Tariffs, Yeah Yeah…

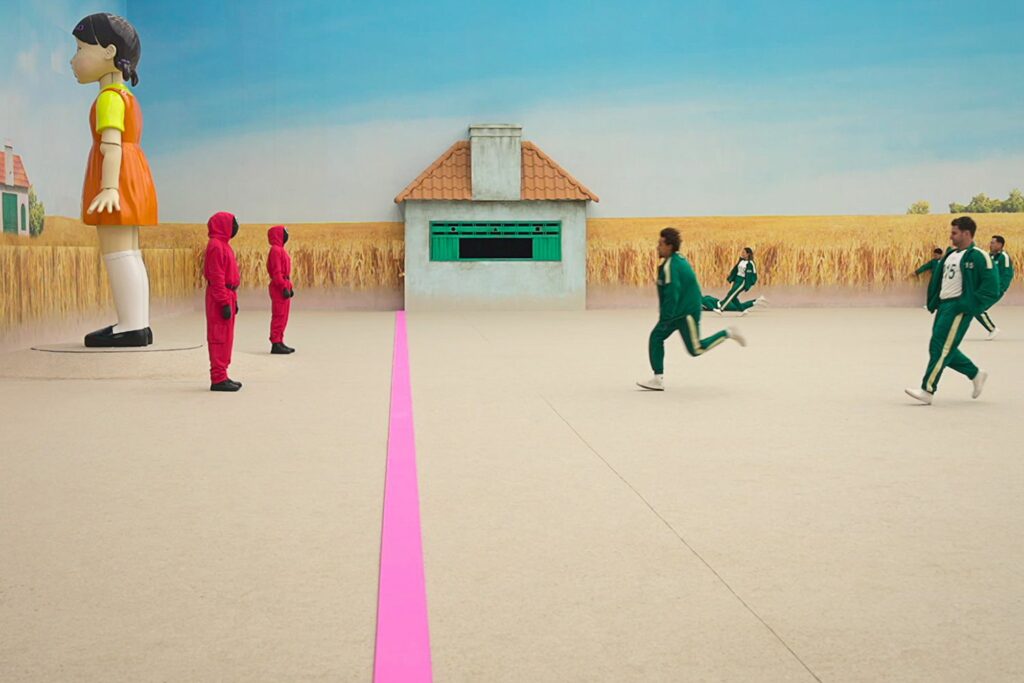

I just went through the latest news from last night and Sunday evening, and it seems that Trump has refrained from making any sharp statements for over 48 hours. At least, no statements that could impact the markets or drag us underwater as we start the week—something we’ve gotten used to since the American President took office. So, we should begin the week on the same footing as the end of last week, hoping that the worst is behind us and, most importantly, that after the storm comes the calm! Nothing Changes Technically, the markets are still highly oversold, and we remain in critical zones. For now, it looks like we’ve limited the damage, and in the grand scheme of things, we’re not that far from all-time highs. It wouldn’t take much for the market outlook to shift from storm warnings to clear blue skies. However, the same issues that got us here are still present and remain a serious thorn in our side. TARIFFS are our main concern—and will likely remain so for quite some time. In early April, Trump is expected to implement reciprocal tariffs with several countries, but there’s still a lot of uncertainty. So far, trade issues haven’t been resolved, whether with Europe, Canada, China, or Mexico. In short, we keep talking about it, but given the lack of clarity—not just regarding their implementation but also the possibility of them being lifted, reduced, increased, or modified—we’re left in the dark. This is what we call UNCERTAINTY, and apart from discussing it every morning, there’s not much hope for clarity anytime soon. The good news is that, “for now,” we seem to have “digested” the situation. As long as the White House doesn’t announce exceptional tariffs on French camembert exports, things might not get worse. Looking at analysts and strategists, expectations for the year have already been lowered, but at the same time, we’re not plunging into an economic abyss. Last week, we did hear some positive news regarding artificial intelligence—take Micron’s quarterly numbers, confirming the sector’s boom. That said, this optimism hasn’t been reflected in the behavior of the Magnificent Seven, particularly Nvidia, as investors remain cautious about the tech sector. We know that at these levels, it’s a great opportunity to reinvest, but for now, risk appetite remains moderate. Confidence—or Lack Thereof While the bleeding has stopped, the rebound has been about as dynamic as an overcooked spaghetti noodle left in boiling water for a week. We need a clear confirmation of this rebound, not this sluggish movement we’ve been witnessing over the past three or four days. The first real test for any meaningful recovery may come from the U.S. consumer confidence data set to be released Tuesday evening. After all, American growth is nothing but a myth if the average American isn’t spending their evenings shopping on Amazon—mostly buying useless things. Lately, however, enthusiasm seems to be fading, with