Alright, it’s done. This whole pricing story is falling by the wayside and we’re busy building a conviction that everything’s going to be fine. What am I saying? EVERYTHING IS GOING TO BE JUST FINE.

For now, tensions between China and the US are tight as a thong, but the CONVICTION is strong and deep — Trump and Xi will talk. And not only will they talk, but ON TOP OF THAT, it’s going to go well.

Then, jobs are looking cheerful after the JOLTS, and Friday’s probably going to be cheerful too. And on top of all that, with inflation going down, who knows — maybe Powell will cut rates in 10 days.

I used to be cautious. Now? I don’t care anymore.

Wildly Optimistic

Over the past few days, I’ve been bombarded with comments saying I’m too negative, too cautious, and only ever talk about things that aren’t positive. So that’s it — I’ve made a decision: no more seeing the glass half empty. I’m switching to half-full mode. After all, it’s pretty clear now that markets don’t give a damn about bad news. The only thing they care about is what’s going well — or, even better: WHAT’S GOING TO GO WELL SOON.

Yes, because right now, optimism is practically mandatory. If you’re not optimistic, you’re out. So let’s stop flirting with the dark side of the Force and instead focus on the thrilling, exciting currents of the BULL MARKET forever.

And the timing couldn’t be better! Yesterday, the Nasdaq turned positive for the year, the S&P 500 is up 1.5% since January 1st, and the rest of the world has been on fire for ages — don’t even get me started on the DAX — it’s total euphoria! EVERYTHING IS FINE. Full employment, inflation under control. After flirting with 2% on last Friday’s PCE, it even dropped below 2% in Europe yesterday. And in Switzerland? Even better: for the first time since spring 2021, the Federal Statistical Office observed a year-on-year decline in consumer prices. Apparently, unlike April, rising rents weren’t enough to offset falling energy prices.

At this rate, it’s becoming so cheap to fill up your tank in Switzerland that I honestly don’t see the point of buying an electric car anymore. In fact, I’m trading in my V6 for a V8 — one that guzzles fuel like there’s no tomorrow! We have to support the oil industry, after all.

What a Wonderful World

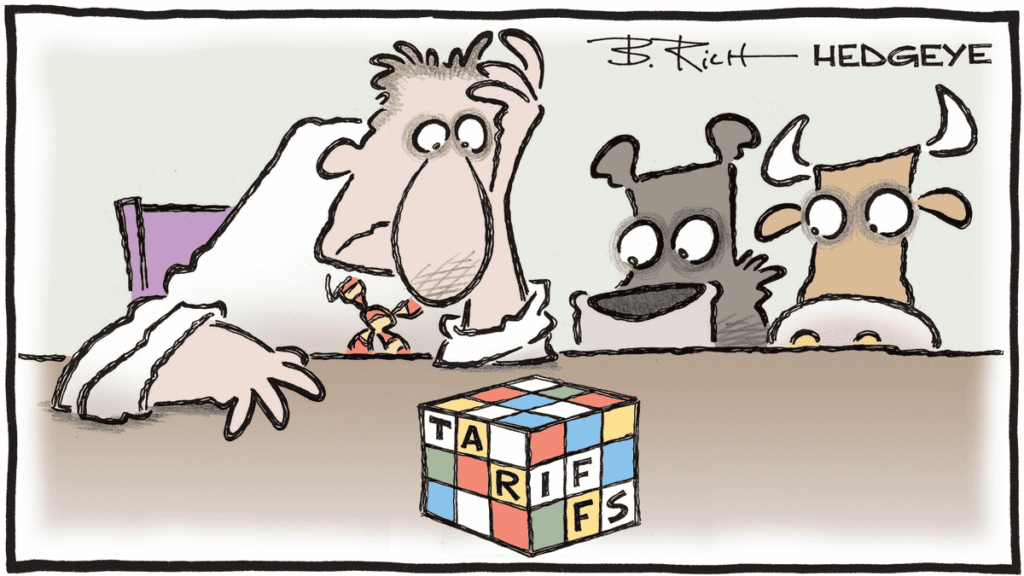

No, seriously — we are living in a glorious, mythical era. Nothing can stop us. We’ve even managed to forget about tariffs. Nobody cares anymore — it’s practically ancient history. Even if nothing has been signed yet, you’d have to be a complete idiot to believe that agreements won’t eventually be reached.

Take China, for instance. Dialogue’s broken down, both countries think the other is a traitor, and each accuses the other of trampling all over the Geneva Agreement — which, by the way, totally justified the marathon-day traffic jams in town, just so they could sit on the deal three days later. But I digress.

The key takeaway? Right here, right now, they politely hate each other — but EVERYONE IS CONVINCED that the two world leaders will talk before the week is out, fix everything, and come out of it besties, licking each other’s feet so enthusiastically that it’ll be borderline awkward.

