. This morning, I read MarketWatch, Barron’s, Investing.com, Zonebourse. I spent time on Bloomberg, CNBC, even the Financial Times. I was all over X. And what is everyone talking about? Recalibrating Inflation I’m going to ask you for a superhuman effort as an investor: try to remember the last five years. COVID, monetary injections, government support, then the onset of inflation. An inflation that was under control and transitory. Oh no, wait—not transitory and not under control at all. So, we had to raise interest rates—AND FAST—to slow down this inflation. Eventually, it worked, but employment and growth started to feel the consequences. And then Trump got elected. He arrives at the White House while our main concerns are the CPI—which refuses to drop—the PPI—which does the same—and the labor market, which has been struggling for months, with figures constantly revised downward and seemingly calculated with a child’s abacus at the Bureau of Labor Statistics. And then there’s the PCE, which is THE FED’S FAVORITE MEASURE

Wall Street’s Show

Last Friday, the market was rising because we expected the “Customs Tariffs” to not be so bad. Last Monday, the market was rising because we expected the “Customs Tariffs” to not be so bad. This Tuesday again, the market was rising because we expected the “Customs Tariffs” to not be so bad. And yesterday, we took a monumental hit because Trump made an announcement about “Customs Tariffs” on cars. And at that moment, we realized that, in fact, YES, it could be much worse than we thought. But to be honest, we have no idea—uncertainty is back, and so is the MUPPET SHOW! I’m going to be super blunt with you: right now, I think we’re bordering on “COMPLETE NONSENSE” but in “Champions League” mode. We’re at a very, very high level, and to top it off, all the players are on the same team. Market participants have completely lost the concept of “taking a step back.” Yesterday, I attended a conference where we tried to explain to “young investors” that they should take a step back and “zoom out” from the momentary market fluctuations to avoid making rash decisions. And yet, yesterday, the markets did—once again—exactly what we keep trying to teach new investors not to do. Sure, the uncertainty we’re experiencing in the markets isn’t pleasant, especially since we feel like Trump is experimenting on us just to see how we’ll react! But sometimes, you really have to wonder if we could take just a little bit of perspective and think for more than 12 seconds. You see, it’s like a guy sitting in a huge armchair on top of a mountain overlooking the financial markets. Next to him, JD Vance sits on a stool, and Trump says to him: “You see, JD, let’s tell them we’re going to raise tariffs on Canadian imports just to see how those idiots react!” And then Trump raises tariffs on Canada, and the market plunges into panic mode. Within the next 24 hours, the kind President climbs back up the mountain, sits in his armchair with his obedient Vice President, and announces that, actually, he won’t REALLY enforce these tariffs, and the market rebounds. Ever since, the kind President has been having fun running experiments, testing how these fools in the financial markets will react. Given that it took them six weeks to admit that tariff implementations could impact inflation—of course, driving it UP—Trump figured there were still plenty of psychological tests he could use to toy with the wonderful world of finance. The Noise By now, you would think we might have learned something and started reacting differently. Maybe we would have stopped listening so closely to the ramblings of an American President whose main characteristic is his uncanny ability to change his mind faster and more effectively than the financial markets have for the past 25 years! But no, instead, like a herd of sheep, we eagerly listen to whatever nonsense Trump spouts so we can immediately run in the direction he points—only for him to change his mind three days later, saying, “Actually, the ‘Customs Tariffs’ won’t be so bad after all!” A statement based on ABSOLUTELY NOTHING, obviously. Over the past few days, the three consecutive days of market gains were driven primarily by the hope that Trump might, just maybe, be merciful—that he was our friend and that everything would turn out fine! BUT NO, NOT AT ALL! He is not our friend. Yesterday, he climbed back up his mountain and thought to himself: — “Hmm, let’s hit them with auto import tariffs. I’ll be super aggressive and spew absolute nonsense just to see how these idiots react!” And he wasn’t disappointed. The markets tanked because we realized that if he is capable of taxing imported cars at 25%, then he is capable of absolutely anything between now and the reciprocal tariff announcement on April 2. Since yesterday, the President has once again stoked the flames of uncertainty—uncertainty we had almost started to forget about. And let’s not even get into the content of his speech, because I sincerely believe an eight-year-old child could dismantle his argument. Unreal It’s early this morning, and this column isn’t meant to dive too deep into everything that was said on Wall Street last night. My job is to help you digest the monstrous mess that happened in the finance world—and, if possible, to make you laugh on your way to work. Otherwise, this column would last three hours, and you’d have to take detours just to get through it. That said, I do have to go back to Trump’s speech from last night. To put it simply, the guy announces that every car or car part imported into the U.S. will be taxed at 25%. Boom! Then, after making a gigantic middle finger gesture to foreign automakers, he turns to Americans and explains that this will be “great” because all the car factories that will open in the States to avoid tariffs will create jobs and ensure that everyone works in the automobile industry. Desire and Time OK. First of all, he didn’t ask people if they WANTED to work in the automobile industry. But more importantly, he seems to assume that Renault, Volkswagen, BMW, Mercedes, and all the rest will arrive in Detroit next week to build factories and hire millions of people. He hasn’t considered for ONE SECOND that moving part of their production to the U.S. takes time, and even if the decision was made yesterday, those factories wouldn’t be operational until AFTER Trump’s presidency ends. Not to mention that, knowing the intellectual volatility of the President, the first question an automaker will ask is: “How long is he actually going to stick to these tariffs, anyway?” Because Trump isn’t known for setting things in stone. He’s more about writing in sand with watercolors—one gust of wind or a bit of rain, and it’s back to square one. Yesterday, we realized that we had spent