Greed and Fear

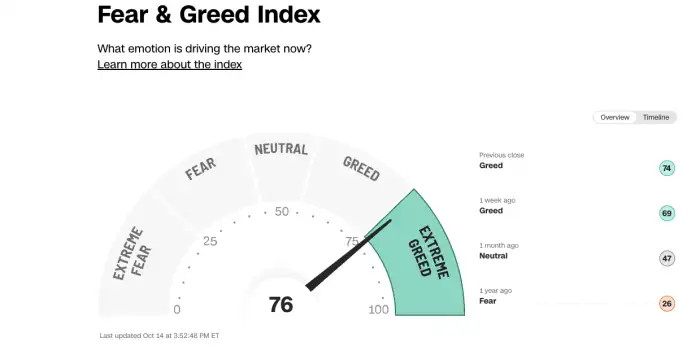

Last week, the Nasdaq tested its “correction zone” but managed to recover. The S&P 500 repeatedly dipped below the 200-day moving average. Employment is showing signs of weakness, but the market is choosing to ignore them—for now. Volatility hit its highest level of the year at 26.56%, and the “Greed and Fear” index remains in “extreme fear” territory. No matter how you look at it, something is brewing, and while buyers are still jumping in to seize opportunities, investors are no longer as confident as they were a few months ago. Doubt Over Tariffs If we believe what we see and hear, the main concern right now seems to be tariffs and the impact of Trump’s “magical” policies on the global economy. Everyone is trying to guess what this tariff policy will look like in a week or a month. The problem? It’s nearly impossible to predict, because, once again, even Trump himself doesn’t seem to know where things are headed or who the U.S. will be at odds with next. And this isn’t just criticism of his policies—it’s simply the reality. He changes his mind every three minutes, moving forward and backward at the same time. These tariff issues are concerning for several reasons. First, they could increase costs for businesses that rely on importing foreign goods, impacting profits and, consequently, stock prices—not to mention employment and wages, which seem to be just a footnote in this equation. Second, these price increases will be passed on to consumers, putting them under financial strain and limiting their shopping sprees. It’s been said over and over again: the American consumer is the engine of economic growth. Without them, it’s not hard to imagine the potential consequences. You don’t need to be a genius to understand that the combined impact on consumers and businesses has some fearing that tariffs could trigger a recession. Yes, I know—we’re not supposed to say “recession” because it’s practically a sin in the wonderful world of finance and economics, where people prefer markets that rise every day. But it’s a reality that must be acknowledged. Even in his weekend interview, when asked whether he expected a recession in 2025, the indefatigable President Trump said: “I hate predicting these things. But there’s a transition period because what we’re doing is huge. We’re bringing wealth back to America. That’s important. It just takes time.” So no, he didn’t explicitly say, “There will be a recession.” But he also didn’t say, “There won’t be a recession.” He’s fully aware that his plans will take time, cost money, and have economic consequences. For now, he’s feeling his way through it—just like the rest of us. To wrap up the tariff discussion, these price increases could hit at a time when the economy is still dealing with residual inflation. Additional price shocks could make it harder for the Fed to cut rates again. Or twice. We’re starting the week in an extremely delicate position for the markets, and Trump’s recent interview has already put pressure on futures, which are looking rough—despite European markets not yet being open and nearly 12 hours to go before Wall Street opens. (Yes, as I write this, it’s 3:30 AM.) The Rollercoaster (Again) We begin the week on a rollercoaster—just like the one we just finished. Tariffs and the uncertainty surrounding them are the dominant topic—aside from the ongoing European rearmament efforts, which are consuming economic and political resources. People are fixated on upcoming tariff decisions. That’s a fact. And we’ll have to live with it. But for how long? That’s another question entirely, and one that only adds more uncertainty. And uncertainty, more than anything, weighs on sentiment. People don’t like not knowing. Sometimes, it’s better to get either good or bad news—something tangible to interpret—rather than being left in limbo. Take last Friday’s job numbers, for example. To keep it simple: 151,000 jobs were created in February—the first full month under Trump 2.0—compared to the 170,000 that were expected. That’s a noticeable miss. On top of that, the previous month’s numbers were revised down by 19,000, and the unemployment rate came in at 4.1%, whereas Wall Street had predicted it would stay at 4%. In a normal world, these numbers would be considered disappointing. Not disappointing enough to short the markets and tattoo “RECESSION” across our foreheads, but still—let’s be honest, “it was not great news.” It confirmed that the job market is still slowing down and that we’re not yet in full “Make America Great Again” mode. But that’s the beauty of finance—somehow, the market managed to spin it as “not too bad because it wasn’t as terrible as feared!” Fear Can’t Be Controlled And there it is! We set expectations for the job report, but deep down, we weren’t confident. You could practically see economists’ hands shaking as they filled out their Non-Farm Payroll (NFP) forecasts. They were nervous, sensing economic trouble ahead. They guessed 170,000, but feared it might be only 35,000 instead. When the number came out at 151,000—sigh of relief! We survived another month! It’s almost magical. And it’s what kept us from closing below the 200-day moving average, which would have been disastrous. However, looking at the futures this morning, I’m not sure we can stay above this thin line of support for long. One thing is clear: analysts and economists want to believe everything will be fine, but deep down, they know something is rotten in the kingdom of the U.S. economy. Even Trump admits it’ll take time to Make America Great Again. Let’s just hope he succeeds—without too much collateral damage on our end. In Summary We’re starting the week with the same uncertainty we had last Friday. Tariffs are an ongoing headache, making it impossible to feel at ease. But after six or seven weeks of Trump 2.0, we’ve realized that this won’t be smooth sailing. If anyone thought they had already seen it all during his first term, they were wrong. It’s going to