Conviction is running so high that we’ve basically erased the entire “tariff era,” which now feels like a mere intermission in the world of finance. On April 4, 2025 — 61 days ago today — the media were practically screaming in panic. Back then, people were seriously wondering: SHOULD WE LIQUIDATE OUR PENSION FUNDS AND GO ALL CASH?

Because Trump was nuts. And that was the polite version of “nuts.”

But today? Nobody gives a damn. Trump hasn’t quite reached “intergalactic genius” status just yet, but if he strikes a deal with Xi Jinping by the end of June and manages to pressure Powell into cutting rates (without breaking his knees or kidnapping his family — just to be clear), I’d say there’s a decent chance the Vatican will revise its iconography and start replacing saint portraits with paintings of Trump.

Permanent Joy Explosion

So yeah, with the whole tariff thing practically behind us (because we all know our brilliant politicians will figure something out — they’re all just brothers from another mother, full of love and good vibes), it’s smooth sailing ahead.

Macron even managed to become BEST FRIENDS FOREVER with Meloni again over a lunch at the Élysée — even though, just a week ago, the Italian Prime Minister couldn’t get within three meters of Macron without reaching for anti-nausea meds. Amazing what a few wine glasses and a shared charcuterie plate can do.

If the world of finance is resilient like a Terminator built from Wolverine’s adamantium, then the political world is clearly operating on a whole other level. So yeah, they’ll find a solution. It’ll look heroic. And we, the humble consumers, will just pay a bit more for everything — no big deal. America will be Great Again, and the Nasdaq will hit new all-time highs.

After all, what more could the people want, if not bread and circuses?

But I digress again. What matters is that yesterday, we mentally filed the whole “tariffs” issue away in our ventromedial prefrontal cortex — and from there, straight into the hippocampus, next to the part that manages goldfish memory.

This freed us up to focus on the JOLTS data: 7,391,000 job openings, compared to the 7,110,000 expected. That’s nearly 300,000 EXTRA JOBS! Madness. There were 5.573 million hires that month — up by 169,000 — and 1.786 million layoffs, up 196,000, the biggest jump in nine months.

But here’s the thing: the market only cared about ONE DETAIL: THERE ARE MORE JOB OPENINGS than last month. That’s it. Done.

Now you might say, “Sure, but that doesn’t mean companies will actually hire those people, or that they’ll all rush to GM and Apple to buy a pickup truck and an iPhone (or maybe a pickup and an iPhone).” And you’d be right.

But given the current mood, I’d look at you with disdain and say: “Such negativity in a world where everything is designed to make us happy and encourage us to consume like crazy (well, as long as they keep giving us credit).”

Actually, I came across a statement by an analyst — whom I won’t name, to spare them the wrath of their adoring fans — and it was so poetic:

“It’s a good signal for the market. The U.S. economy is doing well, and this report gives no reason for indices to slide in either direction. Fundamentally, the U.S. economy is strong, despite Trump’s anxiety-inducing statements, which continue to blow hot and cold across the markets. We’re just waiting for a clear roadmap regarding U.S. trade policy.”

Ode to Joy

See? Can you feel the optimism in those words? Everything’s fine in the wonderful world of finance. Yesterday, the U.S. closed higher. Europe closed higher. Oil hit $63.12 and was still rising. Gold is near its peak. Bitcoin is at $106,000, patiently waiting for the next stop: $125,000.

And then there was Nvidia.

Yes, because yesterday, Nvidia surged past everyone — even Microsoft — to reclaim its spot as the most valuable company in the woooorld. Tuesday’s closing valuation: $3.45 trillion. Just ahead of Microsoft’s $3.44 trillion. Meanwhile, Apple’s limping along at a measly $3 trillion, weighed down by fears of a trade war with China. And Trump.

Which, honestly, is pretty dumb. If we follow the current logic — that everyone will find a deal eventually — you should be buying Apple like there’s no tomorrow, just waiting for Cook and Trump to pick up the phone.

But that’s not the point. Everyone’s piling into Nvidia because demand for AI chips is INSATIABLE. And in this arena, Jensen Huang has become what ChatGPT is in schools: UNAVOIDABLE.

• The Blackwell platform is gaining traction, and will soon bring gross margins back to sexy levels: from today’s 61% (post-China skim) to a projected 75% by year-end.

• The transition to Rubin, their next platform, should be smooth (same rack, same design, more sweat on competitor foreheads).

• Their AI software layer, Dynamo, is tightening their monopoly on pretty much everything that moves inside a data center.

At this point, I’m taking a breather. Just to say: “I don’t understand everything either… but you have to admit, it’s all pretty damn cool.”