consumers opting to browse Vinted rather than the Apple Store to splurge on two new MacBooks and three iPhones. We saw and heard it last week: FedEx isn’t optimistic about the future, and Nike hinted that “this year won’t be easy.” These statements suggest that consumer spending is slowing down, and when that happens, American growth suffers—and the worst-case scenario looms. However, tomorrow’s consumer confidence data will either reassure us or sink us further. If the number disappoints, panic will set in, reminding us of recent reports suggesting that a potential recession could be on the horizon by summer. And I don’t need to explain what happens when people start seriously considering the arrival of a recession—scythe, black hood, and all. Ironically, the only silver lining in this scenario would be if consumer spending slows down enough to help inflation retreat toward 2%—which, in that case, would be a blessing in disguise. It’s for the end of the week And inflation? We’ll talk about it at the end of the week since we’re in “PCE week,” and that’s when we’ll see if everything is falling into place in the right direction and whether we should conclude that this economic slowdown—driven by consumers and falling inflation—is the price to pay to allow Powell to cut rates AND restart the economy while Trump pockets cash with his tariffs. It’s still a bit early to make judgments or place bets on what’s next, but the numbers that will be our daily bread this week might give us a bit more clarity and add some extra pieces to the global financial puzzle. I wouldn’t go so far as to say that the coming week is a “turning point,” but let’s just say that a few seemingly trivial figures could help us navigate our way out of this labyrinth of tariffs, interest rate wars, and the ongoing fight against inflation. The upcoming week will also be interesting from a geopolitical perspective, since last week’s discussions were limited, and the ceasefire between Russia and Ukraine is becoming more and more overdue. As for Gaza, we’ve apparently already forgotten how to spell the word “ceasefire.” In short, investors are filled with doubt, waiting for concrete proof before confirming a rebound—or completely deflating. Yes, because we must be very careful: in case of disappointment and a potential drop back to the March 15 lows, with a possible break below the 5,500 level on the S&P 500, we could find ourselves in what might well be called a “financial bloodbath.” But let’s not sell the bear’s skin before we’ve killed it. For now, futures indicate a grand opening on Wall Street, but if Trump set his alarm early on this penultimate Monday of March, let’s not forget that he has the ability to flip optimism on its head 22 times in a single day. Asia and the Rest This morning in Asia, absolutely nothing is happening. The three main regional indices are in total stagnation. If they were playing “Red Light, Green Light,” they’d be unbeatable. The Nikkei is unchanged, despite

Where To Hide?

