Last night, everyone was hanging on Jerome Powell’s every word. Well, “hanging”… so to speak. Because in reality, everyone had known for three days already that he wasn’t going to do anything, say anything, or especially change anything. But hey, we’re human—and not just any humans, humans who want to invest, get very rich, and never work again—so we always hope that this time, something decisive will happen. Something that will change everything forever and show us the way. Well. It’s not happening this time either. Still no rate cut, still no hike, just… more fog.

The Fed has kept rates unchanged for the third time in a row. Still between 4.25% and 4.5%, that same old monetary corridor in which Powell walks his colleagues—and us—around. A bit like a dog on a leash, not really knowing where we’re going. The real question is: does he know where he’s going? And after last night—if we still had any doubts—we’re pretty much sure that he doesn’t know any more than we do and that he’s waiting for a clear and definitive signal from the economy to move forward. Except the economy is currently taking hits without really knowing where it’s heading—or where it’s supposed to go.

So why didn’t Powell cut rates last night? One reason, always the same—except this time, it’s even bigger: uncertainty. Translation: we still haven’t figured out what Trump is doing with his tariffs, but we need to say it diplomatically, otherwise the gentleman might get angry. He’s not exactly thrilled with the job we’re doing, so it would be dumb to piss him off even more. In its statement, the Fed noted that “the risks of a return of inflation and a rebound in unemployment have increased.” We’d tend to call that potential stagflation. But they’re more diplomatic and call it “a slight deterioration of the economic outlook.” Clearly, they’ve mastered the art of understatement. Something I haven’t.

The geopolitical-economic stroke of genius

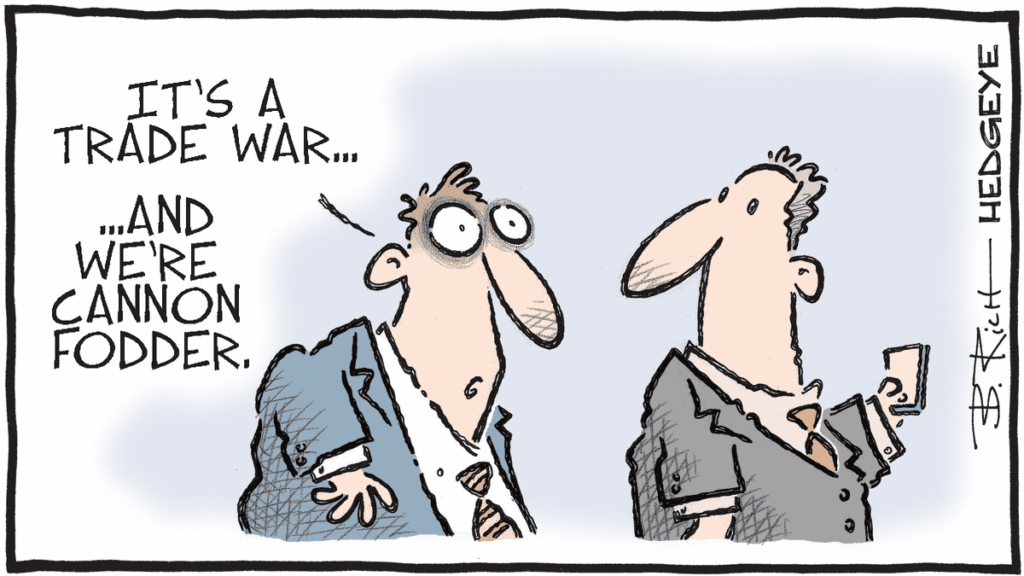

And here comes Donald Trump, the only man capable of tanking an economy by tweeting from anywhere in the world—and at any time. Powell more or less implied it. Still, we know that his new waves of tariffs—which remain as vague and uncertain as ever—are also potentially huge. Result: American companies went panic-buying on imports, which inflated the trade deficit by +14% — and tanked Q1 GDP. Well played. It’s not the only reason for the NON-CUT in rates, but it’s definitely a central one.

Meanwhile, what’s Powell doing? He’s “waiting to see.” Wait and see, 2025 edition. It’s not even flying blind anymore—it’s navigating by the stars. One could imagine Powell walking around with a sextant trying to figure out what to do with rates, but since we’re in the fog, it’s hard to see any stars.

A press conference full of conditionals

In his press conference, Powell said things. Lots of things. Too many things. But if we had to sum it all up, here’s the gist: he said “we don’t know. We’ll see. And most importantly, we don’t want to screw it up.” Okay, he clearly didn’t say it like that. At least not with those exact words—but that’s basically what it means. The guy’s in a tunnel with no light for miles and not a glimmer on either end. Honestly, even if he wanted to turn back, it’s not even certain he’d find the exit.

Basically, Trump’s tariffs could very well “delay the decrease in inflation by a year.” And so—mechanically—“delay the rate cuts by a year too.” But that’s not certain. But it’s possible. But we’ll see. But maybe not. Yes, I agree with you, that’s not the clearest press release ever, but it really shows that he has absolutely no idea what’s going on, yet still had to say something without looking completely lost.

