The day that just passed was another “two rooms, two vibes” session. On one side, Europe is hoping that the upcoming rate cut will save their world, so no one wants to sell. On the other side, the US keeps picking fights with everyone—especially China. Semiconductors are getting crushed from all sides, and Powell shows up calmly with his gas can and lighter, doing just what Johnny once sang: “Light the fire.”

At the close, the Europeans managed to hold on, but over in New York, fatigue is clearly setting in, and the expression that comes to mind is: “we’re fed up.”

Big Fatigue

If you started reading or listening to this piece hoping to discover something new or fresh—or better yet, something original and different—let me warn you right now: you’re going to be disappointed! Disappointed, because at this point we’re just reheating yesterday’s leftovers. It’s becoming clear that there’s a full-blown war between China and Donald Trump, and honestly, sometimes you have to wonder how we’ll ever get back to a halfway normal situation. But let’s start from the beginning…

While Europe was clinging to the railings trying not to panic—desperately SHOUTING ABOUT THE ECB CUTTING RATES TO DROWN OUT EVERYTHING ELSE—the US session kicked off with a general panic in the semiconductor sector. Nvidia, AMD, and ASML were getting slaughtered for nothing. Or rather, for a lot—because Nvidia lost about $200 billion in market cap in one day. That’s like wiping out UBS and ABB combined. But that’s not even the point.

The AI kings got demolished for the same reasons we discussed yesterday morning: AMD and Nvidia can’t sell anything to China that even remotely relates to artificial intelligence. Trump’s comments yesterday didn’t help at all either. Add to that ASML’s earnings report showing slowing sales and a very, very, very cautious outlook for the rest of the year. This morning, we should get Taiwan Semiconductor (TSMC)’s earnings, but I’m not at all sure it’s going to reassure anyone. Because if their guidance is good, it means they’re living in an alternate universe…

Bloodbath Day

The day started with a bloodbath thanks to the semis. Then we tuned in to White House Radio for the latest, and again: nothing new, but nothing good either. Trump talked about an embargo on chips headed to China—which doesn’t change much for Nvidia and AMD since they’re already banned—but it killed any remaining hope of a deal with the White House.

And, as usual, Trump had to one-up himself: he announced a 100% increase in tariffs on Chinese goods. We’re now at 245% import taxes on everything from China. Which makes no sense at all—he might as well have said 1,000% since trade has basically been frozen since the 50% level was reached. Hong Kong Post has even stopped shipping parcels to the US.

Total War

But never mind the numbers—what really matters is that the US is cranking up the pressure on China from every angle. Team Trump even said they’re negotiating with other countries to prevent China from exporting to them and then re-exporting to the US. Basically, Uncle Donald is doing everything he can to isolate China and block their exports.

Over in China, they’re also gearing up for a fight: they’re refusing delivery of their Boeings and demanding “respect” from the US before they’ll even consider negotiating. And right now, you can’t exactly say Trump is showing the slightest atom of respect—to China or to anyone else, for that matter.

Even though these tensions aren’t new, the markets are having a hard time putting a positive spin on it—especially since it’s nearly impossible to gauge the long-term impact of these policies. The numbers change every half hour. Even AI is losing its mind. So just to be safe, Wall Street traders removed the “BUY” key from their keyboards yesterday.

And as if that weren’t enough chaos, Powell flew to Chicago and decided to stir the pot a bit more. Not that he gave us any clarity or helpful info—in fact, quite the opposite.

Powell Spoke

To sum up Powell’s speech in one sentence: the Fed needs to be ready to fight a resurgence in inflation caused by the tariffs. Powell believes those tariffs will hit hard—it’s not just a negotiating tactic—and inflation might spike again.

On top of that, Powell emphasized how worried he is about slowing growth. COULDN’T ASK FOR BETTER NEWS! The head of the Fed himself talking about weak growth and rising inflation. Thankfully, he didn’t actually say the word stagflation, but we’re all definitely thinking it. Hard.

Since 2021, the Fed has been obsessed with inflation. But now, the picture is getting more complicated as slowing growth is added to the mix. Powell hinted that the job market is still okay, but we should stay alert. Economists are already revising growth forecasts downward—but they’re not predicting a full-blown recession just yet. We’re talking slowdown, not crash. Still, the message is clear: risks are rising.

And rates? Nothing. Nada. Not even a postcard. Powell played the classic “wait and see” card. He even repeated it with emphasis: “For now, we’re well-positioned to wait until we get more clarity.” The word “wait” was like a mantra. The zen of monetary policy.

New York Not Happy

So the session ended deep in the red. The Nasdaq dropped another 3%, and the SOX index lost 4.1%. Translation: the markets hated it. As soon as Powell said there was “no urgency” to cut rates, the Dow dropped 2,000 points—as if to really drive the point home.

Yet the market prophets are already betting on four rate cuts before the end of 2025. In other words, the market and the Fed aren’t reading from the same script—and they don’t seem to be listening to each other either.

Meanwhile, other Fed members are sending mixed signals. Kashkari and Collins said they want hard proof before cutting anything—like, say, a surge in unemployment. Chris Waller is playing the dove, saying there are conditions that could justify easing. And even a former Fed member, Kaplan, said Powell will proceed meeting by meeting and won’t move until the data is crystal clear. So this could drag on for a while.

