The least we can say is that we didn’t get bored yesterday, and it doesn’t look like we’ll be bored this Friday either. And to think—we’re lucky there’s not two Trumps and three Elon Musks on this planet, otherwise my columns wouldn’t even be columns anymore; I’d have to do a 24/7 live broadcast just to keep up with everything. In any case, this time we won’t complain, because we’ve got mountains of things to talk about. Mountains that solve absolutely nothing and fix zilch—but at least they give us material to write scripts for the next Netflix season, which they’ll surely churn out sooner or later…

The day was packed.

First of all, the ECB cut rates as expected, and their communication was—as usual—vague. In short: rates probably won’t go lower… unless they need to. Deposit rate at 2%, inflation expected at 2% in 2025, weak growth—but hey, we’re smiling. Christine Lagarde did what Lagarde does best: “we’re cutting, but we might stop.” Translation: we emptied the first-aid kit, now we’re just hoping the wound heals on its own. Oh, and Lagarde also said she won’t leave her post before the end of her mandate—just to put those rumors about her heading to the World Economic Forum to rest. Her loyalty is touching, but really, it’s just that the WEF hasn’t added enough zeros to the check yet.

Meanwhile in Germany, the construction sector is still in the ICU, but business leaders’ morale is through the roof—which is funny, because it lines up perfectly with the 1-trillion-euro blank check the new government signed to celebrate taking office.

When spirits are high, it usually means everyone wants a slice of the cake. Bottom line: the DAX hit an all-time high, while Switzerland is still bored to death in its 250-point range, ending the day above 12,300—woohoo—while posting an unchanged unemployment rate at 2.8%. Thrilling, just like the SMI range. And to cap it all off, Paris was the only major index to close in the red. A light red—down just 0.18%—but the message was clear: the market didn’t like that the ECB hinted the rate-cut cycle might be over. Investors love the idea that the Central Bank is here to help. When they realize there’s not much help left to offer, teeth start to grind.

The Soap Opera

Then Trump spoke with Xi. Supposedly the most exciting news of the day… except, not really. The call was “constructive,” Xi invited Trump to China, Trump invited Xi to the US—we just hope they check their calendars beforehand, because it would be a bit awkward if Trump flies to Beijing while Xi is mid-flight to Washington.

To sum it up: nothing new, just diplomatic small talk, some dinner invitations, and a joint statement to “continue negotiations” on tariffs. Yes, the same ones that have been completely stuck for the past two weeks. Result: they hyped up this phone call, and it turned out to be about as impactful on the global markets as Macron’s argument with his grandma the other day in Asia.

Meanwhile, the markets are playing poker, and Wall Street is holding its breath for the jobs report like someone nervously waiting for a pregnancy test—pure anxiety.

And now, the juicy part…

Here comes the good stuff. The thing that actually moved markets and lit things up:

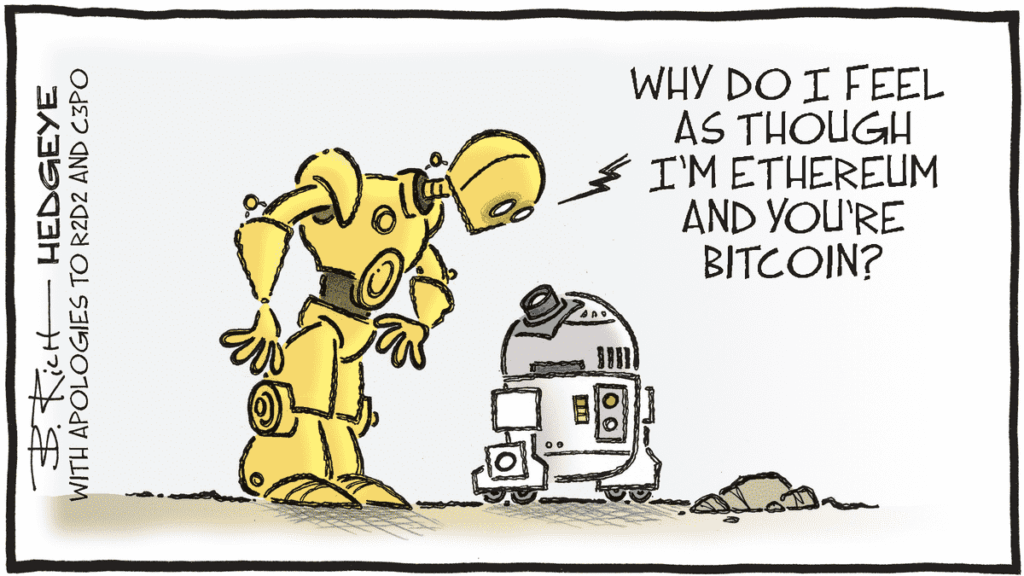

The chronicle of a breakup.

