Right. I’ll be honest with you: right now it feels like we’re just going in circles.

We’re talking about tariffs with China that are supposedly settled, but no one really cares, even though we’ve been waiting on that for three weeks. Inflation is rising again, but not as much as we thought it would—which is good news—but let’s not get ahead of ourselves, because the REAL INFLATIONARY IMPACT is still coming… sometime later. We just don’t know when exactly “later” is. So after waiting all week to LEARN something, it feels like we’re just being told that it’d be nice to wait a little longer. Exhausting.

Title: “Putting Things in Order (or Not)”

Let’s try to sum things up while staying focused: markets ended slightly lower across the board. But these were mild declines, the kind that make it feel like everyone’s already left for vacation and will be back in September. Yet, given the avalanche of news we had to digest yesterday, it’s puzzling why there’s so much disinterest, so much “don’t care” energy, and why the markets felt as dull as the sky, which is full of smoke from Canadian wildfires.

We started the day with a photo. A photo of the six negotiators who “saved the world” from a tariff war. A stairwell shot showing three Americans and three Chinese looking pretty pleased with themselves, saying nothing because they had to report to their bosses first—since in the end, those are the ones with power over life and death decisions. But what we did know was that they had a principle agreement. So markets opened with a “well, that’s nice, but let’s wait and see” vibe. And “wait” meant waiting for the CPI release—to see if Uncle Donald’s tariffs had already started eating into U.S. consumer spending.

Let me tell you right now: the answer is “yes, but not as badly as expected, but let’s not get too excited because more pain is coming”—these are the words of experts who are allowed to change their minds every five minutes depending on the wind, weather, and whatever the President says. The American President, of course.

The CPI: Less Bad Than Feared

Let’s start with the CPI. The long-awaited number came in… up. But less than expected. Contrary to fears that Trump’s Jenga-tower-like tariffs would skyrocket inflation, it actually slowed down. Year-on-year, we’re at +2.4%. Yes, that’s a bit higher than April’s +2.3%, but lower than the expected +2.5%. Experts immediately jumped in to say it was “below expectations,” but that it was only a temporary relief BECAUSE THE TARIFF IMPACT IS STILL COMING. We just don’t know when. Maybe now. Maybe end of the month. Or the summer. Or never. In short, nobody knows—but “it’s coming.”

So the news was GREAT! Another GREAT reason for markets to go up! Right?

Wrong. Because the tariff impact is still coming.

So basically, the GOOD CPI NUMBERS are useless for now, and it’s better to wait a little longer to see when the real pain kicks in. Maybe the core inflation was okay—it came in at 2.8%. But you get the idea: for now, inflation is under control, but we fear the worst is yet to come.

Still, on Trump’s side, everything’s “under control”—except Los Angeles. Trump was quite busy yesterday but still found time to announce that (in his opinion) the inflation figures were “EXTRAORDINARY AND THAT THE FED SHOULD CUT RATES BY 100 BASIS POINTS!!!”

No, you’re not dreaming. You’re not reading last week’s notes:

Trump actually REPEATED HIS DEMAND for Powell to cut rates by 100bps.

And guess what? The Fed meets next week.

So in conclusion:

Yesterday’s inflation was not as bad as feared – but markets prefer to wait.

Wait to find out WHEN THE TARIFF PAIN hits and to learn more about the MAGIC DEAL with our new Chinese friends.

The Deal in Detail—Or Not

Speaking of the MAGIC DEAL with our new Chinese friends: Trump spoke yesterday—which, let’s be honest, isn’t surprising. What would be surprising is if he stayed quiet for two weeks and gave us a break to focus on other topics and people.

Anyway, Trump spoke, and when he speaks, it’s truth.

Well… his truth.

The U.S. President proudly declared that the trade war with China is “over.”

Champagne and caviar for everyone.

Except that, in reality, it’s like declaring a storm over when you still have water up to your knees and your roof blew away 80 kilometers.

Officially, the deal is “done.”

Unofficially, Beijing hasn’t confirmed anything—just vaguely reiterated the “Geneva consensus.” Translation: we’re basically back to where we were before.

Which is to say: nowhere.

Well, not exactly nowhere—I’m probably just jaded.