In Summary?

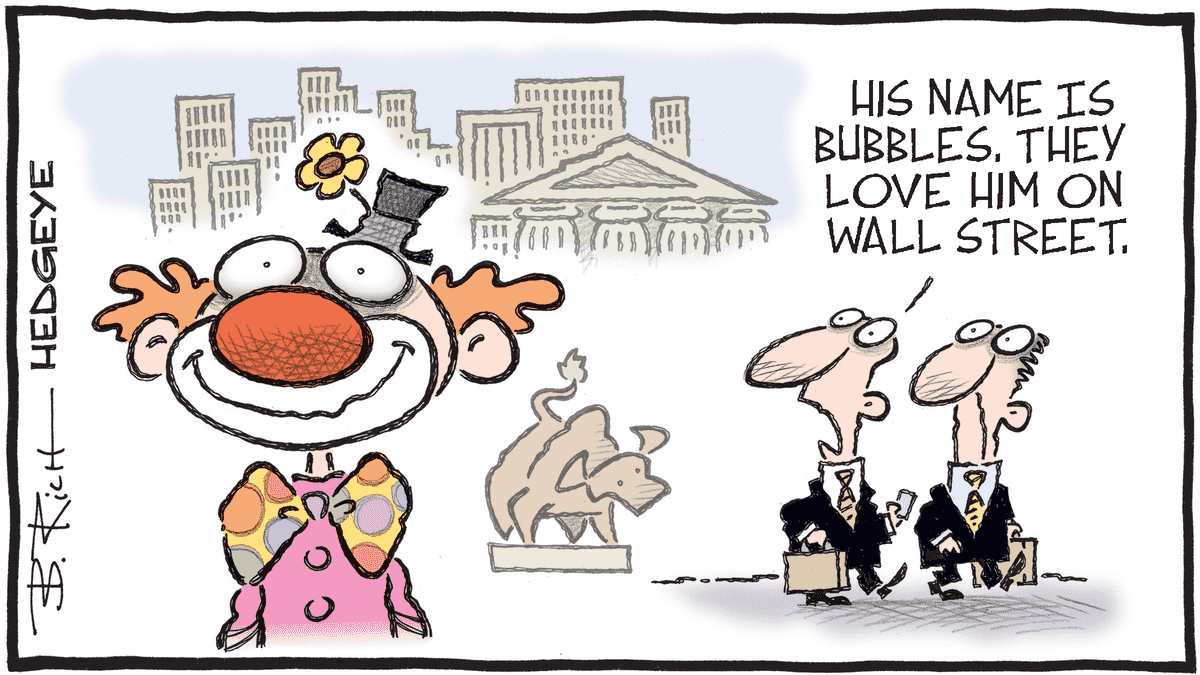

Powell is walking a tightrope: fighting inflation that could resurge—without killing the job market. And in the middle of all that, he wants to keep his credibility, his calm, and his options open. The problem? The market is losing patience. And when Wall Street gets impatient, it never ends well—especially when Powell hints that this time, the Fed won’t step in to save the markets. The famous Fed “put” is locked away in the closet—and we’re going to have to operate without a safety net for the first time in a very long while.

And the rest?

Well, it was a rough day yesterday, but this morning futures are already happily on the rise. And why, you ask? Well, because of Trump—again. This time it’s because he announced that negotiations with Japan are going super well, and that the President was so thrilled to have met the AMAZING Japanese negotiators. As a result, it’s party time this morning in Tokyo. The Nikkei is up 1%—okay, it’s a small party, but let’s just say that for now, any hint of tariff easing is taken at face value and people buy. And Japan, for Americans, is next to China—so it’s almost China. So, we’re making progress.

In short, all of Asia is in the green (even China and Hong Kong), because things feel a bit better than yesterday. If you ask me, I’d say it’s best not to say it too loud, but essentially we’re clinging to anything we can. BUT we mustn’t forget that Trump has the extraordinary ability to change course at the speed of light—and most importantly: without warning.

Meanwhile, oil is climbing again and is trading at $63.35 because the US (yes, again) is tightening sanctions against Iran and, in turn, OPEC is cutting its production. Gold is exploding like we’re in the middle of a full-blown depression. It’s now officially outperforming the stock market over the past 20 years. Gold is up 620%, while the S&P 500 is up 580%. In the past 9 months, gold has risen by $1,000, and this morning we’re sitting at $3,352 an ounce. Bitcoin—no one talks about it anymore—but it’s trading at $83,500.

The numbers

As for today—it’s all about the ECB cutting rates and Christine Lagarde’s speech after the cut. And of course, we’ll get the Philly Fed and Jobless Claims. The bond market will close early due to Good Friday tomorrow, and of course, everything will be shut down tomorrow. Market players will likely wrap up quite a few positions tonight ahead of the long weekend, fully aware that Trump doesn’t take holidays and is capable of absolutely anything in the coming days. No one doubts that anymore. Oh, and tonight Netflix will report earnings—what fun that’ll be—because they don’t have to deal with tariffs!

This morning, futures are up 0.75%, and you’d never guess we had a terrible day yesterday. As far as I’m concerned, all that’s left is to wish you an excellent day, a very happy Easter weekend, and we’ll meet again Tuesday morning to recap the long list of whatever Trump will have come up with…

no sugarcoating.

See you Tuesday!