You thought Married at First Sight was the ultimate romantic suspense and peak reality-TV stupidity? Think again.

Enter: the live broadcast of the BROMANCE EXPLOSION between TRUMP and MUSK—and yes, it’s all happening on X (Twitter).

And it’s so consuming, so dramatic, that today I feel obligated to run a special edition inside the special edition, complete with BREAKING NEWS banners, for this episode of political-financial bromance gone wrong.

Welcome to the latest chapter of this majestic series:

When Trump divorces Musk: A friendship worth $150 billion down the drain

Just three months ago, Elon Musk said of Donald Trump:

“I love him as much as a straight man can love another man.”

Fast forward to yesterday: the eccentric, ketamine-fueled, possibly autistic billionaire accused Trump of being linked to Epstein, blamed him for hiding all the documents, accused him of sabotaging the economy with a “pile of tax abominations,” and even threatened to unplug NASA’s rockets that are supposed to send American astronauts into space.

And yes—all of this publicly, on X.

But be warned—Trump is not sitting idly by. On his end, he’s threatening to cut $21 billion in federal contracts to SpaceX, like an angry father snatching away the car keys: “Since you’re messing around, you’re grounded!!!”

Tesla has lost nearly $200 billion in valuation, with the stock down 25% since May 29.

Trump Media dropped 8%.

And the markets are fluctuating between nervous laughter and panic over Tesla.

So how did two superstars—who had everything to gain by working together—manage to spark a mini-crash with just a few tweets?

Honestly, it’s pretty simple: ego, power, an insatiable need for attention—and a whole lot of money.

It all starts like a political fairy tale: Trump becomes President for the second time, and we can’t deny that it’s partly thanks to Musk. The Tesla CEO injects $300 million into Trump’s campaign, and together they dream of a world filled with electric cars, rockets in every corner of space, and increased tariffs on everything not Made in America.

Trump rolls out the red carpet in return. Musk becomes a “special senior advisor,” moonlights as a government spending watchdog, and gets invited to the White House more often than the DoorDash delivery guy. Everyone wins. Since LIBERATION DAY, Tesla has rebounded 69%. SpaceX pockets billions in contracts. And Trump gets to play the tech-messiah while insisting ELON is so amazing it’s almost embarrassing. He even organizes Tesla commercials in front of the White House, and Musk spends more time at Mar-a-Lago than at Tesla’s board meetings.

Chapter 2 – The Uncontrolled Explosion

This is when the “Bill” arrives. And no, we’re not talking Bill Gates. We’re talking Trump’s national budget.

Musk calls it a fiscal abomination—and says so, loudly. He fires off on X:

“This is an abomination, a disgrace to vote for this, and we’ll fire the traitors.”

Trump, OF COURSE, doesn’t appreciate the sarcasm. The vendetta begins:

He threatens to cut all contracts and subsidies to Musk—Tesla, SpaceX…

He accuses him of being ungrateful.

He fires him from his influencer role at the White House.

He mocks his black eye.

The breakup is official.

Musk’s response is blunt:

“Without me, Trump would’ve lost the election. What ingratitude.”

And the cherry on top of this divorce:

“Trump is in the Epstein files.”

Game over. We’ve gone from the “bromance” of the year to a grotesque public divorce—and it’s just beginning.

In Conclusion: The Ego War Is Getting Expensive

What looked like a genius alliance has turned into a geopolitical-market soap opera, with the only losers being the markets and the taxpayers.

Musk threatens to start his own political party. Trump threatens to cut all his funding. And the stock market is watching, wondering if we’re all trapped in a bad episode of The Simpsons.

So what does this mean in the medium term?

Amplified political volatility – everything Musk touches turns explosive.

Tesla destabilized – investors want a CEO, not a political sniper.

Trump more unpredictable than ever – “Trumpflation” 2025 is underway.

Most importantly, this saga proves one thing: markets hate breakups—especially loud ones. In less than a month, we’ve gone from Make Innovation Great Again to Kill Bill and The Epstein Files.

The breakup of the Trump–Musk duo has wiped hundreds of billions off the markets.

Investors now fear a Musk more focused on political war than running his companies.

And the stock market is discovering that ego clashes—even in 280 characters—come with a price tag.

Is the breakup permanent? Impossible to say. But one thing’s for sure: with exploding rockets, incendiary tweets, and Tesla collapsing on the stock exchange, these two clowns have managed to eclipse the tariff war and bargain-bin trade talks between the U.S. and China.

Yesterday it was simple: everyone was talking about this. Tesla alone lost over 14% in a single day, and the U.S. markets ended down, celebrating this new episode of what’s starting to look like premium-grade nonsense. We’re basically basing investment decisions on the antics of two guys who could both play Bond villains.

