When people hear about Trump’s tariffs, most think it’s a trade war meant to punish China, but who will get hurt the most? How might tariffs negatively impact the economy, companies, and people around the globe? Will the rich or the poor bear the brunt of this? To understand the real strategy behind Trump’s tariffs, we need to break it down.

Why Did Trump Impose Tariffs?

The Common Perception: Many view Trump’s tariffs as a response to China’s trade practices and intellectual property theft. On the surface, it seems like a direct conflict between the U.S. and China over unfair trade. However, there’s much more at play.

The Real Strategy: Trump’s tariffs were part of a larger strategy designed to address not just trade imbalances but also the corporate behavior that hurt U.S. workers and the economy. Here’s why:

Targeting Tax Loopholes: For decades, U.S. companies have used offshore tax havens to avoid paying taxes. By raising the cost of imports, Trump sought to encourage companies to stop outsourcing production and bring jobs back to the U.S. This wasn’t just about China — it was about rebalancing the global economic system.

Encouraging Manufacturing in the U.S.: By imposing tariffs on imports, particularly from China, Trump aimed to make it more expensive for companies to produce goods abroad. This would push companies to reconsider where they manufacture and, hopefully, bring jobs and production back to U.S. soil.

Pressuring Multinational Corporations: Trump’s tariffs were also designed to force multinational companies to face the reality of their offshore strategies. By changing the cost structure, these companies would be forced to play by U.S. rules, supporting local jobs and reinvesting in domestic infrastructure.

How Big U.S. Companies Avoided Taxes for Decades

The Loopholes That Helped Corporations Avoid Paying Taxes: For years, many of the largest U.S. corporations have exploited offshore tax havens in countries like Ireland, Luxembourg, and the Netherlands, where tax rates are much lower than in the U.S. The result? These companies avoided paying billions of dollars in taxes while making enormous profits.

The “Double Irish with a Dutch Sandwich”: A well-known strategy used by companies to avoid taxes was the “Double Irish with a Dutch Sandwich.” This tactic involved shifting profits to subsidiaries in low-tax countries, reducing their overall tax burden. This wasn’t a loophole — it was a system that allowed corporations to play the global tax game to their advantage.

The Numbers: In 2016, U.S. companies had more than $2.6 trillion in cash stored overseas, avoiding U.S. taxes. The question was: why should these companies continue to benefit from this tax avoidance while everyday Americans had to pick up the tab?

Trump’s Response: Through tariffs, tax reforms, and other policies, Trump sought to limit these practices and repatriate jobs and tax revenue back to the U.S. His approach wasn’t just about punishing China; it was about fixing the global economic imbalances that allowed these companies to profit without contributing their fair share.

Is Protectionism Really a Bad Thing?

What is Protectionism?

Protectionism is a government policy aimed at shielding local industries from foreign competition by imposing tariffs, taxes, or other trade restrictions. While some argue that it can benefit local economies, others believe it hinders global markets and raises consumer prices.

Criticism of Protectionism:

Critics argue that protectionism often results in higher prices for consumers, limits access to cheaper goods, and creates trade barriers that may disrupt international markets. However, is this the full picture?

The U.S. Experience with Protectionism:

Under President Trump’s administration, protectionist measures were designed to reduce the U.S.’s dependency on foreign manufacturing. His policies focused on bringing jobs back to the U.S. and ensuring that American companies were more competitive. The ultimate goal wasn’t just to target countries like China, but to rebuild a more self-sufficient and sustainable U.S. economy.

The Impact on European Industries:

Over the years, many European companies have moved production to countries with cheaper labor and operational costs. This trend has caused significant economic shifts, with job losses in industries across several European nations, example:

Germany:

Opel: Once a major name in German automotive manufacturing, Opel was sold to Peugeot (France), and the company is now undergoing restructuring.

Siemens: Parts of Siemens’ manufacturing operations have moved to more affordable locations in Asia.

Miele: Plans are in place to shift much of Miele’s production to Poland, leading to job cuts in Germany.

BASF: This chemical giant announced plans to downsize European operations due to high energy costs.

Schaeffler: The auto parts supplier will reduce its workforce by 4,700 jobs across Europe and close two German plants as part of cost-cutting measures.

France:

Alstom: In 2014, Alstom sold its energy division to General Electric, resulting in thousands of job losses.

Textile Industry: Many French textile companies have outsourced production to North Africa, where labor is cheaper.

Italy:

Fiat and Ferrari: These iconic brands have moved manufacturing to countries like Poland and Brazil to take advantage of lower labor costs.