The Tariffs Waltz

This time, it’s official. The Nasdaq has entered correction territory. It narrowly avoided punishment two days ago, but now it’s done. Once again, blame it on tariffs and blame it on one company—Marvell—which didn’t release an optimistic enough guidance, triggering a broad sell-off in the AI sector and the Magnificent Seven. So, naturally, when the BIGGEST SUPPORTS of the market let you down, there’s not much to hope for. However, when you lean back in your office chair and take a step back, you realize that the market is completely insane and should probably seek professional help. Unless it’s Trump who should be consulting a specialist. The Weathervane Yes, no, because let’s be honest. The President doesn’t know what he wants when it comes to tariffs—he changes his mind every three minutes, and in the end, we don’t even know if it’s “good” or “bad” news. Uncertainty takes over, and when uncertainty dominates, people generally sell everything and wait for things to calm down. That’s pretty much what happened yesterday with tariffs—especially in the U.S. And that’s what we’re going to try to make sense of. Because, to be honest, if I rely on the latest updates from the White House, Trump had ONCE AGAIN put some tariffs on hold. That should have been positive news. But I think people are just fed up with the President’s constant flip-flopping—he treats us like his puppets. Fundamentally, the market isn’t exactly thrilled about Trump slapping tariffs on 194 other countries because it could slightly drive inflation up. But at least we can handle it when it’s a clear government decision that we have to work around. Of course, we’d prefer if he didn’t impose tariffs at all—that would be even better. But what we’re struggling with more and more is the constant reversals. At first, he changed his mind twice a week. Now, it’s almost twice a day. Let’s quickly recap the situation regarding tariffs on Mexico and Canada. At first, he slapped a 25% tariff on them—no discussion. Forty-eight hours later, he delayed implementation by 30 days. Both countries made efforts, but not enough, and 30 days later, he enforced the tariffs—this was on Tuesday. On Wednesday, he made a U-turn and exempted car manufacturers. Yesterday, he exempted fertilizer imports. Then, he spoke with the Mexican President—and flipped again. Once more, tariffs on Mexico were postponed until April. But not Canada. At least not right away, because after so many exemptions on Canadian goods, it’s basically like he made a U-turn there too. And then, just recently, he reiterated his intention to tax steel. IN THE MARKETS, THERE’S ONE THING WE CAN’T STAND: instability and nonsense headlines coming from all directions. A Weathervane on a Carousel on a Boat in the Middle of a Storm If you want an example of uncertainty, just look at the global markets. Depending on Trump’s statements, Europe closed higher at 5:30 PM because investors were happy he loosened the grip on tariffs. Then, by 10:00 PM, the U.S. markets got crushed because Trump changed his mind another 22 times, and traders decided to throw in the towel before taking a beating—something like Apollo Creed getting destroyed by Ivan Drago in Rocky IV. Now, to be perfectly fair, the U.S. market didn’t drop only because of tariff chaos. Marvell’s earnings report hit the tech sector hard. That wasn’t uncertainty—it was just investors overreacting. And I say “overreacting” because, looking strictly at Marvell’s numbers and expectations, the results were either better than expected or in line with estimates. But the problem? Marvell’s guidance was in line, while experts expected it to be better! Well, maybe you should have said your expectations were higher, GENIUS! It’s like telling everyone your dream salary is $300,000 a year, then getting hired at that amount but going home miserable because you hoped for more! Everyone wants to slap you for that kind of attitude! In the end, Marvell lost 20%, and the entire tech sector took a hit just because Marvell was good—but apparently, it would have been better with one less “L” in its name and a more “Captain America” guidance… And at this point, as I often say: why didn’t I study psychology instead of finance?! I’d probably be more useful analyzing the Nasdaq on my couch than on my trading screens. Because if we go back to yesterday’s tariffs, fundamentally, Trump’s latest announcement isn’t that bad. It’s just that we’re exhausted from the constant back-and-forth, knowing full well that another round of tariff decisions will come in a month anyway. We’re simply FED UP with this nonsense and hesitation. It’s affecting volatility and everything else. Right now, we just want to go on vacation and check back later when we can have rational trading days based on macroeconomics—not the neuroses of a politician who doesn’t even know who he wants to be mad at anymore. Right now, tariff policy feels like getting a band-aid ripped off—except instead of one quick pull, it’s peeled off slowly, then halfway through, it’s stuck back on, and we start all over again! I think we can officially say that the market has had “ENOUGH” of these tariffs. And that’s the polite version! Still a Party in Europe Meanwhile, in Europe, it’s still party time. Especially in Brussels, where the valiant knights of the European roundtable gathered in Belgium to worship and glorify the almighty Zelensky. And, of course, so that Macron and Zelensky could have some “quality time” together. So, the European markets handled yesterday’s session relatively well and weren’t as shaken by Trump’s temporary tariff adjustments. To be fair, we should also note that the ECB did cut interest rates, which should help buy a few more guns and cannons. But then Lagarde came out and said that all these massive infrastructure and rearmament expenses “COULD” bring inflation back. Yeah, no kidding! It’s almost funny—governments are about to blow a fortune rebuilding the Maginot Line and reenacting La Grande Vadrouille