Geopolitically, in the Gaza Strip, Israel continues its ground operations, while Hamas has decided to retaliate. In Turkey, new protests were planned Thursday after the arrest of Istanbul’s mayor, Ekrem Imamoglu. As for the Russia-Ukraine conflict, despite the principle of a ceasefire accepted by both sides, Kyiv bombed a strategic air base in Russia on Thursday, while Moscow continues its drone attacks. Under these conditions, perhaps it is best to stay in cash? The Swiss National Bank (SNB) continues its monetary easing policy and thus lowered its key interest rate by 25 basis points, bringing it to 0.25% on Thursday. The decision is motivated by weak inflationary pressure and “increased risks of downward revision of inflation,” according to SNB statements. This marks the fifth consecutive cut since Q1 2024. The SNB began gradually lowering its key rate in March last year, from 1.75% to 1.50%. At the last monetary policy decision in December, the central bank surprised markets with a 50-basis-point cut. The Swiss exception in the markets In Switzerland, the SMI closed up 0.43%, thanks to stocks like Nestlé and Novartis (+1.6% each). Roche (+0.03%) joined the British lab Oxford BioTherapeutics’ therapeutic antibody discovery platform with an initial payment of $36 million (around 32 million francs). In Paris, the CAC 40 ended with a -0.95% loss at 8,094.2 points. The British FTSE fell -0.09%, and Germany’s DAX declined -1.18%. The EuroStoxx 50 lost -1.0%, and the FTSEurofirst 300 -0.41%. The Stoxx 600, affected by profit-taking in the banking sector (-1.72%) and industry (-1.03%), ended down -0.43%. The German Bund yield fell 1.8 basis points, to 2.780%. The French 10-year OAT remained stable at 3.472%, as Bercy seeks to raise €5 billion in equity for defense companies. The spread between the Bund and OAT remained unchanged at approximately 70 basis points. The Bank of England unsurprisingly kept its key rate at 4.50% on Thursday. The Monetary Policy Committee voted 8 to 1, with one member preferring a -25 basis point cut. “A gradual and cautious approach is needed regarding further monetary policy easing,” the institution stated. In the United States, the Dow Jones closed near equilibrium (-0.03%), while the Nasdaq fell -0.33% and the S&P 500 -0.22%. Tesla rose slightly (+0.17%) after recalling over 46,000 Cybertruck pickups, as body panels may fall off due to adhesive failure, the U.S. National Highway Traffic Safety Administration (NHTSA) announced Thursday. In the bond market, the 10-year U.S. Treasury yield remained stable at 4.24% compared to the previous day. The price of Bitcoin reached a high of $87,453 in early New York trading but quickly fell to $83,655 after U.S. President Donald Trump made a video appearance at the New York Digital Assets Summit. Before the video statement, rumors circulated on X suggesting Trump would announce zero capital gains tax for certain cryptocurrencies or make a favorable statement about the U.S. strategic Bitcoin reserve. Ultimately, his most positive statement was his reaffirmed goal to make the United States a leader in all areas of cryptography. This morning in Asia Chinese stocks fell slightly in early trading. Hong Kong’s Hang Seng index dropped -0.68% after a -1% decline on Thursday, as investors became cautious following a tech stock rally and the index hit its highest level in three years on Tuesday. Japan’s Nikkei, however, was up +0.38%, driven by banking stocks. The U.S. Dollar Index, which measures the dollar against a basket of six currencies, remained stable at 103.84, after rising +0.36% on Thursday. The yen traded at 149.11 per dollar, near last week’s five-month high of 146.545. The yen is up +5% this year on expectations that the Bank of Japan will raise rates again in 2025. Spot gold fell -0.3% to $3,034.09 per ounce. Silver dropped -0.8%, platinum lost -0.2%, and palladium fell -0.5%. Copper prices in London edged up today, nearing the psychological $10,000 mark after a report suggested China plans to increase its strategic reserves of key industrial metals, including cobalt, copper, nickel, and lithium, this year. Aluminum rose +0.3%, lead increased +0.1%, zinc gained +0.5%, and tin fell -0.1%, while nickel prices dropped -2.0%. Chicago wheat fell for the fourth consecutive session, nearing a one-week low, as the market struggles with weakening demand for U.S. cargoes and a stronger dollar. Soybeans gained ground, while corn prices declined. Brent crude oil futures rose +0.5%, while West Texas Intermediate crude futures increased +0.6%. Both are set to post +2% weekly gains. Have a nice day! Thomas Veillet Financial Columnist

When in Doubt, Don’t Move

