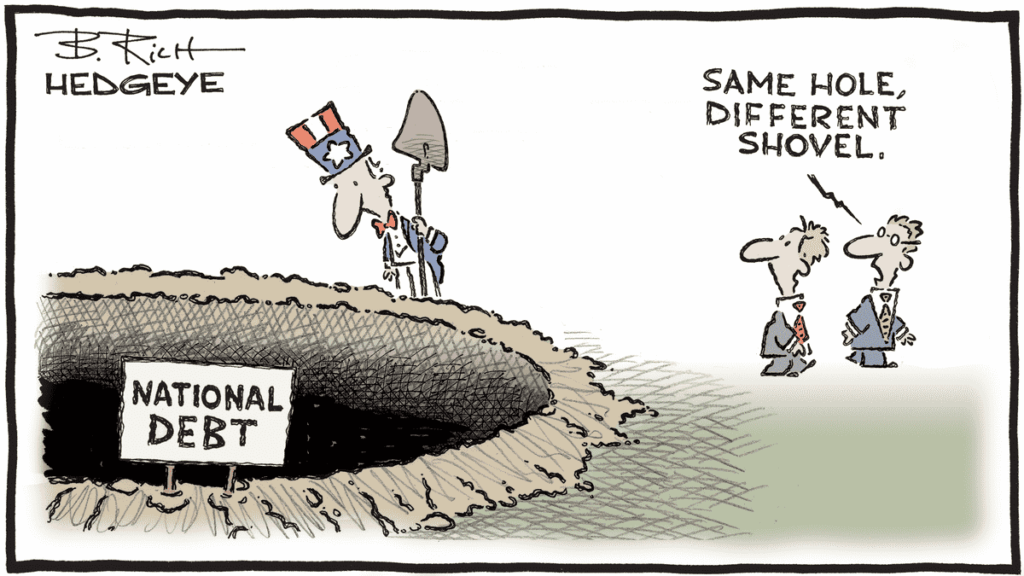

Markets are rising, the economy is slowing, interest rates are screaming for help—and no one cares. Why is no one paying attention? Well, because Trump postponed his economic weapons of mass destruction against Europe. Nothing has been resolved, but we’re celebrating the delay—classy behavior from the world champions of short-term vision. While we wait for Nvidia’s earnings tonight and the PCE inflation report on Friday, the stock market is running on narrative life support. Artificial euphoria and smoky hopes for some mysterious economic miracle. Meanwhile, as the indices throw a party, bonds are groaning, debt is overflowing, and the US Treasury is trying to fiddle with the rules to calm long-term yields. It’s all stand-up comedy, empty words, and wishful thinking.

In short, we’re living in the illusion of stability… with Nvidia as the final judge. At least until tomorrow night, when it’ll already be time to move on. Honestly, doesn’t it feel like we’re living in a stage play, and none of this is real? We’re in a theatrical farce of markets, geopolitics, and monetary policy. The script is always the same, and it feels like we’ve seen the episode before and already know how it ends. Like Netflix messing up the order of its series, and we’re stuck watching entire seasons out of sequence, trying to make sense of it all as we go.

In the current never-ending episode: Donald Trump threatens, markets panic, Trump backs down, markets rejoice… Boom—two days of rally on a non-event, a mere deadline postponement that resolves absolutely nothing.

The stock market now runs on tariff-induced dopamine, addicted to unpredictability, clinging to every Trump tweet or wink. And this week, the ride started again: the 50% tariffs on European goods, initially set for June 1, are postponed to July 9. A simple “we’ll see later” that was enough to spark widespread euphoria in the markets following the start of a “love story” between Trump and von der Pfizer. We don’t celebrate economic results anymore—we celebrate the postponement of chaos. It really feels like we’re going in circles. I feel like I’m rewriting yesterday’s column, except this time it’s the Americans who benefited from Sunday night’s announcements. Can’t wait to get back to actual facts instead of operating based on the lyrical outbursts of the Pied Piper in the White House.

Over to New York

On Tuesday, Wall Street soared. +741 points for the Dow Jones, +2.05% for the S&P 500, +2.47% for the Nasdaq. Investors, still hungover from the extended Memorial Day weekend barbecues, rushed into stocks as if Trump had just signed a global economic peace treaty, dropped the tariff strategy, opened U.S. borders to everyone, and found a cure for cancer between Monday night and Tuesday morning. But let me be clear: this rebound is built on sand. Because in reality, nothing has been resolved. Trade negotiations with Europe are still deadlocked. Trump just offered a tactical pause, a tax carrot, and the illusion that we’re all buddies.