Groundhog Trade

I usually wake up between 3:30 and 4:00 a.m. to read everything and tell you exactly what to think or know about the financial markets by 7:00 a.m. But with everything happening lately, I might have to rethink my schedule—or just give up on sleep altogether—to make sure I don’t miss anything and stay sharp in the morning. The problem? Every day feels like a rerun. The same market manipulations from the White House, the Élysée’s Adjudant-Chef Chaudard charging into battle, and the Germans once again getting their hands on the Bundestag’s checkbook. It’s the same show on repeat—just with different headlines. Disneyland and Its Rides Let’s try to summarize yesterday’s events as simply as possible. There was a time when we could almost try to anticipate what would happen after, but right now, it’s hard to even imagine an after—because in the span of three days, we can flip our stance four times, change our opinion eight times, rebalance our portfolios every five minutes, and consider 14 different investment strategies per half-hour. And all of this while knowing that it would take just one of the clowns in power somewhere in the world to lose it for reasons unknown, forcing us to completely rethink our carefully considered forecasts from just 30 minutes earlier. Just look at what’s happened to the U.S. indices over the past two weeks! The only thing that comes to mind when looking at the S&P 500 charts is that WE’RE LUCKY MARKETS CAN ONLY GO UP AND DOWN—because if they could also move left and right, I’ll let you imagine the complete disaster that would create. In just two weeks, volatility shot up from 14% to 26%, and now we’re back at 21%, which seems to be the “new normal.” The Greed and Fear Index is all over the place and doesn’t make any sense anymore. As for the S&P 500, it’s clinging to the 200-day moving average but mostly looks capable of flipping from total panic to “bull market forever” in a matter of three minutes. All it takes is someone from the White House coughing or sneezing, and we’re back on the rollercoaster. During Trump’s previous term, it was already a spectacle, but now that he’s back, we’ve had to install defibrillators in every trading room, and checking your blood pressure is mandatory every time you grab a coffee. There’s Band-Aids in the Air For once, let’s start with the U.S. this morning. To put things in context, on Tuesday night, we collectively freaked out when we realized that the one-month reprieve Trump had given the Canadians, Mexicans, and Chinese had just ended. Yes, it’s ALREADY been a month—but at the same time, it was an insanely short month. February is always a short month, but this time, we really felt it. SO. The reprieve was over, meaning it became ABSOLUTELY necessary to RE-PANIC, just as we had done a month earlier. The markets got wrecked, and the S&P 500 miraculously held its 200-day moving average. Then, on Wednesday, we went back to RE-TEST it. Just for fun. Kind of like when you wave your hand over the fondue burner to see if it’s on, because like an idiot, you forgot if you already checked. And just when the markets decided to play the let’s scare ourselves again game, Trump pulled his Chinese torture device back into play, and the market rebounded just enough to save face. But with volatility still at 21%, it’s safe to say that traders haven’t fully accepted that we’ve made it out of the woods—or rather, out of the hole at the bottom of the woods. Trump’s Chinese Torture Device If you’re wondering what that is, well, it’s simply Trump announcing brutal, violent, massive rules that will inevitably have economic and especially inflationary consequences. Rules that force you to panic and step out of your comfort zone. Then, just when you’re starting to consider slitting your wrists with a butter knife, opening a bed-and-breakfast in the South of France, or buying an RV to start producing meth, the President of all Americans reverses his decision and explains that tariffs, YES—but not on car manufacturers. Well, not for the next month, anyway. So, you can go ahead and schedule the next panic for the auto sector on April 4, 2025—unless, in the meantime, all the manufacturers have relocated or built factories in the USA to make America Great Again, yada yada, you know the drill… Discounted Tariffs So yes, Trump revised his stance on car tariffs, and everyone realized it was suddenly much easier to breathe without that weight on their chest. Trump is basically the guy who drives a nail into your hand, and while you’re screaming in pain, he gives you a morphine injection so you don’t feel anything anymore. But deep down, you know that as soon as the morphine wears off—in a month—the pain will return just the same, with an infection on top. Either way, the little game of “it goes away, and it comes back”—which was originally invented by a French electrician who tried changing a lightbulb while sitting in his bathtub just to see if it conducted electricity—was once again played by Uncle Donald, who is never late when it comes to stirring things up on Wall Street. In addition to tariffs, we also got some macroeconomic reports that were more or less good, depending on your perspective. First, the ISM Services Index came in above expectations. This showed that the economy was still doing well in that area, but we were still warned that people were worried about upcoming tariffs, which could lead to unwanted inflation in the medium term. Since yesterday’s session was all about optimism, we took the news positively, while storing it in the “cautious, but let’s not think about it until Monday” section of our prefrontal cortex—the part that handles short-term memory. That way, we’re sure to forget about it over the weekend. Then, after

Trade War & HOPE

Cleaned out, wiped, liquidated, and erased. That’s how one could describe the performance of the U.S. market since the November election. We’re back to square one, and the S&P 500 has even retested the 200-day moving average for the FIRST time in 16 months! No one is talking about rate cuts to boost the economy anymore; the entire strategy that brought us here is being questioned. And those who believed that Trump would care about stock market performance to justify his record are realizing they were completely mistaken. Yesterday, the mood was grim, but this morning, hope is reborn. Behind Our Backs Once again, yesterday’s session was a catch-up session for Europeans. Indeed, the blow that the U.S. market took on Friday evening—when we realized that Trump would no longer negotiate on tariffs—had yet to make its impact felt on European markets. By the time Wall Street had taken its nosedive, we were already home, putting dinner on the table. When it came to Europe catching up, we were not disappointed. If on Monday, EU members were on cloud nine, signing arms deals with the €800 billion announced by Brussels—despite nobody knowing where they’d find a single cent of it, considering that most of the region’s countries are on the brink of financial collapse—things took a drastic turn by Tuesday. The equation was quite simple: if Trump refused to negotiate with Canada, China, and Mexico, there was absolutely no reason he would do so with Europe. Europe is probably the next in line to get slapped in the face by Washington. But in the meantime, since we all know that Europe is heavily dependent on the health of global trade, we preemptively reacted as if “Trump had just dropped a bomb in front of the European Union offices in Brussels,” attacking anything that might take a hit. The first casualties were car manufacturers, who got absolutely slaughtered—as if they needed that right now—followed by the banks. The “experts” figured that if the tariffs led to a global slowdown, it was inevitable that banks and brokers would suffer the consequences. Banks are the canaries in the coal mine when things improve, but they are also the first to collapse when the economy slows down. And yesterday, we were clearly in “the economy is slowing down, and we’re all going to die” mode. Even the prospect of the ECB cutting rates tomorrow didn’t ease yesterday’s bloodbath. Awareness, Doubt, and Fear Looking at the numbers, the most notable event was the DAX finally taking a serious hit. This index, which had resisted everything and set 822 all-time highs in recent weeks, finally cracked. The German index dropped by 3.54%, marking its worst day in over three years—a nice way to welcome the right-wing government to power. And the worst part? Yesterday’s massive drop barely even shows up on the chart. To return to the longer-term trend of the past two years, we would still need to see the index lose another 3,000 points. In France, the losses were limited to 1.8%, while Italy performed slightly worse than Germany with a 3.41% decline in Milan. Meanwhile, Switzerland held up better thanks to the three heavyweights in the SMI, which all finished in positive territory, keeping the defensive SMI down by only 1.21%—although UBS got absolutely wrecked as fears of an economic slowdown returned. What’s interesting is how all the bold claims about tariffs being nothing more than a negotiation tactic between Trump and the rest of the world have now gone out the window. Suddenly, everyone is hating Trump for what he’s doing and failing to understand why he’s doing it. But one thing is for sure: these tariffs will make America greater, stronger, better, and Great Again. Honestly, I didn’t study economics much, so I won’t pretend to analyze Donald Trump’s economic doctrines, but let’s just say the market doesn’t buy into them for a second. Confidence in the future is fading fast. It’s clear that this isn’t an easy market, and the geopolitical uncertainty we’re dealing with right now is anything but simple to navigate, understand, or translate into market behavior. To sum it up: If you were a car manufacturer yesterday, you had a hell of a bad day. If you were a supplier selling parts to those manufacturers, it was even worse. For a brief moment, in Europe, we stopped talking about World War III, about the €800 billion rearmament plan, and even Rheinmetall was down. Speaking of that European Union defense loan, I’d love to know how they plan to raise that kind of money. Considering their credibility is about as solid as a corrupt politician in a Banana Republic, and von der Leyen has about as much trustworthiness as a Colombian drug trafficker caught behind the wheel of a 30-ton truck loaded with coke—claiming it wasn’t his truck and that he was just helping a friend—I have my doubts. Honestly, if you gave me the choice between lending money for Europe’s rearmament or smashing my own kneecaps with a hammer, I’d be heading straight to the garage for that hammer. But that’s not the point. Yesterday, we didn’t talk about the war in Ukraine, we didn’t talk about armed forces—we simply realized that these tariffs are no joke. It was a massacre. But, as always, there is hope. Looking Back Over in the U.S., things weren’t necessarily better, but they were “less bad.” The concerns were the same: Worries about the impact of tariffs Anxiety over the 100,000 federal employees Trump wants to fire Nervousness as Canada, China, and Mexico all announced retaliatory measures against Trump’s decisions In this environment, the market reaction was essentially the same as in Europe: Car stocks got hammered, especially those with factories in Mexico Banks took a beating because if the economy slows, financial transactions decrease, and banks make less money We might be jumping the gun on economic cycles, but since we’re all “visionaries,” we won’t miss the opportunity to

