I’ve told you before and I’ll say it again: I’ve decided to be permanently optimistic and to reflect the joy of living at every moment. I promised you I would only see the glass as half full — and that half-full glass, I’ll now only see it filled with champagne or, at the very least, with fine Bordeaux or perhaps a Meursault. In any case, I will no longer speak of what’s not going well or about figures that might possibly, maybe, suggest we’re in a zone where one might be tempted to say it’s “the calm before the storm”… But then again, I’m not the one in charge of the macroeconomic calendar, and when you look at yesterday’s numbers, it’s still not going to be easy…

It’s not my fault!!!

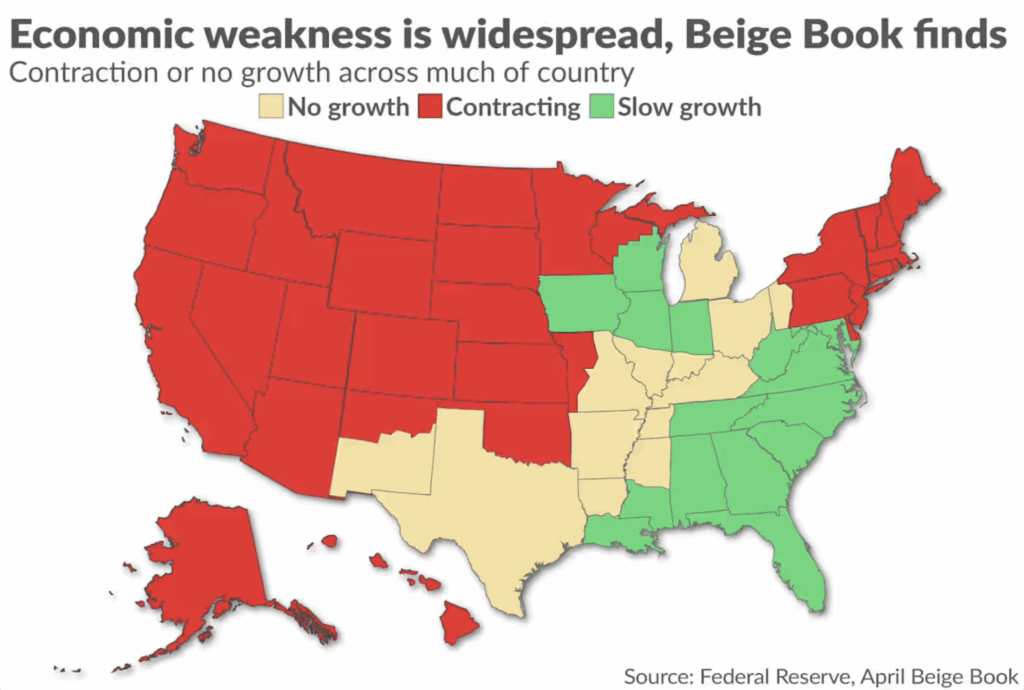

Yes, staying optimistic isn’t going to be easy, but it’s not my fault. I wasn’t the one who published such a crappy Beige Book showing that things are slowing down pretty much everywhere. If you look at the economic weather map, you’ll see that going from west to east across the United States, we go from economic contraction in Los Angeles to Kansas City, then from Texas to Tennessee there’s zero growth, and the rest — in the East — is experiencing “soft growth.” Honestly, when you look at that map the Fed published yesterday, it doesn’t exactly inspire confidence that everything’s going just fine. And repatriating 3 factories and creating 500 jobs isn’t going to fix things. We’ll need more than that. Maybe by cutting rates very, very quickly — but once again — Powell won’t do anything unless he’s absolutely sure inflation is under control. And as long as we don’t know what kind of tariff storm is coming our way, it’s hard to see how any of this could work.

Yet, despite the doubts that yesterday’s economic data so clearly justified, the markets didn’t crack and are still rising. Or at least… not falling.

So, should we say this is the calm before the slap in the face? Hard to tell — especially for someone like me who’s self-labeled “bullish forever.” Some will say we’re already knee-deep in economic crap, but everyone’s just looking the other way and thinking: “No worries, it’s just a temporary dip…” The U.S. economy in May is a bit like this: the engine is sputtering, the driver’s pretending not to notice, and everyone’s just hoping the downhill slope will get the car going again. But when the tank is empty, it’s empty. Your gas tank isn’t going to refill itself by the grace of the Holy Spirit or Saint Mar-a-Lago. And now, we’re clearly seeing more and more signs that we’re running on fumes. I shouldn’t even be saying this (since I’m supposed to be FOREVER OPTIMISTIC), but what we saw yesterday doesn’t make you want to pop the champagne and smear caviar on your salmon toasts. Unless it’s to forget.

