Indestructible

As we approach the end of this second week under Trump 2.0, if there’s one thing to take away, it’s that the market is showing an absolutely impressive level of resilience. I’m not sure whether to use the word resistance or resilience—either way, the relative strength of global markets is striking. After facing the DeepSeek attack on AI, followed by the aggressive tariff measures earlier this week, one might have expected far worse. Just yesterday, the “relatively” poor results from Google and AMD had put the market in a tricky position. But not at all—once again, investors managed to sort things out. Tariffs Still Weigh on Europe As we approach the end of this second week under Trump 2.0, one thing is clear: the market is demonstrating an absolutely impressive level of resilience. I don’t know if we should use the word “resistance” or “resilience”—either way, the relative strength of global markets is striking. After enduring DeepSeek’s attack on AI, followed by the vicious tariff assault earlier this week, we could have expected much worse. Just yesterday, the “relatively” poor earnings reports from Google and AMD put the market in a tough spot. But no—investors managed to sift through the data once again. When looking at where indices closed yesterday, the picture is quite encouraging, considering the fears still looming over us—fears that will last for another 3 years, 11 months, and two weeks. We’ve understood that as long as Trump is in office, we will live under the constant threat of him getting angry about something. And right now, he is very, very angry. But despite these tensions, as well as the “bad numbers” from some major companies that make up a large portion of U.S. indices, things went relatively well yesterday. However, Europe closed slightly in the red, particularly in France and Germany, as both European heavyweights remain wary of what the U.S. president might unleash next regarding tariffs. Based on what he announced for Canada, Mexico, and China, it seems likely he’ll wait until markets close on Friday evening before making a move on the issue. Europe mostly traded in the red, reflecting concerns over a potential American reaction. Additionally, Pernod Ricard expressed pessimism about its future outlook, stating that the economic, political, and geopolitical situation was too complicated to make any solid predictions. The spirits company has therefore decided to “navigate by sight and hope for the best.” Their gloomy comments, which gave the impression that management was in full burnout mode, weighed heavily on the stock, making it the biggest loser in the CAC 40 yesterday. But once again, the central question for European markets remains: “What is the orange man going to do next?” And more importantly, “How will our so-called leaders respond, given that they currently seem about as trustworthy as a group of drug dealers awaiting a shipment at a highway rest stop in southern France?” But Wait, There’s More… In short, Europe saw a slight decline, questioning what the next “Made in the White House” event would bring. Meanwhile, Valneva soared after announcing that the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) had approved its iXchiq vaccine—the world’s first vaccine against chikungunya. This marks its fourth approval, following Europe, Canada, and the U.S. The stock jumped 17%. And once again, I find myself wondering: why do scientists insist on giving vaccines such ridiculous names? In this case, “IXCHIQ”—six letters, only two vowels (which are the same), and four consonants, including a “Q” and an “X”! Seriously? Just trying to pronounce the vaccine’s name makes you feel worse than being bitten by a mosquito carrying chikungunya. They could have simply called it “the world’s most effective chikungunya vaccine” and saved us all some trouble. Okay, sure, it wouldn’t score as many points in Scrabble, but at least it would be pronounceable. Elsewhere, TotalEnergies reported a 21% drop in profits for 2024. The company stated that market conditions were “less favorable” than in 2023. However, this bad news was already priced in, as the stock had fallen 30% from last year’s highs. The company forecasts oil at $70 per barrel in 2025, will continue investing in renewables, and wants to get listed in New York—without offending France. We’ll see how that works out. TotalEnergies’ CEO also joined Bernard Arnault in saying that investing and growing a business in France is nearly impossible under the current tax and economic policies. Of course, that’s not exactly how he phrased it, but the message was clear. What’s interesting is that whenever Total posts record profits, the left-wing crowd gathers outside their headquarters, screaming for the CEO’s head because he isn’t handing out free money to every French citizen. But when profits are down—poof! Silence. Strange, isn’t it? MAGA Mode Activated Meanwhile, in the U.S., the conversation was quite different. The tariff issue was already forgotten. Investors have realized that Trump is using tariffs as a weapon of mass destruction to force trade partners into quicker negotiations—far more effective than hosting luxurious summits in five-star hotels where rooms cost $1,500 a night for a 24-square-meter room with a pool view. So, instead of worrying about tariffs, the focus shifted to economic data and earnings reports. Yesterday, we got the first U.S. employment report under Trump 2.0—the ADP report. Now, we all know these numbers are basically meaningless because what really matters is the Non-Farm Payrolls report coming on Friday. But since yesterday’s ADP data showed strong job growth, it caught investors’ attention anyway. According to the report, the private sector added 183,000 jobs in January. December’s numbers were also revised up, from 122,000 to 176,000. In short, better than expected, plus an upward revision. Funny how that’s the exact opposite of what happened under Biden. Not saying there are two different calculation methods at play here, but… let’s just say I’m leaving that thought unfinished. This stronger-than-expected job data immediately raised doubts about whether the Federal Reserve will cut rates anytime soon. Right now, the

Anything to declare?