Trumpcession and a Rough Awakening

It is extremely interesting to watch the world splitting into multiple parts. I’m not sure if that’s “reassuring,” but one thing is certain: it leaves no one indifferent. Yesterday was the perfect representation of the global mess we are sinking into at the speed of a galloping bear. Between leaders printing money like there’s no tomorrow and spending it all on weapons, making the defense sector explode while gleefully heading to the front lines, and Trump kicking off the steamroller of tariffs while cutting off aid to Ukraine, the equation is becoming seriously complicated. Putting Things in Order To avoid mixing everything up and to make sure we don’t forget anything, let’s take things step by step. Let’s start with what happened in Europe yesterday. In the morning, everyone was excited about the concept of the U.S. cryptocurrency reserve, which sent the sector soaring—but that wasn’t all. There was also the prospect of massive investments in the defense sector, as European leaders now see themselves as Navy SEALs, all dressing like Zelensky to look more like “soldiers.” Every politician in Europe has switched to the warrior side of the force, constantly preaching about a UNITED Europe (a concept that exists only in the adolescent dreams of some). A UNITED Europe that, according to them, would have a military stronger than Russia, stronger than the U.S., and soon even stronger than China. Well, the only difference between these regions of the world is that the U.S. is a country, Russia is a country, China is a country, and Europe is a club of countries that don’t all agree with each other. They can’t even decide on the regulations for selling Greek jam in a German supermarket, yet they want us to believe they can unite against Russia—a Russia that, according to some delusions, is already positioning itself in the Parisian suburbs. Regardless of one’s opinion on the matter, it’s essential to consider Bayrou’s speech yesterday. The guy showed up before the National Assembly to explain, with a few well-calculated additions, that Europe has the strongest army in the world (if they can agree) and that by spending billions, it will be easy to crush Putin. Coming from a guy who never did his military service and was exempted because his ears wouldn’t allow him to wear a helmet, this is immediately reassuring. Personally, it makes me want to enlist… But back to the financial markets. Yesterday, just the idea of massive investments in the defense sector—which had already been hinted at two weeks ago, but less so, because this time, the London meeting made everyone realize it was “for real”—made ESG investors completely change their tune. ONCE AGAIN, they rushed into defense stocks. It was the same story all over again: Thales surged 16%, Dassault Aviation 15%, BAE Systems followed suit. Rheinmetall soared like a missile, up over 13%, Hensoldt gained 22%, Saab more than 11%, and Leonardo jumped 16%. I won’t list them all, but since November, Rheinmetall alone has nearly tripled in value. Clearly, the European arms industry is thriving, and the idea of going to war seems to excite politicians more than ever. Yesterday’s European session was explosive—both literally and figuratively—with the DAX closing up 2.64%, at an all-time high, just like Switzerland, which remains a neutral island while awaiting its F-35s, which, at this delivery pace, may end up in a museum before ever seeing Emmen. And Then Came Trump After Europe’s conscription day—where world leaders handed themselves military ranks and decided on the colors of their medals—we closed the markets in full-on war euphoria. At times, we almost expected Macron, Starmer, and von der Leyen to break into a HAKA dance to demonstrate their warrior spirit. And then the Americans arrived. Or rather, I should say: TRUMP arrived. Because right now—and since January 27—there isn’t a single day when the markets don’t revolve around him. The problem is, no one knows what fuels this guy, because to create this much chaos in the markets every five minutes, he must have an unbreakable cardio. A quick reminder: Trump’s last act of faith was announcing the “crypto reserve” on Sunday night. We won’t go back to that—for now. Instead, yesterday’s Trump-made topic was the announcement of new investments in the U.S. and a return to the subject of tariffs. On the investment side, things looked promising: TSMC is investing $100 billion in the U.S., and Honda, which had planned to build a factory in Mexico, will now do it in the U.S. At that very moment, we were still thinking: “Well, this isn’t bad. Trump is bringing business back to the U.S., which will inevitably create jobs and growth. Maybe these tariff policies aren’t so crazy after all.” I have to admit, the joy didn’t last long, because right after that, we came back to the topic of tariffs. But before going further, let’s remember that throughout yesterday, traders were thinking: “Well, we’re not too worried about tariffs. Trump will surely show some flexibility and give Canada and Mexico more time to negotiate. We all know tariffs are just a massive bargaining tool, and everything will turn out fine.” Actually: NOT AT ALL… The U.S. President decided that tariffs would take effect immediately—end of discussion. At that point, if you remember how the markets reacted when tariffs were first announced… well, it was the same story. The markets plunged into freefall, just as we’ve seen before. Cryptos crashed again because Trump didn’t provide ENOUGH DETAILS about his federal crypto reserve. Tech stocks collapsed because hedge funds are reducing their exposure to the MAGNIFICENT SEVEN and looking for more defensive alternatives. Volatility exploded by 24%, and suddenly, articles began appearing with headlines like: “Options Traders Are Preparing for a Stock Market Crash.” And to top it all off, the Atlanta Fed released its GDPNow indicator, suggesting that the U.S. could be heading toward a recession—largely due to tariffs. Well, “recession” is a bit of a dirty word nowadays,

