After a three-day weekend, it’s always a bit of a moment for reflection. Especially when you know that the rest of the world was more or less open — you kind of feel like you missed something. Yet the American and European markets kept going without us. Which, in turn, allows us to return this morning fresh and ready to analyze everything that happened over those three days.

And to be honest, the main takeaway is that the markets are indestructible. And until we get more details on the outcomes of the U.S.-China trade negotiations and on inflation — particularly the impact of tariffs on inflation — we have no other choice but to keep going up.

Monday Thoughts

Before diving into the details of the recently published figures, I think it’s worth taking a step back to reflect on what’s going on right now.

Let’s start with the U.S. indices, which are just a few points away from their all-time highs. Regardless of the actual economic situation in the U.S., the market is focusing on the geopolitical side — namely: tariffs and the many shows Trump puts on TV, the latest of which is the deployment of the National Guard to Los Angeles to calm down rioters or start an actual civil war.

At the moment, Wall Street seems largely unconcerned by all this. But we can’t rule out the possibility that things could escalate quickly if members of Congress or the Senate begin to feel personally affected. This could quickly morph into another power struggle: the debt ceiling.

Indeed, if Trump keeps falling out with everyone, even his most fervent supporters might feel like asking him to dial it down — through negotiations over the debt ceiling. Just as a reminder: a solution must be found before this fall, or the U.S. risks defaulting.

Another Hot Topic: U.S.-China Negotiations

Another issue keeping everyone on edge at the start of this week is the negotiations between China and the U.S. These talks began yesterday and are supposed to resume this morning. So far, there’s been no news, not a phone call, not even a postcard. For now, we’re clinging to the idea that “as long as they’re talking, it’s a good sign.”

But let’s be honest: we need clarity. Ideally, we need more than yet another moratorium extension — we need a real deal, real clarity in the relationship between the two countries.

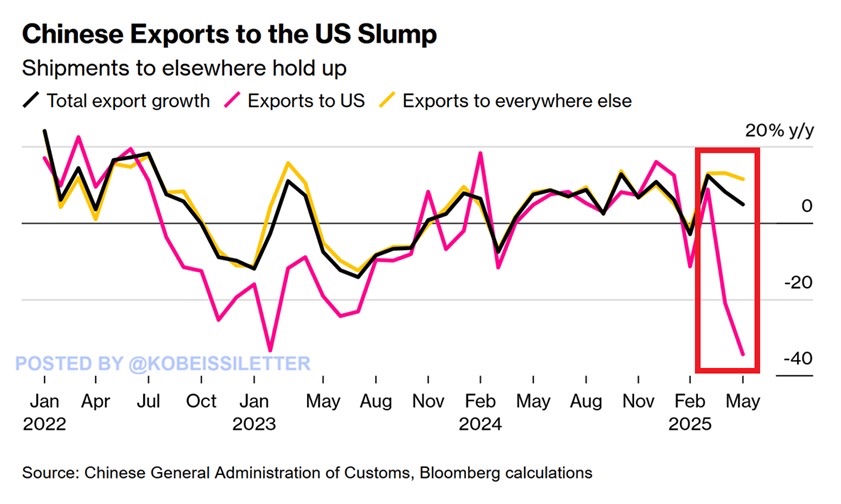

In the meantime, China is virtually at a standstill, and each passing week makes things a little more complicated. The latest figures show that Chinese exports to the U.S. dropped by 34% in May. That’s the biggest hit since February 2020. It’s also the second consecutive month of decline — demand for Chinese products is collapsing. Moratorium or not.

Let’s not forget that tariffs are still at 30%. At the moment, it’s worth noting that China is exporting massively to Vietnam, hoping to use the backdoor to reach the U.S. market. To put it simply, global trade isn’t in great shape due to tariff uncertainty, and Trump’s methods are beginning to show visible damage — not yet necessarily in the U.S., but for how much longer?

Inflation and Tariffs

We’re currently in wait-and-see mode regarding the tariff negotiations with China, and we still don’t know any more about what’s happening with Europe. Ever since Trump gave Ursula those sweet eyes, we haven’t heard a thing. So, we could say “no news is good news,” but at the same time, it kind of feels like we’re sailing blind in a stormy ocean filled with hostile creatures that could jump on us at any moment.