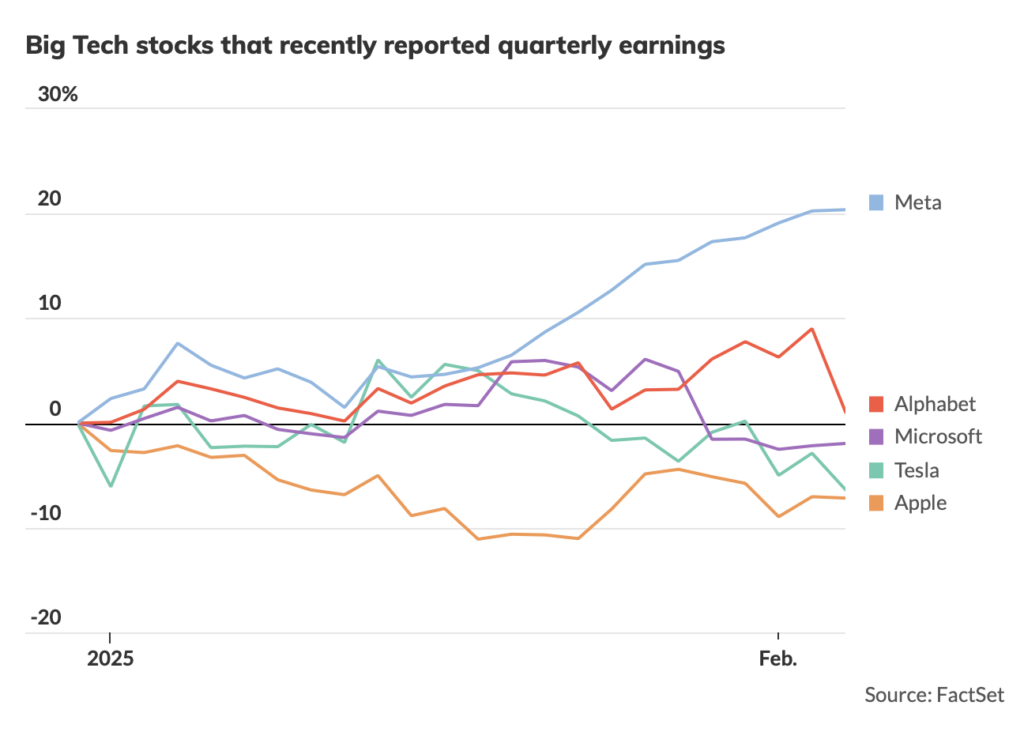

After Monday’s panic, we experienced the calm of Tuesday. Most global indices ended higher after the postponement of Trump-era tariffs. That was the main takeaway. It was also notable that China’s retaliatory tariffs did not faze U.S. markets. Given the ultra-quick resolutions found for Mexico and Canada, the financial world now expects equally swift solutions with China. A phone conference between Xi and Trump is even anticipated any day now. Beyond that, it’s all about earnings reports. The Waltz of Volatility I must say, I’m impressed by one thing: our ability to panic on Monday, send volatility soaring while making anxious calculations about the future of consumption and inflation—only to bounce back 24 hours later with such impressive serenity that you’d think the unemployment rate was at 2%, the Fed had just cut rates to 2.5%, and Powell himself had announced it dressed as a dove to make things more relaxing. And all because 10,000 soldiers and a hefty billion dollars are supposedly going to stop drug trafficking in the North and South of the United States—well, mostly fentanyl, because cocaine has long been part of the culture. In just 24 hours, we’ve gone from tears to laughter, and nobody seems surprised. And on top of that, it’s the second week in a row we’ve been given the same performance. Volatility is back around 17%, and now we’re just waiting to see how Trump is going to handle his issues with China. But one thing seems firmly embedded in traders’ minds: everything’s going to be fine. Well, we still have a couple of problems, especially since the AI stock market darling, Nvidia, is struggling to recover from the DeepSeek affair, and its chart looks pretty ugly. You can feel that AI is starting to lose a bit of its magic as a market argument. It still works, but a little less. Even though Palantir was one of yesterday’s big winners, largely emphasizing AI in their quarterly reports, investors are becoming more cautious and selective on the topic. Nvidia remains a major issue, even if everyone wants to buy it on weakness. The real question is: when will strength return? The Tariffs In any case, if we had to sum up yesterday’s session, we could simply say that we’re back to “business as usual,” calmly digesting the tariff issue—just as we had “calmly” digested DeepSeek last week. Yesterday, the S&P 500 closed above 6,000 points—6,037 to be precise—and we’re now just 91 points away from a new all-time high. The broad U.S. index has just taken a direct hit from: The questioning of its dominance in artificial intelligence The tariff issue, which could drive inflation up and hurt consumers The realization that, in this environment, the Fed is nowhere near cutting rates. We’re not yet talking about a hike to curb inflation, but let’s keep that option open for spring. And yet, despite these developments, which hardly qualify as “fantastic news that makes me want to sell my children to buy the market,” we are just a stone’s throw away from record highs. This applies to the Dow Jones, the Nasdaq, and the DAX. The only real laggard is the SOX, which seems stuck in its sideways channel, waiting for a breakout—up or down. Given AMD’s earnings report last night, we might start to think we’re heading lower. Quarterly Figures In the midst of these markets that now present a completely different face than they did on Monday morning, we have to acknowledge that there’s an avalanche of news to process all at once. And yet, we always refer to “THE MARKET.” A market—meaning it’s masculine, and if I’m not mistaken, men aren’t exactly known for their ability to multitask… except when it comes to the buttons on a PlayStation or Xbox controller, of course. So, let’s admit it: these are long and complicated days, juggling Trump’s omnipresent communications—he seems to have a gift for being everywhere at once on every topic—while weighing their economic, political, and inflationary consequences. And on top of that, we have to seamlessly navigate the flood of quarterly