Fabriano Paper Industry: Once a leader in paper production, Fabriano has faced economic decline as foreign-owned companies scale back operations.

Spain:

The textile and shoe industries in Spain have been outsourcing production to Asia and Latin America for decades in search of lower manufacturing costs.

United Kingdom:

Nestlé: The company announced the closure of its Fawdon factory, affecting nearly 600 jobs, as production moves to other European facilities.

SKF: This company plans to close its Luton plant and shift production to Poland to stay competitive.

British Steel: In 2018, British Steel announced 400 job cuts, largely due to raw material price fluctuations influenced by Brexit.

Greece:

The financial crisis led to the sale of national assets, contributing to the closure or relocation of major businesses, further adding to the country’s economic instability.

The Case for Protectionism:

Proponents of protectionism argue that such measures can help local industries by reducing foreign competition, leading to more jobs and economic growth. They believe protecting industries like steel, textiles, and automotive manufacturing from cheap overseas production can ensure the survival of key sectors in the domestic market. This could also help reduce trade imbalances and improve national security by making countries less reliant on external sources for vital products.

Why Doesn’t the Media Talk About This Side of the Story?

Because it’s complex, and it challenges a global economic model that has enriched multinational corporations and certain European governments. The media, often controlled by powerful interests, avoids discussing protectionism because it contradicts the free-market system that benefits these elites. By selectively framing issues, media outlets shape public opinion in ways that support the status quo. Highlighting the flaws of the global economy would require deeper analysis, which could challenge existing power structures. Fear-based narratives about instability or economic collapse prevent people from considering alternative models, ensuring compliance with the global trade framework that serves the interests of powerful corporations and governments.

What If We’re Being Fooled?

Rising Prices, Global Crises:

As prices continue to climb globally, it’s worth asking: Are the reasons we’ve been given really the cause of the rising cost of living? We’re told that wars and global supply chain issues are to blame, but what about the price hikes on local products like cocoa (Africa)— products with no connection to the Ukraine conflict?

George Carlin’s stand-up routine: ” It’s a big club, and you ain’t in it.”

A Bigger Agenda?

Could it be that these external events are being used as excuses to justify a systematic increase in living costs? While geopolitical events like the war in Ukraine certainly affect some prices, the reality is that the prices of everyday goods are still rising — even those that shouldn’t be impacted.

The Impact of AI and Automation:

At the same time, we’re witnessing an unprecedented rise in automation and AI technology. Robots are replacing humans in a growing number of sectors, from customer service to manufacturing to even creative industries. As machines take over tasks once performed by people, there’s a massive displacement of workers, and people are losing jobs in droves.

This doesn’t just impact the factory floors — AI is creeping into nearly every job sector, including those in the service industry, retail, and finance. As more jobs are replaced by AI and robots, the employment market shrinks, leading to higher unemployment rates and increased financial insecurity for millions of people.

Is There a Connection Between Rising Costs and Job Losses?

Could the growing cost of living and the rise in job displacement due to AI be connected? As more people lose their jobs, the economic pressure mounts, making it harder for individuals to afford basic goods and services. And while the rich continue to profit from automation and new technology, the average person faces a double blow: higher prices and fewer job opportunities.

What Will People Do?

With many workers being replaced by Ai , how will the population cope with rising costs and job losses in a world that’s increasingly dominated by technology? Is the real agenda behind the rise of automation to reduce labor and increase the costs of living?

President Donald Trump’s recent trade policies, including the imposition of substantial tariffs on imports from China, Canada, and Mexico, have significantly impacted global markets and economic forecasts.

On April 7, 2025, President Trump threatened to escalate tariffs on China, demanding a rollback of a 34% increase in Chinese tariffs or face an additional 50% U.S. tariff starting April 9, potentially bringing total U.S. tariffs on Chinese goods to 104%.

These actions have elicited strong responses from affected nations. China vowed to “fight to the end” through countermeasures to safeguard its sovereignty and economic interests, criticizing the U.S. move as unilateral and baseless.

The Organisation for Economic Co-operation and Development (OECD) has warned that these trade tensions are slowing global growth and fueling inflation. The OECD downgraded its growth forecasts for the U.S., Canada, and Mexico, citing the negative impacts of increased trade barriers and geopolitical uncertainty.

Financial institutions have also expressed concerns. Goldman Sachs raised the likelihood of a U.S. recession due to Trump’s new global tariffs, estimating that if sustained, the tariffs could increase U.S. core prices by 0.7% while GDP would be hit by 0.4%.