The U.S. Federal Reserve (Fed), which unsurprisingly left its rates unchanged on Wednesday, mentioned an increase in “uncertainty” and downgraded its forecasts for the world’s largest economy two months after Donald Trump returned to the White House. At the end of a two-day meeting, the Fed’s communication shows that its officials are less confident in the health of the U.S. economy. According to their first forecast update since December, they now anticipate much weaker GDP growth, at +1.7% by the end of the year (compared to the previously expected 2.1%). They also predict an acceleration in inflation to 2.7% (up from 2.5% in December). Profit-Taking in Europe In Paris, the CAC 40 closed with a 0.70% gain at 8,171.47 points. The British FTSE edged up 0.02%. Germany’s DAX, weighed down by profit-taking in defense stocks, fell by 0.34%. The index had hit a record high the day before, at 23,476.01 points. The EuroStoxx 50 index gained 0.46%, the FTSEurofirst 300 added 0.28%, and the Stoxx 600 rose by 0.26%, mainly driven by the energy sector (+1.53%) amid geopolitical risks. Defense companies Renk Group, Rheinmetall, and Hensoldt dropped by 4.53% and 9.31% due to profit-taking after the Bundestag approved a reform of the debt brake, which is expected to support the country’s military spending. Inflation in the Eurozone stood at 2.3% year-on-year in February, slightly below the initial estimate, according to final data published by Eurostat. The yield on 10-year German government bonds ended down about two basis points (bps), at 2.798%, after hitting a two-week low of 2.748% during the session. It had climbed to 2.938% last week, its highest level since October 2023. Investors are focusing on the Fed and U.S. tariffs. In Switzerland, the SMI ended down 0.16%. Heavyweights Roche (-1.0%), Nestlé (-0.8%), and Novartis (-0.2%) weighed on the index, as did UBS (-1.6%), which finished as the worst performer. Rebound in the U.S. The Dow Jones gained 0.92%, the Nasdaq rose by 1.41%, and the broad S&P 500 index advanced 1.08%. Aircraft manufacturer Boeing surged (+6.84%) following comments from its CFO. Brian West assured that the company had little exposure to President Trump’s tariffs, noting that most of its supplies come from the U.S. Tesla saw strong demand (+4.68%) after Bloomberg reported that the company had taken a key step in developing its robotaxis in California, receiving an initial permit to transport passengers. The 10-year U.S. Treasury yield eased to 4.24% from 4.28% the previous day. This Morning in Asia In Japan, markets were closed due to a public holiday, but Nikkei futures rose by 0.2%. In China, the CSI300 index fell by 0.66%, while the Shanghai Composite Index dropped by 0.46%. Hong Kong’s Hang Seng index tumbled 1.5%. The U.S. dollar weakened this morning, losing 0.27% against the yen, at 148.25, while the euro stabilized at $1.0908, its highest level in five months. The British pound reached a four-month high of $1.3015 early in the session ahead of the Bank of England’s decision later today, where it is expected to keep interest rates unchanged. Spot gold remained largely unchanged at $3,048.37 per ounce after hitting a record high of $3,055.96 earlier in the session. Copper prices on the London Metals Exchange reached their highest level in more than five months on Thursday, with markets watching for potential U.S. tariffs on the metal. Nickel was the worst-performing base metal, falling 1.9%, as concerns over supply eased following news that Indonesia’s main nickel processing complex was unaffected by recent floods. Chicago wheat futures rose, recovering losses from the previous session, as the dollar weakened and slower grain shipments from Russia, a key supplier, raised supply concerns. Soybeans rose for the first time in three sessions, while corn advanced for the second consecutive day. Oil prices rose in early Thursday trading amid falling fuel inventories in the U.S. and rising tensions in the Middle East. Brent crude gained 40 cents (0.57%) to $71.18 per barrel, while West Texas Intermediate (WTI) rose 34 cents (0.51%) to $67.50 per barrel. What Would a Day Be Without Trump? Today, President Donald Trump is expected to sign an executive order that will facilitate the dismantling of the U.S. Department of Education, taking a step toward fulfilling a campaign promise. According to reports, the order also ensures that throughout the process, there will be no disruption in the delivery of services, programs, and benefits that Americans rely on. Mr. Trump will instruct his recently confirmed Secretary of Education, Linda McMahon, to take all necessary steps to prepare for the department’s closure and the transfer of its responsibilities to the states. The executive order also states that any program or activity receiving remaining funds from the Department of Education must not promote diversity, equity, and inclusion (DEI) or gender ideology. Have a nice day! Thomas Veillet Financial Columnist