earnings reports that are saturating the media right now, making it feel like a small northern French village experiencing its eighth flood of the year. Since this morning’s market action is all about waiting for Xi Jinping’s call to Trump and interpreting quarterly results, let’s take a moment to review the latest earnings releases from the past 24 hours—just to see how the market is reacting. Because, let’s be honest, today we can classify the interpretation of quarterly figures into four main categories, each leading to its own predictable outcome. The first category includes companies that have exceeded expectations across the board, except for one single metric that falls short. Naturally, the market fixates on this one flaw and sells the stock massively, repeatedly asking, “How could they mess that up?!” This quarter, Microsoft falls into this category. The second category consists of companies that have crushed expectations so impressively that analysts don’t even understand their business model. In these cases, traders rely on the CEO or CFO’s earnings call to decide whether to buy or sell like mad. A little tip: if you don’t understand the business plan and management drops the term artificial intelligence in their speech, you should buy aggressively. This quarter, that’s exactly what happened with Palantir. The third category covers companies that, three months ago, confidently announced they were on fire, their future looked brighter than ever, and that things were only going to get better. Fast forward to today, and they report mediocre results while admitting they’re now flying blind in a fog so thick they don’t even know if they’re upside down or not. Naturally, this kind of result triggers selling. This quarter, AMD and Julius Baer fit the bill. The fourth category consists of companies that get everything right: they beat expectations across the board, dominate their industry, manage costs with surgical precision, see a rosy future, and even

Market Rebounds

Yesterday morning, we were standing at the edge of the cliff. The markets were in full panic mode—talks of inflation, skyrocketing costs for certain industries (just ask car manufacturers), and fears that Europe might be next on the list for tariffs. Goldman Sachs sent its top economists to crunch the numbers and explain how tariffs would drag the S&P 500 down by 5%. Volatility was through the roof, traders were desperately trying to swap their Nvidia stocks for Nestlé, and then—Canada capitulated, and suddenly, everything was forgotten! Tariffs? What Tariffs? I’ve been thinking for a while now that the market could use some therapy, but after yesterday, I’m absolutely convinced. Especially since it’s living in an increasingly toxic environment—one that’s becoming more geopolitical than economic—and with Uncle Donald back in the picture, things aren’t about to get any easier. Quite the opposite. So, let’s rewind a bit. After announcing that the new tariffs against Canada and Mexico would take effect on Tuesday, February 4, at noon, the markets went full panic mode. Global car manufacturers got slaughtered because importing raw materials was about to get a whole lot more expensive. Meanwhile, some American journalists actually took the time to write articles asking, Why is Tesla dropping when they build most of their cars in the U.S.? That’s so unfair! Well, maybe Tesla doubled in six months, and some people took the opportunity to cash in. Makes sense, doesn’t it? More broadly, everyone started realizing that these tariff hikes would cost everyone a ton of money—both inside and outside the U.S. Since Canada and Mexico responded by raising their own tariffs, it became clear that higher costs would mean higher consumer prices, leading to… inflation. Well, return of inflation might be a stretch, considering it never really went away. And since it hasn’t been coming down for the past six months, it wasn’t hard to figure out that these tariffs would only push it even higher. Even the Fed had to send out a couple of its directors