Week Of All Dangers – Or We Don’t Care At All

I’m not going to repeat how long I’ve been doing this job, because it sounds a bit like the old trader who repeats himself and tells the same story over and over. But one thing is certain, when I take my eyes off my MAC and go on vacation for a few days, something spectacular always happens. It wasn’t a surprise to hear Trump ranting again about tariffs or getting into a spat with some foreign leader, but let’s just say we felt a quick gust of doubt sweep across the markets. The rescue might come from employment or from Greed and Fear. Anyway, we’re going to have a good laugh. And it all started last night. Putting the church back in the middle of the village When you’ve disconnected for a week, it’s never easy to get back behind the wheel and find things to talk about on Monday morning. Especially when you’ve spent the week in the fog and the whiteout, trying to avoid unknown skiers passing you on their skis, popping up out of nowhere. But still, with the current news, it’s not difficult to find things to say from the first hour of Monday. In fact, I even started writing my column on Sunday evening to make sure I didn’t miss anything. First off, one thing seems very clear to me – for the moment, we are in “geopolitics and that’s it” mode. We really don’t care much about what’s happening on the fundamental side. The only thing that interests us is knowing who Trump and Vance are going to get into a fight with in the next 24 hours, and which country will get hit with tariffs. Then, of course, there’s the crisis between the US and Europe, which is triggering a shopping spree in the armament sector for the past two weeks. The shopping spree was once again pushed forward this weekend after European leaders decided to spend an unimaginable amount of money on weapons, while half of that sum could have solved world hunger and addressed the needs of the most disadvantaged in Europe. But apparently, according to the warmongers who govern us, it’s way more fun to buy tanks and missiles to kill anything that dares cross the border west of Ukraine. What’s particularly interesting to note is that these weapons are mainly being bought from the Americans. It’s the shepherd’s answer to the shepherdess: “You’re being nasty with Volodimir, so as punishment, we’re going to buy lots of missiles to protect ourselves from your buddy Vlad the Impaler.” I don’t know about you, but I have the feeling they’re treating us like fools, and in the meantime, we’re distracted, and we’re not looking at the mess some of the big countries in the Union are in – especially regarding their domestic policies. But in the end, we don’t care. So, geopolitics is our friend and keeps us busy. Then, of course, there’s the economy, which sometimes takes the spotlight again. Last week, on the last trading day of February, we even got an economic number that really saved our backs. If we remember the CPI figures published two weeks ago, we had good reasons to fear that the PCE numbers, which were to be released on Friday, wouldn’t be good – maybe even worse: worrying. But here’s where the beauty of global markets lies: according to the US Department of Commerce, inflation slowed down in January in the US to 2.5% year-over-year, down from 2.6% the previous month, in line with expectations after several consecutive accelerations. Yes, the PCE is less bad than the CPI. Turns out, inflation is a fake problem; you just have to look at it from the right angle. If you eat nails or screws instead of eggs, meat, and regular food, you won’t even feel the inflation. If you live under a bridge, you won’t pay rent, and you won’t feel the real estate prices hitting your wallet. And to top it off, since you’re living under a bridge, you don’t have a car, so no worries about gas prices. All that to say, when we were worried about the CPI two weeks ago, there was really no reason for that, since the PCE fixed everything last Friday. Again, I sometimes feel like we’re being treated like fools, but since I’m the only one, I’m going to start believing that it’s the one who speaks who is… Aside from that, these EXCELLENT PCE NUMBERS that fully reassure us about inflation will need to be confirmed by the job numbers, to see if the economy is fully aligned in the right direction so that the FED can FINALLY do its job and lower rates as it should, so the bull market can get back on track. And that’s perfect because, as for the employment numbers, the upcoming week is going to be packed: JOLTS, ADP, and NFP – we won’t be spared. But at least, by the end of the week, we’ll know whether Friday’s rebound was a “fake bounce” or if it was something more important and that the contrary indicators, “GREED AND FEAR,” were right to show us that people were way too scared of a downturn. Yes, because for the past few years, CNN has developed an index that shows us that THE MORE WE FEAR, the more it rebounds, and THE MORE WE’RE TOUGH GUYS who fear nothing, the more we get destroyed. And right now, this index is telling us that we have super, mega, crazy fear. So, it can only go up. Normally. And then, I was thinking: the economy and finance are truly magical! No, because if I remember correctly—two weeks ago, we were saying: “BUT, BUT, if inflation is high and growth is sluggish, we’re heading toward STAGFLATION!!! OH MY GOD!!!” Whereas since the PCE on Friday, if the employment numbers show strong engagement, we’re going to say: “BUT, BUT, if inflation calms down AS THE PCE SHOWS