Beige isn’t so beige anymore

The Fed’s Beige Book — that compilation of economic surveys — made the color crystal clear: 9 out of 12 U.S. districts are in “soft growth” mode, or have no growth at all. Consumers are spending less, businesses are slowing down hiring, home prices are stagnating, construction is losing steam, and wages are starting to slam the brakes. The mood is gloomy — and definitely not rosy — with a scent of “I’m not panicking, but I’m softly considering it.”

This slowdown isn’t just economic, it’s psychological. The uncertainty around tariffs, political back-and-forth, and unclear prospects are making everyone cautious. It’s like an empty nightclub at 1 a.m.: the lights are on, the music is playing, but no one dares step onto the dance floor.

The markets are still keeping up appearances, but the economic reality — whether we like it or not — is catching up with us.

And I swear, for an unwavering OPTIMIST like me, it hurts to say it.

And it’s not the ADP numbers that are going to cheer us up.

Yes, I know — it’s not the number that will change the world, and everyone’s eyes are already locked on its cousin, the Non-Farm Payrolls, but still. Yesterday, we were told only 37,000 private jobs were created in May, when we were expecting three times as many. That’s the weakest reading in two years. Now, when I say “weakest in two years,” I’m not talking about economists missing the forecast — that’s routine. I’m saying it’s genuinely low. It hasn’t been this bad in two years.

For economists, it’s a bad omen for tomorrow’s NFPs. Whispers are suggesting 125,000 jobs at best — well below the 153,000 needed to keep unemployment at 4.2%. And let me say it straight — we’ll talk again on Monday — but if the NFPs come in above 150,000, it will be official confirmation that the data is rigged and these numbers are just shiny lies sold at a premium by the BLS. Look at the Beige Book, look at the ADP numbers. Read everything about how companies are hesitating to hire with all the uncertainty around tariffs and the economic slowdown. I CAN’T BELIEVE THE NFPs WILL BE GREAT TOMORROW! (Even though I am resolutely optimistic and bullish on the markets until the end of time, amen.)

Wall Street: Collective denial or full-on delusion?

Meanwhile, Wall Street is partying like nothing’s wrong. The S&P 500 is flirting with record highs — okay, it’s not FULL-ON EUPHORIA, but it’s creeping up, and tech stocks haven’t looked this good in weeks. Still, we’re seeing a subtle shift toward defensive names. It’s like investors are dancing on the Titanic but slowly edging toward the lifeboats, “just in case.”

All in all, it’s holding up pretty well and “looks solid enough.” As if, right now, it’s more dangerous and painful to miss the rally than to get caught in the thresher when the drop finally comes. I might even believe that — if I were even slightly pessimistic. But thank God I’m not.

Yesterday, global markets ended higher. And if you look at the various explanations for that session, the rally was “supported” by — I quote — “hopes of a Fed rate cut later this year” to help the U.S. economy. All because economic numbers were weaker than expected in the U.S.

DO YOU SEE THE PSYCHOLOGICAL BIAS WE’RE STUCK IN???

It’s so obvious. Look at this: The numbers are crap, they clearly show that things will be ugly tomorrow and that the economic weather is turning stormy. And what do we do??? WE BUY THE MARKET because we figure the Fed will have no choice but to cut rates! Seriously?

At the close in New York, the S&P 500 inched up 0.15%, the Nasdaq 0.24%, and the Dow was basically flat. In Europe, Paris ended up 0.53%, Frankfurt gained 0.77%, London rose 0.16%. In Zurich, the SMI gained 0.48%.

All that because the economic numbers were crap — and we tell ourselves that if things are crap, then the Fed (who is always our best buddy and has pulled us out of the muck every single time we dove headfirst into it like a golden retriever charging into a muddy puddle) — this Fed will surely roll out the big guns to save our behinds.

No, honestly, when I see this I think: If the market were a person, it would need therapy. And if — by some miracle — it’s already in therapy: get a new therapist, buddy, yours is an idiot. Or blind. Or both.

The reality catching up

BUT HERE COMES the reality check: a weak jobs report tomorrow could crash the party — and not lightly. Because consumer spending is still the backbone of the U.S. economy, and if that cracks, the whole house of cards is in danger. And beyond the numbers, we’ve also got someone who couldn’t resist fanning the flames again.

Yes, you guessed it: Donald Trump is back on Powell’s case — of course! After the ADP report, he resumed his crusade against the Fed chair, saying: “Hey, Too Late! Cut the rates!” — yep, he actually calls him “Too Late” now. Doesn’t even use his name anymore — no first name, no title, just “Too Late.” The former President insists: he wants to restart the economy with slashed rates, as if the Fed were a growth ATM and job-creation machine.

