We’ve been waiting for it — the new week. And it kicks off with yet another classic Trump “show,” the kind only he can pull off. The hot topic right now? The potential firing of Jerome Powell — and that’s what sent the market spiraling this Monday, April 21. No, it’s not the Pope’s death — it’s just another mess carefully crafted by Trump. It’s not every day you can compare a trading session to the Great Depression, but the Dow Jones is on track for its worst April since 1932. And the S&P 500 isn’t exactly laughing either, after having its sixth day this month with losses greater than 1.5%. That hasn’t happened in three years.

Powell under pressure

This story isn’t new, but clearly it’s been stewing all weekend. Last Thursday, Trump went after Powell and gave him some lovely nicknames. He now calls him “Mr. Too Late” and also used the term “major loser.” Amid all this, he suggested — or maybe his press team did — that he’s exploring legal ways to fire the Fed Chair. Because, in conventional wisdom, the head of the Federal Reserve is independent and cannot be fired by the President. But that’s not entirely true. Technically, there are legal gray areas — even if it’s far from straightforward.

The only problem is that even attempting to fire Powell, whether legal or not, would be enough to damage the Fed’s credibility. And that’s what’s got the markets spooked. Investors are not thrilled about the idea of Powell being ousted, fearing his successor might bend over backward to please Trump — who might be great at manipulating crowds but is far less impressive when it comes to economics. If there were any doubts about how markets feel — besides the S&P 500 dropping 2.36% and the Nasdaq plunging 2.55% — just take a look at the bond market. As Trump played cowboy geopolitics, long-term yields shot up. The 10-year Treasury hit 4.41% and the 30-year climbed to 4.91%. In other words, the credit market’s starting to look pretty nervous. Some of the old-school “Bond Vigilantes” even fired a warning shot, with one expert basically saying:

“Lay off the Fed and focus on your tariffs and Ukraine.”

In other words: “Powell isn’t your punching bag. Go play somewhere else.” Honestly, Trump doesn’t seem too bothered by the criticism — he might as well have quoted Jacques Chirac’s legendary line: “It touches me one without moving the other.” But meanwhile, the market keeps moving. The Dollar Index dropped to its lowest level since 2022. And anyone who thought volatility would ease up this week might want to rethink that bet.

Back to our sheep

So yes, yesterday’s market crash was triggered by the Trump/Powell feud, but also by the ongoing tariff war. China and the U.S. are no longer talking, and their standoff is starting to scare everyone. The American President is doing everything he can to isolate China and push it into a corner. But everyone knows that attacking a wounded animal is dangerous — you never know how it will respond. And if that animal’s a dragon? Well, that’s even worse. I mean, I assume so. Not that I’ve run into a dragon recently, but still.

Anyway, this tariff war is quickly morphing into a full-blown global trade war, reshuffling the deck on a massive scale. According to Trump’s latest announcements, around 70 countries — not exactly minor players — are being offered reduced tariffs… on one condition: cut ties with China completely. No trade, no shipping, nothing. I mean, maybe eating “hungry tiger noodles” at the Happy Panda Buffet could still fly, but that’s about it.

Of course, China isn’t just going to sit there and take it. And Trump isn’t trying to starve them out — he wants them to come to the negotiating table on one knee. Maybe two. The only issue — and it’s a big one, creating even more uncertainty in the markets — is that China has zero intention of being pushed around. The arm-wrestling match is officially on, and until we know the winner — AND THE CONSEQUENCES — don’t expect peace and quiet on the trade war front.

I actually made a video on this too, called “Trump’s Ultimatum to China: Beginning of Global Chaos?” — feel free to click the link if you want the full breakdown. Yeah, sorry, I made a lot of videos this weekend. But it was the best way to exorcise the chaos we’re stuck in. A chaos that took solid form on Wall Street this Easter Monday.

Once again, geopolitics has taken over, and no one cared about economic data or quarterly reports. Not that there was much worth making a fuss over, anyway. So yeah, U.S. markets closed the day “almost” in the gutter, and the all-time highs are now 19% away. The road back is going to be long — especially as everyone starts admitting that Trump’s tariffs are likely to bring rising inflation, collapsing growth, and a potential recession.