The Rest: Asia and Broadcom

Yes, this morning the divorce of the century is taking up a lot of space—for not much, let’s be honest—but the news cycle doesn’t stop.

Over in Asia, the mood is dull and gray. Everyone’s waiting: for hypothetical Trump announcements on China, U.S. employment numbers, and the Indian central bank’s decision. Okay, maybe India’s central bank isn’t exactly top-tier headline material—but hey, it makes us look like we care about more than Trump’s Truth Social account.

Markets are mostly flat. The Nikkei is up 0.5%—for reasons that might baffle the average person: it turns out the Japanese are spending less than expected. So since consumers aren’t consuming, the BoJ might hold off on raising rates. THEREFORE stocks rise. Yep, you have to follow the logic. In China, even after a “positive” phone call between Trump and Xi Jinping, markets are treading water. Investors don’t want more promises—they want a real deal. Meanwhile, Chinese industry is getting wrecked by U.S. tariffs. In India, the central bank is expected to cut rates today. Makes sense: sluggish growth, controlled inflation, and a need for support. Indian markets should be in the green today. Thanks to QE, curry edition.

Oil is at $63.20, gold is at $3,395, Bitcoin at $102,500, and the 10-year yield at 4.387%, all amid deafening silence.

Broadcom and Lululemon

Last night saw some quarterly earnings worth noting. First up, Broadcom delivered, and the semiconductor emperor didn’t disappoint the market. BUT! Yes, because there’s always a “BUT” lately—and as crazy as it sounds, Broadcom didn’t miss expectations. Quite the opposite. They crushed them.

So why the 4% drop after-hours?

The usual excuse: “Yeah, but it already went up a lot.” Followed by: “Sometimes it’s good to take profits.”

After an 88% run in under two months “anticipating good results,” Broadcom fell 4% as investors cashed out. Case closed.

Then there was Lululemon. You know, the yoga apparel company. Well, you’d know it if you did yoga—which clearly isn’t my thing. Anyway, Lululemon did the splits… and tore a groin.

Results were better than expected, but guidance was revised down due to tariffs and weak in-store sales. The stock crashed 22% after hours. U.S. sales are down, customers are cautious, and the competition is fierce.

Crypto Is Back, Baby!

We finish with the IPO of the day: Circle, the stablecoin boss. Listed at $31 under the ticker CRCL, the stock opened at $69, spiked to $103.75 (+235%), and closed up 168% at $83.23.

What drove the frenzy?

Massive demand, an oversubscribed IPO, and a company printing cash from the interest earned on its USDC reserves—its dollar-pegged stablecoin. The result? A valuation of $18.4 billion. The company and its investors pocketed $1.1 billion in the process.

The signs are clear:

Trump loves crypto.

The SEC is getting softer—maybe even cooperative.

A bill (the GENIUS Act) might finally secure the future of stablecoins.

And the whole sector is celebrating.

Coinbase, Robinhood, Galaxy Digital, eToro… all surfing the bullish wave. But beware: Circle is still behind Tether, the current market leader. The difference? Tether operates like a pirate ship out of El Salvador. Circle is playing it clean, hoping U.S. regulation finally rewards the good students.

In short: crypto + Trump + friendly regulation = market boom.

And if Circle’s IPO is any indication, buckle up—more are on the way.

The Numbers of the Day

On today’s economic calendar, we have industrial production and the trade balance in Germany, GDP in Europe, and Lagarde speaking again—probably for those who didn’t get what she said yesterday. But above all, the big one: Non-Farm Payrolls.

Yesterday’s Jobless Claims numbers were crap for the second week in a row, so we’re really expecting shitty figures today. Consensus forecasts are for 126,000 new jobs, unemployment rate to hold at 4.2%, and wage growth around 3.7%. Personally, if the numbers turn out too good, I’ll stand up and scream RIGGED!!! very, very loudly…

Otherwise, for now, futures are up 0.25%—probably because Musk hasn’t crashed a SpaceX rocket into the White House yet, and Trump hasn’t signed an executive order against Musk. So far, so good.

Also, a quick reminder that on June 18, the Swissquote Trading Day will take place in Lausanne. It’ll run for almost six hours, ending with an apéro. It’s free, but you need to sign up, and spots are filling up fast—so if you’ve got nothing better to do, register now. Here’s the link: CLICK HERE!

I’ll also take this opportunity to let you know that Investir.ch is now collaborating with Zonebourse.com – we’ll be republishing some of their articles. And personally, I’ll be posting a weekly video on their YouTube channel, covering – surprise! – finance. But let’s be clear: this is UNFILTERED FINANCE, and that’s not quite the same thing.

See you Tuesday, just in time to find out if Musk announces on Sunday night that Trump ALSO killed Kennedy.