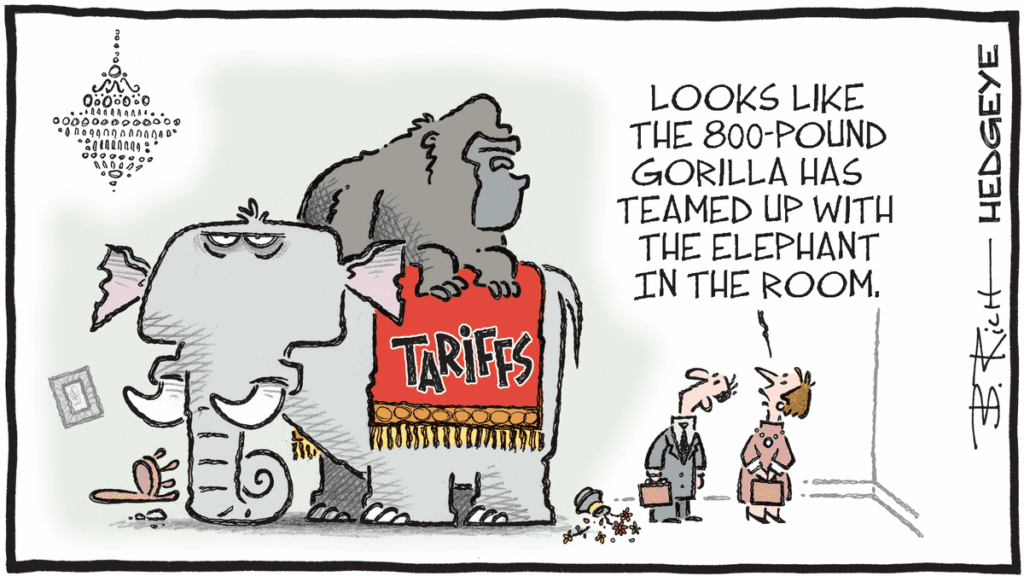

But when Trump says the deal includes 55% tariffs (more or less the same as before, since Biden already slapped on 25% and Trump added another 30%), you don’t really get the feeling that it’s time to quote Steve Jobs and shout: “THIS IS A REVOLUTION.”

Clearly, it’s not.

So: the punitive tariff on Chinese imports stays at 55%.

We’re not going any higher. Great, right?

Well… no.

Because 55% tariffs are already a noose for thousands of companies.

And I’m not the one saying that—it’s the logistics industry, retailers, and CEOs fighting for margins. One CEO from a major retail chain summed it up bluntly:

“This is not a win for America.”

Supply chains are already broken. Job losses are already real. Price hikes are inevitable (which brings us back to June’s CPI—but we’ll talk about that again in July).

Overall, just saying “it’s over” doesn’t fix anything.

Logistics leaders are clear: the damage is done. The wound is deep, and it’ll keep festering in the coming months—just in time for back-to-school and the holiday season.

And Who Pays?

In summary, the deal is signed—well, it will be once the Chinese confirm it, which they haven’t yet. But one thing is certain: the American consumer is going to foot the bill.

Because at 55% tariffs, you have two options:

Raise prices.

Cut costs. (Translation: lay people off.)

Either way, the economy suffers.

And when you hear that holiday shipping orders are already down 14% compared to 2024, you know it reeks of a stealth recession.

The problem isn’t just the tariffs—it’s the complete uncertainty.

Companies are scared to death that a single tweet will undo everything from the day before. So they stop taking risks. They wait. They freeze orders.

And commerce—like the economy—hates a vacuum.

Oh, and the transport market? Suffering too.

Less volume, fewer containers, half-empty ports, and trucks driving around empty.

The American dream, right?

So What Now?

Well, right now the world is waiting for Trump and Xi to shake hands once and for all.

Meanwhile, the global supply chain is burned out, distributors are juggling Halloween stock in June, and small businesses are wondering if they can still make socks without mortgaging their warehouse.

“The war is over,” says Trump.

Maybe.

But the scars are very real.

And they’re going to be expensive.

But the markets don’t care. They live in the present.

Even if yesterday felt as gloomy as the smoke-covered Canadian sky.