Meanwhile, the global economy is holding its breath—not a matter of “if,” but “when” the next hammer blow will fall. We all know he’s going to pull something else—probably with China. We know full well the American President isn’t going to just “magically” move on and forget about the topic. He’s going to strike again—at someone or something, or both. And that’s the current paradox: markets are celebrating sanction delays as if they were massive economic stimulus packages or long-term solutions, while macro fundamentals are screaming instability. Right now, all indices are on life support and we refuse to see the risk in favor of hoping for a miracle. Everything hangs on expectations. Expectations of data, speeches, political or tech miracles. And it’s precisely this buildup of expectations that makes the situation both unstable and hypnotic.

The Day After Yesterday

Let’s not kid ourselves—yesterday, the U.S. was in full party mode to celebrate the postponement of the tariffs to July 9. It’s not a guarantee—it’s a sugar cube to make the Europeans think we’re friends. But behind the scenes, Trump’s got his fingers crossed, and at the first opportunity, he’ll hit us again. But no matter. Now that yesterday’s session is behind us, the celebrations are over, and the S&P 500 is just 3.6% from its all-time high, we can “RE-focus” on this week’s expectations. Two crucial milestones ahead—and when I say crucial, I mean it in ALL CAPS and bold font. First: Nvidia’s earnings tonight. Then: the PCE inflation report on Friday. Two events that will be revealing. Because despite the festive start to the week, the backdrop remains blurry. Like my screen in the morning when I’ve left my glasses at the restaurant and have to set Word to Arial 25 to see anything.

The economy is slowing, long-term yields remain high—yes, they dipped slightly, but they’re still too high—debt is exploding, yet we keep buying. Because we hope AI will solve everything. Because we hope Trump will negotiate with kindness and goodwill. And above all, we buy because we have no choice. The hype must be maintained with more hype, or else it’s no fun. In Europe, since we already cheered the “July 9 deals” on Monday, we didn’t move while waiting for more info. Understandable. Paris stagnated to digest Monday’s nice rise. Frankfurt clung to its records, but with trading volume at historic lows. It’s like everyone is on pause, ready to react, but with zero conviction for now. In Switzerland, the SMI gained +0.06%, helped by Richemont (+1%) and booming watch exports to the U.S. (+149%)—let’s just hope Trump didn’t see that number, or he might slap a special tax on Swiss watchmakers who don’t manufacture in the U.S.

In summary, a strong recovery day in New York, and a maximum boredom session in Europe because no one knows what to do—and ON TOP OF THAT, tomorrow is Ascension Day.

The Noose is Tightening

While stock indices play musical chairs, the real game is happening in the trenches of the bond market. The U.S. Treasury plans to issue $183 billion in debt this week. Yesterday we got the first round: $69 billion in 2-year notes. A decent result with a yield at 3.955%, and demand slightly better than in April. Foreign central banks took 63.3% of the offer. Not great, but not as bad as last time. That gave markets a slight sense of relief—but not enough to declare victory.

The real moment of truth is in Japan. This Wednesday, Tokyo is issuing the equivalent of $3.5 billion in 40-year bonds. And that’s where danger lies. The last 20-year issuance was a disaster. No one wanted it. The result: a mini bond crash in Japan that rippled across the globe. If this 40-year auction flops too, we’ll have proof that a threshold has been crossed. That the digestion of debt is becoming indigestible. That the party may be over.

And it’s in this context that Scott Bessent, head of the U.S. Treasury, wants to play firefighter. His idea is to tweak the “Supplementary Leverage Ratio” (SLR). This post-2008 rule forces banks to hold a capital cushion even against so-called risk-free assets like Treasuries. Bessent’s proposal is to loosen this rule, to encourage banks to return to the public debt market.

In theory, that should boost demand for Treasuries and lower yields. In practice, it’s not that simple. Remember Silicon Valley Bank? A bank that blew up because it bet too heavily on long-duration bonds without hedging. Since then, banks have been wary. And even if regulators give them more flexibility, that doesn’t mean they’ll rush back to gorge on 30- or 40-year debt.

