In the wonderful world of finance, there are generally two camps. Those who are super optimistic, convinced that nothing can go wrong, everything will be fine, and the market will go even higher — “Hey, I’ll take a bit more Nvidia, thanks.”

And then there are those who think it’s all going to end badly, that we’re all going to die in horrible pain, and that when the market drops, it won’t just dip — it will CRASH.

Basically, the BULLS and the BEARS.

As for me — for most of my life as a trader — I’ve been a BULL. Definitely a bull. More out of conviction than anything else.

But now… we’re reaching levels of “bullish attitude” that are starting to really scare me…

Not Quite in Full “We’re All Gonna Die” Mode – Yet

Now, let’s be clear: I’m not in full “we’re all gonna die” mode just yet.

But I have to admit that—at times—I’m really struggling to believe that everything is just fine and that the months ahead will be nothing but joy, happiness, champagne, and caviar by the ladleful.

And yet… that’s exactly the direction we seem to be heading.

And not just based on hope for the future. No.

Because I can totally understand that some of us are willing to bet that certain businesses are going to grow so enormously that it actually starts to make sense to sell grandma just to buy shares in Quantum Computing.

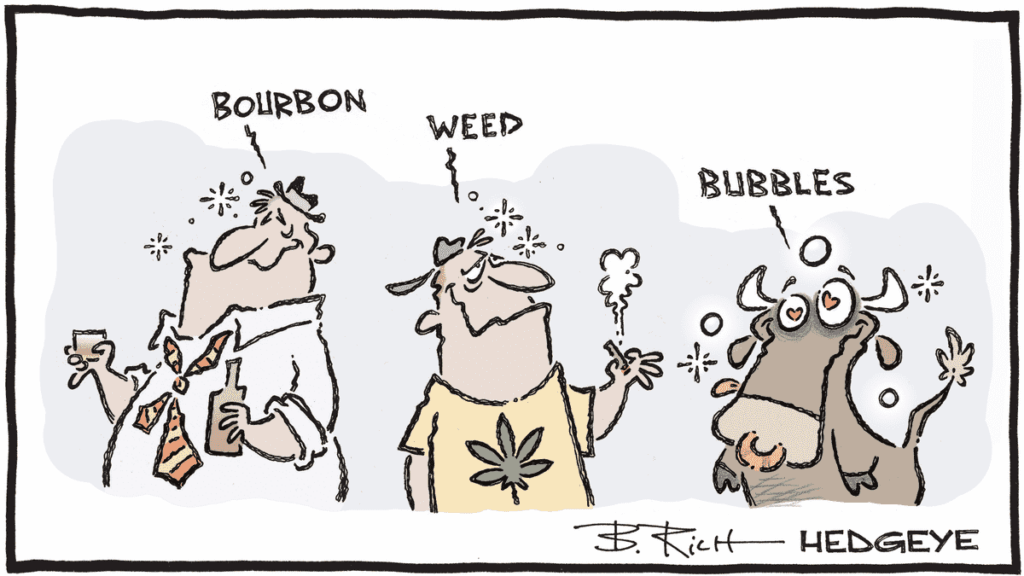

But where I start having a hard time accepting this kind of resilience—this kind of hyper-optimism—is when it reaches the point where we’re building ourselves blinders more rigid and enormous than those worn by the horses pulling carriages in Central Park.

An optimism so massive that it leaves us incapable of fear, incapable of believing—or even imagining—that EVERYTHING THAT’S HAPPENING could actually end badly.

Now, if I’m telling you all this, it’s to draw a parallel with what happened yesterday.

And also with what’s been going on for the past two weeks.

I don’t know about you, but when I start putting all this together:

– bond market concerns after both the Japanese bond auction and the US 20-year Treasury auction,

– the US credit rating downgrade from Moody’s,

– Trump’s extreme volatility as he hands out tariffs almost as casually as communion wafers at Sunday Mass (not that I even know what that is),

– Trump again, changing his mind like he changes shirts—roughly every 24 hours,

– the US deficit skyrocketing by the minute,

– US judges blocking Trump from using tariffs as a weapon, the White House’s appeals, the risk that it’ll all land in the Supreme Court,

– Ukrainians striking at the heart of Russia,

– NATO piling on by saying Ukraine will join the alliance,

– and finally, rising tensions between China and the US—not just economically, but militarily…

Well, when I see all that, honestly, I just feel like curling up on the floor in a fetal position and waiting for the storm to pass, rather than rushing off to borrow money from the Russian mob so I can invest in US stocks under the basic assumption that EVERYTHING’S GONNA BE FINE and that AI is just SO awesome, dammit!