Another Slice Maybe?

According to the Russian news agency TASS, citing the Kremlin, “President Putin supported Trump’s idea of a mutual 30-day renunciation of strikes on energy infrastructure by Russia and Ukraine and has given the order to the military.” In Germany, the Bundestag approved on Tuesday a historic reform of the debt brake and the creation of a €500 billion infrastructure fund. Before dividing Ukraine between them, our friends Trump and Putin exchanged their views. The 30-day truce looks more like a bluffing game than a firm and manly handshake. Why? Because Vladimir Putin has once again set conditions for the truce, including an end to the “rearmament” of Kyiv, according to the Russian presidency. “The Russian side has emphasized several key points regarding the effective control of a potential ceasefire along the entire contact line, the need to end forced mobilization in Ukraine, and the rearmament of the Ukrainian armed forces,” reports the Kremlin in a statement. Meanwhile In Germany, the Bundestag approved on Tuesday a historic reform of the debt brake and the creation of a €500 billion infrastructure fund, thus putting an end to decades of fiscal conservatism in Germany, which could revive economic growth and support the country’s military spending. Meanwhile, in Switzerland, the Confederation’s Expert Group for Economic Forecasts has slightly revised downward its growth projections for the Swiss economy. The GDP, adjusted for sporting events, is expected to grow by 1.4% in 2025 and 1.6% in 2026 (compared to 1.5% and 1.7%, respectively, in the December forecasts). Thus, growth is expected to remain below average for another two years. These forecasts are based on the assumption that there will be no escalation into a global trade war. Due to the prevailing high uncertainty, SECO is supplementing the expert group’s forecasts with two alternative scenarios. Uncertainty surrounding international economic and trade policies and their macroeconomic impacts remains particularly high. The current forecasts assume there will be no escalation into a global trade war. However, much more extreme developments remain possible. A negative scenario of international economic slowdown would have significant consequences on Swiss foreign trade and the economy. But in the “maybe yes, maybe no” series, if global demand and the European economy were to evolve more favorably than expected, notably due to a large-scale fiscal stimulus, such as the one currently being pursued by Germany, a positive scenario would boost demand for Swiss exports, driving up domestic economic growth. What do the markets think? In Paris, the CAC 40 rose by 0.5% to 8,114.57 points, while the German DAX climbed 1.03% and the British FTSE strengthened by 0.29%. The EuroStoxx 50 index ended the session with a 0.76% increase, while the FTSEurofirst 300 gained 0.56% and the Stoxx 600 added 0.59%. In Switzerland, the SMI closed with a minimal gain of 0.03%. Novartis (-0.2%) was a drag, while Nestlé (+0.3%) supported the index. On the bond side, the French ten-year bond yield reached 3.48% on Tuesday, the same level as the previous day at close. Its German equivalent, the European benchmark, also remained stable at 2.81%. In the United States, investors are awaiting the Fed’s decision but even more so the comments that will follow. The markets continue their erratic movements, though they are mostly bearish. The “Magnificent 7” are becoming less and less so. Nvidia fell 3.43%, dragging down part of the semiconductor sector, including Broadcom (-3.00%), AMD (-1.00%), and Micron (-1.35%). Alphabet, Google’s parent company, lost 2.34% after announcing a “definitive agreement” to acquire the American cybersecurity startup Wiz for $32 billion. Tesla’s stock plunged 5.34% after RBC lowered its price target for the electric vehicle maker from $320 to $120, citing lower expectations for the pricing of its fully autonomous vehicles and its market share in the robotaxi segment. The stock is now down nearly 44% for the year. In the bond market, U.S. ten-year Treasury yields eased to 4.28%, compared to 4.31% the previous day at close. Notable were new comments from the Trump administration on tariffs, adding further confusion to the current situation. U.S. Treasury Secretary Bessent stated that reciprocal tariffs with China will not automatically be 25% plus 25%, and that President Trump has asked him to rethink the U.S. sanctions regime. He also mentioned that each country will receive a specific tariff figure on April 2, which could be low for some, while 15% of countries will account for the bulk of tariffs, according to Fox Business News. Understand that if you can… In the commodities sector, metals were all trending lower. The three-month benchmark copper on the LME fell from a five-month high, down 0.1%, while aluminum dropped 0.2%, lead slipped 0.1%, and zinc lost 0.4%. Only nickel was up, gaining 0.5%. Chicago wheat declined, as Russia—the leading grain exporter—agreed to temporarily stop attacking the energy facilities of its rival supplier, Ukraine, even though it refused to approve a full ceasefire. Corn fell for the second session under pressure from expectations of increased planting in the United States this year, while soybeans rose. Cryptos are suffering. Bitcoin fell 1.82% to $82,472, while Ethereum (-1.42%) and XRP (-3.51%) also declined. However, U.S. Bitcoin ETFs recorded net inflows of $274.6 million, the highest since February 4. This morning in Asia Asian stocks were muted on Wednesday, and gold hovered near its highest levels as economic concerns and a shifting geopolitical landscape kept risk appetite in check, while the yen stabilized after the Bank of Japan () kept rates unchanged as expected. The Japanese Nikkei rose 0.69%, staying close to the levels it traded at before the decision. Spot gold held at $3,029.70 per ounce after reaching a record high of $3,038.26 on Tuesday. In contrast, spot silver fell 0.3%, platinum lost 0.5%, and palladium declined 0.7%. Brent crude futures fell 0.24% to $70.39 per barrel, while West Texas Intermediate crude slipped 0.2% to $66.75 in early trading. Have a nice day! Thomas Veilet Financial Columnist

What Do They Want?