to go on TV and confirm the obvious: if consumer prices rise because of tariffs, inflation isn’t going to drop—on the contrary. So don’t expect any rate cuts from them anytime soon. Then they kindly reminded us that water is wet, fire burns, and any object submerged in water for more than five minutes is considered lost—unless it’s a world-class free diver or a dolphin, but that’s beside the point. The silver lining? None of the Fed officials who spoke yesterday mentioned hiking rates to combat inflation. No, they wouldn’t dare—because their wives and kids were being held hostage by the CIA to ensure Trump’s master plan went smoothly: slash interest rates while turbocharging inflation with tariffs. Yes, yes, I’m joking. But still, looking back at yesterday’s market session, it felt like something straight out of a thriller by Harlan Coben or Michael Connelly. The Plot Twist of the Day Yes, suspense and sudden twists—because just as global markets were teetering on the edge of a cliff and most car manufacturers were considering pivoting to AI, Mexican President Claudia Sheinbaum announced that she would deploy 10,000 National Guard troops to the U.S.-Mexico border to “prevent drug trafficking, particularly fentanyl, from Mexico to the United States.” Moments later, Trump announced that he was suspending the implementation of tariffs for 30 days to “see how things unfold.” Global markets breathed their first sigh of relief, immediately realizing that Trump was simply using tariffs as leverage to force his partners into action—bypassing the endless hours, days, weeks, or even months of negotiations that usually lead to nothing. The only question left was: what would Canada do? After all, Trudeau had been posturing defiantly, showing no intention of being intimidated by the man with the orange hair. Well… turns out, Trudeau was intimidated. Following Mexico’s lead, Canada announced that it would: Implement a $1.3 billion border surveillance plan Deploy 10,000 personnel to the frontlines of border protection Appoint a “fentanyl war chief” to combat drug trafficking Establish a joint U.S.-Canada intervention task force Cut a $200 million check for intelligence operations In short, everything that had seemed impossible to negotiate for months, Trump managed to secure in the span of a single trading day. Canada, too, got a 30-day tariff suspension in return. I’m not sure if politicians feel invincible after “negotiating” with Trump, but ever since he returned to the White House, it seems like he does whatever he wants—and more importantly, gets whatever he wants. Speaking of which, Trump has now demanded that Ukraine hand over all its rare earth minerals and precious metals to the U.S. in exchange for American aid. He also confirmed to the press that he definitely intends to slap tariffs on Europe. Just 24 hours ago, several of Macron’s “clown ministers” were boasting about how they would “stand firm against Trump, or else no one would take them seriously.” Since last night, truckloads of Vaseline have been delivered to the French National Assembly and the Élysée to help them “stand firm” against Trump. If Macron or Scholz prove to be as “firm” as Trudeau, the EU tariffs should be settled within 12 minutes of their announcement. Rumor has it that Ursula von der Leyen is already applying for political asylum in Guantanamo. The 180-Degree Turn of Global Markets Needless to say, the announcement of a 30-day suspension of tariffs instantly reversed market sentiment at lightning speed. The Dow Jones was down 600 points but clawed back nearly 500 before the close. I’m convinced that if the NYSE had stayed open for just one more hour, the Dow would have ended in the green. The Nasdaq rebounded 300 points from its lows, the S&P 500 gained nearly 100 points, and this morning, futures are back above 6,000 points. Europe benefited less due to the time difference, but it should catch up this morning. Some stocks remain under pressure, however—Nvidia is still at rock bottom, with ongoing concerns about AI

War is on!