One strategist summed it up perfectly last night: “Even if they loosen the SLR, banks won’t move. And if they don’t, who has to step in? Yep – the Fed. Again.” And so begins another round of disguised monetary easing, market life support, and a system addicted to regulatory morphine—unable to stand on its own without central bank help. Not sure this so-called miracle solution is much of a miracle after all.

Artificial, but Not So Intelligent

And in the middle of all this stands Nvidia. The king of AI. The last of the “Magnificent Seven” to report earnings. The one company that can make or break an entire quarter by itself. Since April, tech has erased its losses thanks to a spectacular AI-driven rebound—and last night, it was once again tech pulling the market higher. Nvidia is up 56% from its April lows.

But tonight, it’s time to deliver. The market expects revenue of $43.3 billion, earnings per share of 73 cents, and +74% growth in data center revenue (down from +93% previously). But raw numbers won’t be what matter most—it’s the message. The storytelling.

Can Nvidia survive the decoupling from China? Will the imminent launch of a stripped-down, regulation-compliant Blackwell chip be enough to regain footing in the Middle Kingdom? Can margins rebound after falling to 58%? In short: can Nvidia still carry the AI narrative that justifies the delirious valuations slapped on certain US tech darlings? That question will be answered tonight—loud and clear.

Because if Nvidia disappoints, the house of cards could start to wobble—seriously. And not just for tech stocks. The entire current logic of the market—the idea that “we invest in the future because the present is too ugly”—could be called into question.

In short, we are living in an illusion of stability. A perfectly staged performance where hope trumps facts, where yields rise while stocks soar, and where the real economy is buried under a pile of chips, narratives, and political tweets.

Tonight, Nvidia isn’t just a chipmaker. It’s the emotional barometer of a market in deep addiction. And if Nvidia sneezes, it won’t just be the Nasdaq reaching for the Tylenol—

the entire system will be looking for a new dealer.

And the Rest

This morning, Asia rode the wave of post–Wall Street euphoria: Trump delays his tariffs, and everyone breathes a sigh of relief. Tech stocks are leading the charge, boosted by Xiaomi and anticipation ahead of Nvidia’s big earnings reveal. In Seoul, the KOSPI is soaring, driven by chip suppliers. But in China, it’s a different story: PDD disappointed, consumption is stalling, and deflation is lurking. Even a stellar Xiaomi can’t make up for it. The result: a two-speed Asian market, hanging on AI magic… and Washington’s mood swings. The Nikkei is up 0.3%, the Hang Seng is down 0.5%, and China is up 0.07%. But still without a license to kill.

On the oil front, prices are starting to recover: Trump banned Chevron from exporting Venezuelan crude, and just like that, supply tightens. As a result, prices are creeping back up—now at $61.22—and meanwhile, OPEC+ is pretending to consider increasing production in July. In parallel, Iran and the US continue their awkward nuclear tango, and refineries are beginning to sweat. Gold is at $3,324, Bitcoin at $109,000, and the U.S. 10-year yield is at 4.47%.

Still More

In today’s news, Salesforce is dropping $8 billion to acquire Informatica, the king of data cataloging, to beef up its AI game. Markets are cheering: +6% for Informatica, +1% for Salesforce. Behind the deal is a promise of “truly autonomous” AI agents—but more importantly, it marks the beginning of a tech arms race that’s only accelerating.

Meanwhile, Trump is talking about new sanctions against Putin—there’s not a day that goes by without a verbal jab at his Russian counterpart. But beyond that, I just skimmed the front page of the Wall Street Journal, and it’s absolutely wild how half the highlighted articles start with: Trump, Donald Trump, or President Trump. I don’t remember this level of media saturation during his first term. I’m not sure if it’s worrying—but annoying? Definitely.

As for today’s key data, you already know about Nvidia, and the FOMC meeting minutes coming out tonight (which won’t tell us anything new). But we’re not talking enough about the French GDP, as well as consumer spending in France. Consumers who will be spending less and less, considering the sacrifices the “GENIUS BAYROU” is about to ask them to make.

In short, today brings French GDP, consumer spending, and unemployment figures from Germany. Several Fed officials will also speak to reiterate that rates won’t be coming down—but the one we’ll all really be listening to is Jensen Huang, after the close.

Have an excellent day and a great Thursday holiday. See you Friday for the recap. Or maybe tomorrow… if there’s REALLY something worth talking about—like Nvidia crashing 35% after hours.