While awaiting information on the discussion between Trump and Putin regarding the division of Ukraine, markets are holding back ahead of meetings of various central banks: the U.S. Federal Reserve and the Bank of Japan on Wednesday, followed by the Bank of England and the Swiss National Bank (SNB) on Thursday. Meanwhile, the Empire strikes back. The Canadian Prime Minister is in Paris before meeting with leaders from other European capitals. A bit of economics…The global economy remained resilient in 2024, with a robust 3.2% annualized growth rate in the second half of the year. However, recent activity indicators suggest a moderation in global economic growth prospects. Business and consumer confidence have deteriorated in some countries. Inflationary pressures persist in many economies. At the same time, uncertainties regarding public policy remain high, and significant risks persist. The continued fragmentation of the global economy is a major source of concern. Higher-than-expected inflation would lead to a more restrictive monetary policy and could result in disruptive price corrections in financial markets. Conversely, agreements to lower tariffs from their current levels could boost growth. The OECD now expects global growth to reach 3.1% in 2025, down from 3.3% in its previous December projections. The United States, where President Donald Trump has sparked a trade war with key partners, is projected to see its GDP grow by 2.2% this year, before slowing to 1.6% next year, according to the OECD, which has thus lowered its growth forecasts for the country by 0.2 and 0.5 percentage points, respectively. OECD experts expect inflation to accelerate to 2.8% in the United States this year (+0.7 percentage points compared to their previous forecast), after 2.5% in 2024. A Bit of Trump… As Usual Why is Canada in the crosshairs of the American president? Oil, base metals? Well, according to Tricia Stadnyk (The Conversation, March 13, 2025), Trump wants to put some water in his Californian wine. Explanation. The United States’ interest in Canada’s water is concerning, even though it is not new. Recently, the U.S. halted negotiations on the Columbia River Treaty, a key agreement on water sharing between the two countries. Geopolitical tensions, combined with demand outpacing supply in a context of climate change, pose an imminent and very real threat to Canada. A long-abandoned water project, known as the North American Water and Power Alliance (NAWAPA), was initially proposed by the U.S. Army Corps of Engineers in the 1950s. It is considered a “zombie project” that keeps resurfacing but never truly dies. It is no coincidence that water is referred to as “blue gold.” And What About the Markets? European stock markets ended higher as the U.S. economy confirmed its slowdown, just two days before the Fed meeting. The CAC 40 index gained 0.57% to 8,073.98 points, while the EuroStoxx50 rose 0.69% to 5,441.46 points. In Switzerland, ahead of the Swiss National Bank (SNB) decision next Thursday, the SMI closed up 1.09%. Novartis rebounded and gained 2.3%. The other pharmaceutical heavyweight, Roche (+1.7%), also supported the index, as did Nestlé (+1.2%), though to a lesser extent. German bond yields fell after reaching their highest levels since October 2023, following the debt brake reform agreement in Germany. The downward revision of Germany’s growth forecasts by the Ifo Institute also contributed to lower yields. The 10-year German Bund yield fell by 7.1 basis points to 2.8030%, while the 2-year yield ended the session slightly lower at 2.1810%. In France, the 10-year OAT yield dropped 9 basis points to 3.4780%. In the United States, the picture was more mixed. The Dow Jones advanced 0.85%, the Nasdaq gained 0.31%, and the broader S&P 500 rose 0.64%. Chevron, the American oil giant, gained 1.08% after announcing the purchase of about 5% of Hess Corporation’s shares. Intel surged 6.82% after documents revealed that its new CEO, Lip-Bu Tan, had purchased $25 million worth of company shares. The 10-year U.S. Treasury yield increased by 0.6 basis points to 4.314%, compared to 4.308% last Friday. The 30-year U.S. bond yield fell by 1 basis point to 4.6045%, from 4.615% on Friday evening. The 2-year U.S. bond yield increased by 4.4 basis points to 4.059%, compared to 4.015% on Friday night. Foreign Exchange Market The euro, which has strengthened in recent sessions due to hopes of a German budget agreement, was up 0.4% at $1.092. It was near its $1.0947 peak from last week, the highest level since October 11. The dollar rose 0.4% against the yen, reaching 149.160 yen, close to last week’s low of 146.52 yen. Meanwhile, the Chinese yuan approached its four-month high in offshore trading, trading at 7.233 per dollar. In cryptocurrencies, Bitcoin was up 1.6% for the day at $84,552. Commodities Spot gold was up 0.2% at $3,008.08. Spot silver gained 0.2%. Platinum added 0.5%, and palladium increased 0.5%. On the London Metals Exchange (LME): Copper remained at its five-month high of $9,864 per ton, driven by China’s stimulus plan and a weaker U.S. dollar. Aluminum remained stable. Lead dipped 0.1%. Zinc lost 0.2%. Tin declined 0.5%. Nickel fell 0.8%. Oil Prices Oil prices rose on Monday after the United States reaffirmed its commitment to relentlessly attack the Houthis in Yemen. Additionally, China’s economic data released earlier in the day fueled hopes of higher demand. Brent crude increased 0.43% to $70.88 per barrel. West Texas Intermediate (WTI) crude gained 0.31% to $67.39 per barrel. Agricultural Commodities Wheat futures in Chicago surged on Monday, as windstorms in U.S. grain regions raised fears of crop damage. Analysts also noted that traders expect a decline in Russian exports, which could increase demand for U.S. wheat. Soybean prices fell due to lower-than-expected production figures. Corn prices edged slightly higher. This Morning in Asia The Hang Seng was up 2% in morning trading, and its 23% gain since the beginning of the year is the largest among major financial markets. Mainland Chinese stocks recorded more modest gains, while the MSCI Asia-Pacific index rose 1%, with markets in Seoul, Sydney, and Taipei also posting gains.