Let’s be honest, it’s no surprise. If I’m not mistaken, since the start of the election campaign, now-President Trump had warned that he would impose tariffs with a sledgehammer, just to show the world who’s boss. We knew it, but at the same time, we thought he might start by boosting the economy, cutting taxes, and creating jobs before shaking up global trade. Instead, he did everything out of order, and the realization we’re experiencing promises yet another “DeepSeek” Monday. Miserable Sunday Night The weekend ended on a rough note—especially for investors who bought the dip before heading out. This morning’s market open looks grim. Not that the announcement was a shock—we knew for days that Trump was about to make his move. The officially confirmed tariffs were exactly as expected: 25% against Mexico, 25% against Canada (except for oil, so Americans don’t freak out over gas prices), and 10% against China. Trump’s unpredictability is no secret, so no one can call this a surprise. But judging by the futures market reaction, it seems like investors were in full denial: “He won’t do it, he won’t do it… Oh, damn. He did it.” This is the most significant act of American protectionism in nearly a century, and it’s tearing apart the regional trade pact that has been the foundation of U.S. economic dominance. Friends or Frenemies? For decades, American companies thrived on the U.S.-Canada-Mexico economic alliance, leveraging U.S. innovation, Canada’s vast resources, and Mexico’s cheap labor. Sure, it wasn’t perfect—factories closed, industrial towns turned to dust. But Trump saw a winning political strategy: Bring the jobs back! Fire up the factories like it’s the ‘50s! America First! And so, MAKE AMERICA GREAT AGAIN… Except his master plan is just slapping tariffs on everything, as if that alone could fix unemployment, the national debt, and even the opioid crisis. (Yes, he actually linked tariffs to drug abuse—next-level economic genius.) The problem? Tariffs alone won’t magically bring back American factories, but they will: Raise prices on imports (Make Inflation Great Again!) Strain geopolitical ties (Punching Canada in the face? Not exactly “best friends” material.) Potentially weaken U.S. global competitiveness long-term. Trump’s tariffs feel like a Hollywood blockbuster—flashy effects, a weak plot, and a hero who thinks he can fix everything with three car chases and a couple of fistfights (probably learned from a Chinese Kung-Fu master before tariffs kicked in). But will the audience—voters—stick around to see how it ends? Or will they leave early, realizing that bringing jobs back home might be as mythical as the Loch Ness monster or Area 51? Reality Check That’s all great Monday morning theory. But for investors? We never thought he’d actually pull the trigger. We assumed he’d wave tariffs around like a scarecrow—never actually use them. Yet, here we are. And after last week’s DeepSeek beating—where Nvidia closed below its 200-day moving average for the first time in two years—this was the last thing we needed. And yet… here we go again When officially announcing the tariffs, Trump posted a message on X that said: “Will there be pain? Yes, maybe (or maybe not!), but we will make America great again, and the price to pay will be worth it.” Now, I’m not sure if, this morning, comments like that will reassure market participants, but one thing is certain: today is going to be rough. Futures are set to open sharply lower—down 2% on the S&P 500 and 2.7% on the Nasdaq—while volatility, measured by the VIX index, is expected to skyrocket by 20% at the open. We’re not talking about terror or panic just yet, but suddenly, there’s doubt creeping in about Trump’s strategy—assuming he even has one. Last night, The Wall Street Journal reported that the White House has implemented the most STUPID strategy in history, and plenty of experts—including those who actually voted for Trump—are now wondering how this will end. And to be honest, we have no clue how it ends, but we do have an idea of how it starts. Canada has already announced its response—Trudeau is raising tariffs on American goods by 25%. Mexico is “working” on a similar retaliation, and China has yet to respond. And that’s what’s truly frightening. One thing is clear: the trade war is back. And like all wars, we know where and how it begins, but we never know how it will end. A Tough Week Off to a Rough Start We’re kicking off this week under the weight of tariffs, and there’s no choice but to deal with it. And as if that weren’t enough, the days ahead won’t be any easier—an avalanche of quarterly earnings reports could add more fuel to the fire. Plus, at the end of the week, we have January’s employment numbers, which will pile onto the ongoing debate over