People always say global markets hate uncertainty — and right now, we’re getting plenty of it.

But that’s not all, because in the middle of all this, there’s also inflation lurking just around the corner. And this is another layer entirely — we’re no longer just watching inflation by itself, but also closely monitoring when tariffs will start impacting said inflation.

Let me take a quick step back: ever since tariffs have become a major topic, the so-called EXPERTS IN FINANCE AND TRADE TARIFFS (who, by the way, can double as experts in pretty much any topic trending in the media) — these very experts told us that the impact would be felt in May — or June at the latest.

Except that all the recent inflation numbers have pointed more toward a rather tame inflation, drifting back toward the 2% target. Yet with every new data release, the same experts come back and say: “Oh no, not yet — you’ll see the impact next month.”

And then this morning I came across an article saying the impact might show up rather toward the end of the summer. And who knows, maybe before summer ends, they’ll reach a deal and the impact will never come.

In the end, maybe Trump is right when he says there’s no inflation and that Powell is completely nuts for not cutting rates by at least 100 basis points…

In any case, one thing is certain: we’ll have a chance to talk about this again this week, since the U.S. CPI is coming out tomorrow.

All things considered, if we ask ourselves how the markets are feeling right now, it seems like nothing can shake our belief in this bullish trend. The fear that gripped us during Liberation Day on April 2nd is now under control — or at least buried deep inside us. Kind of like the monster that used to live under our childhood beds.

And even if inflation does pick up again, it’ll be seen as “expected,” and Trump will surely find a way to calm things down — so record highs on the S&P 500 should be nothing more than a formality this week.

A Mere Formality

A formality — because the things that could make us doubt are already priced in, and no one wants to believe in a NO-DEAL scenario with China anymore, or in a dramatic comeback of inflation. Because without a deal with Trump, China could be pushed to the brink, and I’m not so sure that a China in recession would be a positive thing for the global economy.

As for inflation, we all want to believe that things will go smoothly, and that a miracle will happen. Even though we’re all fully aware that a resurgence of inflation right now would be a very bad signal for the economy — and even worse for Powell, who’s been trying to contain it for four years now, ever since he realized it wasn’t really under control and certainly not “transitory.”

So, we can look at it however we want — but if you open a history book, you’ll see that every time we’ve played the tariff card to try and push protectionism, it’s ended poorly for the consumer. In other words: for you and me.

So, if we start from the assumption that tariffs are inherently inflationary, there’s no miracle here: INFLATION WILL come back. And POWELL CANNOT, MUST NOT cut rates, or it’ll only make things worse. We now find ourselves in a Kafkaesque situation — Powell can’t and won’t lower rates, because stimulating the economy while inflationary pressures are expected is like trying to put out a fire with gasoline. And yet TRUMP demands a rate cut to boost the economy.

But if you cut rates, you stimulate demand. If you raise tariffs, you increase prices. And if you stimulate the economy while inflation is about to rebound — it CANNOT end well…

Or Maybe: It’s All Rigged

So, when I have these kinds of thoughts on a Tuesday morning, I start thinking something doesn’t add up. On one hand, last week we were given job numbers that suggest the labor market is booming. And on the other, we’re being told inflation doesn’t exist. Or almost.

How can anyone say that the economy is in top form, the labor market is laughing, and at the same time inflation is gently slowing down? In what kind of narrative does that make sense? Unless, of course, the numbers being published are carefully cleaned up to hide what’s inconvenient — or the market is so resilient now that it filters the truth all by itself.

And that’s exactly what happened last Friday with the NFP report. While everyone expected a lousy month, the BLS released a number that was just slightly better than expected: +139,000 jobs in May, vs. 125,000 expected. Unemployment is stuck at 4.2%. Nothing is moving. Suspiciously so, actually.