No Worries

The Christian Democratic Union (CDU) of future Chancellor Friedrich Merz, the Social Democratic Party (SPD), and the German Greens reached an agreement on Friday to ease federal debt rules. Meanwhile, in the United States, the government narrowly avoided a federal shutdown on Friday, thanks to some reluctant votes from Democratic senators in favor of a budget bill pushed by Donald Trump. However, Trump congratulated Chuck Schumer “for doing what was necessary and showing courage.” And then there’s Musk… European markets lifted by defense stocks and German policy In Paris, the CAC 40 gained 1.13% to 8,028.28 points. In Frankfurt, the DAX rose by 1.65%, and in London, the FTSE 100 increased by 1.05%. The EuroStoxx 50 closed up 1.34%, the FTSEurofirst 300 gained 1.12%, and the Stoxx 600 advanced by 1.11%. However, for the week, the CAC 40 lost 1.13% and the Stoxx 600 fell by 1.25%, marking their worst weekly performance since mid-December. The European defense sector (+3.91%, +3.92% for the week) had another strong day on Friday, bolstered by Germany’s agreement on the debt brake. In France, Thales led the CAC 40 with a 5.57% rise, while Safran gained 2.28%. Rheinmetall AG surged by 6.29%, and Leonardo SpA climbed 7.13%. In Switzerland, the SMI closed up 0.63%. Among heavyweight stocks, Nestlé (-0.1%) and Novartis (-0.6%) weighed on the index, while Roche (+0.9%) gained ground. ODDO downgraded Novartis from “outperform” to “neutral” without changing its price target, while it raised Roche’s price target but maintained an “underperform” rating, citing an unattractive risk/reward ratio for upcoming Phase III clinical trials. The German 10-year Bund yield rose by 2.1 basis points to 2.8750%. The 2-year Bund yield increased by 1 basis point to 2.1900%. The euro strengthened by 0.29% to $1.0877, supported by expectations of higher German defense spending. The U.S. dollar fell 0.14% against a basket of major currencies. The British pound declined by 0.16% against the dollar due to an unexpected contraction in the UK economy in January. A breath of fresh air in the U.S. The Dow Jones climbed 1.65%, the Nasdaq soared 2.61%, and the broad S&P 500 index jumped 2.13%. The rebound in mega-cap stocks contributed to market gains: Nvidia surged 5.27%, Apple rose 1.82%, Amazon gained 2.09%, and Microsoft advanced 2.58%. Tesla, which had fallen nearly 50% in three months, gained 3.4% on reports that Elon Musk’s company is considering producing a cheaper version of its Model Y in Shanghai to regain market share in China. However, for the past week, the Dow Jones lost 3.07%, the S&P 500 fell 2.28%, and the Nasdaq declined 2.43%. U.S. Treasury yields remained stable, with the 2-year note rising 3.5 basis points to 4.015%, while the 10-year note was at 4.304%, up 3.1 basis points. Gold and oil movements On Friday, spot gold briefly surpassed the $3,000-per-ounce mark for the first time during early London trading before retreating. The precious metal is still up 13.7% since the beginning of the year, as trade wars and economic growth concerns boost its safe-haven appeal. However, the record-breaking moment was short-lived, with gold closing down 0.12% at $2,984.19 per ounce. Oil prices rebounded on Friday, recovering some of the previous session’s losses of over 1%, partly due to uncertainty surrounding a potential halt to the war in Ukraine. Brent crude rose 0.8% to $70.44 per barrel, while U.S. West Texas Intermediate (WTI) crude gained 0.83% to $67.10 per barrel. And then there’s Musk… the lizard Early Friday, Elon Musk shared a post from an X user about the actions of three 20th-century dictators—then quickly deleted it after sparking backlash. The post falsely claimed that Joseph Stalin, the communist leader of the Soviet Union until 1953, Adolf Hitler, the Nazi leader of Germany, and Mao Zedong, the founder of the People’s Republic of China, were not responsible for the deaths of millions under their rule. Instead, it argued that public sector workers were to blame. This morning in Asia Official data showed that Chinese industrial production grew by 5.9% in the first two months of the year compared to the previous year, while real estate investment continued to be a drag. On Sunday, China’s State Council unveiled what it called a “special action plan” to boost domestic consumption, including measures to increase household incomes and establish a childcare subsidy system. The Shanghai Composite Index was still up 0.28%, while Hong Kong’s Hang Seng Index jumped more than 0.8%. Japan’s Nikkei 225 gained 1.24%. Futures indicate a lackluster opening for Wall Street. U.S. Treasury Secretary Scott Bessent stated in an interview on Sunday that there are “no guarantees” the United States will avoid a recession. Have a nice day! Thomas Veillet Financial Columnist

A Toast to 200% Tariffs!