And Yet…

Yet, that’s exactly what the market is doing. What investors are doing: NO FEAR.

Or rather: COULDN’T CARE LESS.

Honestly, I’m starting to question everything.

Just yesterday morning, we started the week and the month with Trump basically insulting the Chinese—and the Chinese firing right back.

And still, I struggle to tell myself: “Oh hey, the market looks like a good buy, doesn’t seem too expensive. Great opportunity, especially since they’ll probably cut rates soon to keep the US out of recession.”

And yet… that’s exactly what happened.

Fear is gone.

Since the obscene market slap of April 2nd—the day everyone wanted to liquidate their pension funds and go raise goats in the French countryside (preferably far away from Trump)—since then, people just don’t dare not buy.

Rallies feed more rallies, and even the worst news—or better yet, an avalanche of bad news—somehow always leads to a market rebound.

As if it costs nothing.

As if there were no real problems.

As if whatever issues we’re facing will obviously be resolved soon.

I’m starting to feel like everyone has bought into this new TACO trade strategy as if it’s gospel truth.

Things Look Good… But Still

Sure, we’ve understood how this market works.

We all know Trump loves pushing his opponents to the brink, only to pull a 180 and become the “nice guy President” who’d love nothing more than to have lunch with Madame Ursula von der Pfizer.

Everyone assumes that within 24–48 hours, he’ll announce he spoke with Xi Jinping and they’re now Best Friends Forever—and that everything will be just fine.

That’s clearly what Wall Street is betting on.

Trump’s team is already flooding the media saying he’s doing everything he can to talk to Xi Jinping.

So obviously, IT CAN ONLY END WELL.

Let’s say it does end well.

Let’s say that by July 9th, all of Europe caves to the tariffs.

Let’s say Trump plays golf with Xi every other week, and everyone laughs it off for the next 27 years.

Fine.

BUT—what if, hypothetically, the implementation of those tariffs still sparks some inflation?

What if job creation starts melting away like snow in the sun?

What if consumer prices rise again?

What if the Fed can’t lower rates—or worse, is forced to hike them again?

What happens if the tariffs don’t generate enough revenue, and the deficit grows even further?

What if bond yields head toward 6%, and old low-yield bonds start hurting bank balance sheets so badly that we see the first writedowns by fall?

Look at Japan: 30-year government bonds have lost 45% of their value since 2019.

Not 4.5%. FORTY-FIVE.

That’s not a drawdown—it’s a massacre.

And that’s simply because yields on those 30-year bonds have jumped by +275 basis points (+2.75%).

Result? Prices collapsed. Naturally.

And we’re nearly at all-time highs since their issuance back in 2007.

In just the last 12 months, yields have jumped a full 1%.

I’ll let you imagine the carnage for anyone holding those bonds in their portfolio…

Japan’s four biggest life insurers are now discovering the joys of massive unrealized losses.

Those losses have quadrupled in one year, hitting a record $60 billion in Q1 2025.

Yes, 60 billion.

And it’s not on crypto—it’s on Japanese government bonds.

The ones that were supposed to be “ultra-safe.”

But when rates go up, low-yield bonds crash.

And in Japan, they’ve been living in a zero-rate world for 30 years.

It’s teetering, losing balance

The Japanese bond market is starting to wobble.

And given Japan’s weight in the global financial system, if this unravels, it could very well shake other corners of the world. Especially those stuffed with long-term debt.

• Japan bet on zero interest rates for way too long.

• Now that rates are rising, the bill is coming due.

• And it’s not a tab, it’s a tsunami.

And the reason I’m telling you this is also to point out that the same kind of issue could be heading toward the U.S. as well — maybe not as quickly or with the same magnitude, but there are definitely a couple of skeletons that are starting to stink. So sure, all it would take is for rates to drop. Massively. Powell just has to save the world. But at the same time — can he? How much will rate cuts cost on the CPI or the PCE? What would happen if he cuts too fast? Well, between you and me, we won’t dig into that today, but I just wanted to highlight how phenomenal it is that U.S. markets don’t want to go down anymore — even though there are plenty of reasons to be scared, without even looking too hard — and I’m not convinced that, on paper, given the fundamental reality of the markets and the broader economy, the TACO Trade strategy is going to solve all the issues we’re facing.

