On April 30, Donald Trump will celebrate his 100th day in the White House.

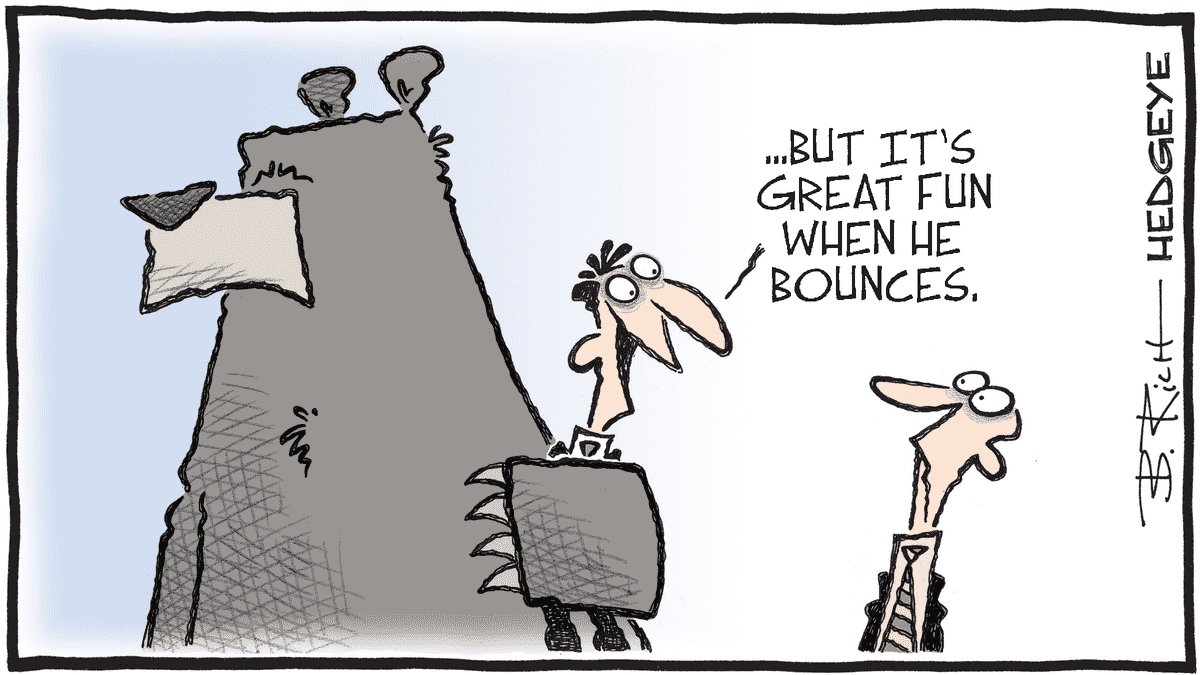

The first assessments are starting to come out, and there’s a lot of talk about the number of Executive Orders he has signed — currently sitting at 137 — and that’s clearly better than his predecessors. However, what really matters to us as investors is that the President has created an unprecedented mess in the global stock markets. Things seem to be settling a bit in the last few days, and the rebound is, for now, SPECTACULAR. But confidence has been replaced by doubt, and we’re still walking on eggshells. Even if markets are regaining some color, caution is still the order of the day.

Surgical precision

It’s never easy to know “why the market goes up or why the market goes down.” Sometimes it’s due to minor things, sometimes it’s very clear and obvious — but right now, since nothing has been the same since January 26, it’s a mix of many factors that drive the extremely violent movements of global markets, especially the U.S. ones. And yet, amid the avalanche of news flooding us daily for the past three months, there is one common denominator: Donald Trump.

Donald Trump, who could also be described as a “multiplier of volatility,” or a “stress emancipator,” or even a “mass producer of tariffs.” But we wouldn’t be fully accurate in our analysis if we didn’t also acknowledge Trump’s HUGE contribution to green energy — since by flipping his position every 24 hours, he’s generating enough electricity to power Washington for the next 12 years.

Yesterday again, it was nearly impossible to find a SINGLE news story where Trump’s “brand” wasn’t stamped in capital letters.

Sure, one of the main reasons for the recent rally is still the Champions League-level backpedaling on Chinese tariffs and the whole Jerome Powell situation, but beyond that, it seems like every company releasing earnings right now is mentioning the issue of tariffs — both in their current results and in their hesitant forecasts for the months to come. So let’s try to unpack yesterday’s session. I say “try,” because right now it feels like unless I keep it simple and go straight to the point, we’re going to need 18 pages and a one-hour podcast to cover it all.

So let’s start from the beginning.

