Billy Joel once sang: “We didn’t start the fire.” Well, it sure feels like the fire’s been burning since forever, and the market keeps pouring gasoline on it. The day before yesterday, we soared. Yesterday, we dropped. And after bouncing up and down so much, I have to admit: it’s hard to know what to think anymore. Or maybe not. Personally, I think the best thing we could do right now is shut down the markets until he figures out what he wants to do with his tariffs. Once the self-proclaimed President of the World decides who’s going to pay what, we can reopen global markets and start living a normal life again. Because right now, uncertainty is running the show, and frankly, it’s exhausting.

While we wait for the big players to decide to close the stock exchanges indefinitely — just long enough to let the rulers of the world play their little economic war games — we spend our days doing the financial hokey-pokey: “up, down, down, up,” all to the rhythm of a dusty old ‘70s tune. And honestly, it’s getting seriously annoying — if not downright unbearable. I’ve kind of lost the beat.

Let’s recap:

We got crushed on Monday because there were no negotiations over the weekend and Trump said there wouldn’t be a moratorium.

Then Tuesday, markets exploded nearly 10% because Trump said there would be a 90-day moratorium.

And yesterday, we tanked again because uncertainty came roaring back and, surprise surprise, the US-China trade war is making investors nervous.

I’m glad everyone’s finally realizing that the US-China trade war is a problem, but I’m starting to wonder what the point of trading even is anymore. Opinions flip faster than a pancake, and there’s no safety net — especially when the man in charge has the mental stability of an overcaffeinated Labrador chasing a biscuit under the couch.

At this point, buying a stock on Monday and hoping to sell it by Friday at a profit is like playing Russian roulette with five bullets in the chamber. One in six chance you survive. These wild swings bring nothing of value to analysis, because what’s the point of thinking strategically when the guy pulling the strings is completely unpredictable? Tariffs on China are at 145%, and it feels like they climb another 20% every day depending on Trump’s mood. Nothing guarantees he’ll stick to that 90-day moratorium — especially since the weekend starts tonight, he’s heading to the golf course, and by Sunday night he’ll probably tweet something ridiculous from Air Force One on his way back from Florida.

No Filter

Back to reality. I still believe everything should be shut down until the clowns running the world make up their minds. But in the meantime, markets are open — unfortunately — so let’s stay with the facts. After Wednesday’s explosive rally, European markets had no choice but to chase the US gains on Thursday morning. You can re-read every market summary and search for rational explanations behind Thursday’s European rebound, but there’s only one real reason: the stratospheric rise from Wednesday. For now, as long as the Muppet Show in Washington continues, Europe is just following America’s lead, albeit with a bit of a time delay — like watching a rerun in slow motion.

If you tuned in to European news channels yesterday, you’ll have noticed nothing else happened apart from Trump’s sudden U-turn on tariffs. We spent the entire day in “special edition mode” trying to figure out why he flipped and whether he manipulated the markets for personal gain. No clear answers emerged, of course, but European indices closed sharply higher. Some politicians even started patting themselves on the back, thinking Trump blinked because he was afraid of Europe. Right.

Still No Filter

Then the Americans came into the office and started taking profits after the previous day’s euphoric rally. As soon as Europe closed its markets, the sell-off resumed in New York. By the end of the session, the S&P500 had lost 3.5% and the Nasdaq 4.5%. And honestly? Nothing much happened during that session. Well — at least Trump didn’t say anything new. The media took over and started throwing around words like “insider trading” and dissecting the logic (or lack thereof) behind his reversal, just to keep things passionate and semi-rational. But again, the day was violent and volatile.

I remember not so long ago, when we proudly counted the number of days the market didn’t move more than 2% in either direction. Days when the only driver of stock prices was: “Well, the Fed’s going to cut rates anyway!”

That golden age feels like ancient history. And once again, just as Europe was celebrating gains, the Americans were dragging everything down again — almost as if they were deliberately trying to do the exact opposite. But let’s stay calm. After a 10% rally, a pullback is completely normal. It’s what White House Trade Adviser Peter Navarro said yesterday — that the market decline was nothing special and just a natural profit-taking move. Navarro, by the way, is the guy Elon Musk once called an idiot. Given his track record and deep anti-China stance, I wouldn’t be surprised if he avoids Chinese food altogether.

