I’m not sure that without the weekend’s about-face, scripted by Donald Trump, the Old Continent’s markets would have experienced such a day. The good news is that I can turn it over in my head in every way; we’ll never know what would have happened if Trump had slammed the door on Ursula von Pfizer. One thing is certain: the week’s opening was joyful and bullish. The DAX crossed 24,000 once again, and the increased tariffs are just a bad memory. Yet, this is when things are really going to heat up — real negotiations will have to start, and we need to stop relying on hypothetical postponements to push the market up.

A Monday in the Sun

Yesterday, the markets returned from the weekend like someone coming back from three days in Ibiza: a bit dazed, not very clear-headed, but relieved not to find a corpse on the lawn.

The corpse on the lawn being the tariffs. And all thanks to whom? Thank you, Donald. Since our memory is short, let’s recall that on Friday, the markets took a hard hit because of tariffs. Trump had decided to restart his trade war with Europe, like a Netflix series the writers can’t find a proper ending for.

Then, on Sunday, just before happy hour, boom: strategic turnaround! Sanctions postponed to July 9. A month and a half of reprieve, or illusion, depending on how you see it. On Monday, European markets suddenly bounced back. As if everyone said, “False alarm! Pack up the panic, we’re back for another round.” The DAX climbed, the CAC followed, the Swiss fired up their fondue burners, and across Europe, joy was quite contagious. Of course, US and UK markets were closed for Memorial Day, so volume was as lively as a rainy Sunday in the Creuse region. But that didn’t stop US futures from strutting around with promising gains, just to make it look like everything’s fine.

Really? Is Everything Fine?

But let’s be honest: you can’t seriously judge a session without the Americans. It’s like judging a concert without the singer. So the real session, the one that counts, is today. And it starts with a simple question: how far will the “Trump model” go?

Yes, because now we know the routine. He threatens, he scares, markets dive. Then he backs down, and everyone starts buying again as if nothing happened. Maybe even more than before, even though nothing fundamental has changed — it’s just relief that makes the rebound twice as strong — because everyone wants to believe everything is settled and that we’re all brothers. Or all Americans, depending on how you look at it.

It’s become a classic. And over time, this pattern even makes some speculators happy: they bet on the about-face before it happens. They play Trump like quarterly earnings of a semiconductor company or employment figures calculated on an abacus by the guys at the BLS who haven’t yet sobered up from the long weekend. But beware, June could be eventful. Because real negotiations will inevitably start now. And any disagreement between Europe and the US — or the US and China — or even the US and the US, will make indices shiver as if Powell had quit and handed his job to Britney Spears.

And above all, we’re not safe from another Trump reversal. The US President has shown he’s as stable as Macron and his partner squabbling with punches while getting off the plane. And as steady as a Cessna caught in a summer cumulus full of hail. The boss of the United States has shown multiple times in recent weeks that he can’t hold a position for more than 10 days. If nothing changes in that timeframe, he’s capable of ruining everything just to throw a tantrum. When you see last Friday’s reaction to Europe, you really fear what might happen in a few days with China if NEGOTIATIONS don’t progress. And right now, it’s not with the info we’re getting that you can get excited, thinking it will be a party in three days because everything will be fixed. We have two huge egos clashing, and it would be miraculous if Trump and Xi could solve everything on the first try. And what do you think would happen if Trump did the same thing to China as he did with Europe?

Yeah, I don’t really want to know either. But one thing I’m sure of: it will leave marks on global markets. Even if today — in Europe — we’re swimming in the joy of having gotten our moratorium back, not a day more. Nothing is settled, and it’s better not to sell the panda’s skin before killing it.

Back Above 12,300

Meanwhile, in Switzerland, they’re not pretending either. The SMI has bounced back, comfortably above 12,300 points. We’re breathing easier here too. But without forgetting the storm could return anytime. Because yes, Trump backed down. But stepping back is also taking momentum… And the Nestlé Waters trial, referred back to the Nancy criminal court for illegal dumping of waste in the Vosges, was postponed to November, partly because of the large number of witnesses, and maybe also because for now, it’s better not to rock a French government that’s looked like a mess for a long time, with everyone running to replace Macron.

Today, eyes will turn to Germany for consumer morale, Paris for inflation, and the United States for… everything else. Especially household confidence, which will say a lot about the American economic mood. We’re eager to see what comes out, given the recent weakness in American morale. After several negative figures, whether Trump has managed to raise his compatriots’ motivation remains uncertain, but one thing is sure: we can no longer do without him and his outspoken interventions. Otherwise, frankly, I wouldn’t know what to say in my columns.

And this week will also be the big moment of truth for NVIDIA. If the AI superstar disappoints, it won’t just be semiconductors that falter. The whole tech-bullish narrative of recent months will take a hit, but let’s not get ahead of ourselves. It’s only Tuesday, and Nvidia reports tomorrow night. Let’s remember, though, that the stock has gained 51% since April 7. Personally, I don’t know what’s priced in, but they’ll have to deliver on the past and not disappoint for the future, or it’s going to hurt the SOX, the tech sector in general, and the bulls badly.