In Summary:

Nvidia is once again the #1 U.S. company by market cap

AI is powering everything — even when the macro is shaky

Margins are rising, platforms keep evolving

The Middle East is financing the future with Nvidia chips — not oil, cash

The message is loud and clear: AI isn’t a bubble — it’s a bulldozer

Moral of the story:

While Apple sneezes and Microsoft coughs, Nvidia is sticking its fingers in the socket and turning into an investment nuclear missile. Or at least, that’s how it feels when you see what you see and think what you think.

As for the rest, optimism still reigns…

This morning, we’re staying in that soft euphoria, as Asian markets opened their chakras this Wednesday, gently buoyed by hopes that a quick phone call between Donald Trump and Xi Jinping might be enough to breathe life back into trade talks that are about as dead as a Swiss economist’s LinkedIn profile.

South Korea woke up with a post-election hangover… but with a KOSPI on fire (+2.4%), riding high on the surprise victory of Lee Jae-myung, a.k.a. “the guy who wants peace, not tanks.” China is seeing the world in soft pink hues: Shanghai and Shenzhen are gently climbing, while investors cross their fingers that Trump and Xi won’t hang up after three minutes. Yes, them again.

But caution is still advised: Trump just doubled tariffs on steel and aluminum to 50%, casually, between two tweets – which is putting a slight chill on New York futures this morning. In Hong Kong, the market is up 0.6%, thanks to surging tech stocks, especially chipmakers, even as Chinese factories continue running in slow motion. In Japan, the Nikkei is up 1%, riding the wave of general optimism.

Markets are climbing. But not because things are actually getting better—just because they’ve chosen to believe they might not get worse. And amid the wildest hopes and the boldest convictions, we all know that things are definitely going to work out between Trump and Xi, and then the rest will follow.

Today’s Headlines

CrowdStrike dropped 5% after hours Tuesday evening, despite posting solid results (adjusted EPS of 73¢ vs. 65¢ expected, revenue right in line at $1.10 billion). No need to look far for the culprit: the outlook was deemed disappointing. The company expects $1.14–1.15 billion for Q2, slightly below the $1.16 billion consensus. They also announced $1 billion in stock buybacks. But this time, it wasn’t enough; the stock dropped.

And as somewhat expected, the bromance between Trump and Musk is no more. Elon Musk launched a scathing attack on Trump’s tax plan, calling the bill a “disgusting monstrosity.” The ex–“spending reduction czar” of the White House criticized the tax cuts combined with slashes to Medicaid and food stamps, accusing the plan of doing nothing to address the deficit.

On X, he directly called out Republican lawmakers:

“Shame on those who voted for this. You know you did wrong.”

He called it a “backroom-deal-filled bill” and warned: “This November, we’re voting out all the traitors.”

Not sure he’ll be spending Christmas at Mar-a-Lago again.

Meanwhile at Wells Fargo, it’s finally time to exhale: the Fed has lifted the $2 trillion asset cap that had been stifling the bank’s growth since 2018, following the fake account scandal. This was the harshest penalty ever imposed on a U.S. bank, in response to massive client abuse.

Now, for the first time in 7 years, Wells can grow again: more loans, more deposits, more deals. CEO Charlie Scharf, hired in 2019 to clean house, called it a “major turning point.” As a bonus, employees are getting a $2,000 bonus each.

And in more banking news, Jefferies just gave UBS a huge upgrade, moving the Swiss giant from “Hold” to “Buy” and raising the price target from 22 to 37 Swiss francs. That’s not some Mickey Mouse upgrade—this analyst sees the light at the end of the tunnel… and it must be a very bright light.

The Numbers

Today’s data drop includes service PMIs across Europe. In the U.S., we’ll get the S&P Global Composite PMI, the Services PMI, and the ISM Non-Manufacturing PMI. Also coming: ADP employment numbers, expected at 111,000 versus 62,000 last month—a nice warm-up for Friday. On top of that, Bostic is scheduled to speak, the Beige Book will be released, and oil inventory data is also due.

At the moment, futures are slightly down 0.06%, and we’re patiently waiting for that Trump-Xi call to rocket the S&P back to all-time highs—which won’t be hard, considering we’re only 3% off the peak and that EVERYTHING COMING UP IS GOOD NEWS.

The jobs data will be excellent (100% probability), the U.S. and China will strike a deal, and who knows—maybe even Apple will find common ground with Trump.

The future isn’t just rosy. It’s fuchsia—somewhere between magenta and warm violet.

Have an excellent day, just like all the ones ahead.

We’ll see you tomorrow for more adventures!

Until then!

Moral of the story: The stock market doesn’t require brilliance—just that you’re not completely stupid.