The Bishop’s Move

Trump behaves like the absolute master of a chess game in which he dictates the rules. But one must not forget the famous bishop’s diagonal. Is the king mad, or should we look for the king’s fool? While waiting for an answer, the markets experienced strong declines last night and this morning. And what about Bitcoin? While waiting for an answer, the master of the game disrupts European markets In Europe, the consumer confidence index came in at -13.6 in February, as expected, compared to -14.2 in January. But it was mostly Trump’s impact on tariffs that weighed down the markets. The CAC 40 lost 0.51% to 8,102 points, and the Euro Stoxx 50 dropped 1.12% to 5,465 points. The DAX fell 1.2%, while the FTSE 100 gained 0.28%. Ferrari took a hit, losing nearly 8% after Exor, the Agnelli family’s holding company, announced the sale of around 4% of its shares. Meanwhile, in England, Rolls-Royce (a defense-linked stock) soared by 16% after raising its annual targets and announcing a dividend payout. In Switzerland, the SMI closed down 0.65%. Roche (-0.5%) and Nestlé (-0.6%) weighed on the index. Swiss Re, however, reported strong 2024 results. However, first-quarter 2025 earnings will be impacted by the wildfires in California. As expected from an insurer, premium prices will continue to rise. Swiss Re surprised positively with a higher-than-expected dividend and a smaller-than-anticipated impact from the Los Angeles wildfires. Meanwhile, the Swiss Confederation’s president expressed confidence that Trump’s retaliatory measures against the EU would not affect Switzerland. An interesting certainty in a completely unstable world where the U.S. Secretary of Health may take decisions that could impact Swiss pharmaceutical exports to the U.S., which account for 40% of total export value. In the European bond market, a slight easing is underway, with French OATs down 1.5 basis points to 3.14% and German Bunds down 2.5 basis points to 2.415%. Across the Channel, Gilts remain stable at around 4.564%. In the United States Economic figures in the U.S. continue to follow a familiar pattern. Jobless claims increased more than expected last week, while another report reaffirmed that economic growth slowed in the fourth quarter. Today, new data on personal consumption expenditures will be released. The U.S. yield curve inversion deepened on Thursday, with three-month Treasuries (4.33%) yielding more than ten-year bonds (4.27%). The Dollar Index, which measures the greenback against a basket of currencies, rose by 0.72% to 107.23, marking its biggest daily gain since December 18. The euro fell 0.74%, heading for its sharpest drop since January 2, trading at $1.0405. The Canadian dollar weakened by 0.69% against the U.S. dollar to 1.44 CAD, while the Mexican peso lost 0.12%, reaching 20.464 per U.S. dollar. Spot gold fell 0.1% to $2,874.69 per ounce, down 2% for the week so far. Silver rose 0.4% to $31.37 per ounce, platinum firmed by 0.3% to $951.95, and palladium gained 0.1% to $920.34. Commodities, except oil, are also suffering Brent crude futures rose by $1.43, or 2%, to $73.90 per barrel. WTI crude futures increased by $1.46, or 2.1%, to $70.08 per barrel. Three-month copper on the London Metal Exchange (LME) edged down 0.1% and was down 1.9% for the week. Among other metals, LME aluminum rose 0.08%, tin gained 0.2%, LME zinc fell 0.2%, nickel dropped 0.6%, and lead declined by 0.2%. Corn fell by 12-1/2 cents to $4.81 per bushel after hitting its lowest level since February 3. Wheat lost 16-3/4 cents to $5.63 per bushel, marking its lowest point since February 4. Soybeans dropped 4 cents to $10.37-1/4 per bushel. And Trump continues playing chess… On Thursday, Donald Trump told Keir Starmer that a minerals agreement was the only security guarantee Ukraine needed against Russia. He also pretended not to remember calling Ukrainian President Volodymyr Zelensky a “dictator” last week. Thus, the U.S. position remains unchanged: no discussion of peacekeeping forces before an agreement is signed between Russia and Ukraine. And just like that, Trump keeps the upper hand… This morning in Asia Japan’s Nikkei dropped 2.4% at the start of trading, while South Korea’s Kospi lost 1.8%, and Australia’s benchmark index slipped 0.9%. Chinese stocks performed relatively better, with the Hang Seng down 1% and the CSI 300 falling 0.3%. Bitcoin was last down over 5% on the day, trading at $79,666—falling below $80,000 for the first time since November 11. Ether followed the trend, dropping nearly 6% to $2,149.38, hovering around its lowest level since January 2024. “Because the people are ignorant of the higher interests of the State, lies are a legitimate political instrument: ‘The good prince must be a great simulator and dissimulator.’” — Machiavelli Thomas Veillet Financial Columnist

Money has no smell

Any reference to the AI-generated photo showing Trump kissing both of Musk’s right feet would be purely coincidental… But it’s mainly the weak U.S. economic data and Tesla’s sales that are dragging down the market, while European stocks are holding up. What about the Trump effect? The Conference Board’s Consumer Confidence Index came in at 98.3 in February, down from 105.3 in January (revised from 104.1). The expected figure was 102.7. This marks the sharpest monthly decline since August 2021.” When consumers are asked about their situation in six months, we see that their outlook on the business environment has become negative. Pessimism regarding the labor market outlook has worsened, and consumers are less optimistic about their income prospects. And Tesla is suffering from a tarnished image… The Musk effect… Tesla saw its sales in the EU, the UK, and the European Economic Area drop by 45.2% year-on-year in January 2025. In contrast, the Chinese company SAIC Motors saw its sales increase by 36.8% over the same period… while awaiting the rise in customs duties promised by Europeans. According to ACEA statistics, in January 2025, sales of new battery electric vehicles rose by 34%, reaching a market share of 15%. Three of the four largest markets in the region, which together account for 64% of all battery electric car registrations, saw strong double-digit growth: Germany (+53.5%), Belgium (+37.2%), and the Netherlands (+28.2%), while France saw a slight decline of -0.5%. Sales of hybrid and gasoline cars dropped by 8.5% and 18.9%, respectively. New Car Registrations by Manufacturer for the EU, EFTA, and UK Markets. A Brief Look at the Financial Markets European markets reacted relatively modestly, with the exception of the CAC 40. The Paris stock exchange lost 0.49%, while the DAX fell by 0.13%, and in London, the FTSE 100 gained 0.11%. The EuroStoxx 50 index closed down by 0.17%, the FTSEurofirst 300 rose by 0.14%, and the Stoxx 600 gained 0.13%. The hardest-hit sector was technology, suffering from Trump’s comments on semiconductors and China. STMicroelectronics dropped by 2.2%, ASML by 2.3%, and ASMI by 2.9%. In Switzerland, the SMI finished up 0.55%, thanks to the strong performance of Novartis (+2.4%), good results from Lindt (+2.0%), and Nestlé (+1.4%). Tech stocks weighed on the U.S. market. While the Dow Jones gained 0.37%, the S&P 500 fell by 0.47%, and the Nasdaq dropped by 1.35%. Nvidia lost 2.8% ahead of its highly anticipated quarterly earnings release, while press reports indicated that the U.S. administration intends to further restrict semiconductor exports to China. Zoom Communications declined by 8.5% after issuing a disappointing annual forecast. Bond Market German 10-year Bunds eased slightly to 2.455% (-1.5 basis points), while the French OAT for the same maturity dropped by 2.2 basis points to 3.198%, resulting in a narrowing spread to 74 basis points. U.S. Treasury yields came under pressure due to bets on a Federal Reserve easing, with the benchmark 10-year yield falling to a two-month low of 4.283%. The 2-year yield decreased by 1 basis point to 4.086%, and the 30-year yield stood at 4.565%. The Dollar’s Struggles The dollar is suffering from this situation. The Dollar Index dropped by 0.25% to 0.30%, while the Euro strengthened by 0.4% to 1.0510 USD, the Pound rose by 0.35%, the Swiss Franc gained 0.50%, and the Yen climbed by 0.4%. Precious Metals Spot gold was up by 0.1% at 2,918.01 dollars per ounce. Silver remained stable at 31.74 dollars per ounce, platinum fell by 0.3% to 964.00 dollars, and palladium rose by 0.3% to 930.73 dollars. Commodities Oil prices dropped significantly, with Brent falling by 2.45% to 72.95 dollars per barrel, and West Texas Intermediate (WTI) declining by 2.55% to 68.90 dollars. Wheat followed corn’s downward trend as weather threats to northern hemisphere winter crops eased, while soybean futures were mixed in a volatile market. Bitcoin’s price fell by 6% to 88,333.09 dollars, according to Coin Metrics. Earlier, it had dropped to 85,899.99 dollars, its lowest level since November. The plunge in Bitcoin triggered a wave of liquidations, forcing traders to sell their assets at market prices to settle their debts. Centralized exchanges recorded 697.6 million dollars in long liquidations in the last 24 hours, according to CoinGlass. The Trump effect fades… This Morning in Asia The MSCI Asia-Pacific index excluding Japan rose by 0.63% on Wednesday, boosted by a rally in Chinese markets. The Hang Seng index surged by more than 2%, the Hang Seng Tech index gained 2.7%, and the CSI300 index of large-cap stocks rose by 0.54%, while the Shanghai Composite index gained 0.7%. On the other hand, the Nikkei dropped by 1.15%. Oil prices regained some color, with Brent up by 0.34% and WTI rising by 0.35%. Copper prices in London climbed on Wednesday, following a weak dollar after U.S. President Donald Trump ordered an investigation into potential new tariffs on copper imports, aimed at boosting U.S. production of the metal. Three-month copper on the London Metal Exchange (LME) rose by 0.6%. Among other metals, LME aluminum fell by 0.06%, LME zinc added 0.2%, nickel rose by 0.3%, lead gained 0.4%, and tin dropped by 0.6%. Have a nice day – See you tomorrow! Thomas Veillet Financial Columnist