Unless it’s just that we’ve realized Trump is going to keep screwing with us for three more years, and nothing is moving forward!!!

Asia

Asian markets mirrored yesterday’s Western session: dull and depressed. Trump is talking tariffs again with the rest of the world—says progress is being made but still half-threatens. Meanwhile, the US-China deal remains unclear. At the same time, the Middle East is heating up: oil is rising, the US is evacuating Iraq, and Israel is ready to strike Iran (again). A festive atmosphere all around, as Americans pull out from certain bases in the region because Trump says things could get hot and dangerous in the coming days. Always reassuring when you’re trying to protect the troops.

China dipped slightly, with the Hang Seng down 0.5%, weighed down by the lack of clarity on the deal, and EV stocks like NIO and BYD sliding. Japan got hit too, with the Nikkei dropping 0.8%, hurt by a strong yen and a sulking tech sector.

In short: geopolitical tensions + tariff uncertainty = nervous markets and cautious investors.

Gold is at $3,393.25, oil is surging to $67.89, Bitcoin is at $107,700, and the 10-year yield sits at 4.40%.

Meanwhile

Oracle reported earnings above expectations with adjusted EPS at $1.70 (vs. $1.64 expected) and revenue at $15.9 billion (+11% YoY). The cloud is in turbo mode with projected cloud growth of +70% by 2026, targeting $67 billion in revenue that year—well above forecasts—and Oracle even aims to surpass $104 billion by 2029. The cloud is carrying everything on its shoulders and all metrics beat the consensus. In short, Oracle crushed it and is promising spectacular growth thanks to the cloud. The stock jumped 8% after hours yesterday.

Elsewhere, Tesla has once again delayed the launch of its Robo-Taxis. I won’t even comment on it anymore—it’s become routine. So routine that even the stock no longer reacts, especially with Tesla’s CEO too busy apologizing to Trump, which is starting to get awkward.

In other news

Voyager took off like a rocket—literally. The start-up specializing in space capsules made its stock market debut with a stratospheric performance: +82.3% in one session. IPO price was $31, ending at $56.48. Result: a valuation north of $3 billion. When NASA is your main client, you’re aiming for the moon—and beyond.

Meanwhile, Lockheed Martin got smacked: -4.3%. The Pentagon is cutting its F-35 purchases: only 24 units planned this year, compared to 48 last year. When your biggest program makes up a third of your revenue, that stings.

Nvidia, for its part, lost its crown as the world’s most valuable company. Microsoft is back on top with a $3.51 trillion market cap, compared to a “mere” $3.49 trillion for the GPU king. Meanwhile, Jensen Huang is hyping everyone up about quantum computing—he used to be cautious, now he’s fired up…

Steel stocks are down in the dumps. Nucor (-6%), Cleveland-Cliffs (-8.3%), and Steel Dynamics (-2.8%) all dropped as Washington and Mexico are reportedly close to a deal to cut steel tariffs by 50%. Less protection = lower margins = less fun.

Keep an eye on Chime Financial, which is about to go public. The fintech, focused on online banking services, is targeting a valuation of over $10 billion. Proposed price range: $24 to $26 per share. Verdict coming very soon.

On the bond side

The U.S. Treasury piled on a bit more debt yesterday. It auctioned $39 billion in 10-year notes. Yield: 4.42%—still strong in the current environment. Investor appetite was there, with demand 2.5x the supply. Slightly lower than in recent auctions, but nothing alarming. Bottom line: America keeps borrowing like crazy… and the market keeps going along. For now. But really—just for now. Honestly, I’ve never followed the bond market so closely in my life!

Today’s key data: PPI and Jobless Claims.

Honestly, if you’re looking for a visual definition of “perpetual motion,” you don’t need a quantum physics textbook—just watch the markets and you’ll get it. It’s a loop. Same news over and over. Tariffs? “Resolved,” but not really. Inflation? Rising, but not too much—or not enough. Maybe we’ll feel it later. Or not. So everyone waits. Again. Like they’ve been waiting for six months. And Powell still won’t cut rates—and Trump hates him more each day.

Feels like we’re all hamsters running in a wheel… except even hamsters take breaks sometimes.

Have a great day at the pool and see you tomorrow, same time, same place!

See you tomorrow.