In summary, President Trump’s trade policies are reshaping global trade dynamics, introducing significant economic uncertainties, and eliciting strong reactions from international partners. The full economic impact will depend on the duration and escalation of these trade tensions.

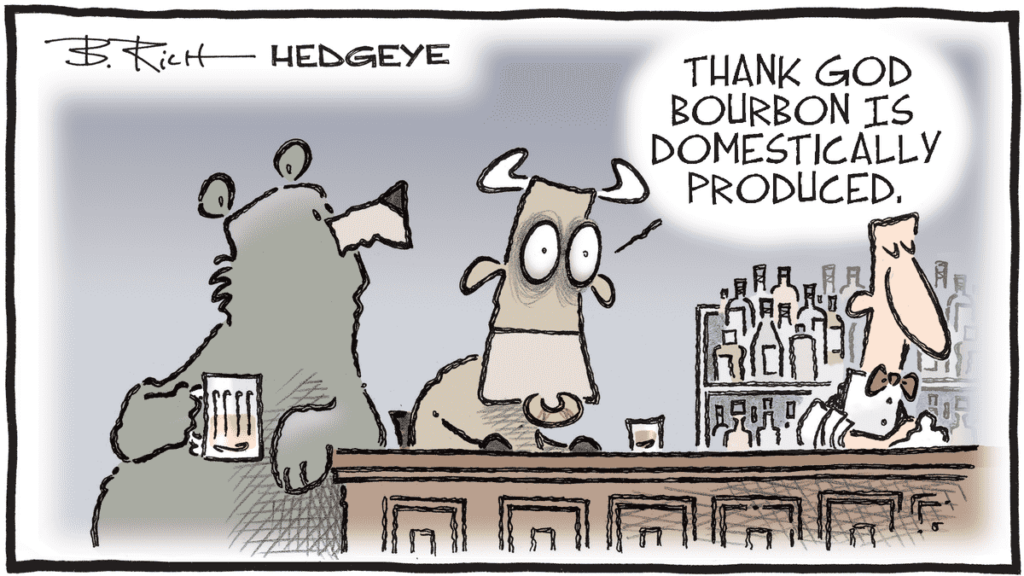

Market Turmoil and Investor Sentiment: The markets have been unpredictable, with significant volatility. The commentary compares the situation to a blender out of control, with investors torn between fear of losses and the terror of missing a market rebound. Despite recent instability, the S&P500 has been moving drastically, much more than in the past, showing how different the environment is compared to previous years.

U.S.-China Trade Relations: The ongoing trade conflict between the U.S. and China remains a central issue. Trump’s tariffs are a point of contention, with both countries needing each other but also unwilling to back down. Negotiations are expected, but the pride of both sides, particularly China’s, could complicate matters.

Europe’s Response to Tariffs: Other countries, including Switzerland, are also looking to negotiate with the U.S. over tariffs. Despite the global tension and dislike towards the U.S., countries are inclined to find solutions, largely due to economic reasons.

Oil Prices and Inflation: Despite the turbulence, the drop in oil prices, along with other factors like lower interest rates and food prices, is seen as potentially alleviating inflation concerns. Trump claims that these factors counter inflation and that the U.S. is benefiting from the tariffs, though his rhetoric often leans towards a victimization narrative.

Corporate Earnings Reports: The upcoming earnings season is expected to bring some surprises, especially since analysts have not significantly lowered their expectations for the first quarter. However, the real insight will come from earnings calls, where corporate leaders are likely to blame tariffs for their struggles, setting the stage for lower expectations in the coming months.

Global Market Movements: In Asia, markets are showing signs of recovery after recent setbacks. The Nikkei has regained some ground, and Chinese markets are moving in various directions, influenced by Trump’s trade stance. Despite the trade tensions, investors seem pleased that the U.S. and China are still engaging in communication, even if the nature of that communication is combative.

Economic and Market Outlook: While economic data today isn’t significant, Trump’s ongoing influence on trade policies and the financial landscape continues to shape market sentiment. The question on everyone’s mind is whether the recent market correction is over or if further volatility is ahead, with some investors still taking cautious bets, awaiting the next major move from Trump.

In short, the financial markets are in a period of significant uncertainty, with trade tariffs, global negotiations, and corporate earnings reports all playing key roles in shaping future movements. Investors are navigating a complex environment with high volatility, making it difficult to predict the market’s direction in the short term.