The guy says “let’s start from the beginning” after a whole page of verbal diatribe about Trump. We’re not out of the woods yet.

Markets are happy, and so are the Americans (well, maybe)

First, the numbers. Yesterday, European markets were pleased by Powell’s comeback and the “easing” announced by Scott Bessent regarding China — not to mention Trump’s comments saying they were going to “be nice” to the Chinese.

If we dig a little deeper, some economists are starting to say that in this trade war, the Americans actually have more to lose. It’s not by much — maybe two cargo ships of soybeans and a load of semiconductors — but still.

Yesterday, Europeans were relieved and could FINALLY focus on their quarterly earnings. In the “quarterly results buffet” category, Dassault Systèmes kicked things off in depressed mode: net profit down 8.8%, 2025 margin revised downward, and BAM! -5%.

Thales followed with weak order intake, resulting in a 4% drop after flirting with -5% at the open — surprising, as it was one of the darlings of European rearmament, now seemingly fizzling out.

Kering continues to slide, with sales plummeting 14% and the tone becoming as upbeat as a rainy November day in Brest. We talked about it yesterday.

Worldline got a real smackdown: -11.43% after losing a major contract and reporting gloomy revenue figures.

Luckily, Renault came to the rescue with a +4.4% boost thanks to strong EV sales — I almost bought an electric Alpine yesterday.

And Orange did its job quietly with international growth and a gentle +0.36%.

In Switzerland, there was joy over Roche’s results, cautious optimism at Nestlé, solid happiness at Kühne + Nagel, and a boom for Belimo and Galderma.

Vontobel posted a positive performance for Q1 despite political uncertainty and rising volatility. Assets under management increased, but the stock wasn’t rewarded — it dropped 3.3%.

At the end of this crazy day where the word “uncertainty” was used an incalculable number of times (thank you Mr. Trump), the DAX was up 0.47%, France advanced 0.27%, and our good old Swiss SMI gained almost 1%, nearing the 12,000 mark.

But you could still feel a sort of uneasy sensation in the European markets — that stomach-churning feeling. Not the one you get after eating six dozen bad oysters that hitchhiked from Arcachon, no! More like the one where, deep down, you just know that as soon as you turn your back, Donald Trump is going to mess things up again.

But no!

Well, for once, we were wrong.

Europe ended slightly higher, wondering whether the China/Powell dynamic would be enough to keep the U.S. afloat through the close and whether Trump would unleash one of his trademark statements. And he didn’t. Or rather, he did — but not in the way we feared.

Basically, just minutes after the European close, the S&P 500 started rising a little faster, despite a complete lack of news.

Absolutely nothing was happening.

Everyone was watching the S&P rise and thinking, “Hmm, why is this going up???”

And then suddenly, Trump announced that “discussions had begun with the Chinese.”

After weeks of mutual attacks via random percentages, the two giants finally agreed to talk it out in front of a therapist.

The indices skyrocketed, ending the day with a bang, and the Philadelphia Semiconductor Index went nuts, soaring 5.63%.

It has rebounded 24% from its lows but still needs to climb another 40% to reach all-time highs. That’s how badly it got battered these past eight months.

But now, if “talks begin” and they all end up being best friends forever, it’s going to be a party.

But the story doesn’t stop at the close — that would be way too simple — no, because we love things to be messy and full of doubt and suspicion.

First thing to note is that U.S. indices curiously accelerated ONE HOUR BEFORE Trump announced the thaw with China.

As always, whenever the President announces something bullish, the market rallies before he says it.

Almost as if, while he’s drafting his press release, someone’s already out shopping because they’re better placed in the info chain.

It reeks of insider trading, but the guy from the SEC, appointed by Trump, seems to be deaf, blind, mute, and also — let’s say it — completely clueless. Or maybe he’s the one doing the buying…

Anyway, once again, some people probably ended the evening sipping Dom Pérignon — even if it’s 100% more expensive than two months ago.

And then the other hilarious part: right after Trump’s announcement, the Chinese declared that they weren’t aware that any negotiations were underway…

Since then, Trump and Bessent have been ranting on CNBC, CNN, and Pif Gadget to explain that, yes, yes, they are talking with the Chinese, and for now, it’s all secret, but once a deal is signed, we’ll hear everything…

Maybe the guys just had dinner at “The Simmering Tiger,” the Washington branch of “The Greedy Panda” in Beijing, and since the owner’s Chinese, they think they’re negotiating with Xi Jinping’s delegation.

Anyway, the S&P 500 gained 2%, climbing out of correction territory, and the Nasdaq jumped 2.74%.

And the Chinese and Americans are talking — as far as we know.

For now, we’ll believe everything’s going to be just fine.