interest rates and inflation. Some economists are already raising concerns about the potential fallout. Morgan Stanley’s chief economist even crunched the numbers and concluded that the new tariffs could mechanically push inflation up another 0.5%. Now, I’m no economic expert, but that’s not exactly the kind of move that will help lower interest rates in the U.S. by 2025. And now that Trump has made his move, it’s safe to assume Europe will be the next target. EU leaders are already preparing their counterattack, knowing full well that the hit is coming—they just don’t know when. Futures are deep in the red, we’re teetering on the edge of panic, and cryptocurrencies—the so-called risk appetite indicator in today’s wonderful world of finance—are getting absolutely wrecked. Asian markets have already set the tone: Japan is down 2.8%, Hong Kong is sliding 1%, and China remains closed for Lunar New Year. Meanwhile, China’s latest manufacturing PMI came in at 50.1—below expectations. Oil, sensing the chaos, is making another run at $74, gold is sitting at $2,813 an ounce, and as for Bitcoin—let’s just say I’ll spare you the details of its current lovely shade of red. Yet another sure

Stock Picking Strategy

Dear Investors, Thank you for choosing us as your trusted advisor in the world of stock trading and investments. Our mission is to provide you with expert recommendations, personalized strategies, and the insights you need to achieve your financial goals. Insight By reading this, you will gain insight into our method of selecting and managing U.S. stocks to build a strong and profitable portfolio. First, after identifying potential stocks, we monitor them daily. We set reasonable objectives based on a thorough analysis of financial developments in similar companies. Our approach primarily involves studying quarterly and annual earnings reports, trading volumes, and the economic outlook for various sectors. This ensures diversification and minimizes risk. We avoid putting all our eggs in one basket! Additionally, we never allocate more than 15% of our capital to a single stock. Stock Strategy Trigger Price Confirmed Price Target 1 Target 2 Stop Loss X Price ($) X Price ($) +8-10% +15-20% -8-10% Our Trade Strategy A simple, step-by-step approach to help you make informed decisions in the market. 1. Set Price Targets & Stop Loss For each stock, define the following levels: Target 1 (T1): +8 / 10% Target 2 (T2): +15 / 20% Stop Loss (SL): -8-10% 2. Actions at Target 1 (T1) When the price reaches Target 1 (T1), sell 70% of your stock position. 3. Actions at Target 2 (T2) Once Target 2 (T2) is reached, sell the remaining 30% of your stock position. 4. Stop Loss Adjustment After reaching Target 1 (T1), you have two options for adjusting your stop-loss for the remaining 30%: Leave your stop-loss at the original level. Raise the stop-loss to lock in 3.5% profit and minimize risk. Buying and Selling Strategy This graphic illustrates a practical example of how to implement the buying and selling strategy using market trends and price triggers. It serves as a visual guide to help you understand the key actions for effective stock trade management. Watch the Video – Stock Strategy in Action https://www.soleyam.ch/wp-content/uploads/2025/01/fixed-Soleyam-stock-advisor-video.mp4 Conclusion While this may be a tough time for those who are relatively new to the stock market, the process of clearing (Stop) is a necessary step that helps us hold strong positions while eliminating the weakest ones. In fact, completing a “clean” is often the signal to become more aggressive. This is exactly how a successful portfolio is built! As seasoned investors know, a powerful portfolio isn’t built overnight. After all, no portfolio, no matter its size, can hold too many positions for long. However, investors who don’t let their emotions take over and stick to the plan will be the winners! The stock market has many cross currents, which can often weigh it down. Investors are still confused and hesitant to commit more money. The market lacks a true catalyst, so be patient and let the market settle while sticking to the plan. Don’t drown in the rip tide of indecision. Above all, always wear your life jacket and practice good risk management (never put all your eggs in one basket). Risk Warning Trading may expose you to risks of losses exceeding your deposits and is suitable only for informed clients with the financial means to bear such risks. Only risk a very small portion of your capital, particularly an amount you can afford to lose without any financial impact on your daily life. You should seek advice from an independent financial advisor and ensure that you have a certain risk tolerance. Past performance is not indicative of future results.