Stats and Inflation

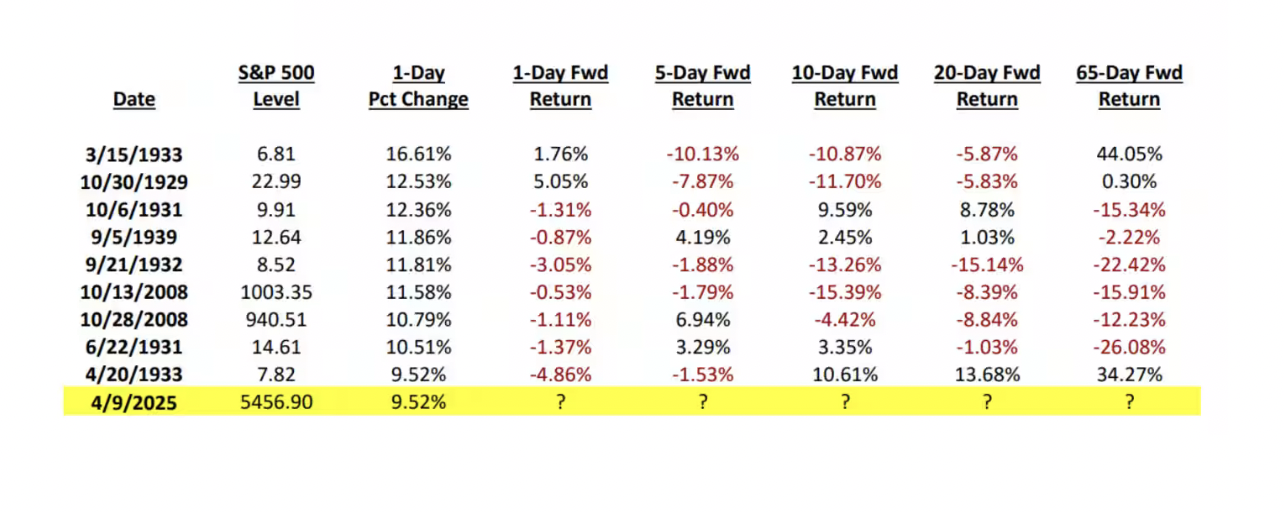

And since we were in “special edition” mode all day, we went digging through old statistics and found out that Wednesday’s surge was only the 10th biggest single-day gain ever. Most of the top gains happened in the 1930s. The all-time record still belongs to March 15, 1933, when the S&P500 jumped 16.61%. We also saw better days during October 2008.

Historically, when you get a “meltdown-mania” kind of day like Wednesday, markets tend to lose it all again within 10 days. And for those wondering what triggered the 1933 rally: it was the passage of the Emergency Banking Act, meant to restore faith in the system. Some things never change in the world of high finance. On days like that, everything rises — even junk stocks. Investors just start buying blindly. It was the first time since 1929 that risk appetite returned. But let’s be clear — it wasn’t the start of the bull market of the century. Just a massive short squeeze with a little sprinkle of hope.

Amid all the profit-taking and comparisons to the 1930s, it’s still worth noting that the U.S. CPI was published. And as expected: no one gave a damn. Yet it dropped by 0.1% in March, bringing the 12-month inflation rate down to 2.4%, compared to 2.8% recorded in February. Excluding food and energy — and all that stuff that’s apparently useless — the so-called core inflation came in at an annual rate of 2.8%. That’s the lowest core inflation rate since March 2021. And these numbers were ALSO below economists’ expectations. But to be frank with you, the general reaction was:

“Yeah, well, who cares if inflation is lower than expected — with all the stuff that’s going to hit us because of Trump’s tariffs, it’s DEFINITELY going to go back up in the months ahead.”

Well yeah. That makes perfect sense since the guys who forecast inflation and Fed rate hikes or cuts have been SO accurate in recent years that we should ABSOLUTELY not ask any questions!!! So, inflation’s doing better — but only so it can get worse later. It’s a certainty accepted by this market that is never wrong and never makes mistakes.

Are we getting back on the carousel?

This morning Japan is down more than 4% to celebrate last night’s solid U.S. performance. Meanwhile, China and Hong Kong are in the red and seem to care absolutely zero about the fact that tariffs to the States are rising 20% a day. Oil has dropped below $60, gold is at $3,234, and Bitcoin is worth $80,000.

On today’s news front, there’s not much to say that we haven’t already covered earlier — except that this morning, there’s something that might try to distract us from the psychotic ramblings of the White House: earnings season is starting. Before the market opens, we’ll get numbers from JP Morgan, Wells Fargo, Bank of New York, BlackRock, and Morgan Stanley. There’s an old market adage that says you should buy when there’s blood in the streets — I don’t know if there’s blood in the WHOLE street, but when it comes to the banks, judging by where they’ve been, it’s probably close to a little femoral artery hemorrhage. So there should be some action in the sector BEFORE the open.

It’ll also be very interesting to listen to the post-earnings press conferences, especially since Dimon sold a boatload of his bank’s shares BEFORE the drop — but more importantly because words really matter in the world we live in. By the way, here’s a thrilling little anecdote that sums up today’s mood and the current appetite for risk:

Yesterday CarMax posted some not-so-great numbers, and the stock ended down 17%. So far, nothing unusual. But the funniest part is that the CEO refused to provide any future outlook because he believes that “macroeconomic uncertainties” make it impossible to anticipate or forecast the future of the business.

Let’s just say that if one out of every two companies this earnings season comes out with that kind of line — and blames the lack of visibility on macro and geopolitical factors — we’re going to get slaughtered. As for visibility, it’s not any better from the central bankers either. Yesterday, we had Michelle Bowman saying that while the U.S. economy remains strong, the consequences of Donald Trump’s trade policy remain uncertain. And to pile it on, the president of the Chicago Fed, Austan Goolsbee, said the Fed might (eventually) start cutting rates again — but only once trade uncertainties are cleared up. Which clearly isn’t happening anytime soon.

The Day’s Expectations

As far as today’s data and the current situation go, we’ll be watching for bank earnings, the CPI in Germany, the CPI in Spain, consumer climate in Switzerland according to SECO, and then we’ll also have Lagarde speaking. In the U.S., it’s the PPI that’ll be released — probably in the same vein as the CPI, with the same kind of dismissive interest from investors. Then there’s also the University of Michigan Consumer Confidence report. Another useless survey that doesn’t serve any real purpose, but which the market might highlight just to fill time while waiting for the next idiotic statement from President Trump.

At the moment, U.S. futures are dancing the samba and swinging between -0.6% and +0.2%. One thing is clear: we’re in a bath of volatility, and no one really knows what to do or where to go. What is certain, for now, is that the keeper of the keys is in Washington, and the slightest post from him on social media has the power to make us perform a world-class triple lutz. In the meantime, we’ll go light a candle and hope JP Morgan’s numbers provide a bit of a distraction.

Have an excellent weekend, everyone — enjoy, breathe, meditate, and unfollow Trump’s accounts!

See you Monday.