In Asia, precisely…

Asian markets are wrapping up the week on a high note, mainly thanks to tech stocks following the fireworks on Wall Street after Alphabet’s (a.k.a. Google’s) stellar results. Japan absolutely soared during the session: even though the CPI came in a tad too strong for the experts, investors chose to latch onto hopes of positive trade talks with the U.S. rather than panic over a potentially more aggressive Bank of Japan.

In short, everyone hopped on the Wall Street train, which ended with a bang last night, boosted by excitement over a potential thaw in relations and some subtle hints from the Fed suggesting it might continue cutting rates if needed (and when you look at some of the numbers, you could argue it will be needed soon).

Bottom line: everything’s fine… until it’s not.

The Nikkei is up over 2%, the Hang Seng is rising 1.36%, and China is up 0.15%.

Oil is sitting at $63.21, still influenced by the tricky U.S.-Iran negotiations. No surprises there.

Gold is at $3,332, and Bitcoin is trading at $93,200.

Elsewhere…

The market is flooded with quarterly earnings, but the star of the show is Alphabet. Google’s parent company smashed expectations and was up 6% after-hours. Alphabet flexed some serious muscle: EPS way above expectations ($2.81 vs. $2.01), a beefy $90 billion in revenue, and as a cherry on top, a 5% dividend increase. To make a good impression, the board also approved a $70 billion share buyback—like it’s pocket change.

Google isn’t a search engine anymore, it’s a cash-printing machine.

One slight hiccup: whispers are floating around Wall Street’s backrooms that matching this Q1 performance might be tough for the rest of the year… BECAUSE OF POLITICAL AND ECONOMIC UNCERTAINTIES, of course.

And then…

Also in earnings news, yesterday marked the first public appearance of Intel’s new CEO, Lip-Bu Tan. Let’s just say there were no fireworks: revenue forecasts below expectations, breakeven earnings, and a gloomy vibe thanks to the China-U.S. trade war. Investors were hoping for a Rocky Balboa-style comeback plan—they got a cost-cutting PowerPoint instead.

Intel is tightening its belt: less spending, less investment, and maybe soon… less hope? In short, Intel wants to streamline everything—even the good news. The stock dropped 5.7% after hours. We’re not back to the 1990s Intel success story, and it’s doubtful we’ll see those days again.

That said, the CEO did mention meeting his counterpart at TSMC, and they now consider themselves “partners.” Maybe a merger is the best thing that could happen to Intel.

While Intel struggles, ServiceNow steals the show: strong results, jam-packed order books, and a chunky 15% stock jump to celebrate that AI isn’t dead. Contracts over $5 million are pouring in (508 of them!), and even the typically cautious federal sector seems ready to say, “Okay, let’s automate.”

Despite a macro context that’s not exactly thrilling, the company delivers, reassures investors, and surfs the AI wave like a pro. As a result, analyst upgrades are rolling in, investors are popping champagne, and the stock gained 15% after hours.

Meanwhile, Pepsi’s numbers were “meh” and their guidance sucked—BECAUSE OF POLITICAL AND ECONOMIC UNCERTAINTIES, of course—joining other companies like Procter & Gamble and American Airlines with the same storyline.

Oh, and for the macro geeks out there (even if no one seems to care about macro lately): jobless claims were higher than expected last week. That number doesn’t mean much on its own, but a few days ago, we were saying the last pillar of the economy was employment… now imagine if that falls apart before a China trade deal is signed.

The numbers and the takeaway

What you need to remember from yesterday’s session is that things are clearing up with China, Powell seems to be out of the picture for now—but the rate cut issue is far from resolved.

U.S. debt levels keep rising, economic numbers show a slowdown, and if next week’s PCE comes in below expectations and employment stalls, the odds of a Fed move in May could shoot up faster than a Donald Trump flip-flop.

We also need to remember that one off-script comment from the President could throw us into correction mode. Let’s just hope his team manages to keep him muzzled for the next three weeks—just long enough for us to get our heads straight.

As for today’s session, futures are up 0.37%—apparently, people still trust Trump. At least more than they trust China’s official statements.

And economically, not much to expect today except the University of Michigan’s Consumer Sentiment Index—probably the most questionable macro number in the U.S.—and it’s likely to be ugly, just to keep Powell under pressure.

On the corporate front:

In the U.S. – Schlumberger, AbbVie, Phillips 66, and Colgate

In Europe – Safran, Lagardère, and BB Biotech

Wishing you a great weekend, and just a heads-up: Monday morning’s tone might be very different depending on what Trump says—or how he scores on the golf course this Sunday! 🏌️♂️⛳