In Asia This Morning…

This Tuesday, Asian markets opened in a “not quite sure” mode: flat or slightly down. The culprit is the anxiety over US tariffs hanging like a giant radioactive cloud. Trump postponed sanctions on Europe — we talked about that — but said nothing about smartphones, and it’s still painful for Asian tech. In Japan, the Nikkei fell 0.2% after Kazuo Ueda, BoJ’s head, threatened to raise rates if the economy picks up. Basically: inflation’s okay, growth is shaky, but we’ll tighten anyway. Honestly, between debt pressure and an economy going every which way — except the right one — I’d rather be Powell getting whipped by Trump every three days on Truth Social than BoJ’s chief trying to bail out the Japanese ship with a teaspoon. Overall, chip makers, gadget and component manufacturers fell, from Korean Samsung to Chinese Xiaomi. Meanwhile, US futures are up because Trump said “not yet the taxes.” So, a slow but tense day — like a stretched rubber band ready to snap anytime.

On Oil

A little calm. OPEC+ meeting is expected at the end of the week. Some voices anticipate a production increase. But everyone keeps in mind that as long as Trump blows hot and cold, nobody knows where global demand is heading.

Also, Trump insulted Putin — yes, he said the Russian President is completely crazy and he can’t accept him killing people anymore — so Trump is playing geopolitical heads or tails. I’m starting to realize that the letters “T-R-U-M-P” are worn out on my keyboard since all we talk about for 6 months is that. Meanwhile, Christine Lagarde is trying to sell us the euro as the next dollar. But before the euro becomes a global safe haven currency, Europe will have to build more than a common PowerPoint and two parliamentary committees on plastic bottle caps.

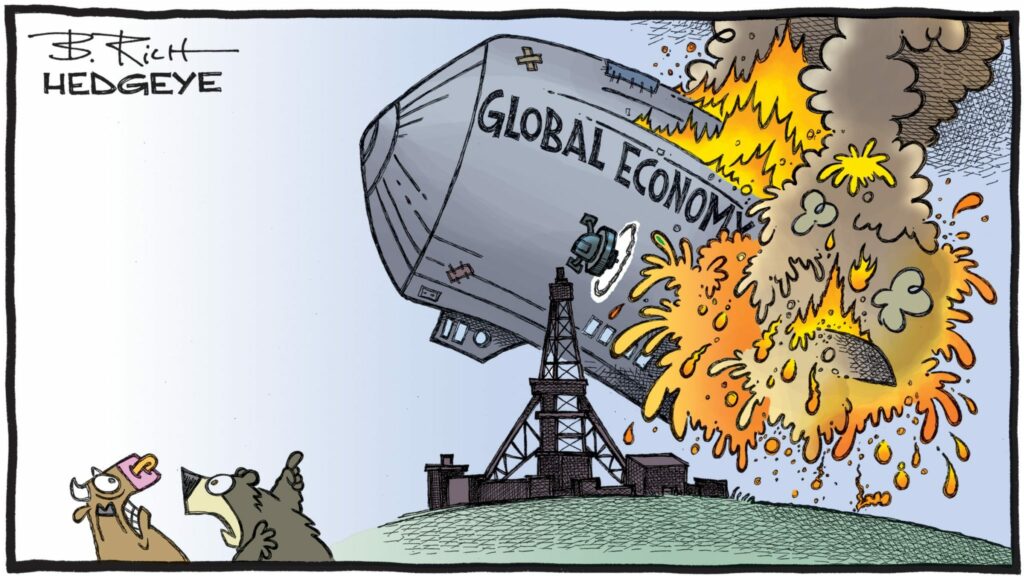

For the rest

What we see reflected in the markets is the arrogance of a global economic model playing with matches during a drought in the middle of a pine forest. Everyone knows that one incident could blow everything up, but as long as the music is blasting, we dance as if we never get tired. And above all, I think we must not forget the slight tension on U.S. interest rates. They were closed yesterday, sure, but are ready to bounce back starting today. The yield curve is just waiting for an excuse to start playing yo-yo again. And believe me, the drop in U.S. consumer confidence expected this week could be exactly the signal everyone fears… or hopes for, depending on our positions. Meanwhile, gold is at $3,367, Bitcoin is trading at $109,000, and the U.S. 10-year yield offers 4.486%. So far, so good.

In Germany, we keep an eye on signs of fatigue: consumer morale is slowly declining. In France, everyone awaits inflation figures with the same excitement as a tax notice. And in Switzerland, the watch industry is closely watching exports, praying that America still has a taste for five-figure watches. Add to that the geopolitical tensions tightening like a too-small thong. Trump threatens Russia, criticizes Ukraine, insults China, and negotiates tariffs with an hourglass in hand. Everything is fragile, everything can tip over, yet we keep believing that the markets will climb all the way to the sky. At least in Germany.

No transition

In short, a transition day that isn’t really one. Because everything is already here: tensions, risks, opportunities. And the week truly begins today. With the United States back at their desk, Trump conducting the orchestra, and the markets holding their breath. For now, U.S. futures are up 0.9%, and that’s been going on for 24 hours — now we just have to hold it until the open.

Have an excellent day and I’ll see you tomorrow for a special all-green NVIDIA day…

See you tomorrow!