And let’s not forget, the term “Taco Trade” wasn’t invented by Trump or for Trump. The President didn’t appreciate the reference at all — or the accusation that he chickens out every time. Just imagine for a second if next time — say, with China — he decides not to cave. Are you really sure that they, the Chinese, are going to drop to their knees and beg Trump for a favor? I don’t know, but I wouldn’t bet on it. Anyway, yesterday, European markets dipped slightly “due to concerns over tariffs and tensions with China.” At the same time, if those fears only led to a 0.19% drop in Paris and 0.28% in Frankfurt, then we’re not that scared, are we? Meanwhile, the U.S. stayed in the green, banking on the idea that “it’s all going to be fine” and that “Trump will chicken out” — and then we’ll head even higher. Let’s hope that works out.

In Asia and beyond

Asian markets started the day in “I’m going but I’m scared” mode. Yes, the indexes are rising — especially tech stocks — with Hong Kong up +1.1%, the Nikkei +0.2% — following Wall Street’s unexpected rebound and the U.S. market’s impressive resilience, which gives the impression they’re as strong as the entire Avengers cast. But the mood is far from euphoric, because the sword of Damocles is still called “Trump and his tariffs.” Local tech stocks are breathing easier thanks to a slight easing of U.S. yields — although that’s saying a lot when the yield is still over 4.42% — and semiconductors are still riding the AI wave: TSMC is up 1%, despite its CEO admitting tariffs will have an impact… But “luckily,” AI is saving the day with its vertical growth and knocking down the customs officers.

As for Chinese car stocks, BYD bounced back 2% after six days of beatings, thanks to strong foreign sales. China resumed trading after a long weekend, but with no real excitement. The CSI 300 and Shanghai Composite are stagnating, weighed down by escalating trade tensions. Also worth noting: the Caixin Chinese manufacturing PMI dropped to 48.3, its lowest since September 2022. Export orders are plunging, hit by U.S. tariffs. Domestic demand is faltering, employment is retreating, and inventories are piling up. Meanwhile, the official index confirmed the second straight month of contraction. In short, the world’s factory is coughing — and it’s more than just a little cold.

On the commodities side, oil is at $62.82. Gold is at $3,385 and Bitcoin is at $105,300. The 10-year yield sits at 4.432%.

Among the things to keep an eye on — even if it’s not the market’s main concern — Moderna just got FDA approval for a new COVID vaccine for high-risk groups. Yeah, I know, it’s a bit outdated, but apparently there’s a new super-variant coming this summer, so you never know…

Still in medicine: BioNTech hit the jackpot with a $1.5 billion cash deal from Bristol Myers for a cancer treatment, with potential to reach $7.6 billion depending on future progress. Also in biotech, Sanofi whipped out the checkbook to acquire Blueprint Medicines for $9.5 billion — a specialist in immunology.

Then there’s Boeing — which is becoming Wall Street’s new darling. Bank of America upgraded the stock and now sees it at $260. The aircraft maker is also becoming a tool in Trump’s trade negotiation playbook. Suddenly, everyone loves Boeing. No one would’ve bet on that six months ago.

And in the gambling world, Illinois just slapped a tax on sports betting. That hit the bookmakers and DraftKings hard.

To wrap up

Yesterday’s star was Applied Digital, which soared +52% after announcing two massive 15-year contracts with CoreWeave, a cloud specialist turbocharged by AI. The plan is to host 250 MW of AI infrastructure in their data centers in Ellendale, North Dakota. Expected revenue over 15 years: $7 billion. The first center (100 MW) will be ready end of 2025, the second (150 MW) by mid-2026, and a third one is already in the pipeline for 2027. AI continues to make the servers sweat… On April 21, Applied Digital was trading at $3.30. Yesterday’s close? $10.14.

We’re jumping from topic to topic, and now we move on to today’s data: Swiss and European CPIs. Yesterday we also learned that Swiss GDP grew 0.8% in Q1, after a 0.6% rise the previous quarter and an early estimate of 0.7%, thanks to above-average growth in the chemical and pharmaceutical industries. In addition to the CPIs, tonight we’ll get the JOLTS in the U.S., marking the start of jobs data season. For the stat lovers out there, we’re expecting 7.1 million job openings. Right now, futures are down 0.3% — as if the market is regretting yesterday’s close.

That’s it for today.

Between weightless markets, investors in “whatever” mode, and political volatility, we’re moving forward in an atmosphere as stable as a game of pick-up sticks in a hurricane.

Have a great day — don’t go selling your grandma just to buy into AI — and see you tomorrow, same time, same sarcasm.