He sounds like a teenager explaining to his parents why he didn’t do his homework—and that, in any case, it’s not his fault. Oh, and he also threw in a line that was clearly aimed at his parents—uh, I mean—clearly aimed at Trump, because he took the time to explain that the Fed cannot be preemptive. In other words: “we can’t act before it’s too late—can’t act in anticipation—because we have no idea what’s going on.” We have no idea where the economy is headed in general and inflation in particular. We can’t “make plans” because we don’t even know what kind of mess this economy is going to end up in with all this tariff chaos.

Powell vs. Trump: The Silent Duel

What was fascinating about last night’s statement is that Powell didn’t mention Trump once. He only referred to “uncertainty surrounding trade policy,” “tariffs,” and “unstable external conditions.” The President must have loved being considered an “unstable external condition.” Still, even though Powell never mentioned Trump by name, everyone understood the message loud and clear — saying nothing and naming no one is a powerful way to emphasize that the Fed remains independent and isn’t here to please the current hysterical President.

Trump has been hounding Powell for months to lower rates. He’s threatened (implicitly) to fire him. He calls him incompetent, a “loser,” a traitor to the nation. And Powell, stoic, replies:

“I don’t see any reason to request a meeting with a president. That’s not part of my job.”

Classy. Cold. Clinical. And probably boiling inside. Meanwhile, Trump is likely smashing Oval Office furniture in a fit of rage.

What now?

So, what should we take away from all this? Well, the Fed is still projecting two rate cuts this year, according to the dot plot. But that was before the return of tariffs. Before the exploding deficit. Before the economy started coughing. Before inflation pretended to slow down while secretly preparing a comeback — especially if iPhone prices double and Chinese-made Barbies are sold at Beluga caviar prices.

So let’s be clear: these two cuts are “highly conditional.” If Trump keeps shaking the economy like a snow globe, there’ll be zero cuts in 2025. One economist even said yesterday that if there’s any rate cut in 2025, it should be seen as a clear signal of economic distress — basically, if the Fed’s only option is to cut rates despite the risk of reigniting inflation like a cork launched from the bottom of a pool, then things are truly desperate.

Right now, everyone is watching economic data nervously — like the guy in the lookout post on the Titanic. He knew the ship was headed straight for the iceberg — but deep down, he still hoped for a miracle. We’re in the same boat: we can see that growth is slowing, unemployment is rising, and inflation is lingering. And if tariffs push it higher again… then we’re heading straight into “bad 1970s reboot” territory. Stagflation. Uncertainty. Monetary policy gridlock. Let’s not forget: back then, rates had to be raised to 15% to crush inflation once and for all.

I can easily imagine Powell stepping up to the podium in six months and announcing a 10% rate hike to start with. At that point, Trump would probably order the CIA to take him out.

Conclusion: Schrödinger’s Economy

The Fed is on pause. The economy is expanding — and contracting. Inflation is high — but maybe not that high. And rates might be coming down. Or not. The Fed’s monetary policy today is like Schrödinger’s cat: rates are simultaneously on hold, possibly declining, and totally stuck… until someone opens the box. Problem is, Powell lost the key.

And in the middle of it all, the Fed chair remains impassive and says:

“We’re in a good position to do nothing and wait and see.”

In summary: nothing is happening. But anything could happen. Welcome to 2025.

And what about the markets?

You could feel it in the markets: everyone was waiting on the Fed, hoping it would change everything — while knowing full well it wouldn’t. U.S. markets closed slightly higher, telling themselves that “for now, we’re okay.” To borrow the metaphor: it’s like someone falling from the 50th floor — the problem isn’t the fall itself; it’s the landing. As Jeremy Clarkson once said:

“Speed has never killed anyone. Suddenly becoming stationary, that’s what gets you.”

So in short: everything’s fine as long as it stays like this. The real trouble starts when we finally realize what’s happening — or what could happen. And so far, as I write this, Trump hasn’t yet responded to the Fed’s inaction. But he’s been very clear about the China tariffs: they’re not coming down until a deal is reached.

This morning, Asian markets are in the green, fueled by hope for tariff progress. And here’s a breaking news update:

The UK is reportedly about to sign a trade deal with the U.S.

And note: this would be the very first deal since Trump launched his “reciprocal” tariffs with a chainsaw on pretty much everyone. The New York Times broke the story, right after Trump teased a “big trade announcement” last night — without saying with whom, why, or whether it was a real deal or just a random idea he had after finishing a burger.

So far, silence from both the White House and 10 Downing Street. But on the UK side, they did release a very polite statement:

“Economic discussions between the U.S. and the UK are ongoing. The United States is an indispensable ally.”

Translation: we’d love to be pals, but we’re waiting to see whether he signs the deal with a pen… or a grenade. Stay tuned — but one thing is certain: futures are up nearly 1% as I write this, so clearly something’s brewing.

Have a great day, and we’ll see you tomorrow, same time, for more adventures. And I think I’m not wrong in saying we’ll probably be hearing from Trump — I’m almost starting to miss Biden sometimes…

See you tomorrow!