In short, Wall Street “experts” are bracing for the worst — whether it’s just a mild recession with easing inflation or the dreaded stagflation. Opinions are all over the place, and right now it’s hard to find anyone still practicing the good old “positive thinking” method.

Meanwhile — as Asian markets this morning digest Wall Street’s plunge by doing absolutely nothing — maybe there’s hope. Hope that since Trump hasn’t said anything in 24 hours, he might just stay quiet forever. Or maybe it’s just because U.S. futures are already up 0.32% and people are hoping — ipso facto — that the Powell/China-driven sell-off is behind us and we can finally move on. Personally, I have no idea. What I do know, however, is that in this environment, it’s easier to have a 10-year vision than a 10-minute one. At least in 10 years, Trump will be gone.

But the more we go forward, the more I start thinking… maybe Trump is actually an underestimated genius.

Okay fine — maybe not the kind of genius you’d invite over for dinner or trust alone with the nuclear codes… But when it comes to manipulating public opinion, political communication, and finding scapegoats, the guy’s become the Cristiano Ronaldo of manipulation and the Michael Jordan of political spin. And if you want an example, look no further than the “Powell Affair.” Trump is managing to paint him as the villain of the story — even though the Fed Chair is just trying to keep the economy from spiraling out of control.

Yes, Powell. The head of the Fed. The guy Trump personally appointed in 2017. That’s right — HIS OWN DECISION! And now Trump’s going after him like he’s some kind of Chinese spy trying to steal Nvidia’s AI chip secrets. Think I’m exaggerating? Just look…

Trump slapped tariffs on half the planet, crashed the dollar, tanked the markets — and now, who’s to blame for it all? BINGO! Powell. The looming recession (90% probability, according to Torsten Slok, economist at Apollo, if Trump’s tariff policies aren’t changed quickly)? Powell’s fault. Inflation that refuses to go down, even though it was the 2020 rescue plans that lit the fuse? Powell again. And the global market panic? You guessed it — Powell once more.

We all know it’s bogus. But half of the U.S. believes Trump, and meanwhile, the former President is sipping a Diet Coke and telling you everything’s fine — except for that “major loser” Jerome.

The Dollar Nosedive

And in the meantime, the dollar’s been in freefall since the so-called “Liberation Day.” The damage? Down 6% on the Dollar Index, 7% against the Swiss franc, 10% against gold, and even 3% against the Mexican peso! Sure, it’s great for exports — except exporters might not be able to export anymore due to reciprocal sanctions. But whatever — who’s going to blame Trump? Certainly not himself. Definitely not the Republicans. And absolutely not the Supreme Court. Not Mexico. Not China (too messy). Nope — he needs an all-American scapegoat. And that scapegoat has a name: Jerome Powell.

The narrative is simple: “If the economy is doing poorly, it’s Powell’s fault because he refuses to cut rates.” Easy to remember, like a catchy pop tune. And the MAGA crowd isn’t asking questions. Plus, to hammer the message home, Trump’s got his media machine: Fox News, Truth Social, X, Newsmax… A chorus of repetition, again and again, until you find yourself believing it. Like a terrible rap song played on repeat until you’re humming it on the bus, making ridiculous hand gestures.

Yet once again, you can’t really blame Powell. He doesn’t want to cut rates too soon and risk reigniting inflation. HE’S RIGHT. There’s no reason to fire him. And yet, markets are freaking out at the mere thought it could happen.

Whose Fault Is It, Again?

Meanwhile, long-term rates are rising, credit is tightening, mortgage rates are climbing, and confidence in the Fed is eroding. Even if Trump never actually fires Powell, the mere fact he screamed about it so loudly may already have done the damage.

The only flaw in this strategy — the one thing that could backfire on Trump — is that eventually, he might run out of scapegoats.

Biden will be gone. Hillary Clinton is yesterday’s news. Greta Thunberg would be a stretch. Blaming China again might come off as a bit repetitive. That leaves… maybe climate change?

In any case, he can’t always blame someone else forever. But for now, Trump doesn’t care. Populism needs a permanent enemy. And Powell is the perfect punching bag. Even if it means wrecking a bit more economic stability. Even if it pushes long-term rates higher. Even if it rattles the stock market.