Spot the mistake

The stock markets wavered based on corporate earnings results but also on Trump’s statements about tariffs. More importantly, the press conference with Trump and Macron… the former is keeping his cards close to his chest, while the latter is getting lost in dubious rhetoric. The holiday season is a great time for entertainment, and here are a few riddles: Trump/Putin. Who is the puppet?Trump/Silicon Valley. Who is the strongest?1940/2003. Who is history’s fool? Answers: During the third 2016 presidential debate between Democrat Hillary Clinton and Republican Donald Trump, Trump expressed his willingness to restore normal relations with Vladimir Putin. “That’s because he’d rather have a puppet as President of the United States,” the Democrat retorted. Thiel and Musk founded PayPal, and Thiel also co-founded Palantir Technologies. In 2007, Fortune magazine used the term “PayPal Mafia” to describe 13 highly influential figures in the tech world. These individuals supported Trump. So, Trump may be the strongman of the moment, but Silicon Valley will be the long-term winner. On May 10, 1940, German troops attacked Holland and Belgium despite both countries’ neutral status. Later, the armistice with France was signed, and Hitler demonstrated that a new order would now reign over the French capital, which would have to live on “German time.” On March 20, 2003, a coalition led by the United States, with allies like the United Kingdom and Spain, invaded Iraq after U.S. intelligence claimed Saddam Hussein possessed weapons of mass destruction. We know how that turned out… The fool is Europe, which—except for France—endorsed Bush’s decision. In conclusion, we can hypothesize that Europe finds itself in the position of a boxer practicing the art of dodging against a Mike Tyson, who will eventually land a violent blow and win by knockout. Note: Trump and Macron’s press conference will likely roll off Putin like water off a duck’s back. We’ll see today and later in the week when the British Prime Minister meets with Trump what the latter will write on his website… Overnight, the UN Security Council adopted a U.S.-backed resolution calling for a swift peace in Ukraine, with Russia’s support, but without any reference to the country’s territorial integrity. The four EU countries (France, Slovenia, Greece, Denmark) and the UK abstained. Meanwhile, in the markets… European stock markets closed lower on Monday, except for Frankfurt. The CAC 40 lost 0.78%, the DAX gained 0.60%, and in London, the FTSE 100 remained flat. The EuroStoxx 50 fell 0.42%, the FTSEurofirst 300 dropped 0.12%, and the Stoxx 600 declined 0.10%. German defense companies Rheinmetall, Hensoldt, and Renk rose between 3% and 6.4%, boosted by expectations of increased military spending after Sunday’s conservative victory. In contrast, electrical equipment suppliers involved in data center construction (Siemens Energy, Schneider Electric, and ABB) lost between 4% and 7% after Microsoft secured U.S. AI data center leasing contracts. In Switzerland, the SMI ended up 0.04%. Notably, Nestlé performed well (+3.2%) after Goldman Sachs raised its price target to CHF 93. The American investment bank may be positioning itself as the orchestrator of a potential spin-off or sale of Nestlé’s Water division. In the U.S., Trump’s statements on tariffs imposed on Canada and Mexico sent a chill through the markets. The Dow Jones edged up 0.08%. However, the Nasdaq fell 1.21%, and the broader S&P 500 lost 0.50%. Chinese tech giant Alibaba’s stock plummeted more than 10% in New York on Monday after announcing plans to invest €50 billion “over the next three years” in artificial intelligence (AI) and cloud computing. Data analytics company Palantir also tumbled more than 10%, marking its fourth consecutive decline after the U.S. Department of Defense announced a budget review. Nvidia also fell (-3.09%) ahead of its quarterly earnings report, which investors will closely watch on Wednesday. In the bond market, German Bunds fluctuated before settling at 2.489%. French OATs followed suit, closing at 3.224%. Further south, Italian BTPs remained stable at around 3.555%, while Spanish bonos rose +2.5bps to 3.164%. In the UK, Gilts continued to decline (+1.5bps) to 4.626%. Meanwhile, the yield on U.S. 10-year Treasuries eased to 4.40% from 4.43% on Friday. In currency markets, the euro’s recent gains vanished, bringing the currency back to its level from the start of the week, trading at $1.0461. The U.S. dollar rebounded from its lowest point in two and a half months against major peers, reaching 106.75. In commodities, spot gold remained largely unchanged at $2,950.39 per ounce, about $6 below its all-time high of $2,956.15. Spot silver rose 0.3% to $32.45 per ounce. Platinum held steady at $966, while palladium fell 0.4% to $936.25. Commodities Lagging… Except for Oil Chicago Board of Trade wheat futures closed lower on Monday due to weakness in corn and soybeans, along with reduced concerns about weather conditions for winter wheat crops in the Northern Hemisphere, traders reported. Three-month copper on the London Metal Exchange (LME) fell 0.3%. Among other metals, LME aluminum dropped 0.8%, zinc lost 0.5%, nickel declined 0.3% to $15,395, tin fell 0.3%, while lead gained 0.1%. Brent crude rose 0.2% to $74.93 per barrel, while U.S. crude climbed 0.3% to $70.92 per barrel. This Morning in Asia The broadest MSCI index of Asia-Pacific stocks outside Japan fell 1.3%. Japan’s Nikkei returned from a holiday with a 0.9% drop. Hong Kong’s Hang Seng Index tumbled 2.3%, extending Monday’s losses after U.S. President Donald Trump signed an order restricting Chinese investments in strategic sectors such as semiconductors, AI, and aerospace. Chinese blue-chip stocks fell 0.9%. Have a nice day, see you tomorrow! Thomas Veillet Financial Columnist