Wages? Up +0.4% for the month and +3.9% year over year. But be careful — behind those good-looking numbers, something doesn’t feel right. The April figure was revised downward: –30,000. March as well: –65,000. So on one hand, the NFP report announces +139,000 jobs created — that’s 14,000 above expectations — and the market cheers, without giving a second thought to the 95,000 jobs that were quietly removed from previous reports. That’s what we call selective analysis — or maybe I don’t know what I’m talking about.

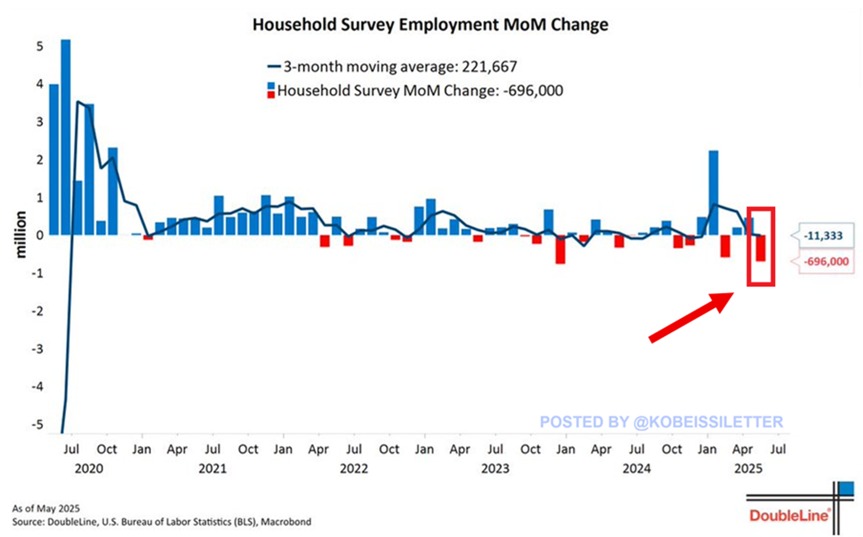

And then there’s another number that came out which no one is talking about: the Household Survey. This survey showed a completely different picture: 696,000 people lost their jobs in May — the second worst monthly drop since 2020. This survey is often seen as more accurate since it counts each worker only once, even if they hold multiple jobs.

And on top of that, we also learn that 625,000 people left the labor force last month. Bottom line: the numbers don’t match. And it’s starting to become really obvious.

Abyssal

So. Last Friday, America proudly announced the “creation” of 139,000 jobs, but in another stat, we’re told that 696,000 people lost their jobs. Don’t bother doing the math, that’s 835,000 jobs. It’s an abyss, a statistical black hole. At this point, even an intern at Lehman in 2008 would’ve said: “uh, guys, isn’t this a bit weird?”

And yet, based on these numbers, the indices ended higher and kept rising this Whit Monday and probably still are today — simply because no Chinese or American negotiator has stormed out of the trade talks, and that alone is considered good news. Now we just need the CPI to drop tomorrow, so Trump can go ballistic on Powell, calling him a traitor to the nation. If he doesn’t cut rates, Trump might just have him shot. And yes, of course, the pessimists will say: “Yeah but the tariffs will push inflation up by the end of summer!”

To which the market replies: “Pff, end of summer is ages away…”

That’s where we are this morning: already gearing up to find the right excuses to keep seeing the glass half full, to keep finding reasons to climb higher. And I’ll even tell you this: I’m convinced we’re going higher. As long as we live in this geopolitical mess, as long as instability and uncertainty reign, chances are we’ll keep wanting to believe that tomorrow will be better.

Anyway, there’s no longer ANY CONNECTION between Wall Street and Main Street. And as long as Main Street doesn’t move, doesn’t complain, doesn’t take to the streets, Wall Street keeps its smoke screen running, its illusion machine making everyone believe everything’s fine. And everything is fine! For now. And as we all know, when you fall from the top of an 80-story tower, it’s not the fall that hurts — it’s the landing.

But until then, we’re doing just fine. Even if we can clearly see the pavement now. All that’s missing is for us to find out those published numbers are fake. But of course, that’s not possible.