Trump plays the arsonist. Powell plays the firefighter. And while they battle it out — the economy is on fire. But in the end, it’s still the firefighter who’s going to get all the blame.

So yeah… maybe Trump really is a certain kind of genius.

News to Remember

As for the little headlines worth noting, let’s start with Netflix — they released their earnings last Thursday, and they weren’t bad at all. Most analysts now expect the company to break through the $1 trillion valuation mark, which, according to the weekend press, would be totally justified.

Meanwhile, Tesla took another beating yesterday. The stock plunged nearly 6% after rumors suggested that their low-cost model would be delayed yet again. Let’s just hope the Robo-Taxis won’t be pushed back five years as well. In any case, Tesla is set to report quarterly earnings tonight — can’t wait for that.

Then there’s United Healthcare, which dropped some truly awful numbers last Thursday and continues to sink. After a 22% drop on Thursday, the stock fell again yesterday — though this time by “only” 6.4%. Not only did they miss the quarter, but they also revised their full-year guidance down.

Eli Lilly was down 2.6%. That’s after the stock soared 14% last Thursday when it announced its new weight-loss pill had successfully completed a phase 3 trial. Patients on the highest dose lost an average of 8 kilos — or 7.9% of their body weight — over 40 weeks, beating the company’s target range of 4% to 7%. Lilly hopes to manufacture the miracle pill in the U.S. Thanks, Uncle Donald.

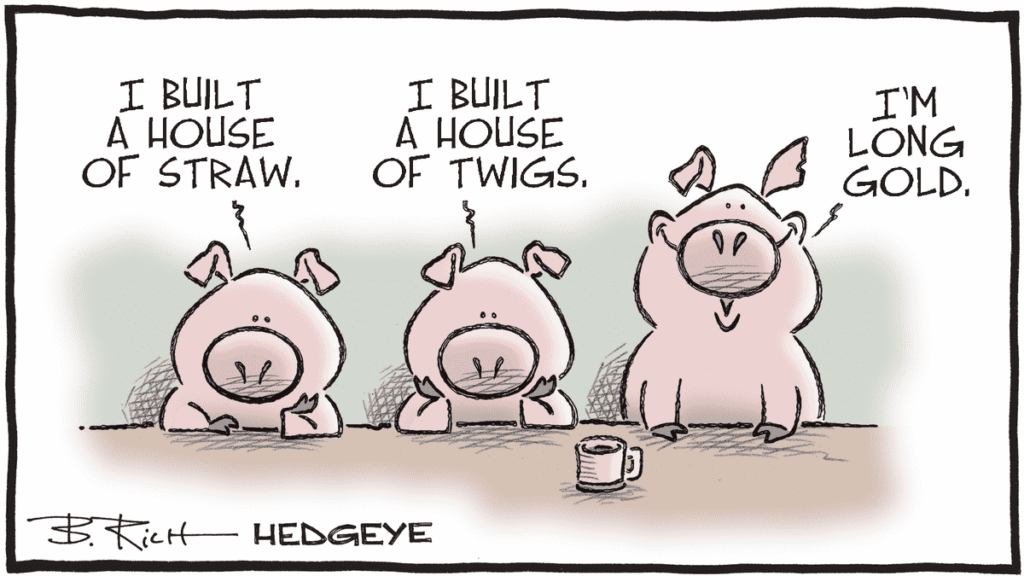

Elsewhere, oil prices were down on Monday. Blame it on weak global demand due to the trade war, and also on encouraging talks between the U.S. and Iran. This morning, Brent crude is at $62.85 a barrel and gold is flirting with $3,500. Bitcoin, for its part, is trading at $88,000.

As for today’s outlook, we’ll try to get back to a bit of macro — as long as Trump keeps quiet — and also dip into some micro — again, as long as Trump keeps quiet. On the macro side, a few Fed officials are expected to speak, along with Christine Lagarde. As for earnings, we’ve got Verizon, GE Aerospace, Lockheed Martin, and Halliburton in the U.S. before the open, and in Europe, SAP and Temenos. And tonight… it’s Tesla — and then nothing else will matter.

For now, futures are still up 0.39%, but we’ll still have to digest yesterday’s beating. We’ll take it one step at a time and pick it up again tomorrow. Have a great day, and see you then!