Resting…no more gifts

A Friday full of surprises: Macron wants to go give Trump a few lessons, U.S. consumer confidence somewhat shaken, and anticipation for the elections in Germany. Consumer Confidence, Macron, and Trump Are on a Boat… Guess Who’s Drowning? The economic and political news has been surprising. The University of Michigan’s Consumer Confidence Index fell to 64.7 from 71.7 in January, marking a 10% drop in a month and nearly 16% over the year. The index is now even lower than the preliminary estimate (67.8), which, when published on February 7, had already depressed the markets as it was well below expectations. Regarding his meeting with Donald Trump in Washington, Emmanuel Macron, the self-proclaimed Sun King, is set to offer some advice to Emperor Trump: “I’m going to tell him: you can’t be weak in front of President Putin—that’s not you, that’s not your brand. How can you then be credible in front of China if you’re weak against Putin?” He added, “If you let Ukraine fall to Putin, Russia will become unstoppable for the Europeans.” Meanwhile, European leaders are acting like Switzerland’s president, who has read Trump’s book (an important detail), meaning they are “waiting to see.” A small piece of advice… read Machiavelli. One last thing before we go: maintaining Ukraine’s access to Starlink, owned by SpaceX, was reportedly discussed between U.S. and Ukrainian officials after Ukrainian President Volodymyr Zelensky rejected an initial proposal from U.S. Treasury Secretary Scott Bessent, sources said. Financial markets remain more sensitive to economic data, and the latest U.S. figures had a visible impact: the Dow Jones dropped 1.69%, the Nasdaq plunged 2.20%, and the broader S&P 500 index fell 1.71%. Semiconductor giant Nvidia lost 4.05%, while Microsoft fell 1.90%, Amazon declined 2.83%, Tesla dropped 4.68%, and Alphabet lost 2.71%. Meanwhile, in the crypto world, while the U.S. financial watchdog decided to drop charges against Coinbase, Bybit, one of the world’s largest cryptocurrency exchanges, announced that a hacker had taken control of an Ethereum wallet and transferred $1.4 billion to an unidentified address. In Europe, markets were in another world. The CAC 40 closed up 0.39%, the British FTSE ended nearly flat with a 0.04% decline, while Germany’s DAX finished down 0.23%. The EuroStoxx 50 closed 0.19% higher, the FTSEurofirst 300 gained 0.47%, and the Stoxx 600 added 0.49%. In Switzerland, the SMI rose 1.10%, boosted by heavyweights like Nestlé (+3.4%), Roche (+1.1%), and Novartis (+1.5%). Bond yields also fluctuated, with Germany’s 10-year Bund yield dropping 6.9 basis points to 2.4640%, while the two-year yield fell 5.0 basis points to 2.1010%. U.S. Treasury yields also declined, with the 10-year yield down 4.3 basis points to 4.4565% and the two-year falling 2.1 basis points to 4.2448%. By late morning, the dollar remained stable against the yen at 149.58 yen. It has fallen in five of the last six weeks, losing 1.8% this week. The yen has gained about 3.2% so far in February. A quarter-point rate hike is not fully priced in until September, though interest rate markets have factored in a slight possibility of an increase as early as May. Meanwhile, the euro fell after a series of economic activity surveys showed a sharp contraction in early February in France and a slight improvement in Germany—historically the two key drivers of eurozone growth. Gold and Commodities Decline, Except for Wheat Spot gold lost 0.3% to $2,930.85. The bullion gained about 1.7% last week after reaching a record high of $2,954.69 on Thursday. Spot silver was down 0.6%, palladium fell 0.9%, and platinum lost 1%. Oil prices declined on Friday but were still heading toward a positive weekly close amid supply chain disruptions in Russia and a potential rebound in demand from China and the United States. Brent crude dropped 1.96% to $74.98 per barrel, while U.S. crude fell 2.06% to $70.99 per barrel. Soybeans closed down 5-3/4 cents after hitting their highest level since February 11. Over the week, the contract advanced by 0.4%. Chicago Board of Trade wheat futures ended higher on Friday due to short covering and buying by commodity funds, traders said. German Elections… The Christian Democrats secured the largest share of votes (29%) in the German legislative elections, but the sharp rise of the far-right party Alternative für Deutschland (21%) is likely to complicate the formation of a government tasked with providing a European response to growing global threats. DAX futures rose 1.1%, while the euro gained 0.5% to $1.0516 and appears poised to test its January high of $1.0535. This Morning in Asia Liquidity was reduced due to a public holiday in Tokyo, and the MSCI index of Asia-Pacific stocks outside Japan declined by 0.2%. Chinese blue-chip stocks fell by 0.1%, but Hong Kong stocks strengthened by 0.2%, extending their recent bullish run driven by the technology sector. Have a nice day and see you tomorrow! Thomas Veillet Financial Columnist