Elsewhere

Asian markets are optimistic this Tuesday, buoyed by hopes of easing tensions in the US–China trade war. A classic start-of-week story. Trump is reportedly considering lifting some restrictions on chip exports to Beijing, boosting investor confidence. Of course, one “tweet” and everything’s magically resolved. The US President has supposedly given Scott Bessent and his team free rein to ease tech restrictions, hoping China will give some ground on rare earth exports.

China is up 0.11%, Hong Kong 0.32%, and Japan is climbing 1%.

China’s enthusiasm is still dampened by disappointing economic data: weak exports in May and slowing inflation — crappy figures released yesterday, reinforcing the impression that China is in such a situation it has no choice but to find a solution in negotiations.

Gold is at $3,328, oil keeps climbing — now at $65.60 — despite all news that should push it down. Trump wants to reopen talks with Iran, OPEC wants to increase production, and still, it rises.

Bitcoin is at $109,650, and the US 10-year yield is at 4.49% — also climbing…

In other news: Tesla is rebounding, but the week remains grim. The stock gained 4.5% yesterday, but last week saw a 15% drop — its worst since October 2023. The main culprit? The media clash between Musk and Trump.

Still, Tesla isn’t just Musk, and the market is watching closely for the launch of the robo-taxis announced in Austin this Thursday… though Tesla hasn’t officially confirmed anything.

Apple disappointed at its developer conference. The stock dropped 1.2% for the session, and it’s all due to what was said at WWDC — or rather, what wasn’t. The AI update to Siri is delayed. Apple says it “needs more time,” without giving a date. One analyst said last night that if Steve Jobs had seen yesterday’s event, he would have been “disgusted” by the lack of innovation. Apple is still down nearly 20% on the year.

Robinhood and AppLovin were rejected from joining the S&P 500. Other candidates like Cheniere Energy and Interactive Brokers were also turned down. In the end, the S&P 500 stays as-is. Much ado about nothing.

Meanwhile, Nvidia keeps charming the world with its AI tour. Jensen Huang got a rockstar welcome — reportedly better than the Beatles ever received. He opened London Tech Week hand in hand with the Prime Minister.

Also

In US health news, Robert F. Kennedy Jr. fired all members of the CDC vaccine advisory panel without warning, via an op-ed in The Wall Street Journal. This move breaks his promise to the Senate to follow proper procedures.

Kennedy cites longstanding conflicts of interest. The scientific community is deeply concerned about who will replace them, and what ideological shift may follow. The committee is set to meet in two weeks — but no one knows who’ll be on it. Casimir’s unavailable, and Bozo the Clown isn’t free either. Apparently Olivier Véran and Agnès Buzyn applied, given their “experience.”

Elsewhere, OpenAI has reached $10 billion in annual recurring revenue, according to a spokesperson. A stunning figure just two and a half years after launching ChatGPT. Revenues come from consumer plans, business products, and API usage.

And over in Los Angeles, Trump just sent in the Marines. After deploying the National Guard, now it’s the army. I’m not sure this is going in the right direction, but in the meantime, we’ll focus on tomorrow’s CPI and make sure our blinders are firmly in place.

We’ll end with Qualcomm, which jumped 4.1% after announcing the acquisition of UK-based Alphawave IP for $2.4 billion. The goal: to strengthen its capabilities in high-speed, low-power chips essential for fast data transfer.

Today’s Numbers

As for today’s figures — there aren’t any. Well, nothing major except SECO in Switzerland, which will provide insight into Swiss consumer sentiment.

Doubtful that it will overshadow the negotiations in London.

After the close today — if anyone still cares — GameStop reports earnings.

Futures are currently up 0.42%, because everyone’s confident everything will go just fine in London and everywhere else too, for that matter.

Everything is rising, everything is fine, nobody understands anything, but everyone pretends it’s normal. As long as Trump tweets, Powell doesn’t panic, and China doesn’t walk out, the party continues.

And if inflation comes back? No problem, we’ll sweep it under the rug with a big smile and a doctored chart.

So yeah: everything’s fine.

Until the day it isn’t. And when that day comes, we’ll say: “Nobody saw it coming.”

As usual.

Have a great day, and see you tomorrow for another blast of optimism!