But the Fed is still in its usual foggy haze. Yes, inflation is slowing — but not enough to trigger an immediate pivot. The next big date is June 18, with potential updates to growth and rate forecasts. And until then, it’s incredibly unlikely that Jerome Powell will pop up at the White House press room saying, “Hi everyone, I’m here to cut rates.”

Especially — again — because we still don’t know what’s going on with tariffs. Worse: according to a study from the University of Chicago and the New York Fed, the first wave of tariffs Trump put in place cost around $831 per household per year. If a generalized 10% tariff hits all imports, we’re talking an extra hit of $500 to $800 per household annually.

Never forget: every tariff is a hidden tax on your grocery basket.

So put yourself in Powell’s shoes: he can’t cut rates until he has a clear view of inflation six months down the line — and he can’t have that view if tariff policy is still up in the air. The moratoriums expire July 9 for “the rest of the world” and mid-August for China.

So don’t expect any decisions before that. Unless, of course, someone fires Powell and replaces him with someone more obedient.

But Trump would never do that.

…Unless???

So now what? What are we going to do?

So yeah, I’m still resolutely optimistic, but I also have to be realistic. Yesterday’s numbers were absolute crap, clearly suggesting that the U.S. economy is sinking into the sand—and stomping the accelerator like a maniac with all four wheels isn’t going to get us out of it.

That said, to feel like a proper finance superstar, we can at least try to sketch out three possible scenarios.

OPTION 1: The optimistic scenario:

Tomorrow’s numbers aren’t as bad as expected, Powell keeps calm, Wall Street breathes and keeps riding its bullish high. Summer is saved.

OPTION 2: The middle-ground scenario:

The numbers disappoint, the Fed remains cautious, markets take a hit, but no panic. We wait for a potential pivot in September.

OPTION 3: The all-out crappy scenario:

The numbers are a disaster, rates don’t move, and we realize we’re sliding into a soft recession disguised as a “controlled slowdown.” Then all we can do is hope for a miracle on the tariffs front so Powell can act. But you can feel the wall rushing toward us at full speed.

Bottom line: it’s not that easy to stay optimistic, bullish, and full of zest for life right now.

The rest of what you need to know

Elsewhere, Asia’s still trying to pick a direction, Wall Street is sending out weak signals, and Trump is on everyone’s mind. Hong Kong is keeping things afloat thanks to the tech sector, while Japan is freaking out over stagnant wages. Markets are dreaming of fresh stimulus from China and a miracle phone call between Xi and Trump. Meanwhile, South Korea is booming thanks to its new president, who’s finally brought some calm after months of political chaos.

Oil is at $62.61, gold is at $3,393, Bitcoin is at $105,000, and the 10-year yield continues to fall to 4.37%, sparing us another problem—for now.

Headlines to note

Aside from tomorrow’s all-important jobs report, we’ll also hear who the new entrants to the S&P 500 will be. Robinhood, AppLovin, Cheniere, and Interactive Brokers could finally get a seat at the grown-ups’ table. With valuations between $54B and $135B, they check all the boxes. There’s also MicroStrategy potentially crashing the party—but considering their entire business model is just:

Buy Bitcoin → Borrow money → Buy more Bitcoin → Borrow more → Repeat

—you’ve got to wonder if the folks at S&P will take that seriously.

Likely S&P 500 exits? Possibly:

Caesars Entertainment – the fallen king of casinos

Enphase Energy – once a darling of the energy transition, now wrecked by rising rates

Mohawk Industries – flooring specialists

Invesco – totally overshadowed by giants like BlackRock and Vanguard

APA Corp (formerly Apache) – just too small to keep up with the big boys

Numbers for the day

As for today’s expectations, the ECB is about to pull the trigger on its 8th rate cut, because global trade is starting to look more like a minefield. Who do we thank? Uncle Donald, of course. On Thursday, we’re expecting a -0.25% cut, bringing the deposit rate to exactly 2%. And since that won’t be enough, expect another cut in September—right after the U.S. trade talks produce either a disaster or a miracle.

In short: inflation’s slowing, growth is coughing, and the ECB’s pulling out the band-aids while Trump runs around with a flamethrower.

And in the U.S., we’ll also get the Jobless Claims report today—because clearly, we didn’t have enough employment data already before tomorrow’s big event. Oh, and don’t forget: tonight after market close, Broadcom reports earnings. And considering the stock is up 88% since April 8th, they’d better not disappoint or come in with weak guidance.

For now, futures are slightly down, and we’re just waiting for the next bad news… so we can feel justified in pushing markets even higher because “rates will come down.”

Have a great day—and we’ll see each other tomorrow to close out the week and check on how our therapy is going.

See you tomorrow!