On his Truth Social platform, Donald Trump threatened to impose a 200% tariff on all alcoholic products from European Union countries in retaliation for the 50% tariffs imposed by the EU on whiskey. “This will be great for wine and champagne businesses in the United States,” he wrote. No Inflation, So No Stagflation in the U.S. (For Now) The Producer Price Index (PPI), considered a leading indicator of inflationary pressures, remained unchanged over the month after rising 0.6% in January, according to seasonally adjusted figures. Economists surveyed by Dow Jones had expected a 0.3% increase. A 0.2% decline in service prices offset a 0.3% rise in goods prices. Two-thirds of the increase in goods came from a 53.6% surge in egg prices, according to the Bureau of Labor Statistics (BLS). Egg prices spiked partly due to the avian flu affecting supply, although signs indicate that prices dropped in March as outbreaks slowed. Excluding food and energy, the core PPI fell 0.1%, against expectations of a 0.3% increase, marking its first negative reading since July. Core prices, excluding trade services, rose 0.2%, also below the expected 0.3% increase. Year-over-year, producer prices increased 3.2%, still well above the Fed’s 2% target, but lower than January’s 3.7%. The core PPI rose 3.4% in February, 0.4 percentage points lower than in January. Europe Feels the Impact of Trump’s Announcements In Switzerland, the SMI closed down 0.25%. Nestlé (+0.2%) supported the index, while Roche (-1.4%) dragged it down. In Paris, the CAC 40 lost 0.64%. Germany’s DAX fell 0.63%. The FTSE 100 in the UK stood out with a 0.02% gain, supported by the defensive healthcare sector. French spirits companies took a hit from Trump’s latest threats: Pernod Ricard lost 3.97% Rémy Cointreau dropped 4.67% LVMH fell 1.11% In the bond market, Germany’s 10-year Bund yield fell 3.5 basis points to 2.855%, after reaching a 17-month high of 2.938%. Meanwhile, the German Parliament has begun debating a €500 billion special fund and the reform of the “debt brake” policy. Trade War Still Weighing on U.S. Markets The Dow Jones dropped 1.30%, while the Nasdaq declined 1.96%. The broad-based S&P 500 fell 1.39% to 5,521.52 points, entering correction territory, meaning it has lost 10% from its yearly high on February 19. The “Magnificent Seven” tech stocks all declined: Tesla (-2.99%) Alphabet (-2.53%) Amazon (-2.51%) Meta (-4.67%) Apple (-3.36%) Microsoft (-1.17%) Nvidia (-0.15%) Software giant Adobe plummeted 13.85%, despite better-than-expected Q1 earnings, as investors found its quarterly forecast disappointing. Meanwhile, Intel soared 14.60% after appointing Lip-Bu Tan as CEO, a move seen as a potential turnaround for the struggling company. In the bond market, the yield on 10-year U.S. Treasury bonds eased to 4.27%, down from 4.31% the previous day. Gold remained stable at $2,986.45 per ounce, after hitting a record high of $2,989.46. Silver fell 0.3% Platinum rose 0.3% Palladium gained 0.7% Commodities Remain Weak Concerns over economic outlook and global oil supply-demand forecasts pushed oil prices lower: Brent crude fell 0.94% to $70.28 per barrel West Texas Intermediate (WTI) dropped 1.18% to $66.87 Soybean and corn futures in Chicago declined slightly on Friday, both on track for weekly losses. Trade disputes and ample supply from South America weighed on prices. Wheat also retreated but remained set for a weekly gain due to expectations of lower Russian exports. This Morning in Asia Optimism over a likely U.S. government shutdown avoidance boosted Asian markets in early trading. Senate Democrat Chuck Schumer announced he would vote to advance a Republican stopgap funding bill. The MSCI Asia-Pacific index (ex-Japan) gained 0.2% Japan’s Nikkei reversed early losses to rise 0.12% Hong Kong’s Hang Seng climbed 1%, though it was set for a 2.3% weekly decline China’s CSI300 rose 1.4%, heading for a 0.6% weekly gain One key reason for optimism? Cheap Chinese stocks: Chinese stocks trade 30% below their 2021 highs The Hang Seng Index is valued at 7x forward earnings, compared to 20x for the S&P 500, according to LSEG data The U.S. dollar regained some ground: The euro edged down 0.1% to $1.0841 The British pound slipped 0.05% to $1.2944 The dollar rose 0.3% against the yen to 148.25 Have a nice day! Thomas Veillet Financial Columnist

Blowing Hot and Cold

The president had announced new tariffs with Canada before backtracking that same evening… Australia will not enter a trade war with the United States but is requesting an exemption from tariffs on steel and aluminum. Meanwhile, Europeans are once again bringing up tariffs similar to those imposed during the president’s first term. The same old song, over and over again. For now, markets have focused on the CPI figures. Today’s news: Donald Trump announced on Wednesday that American negotiators would head to Russia “immediately”… while waiting for all the players to gather around the liar’s poker table. Inflation stabilizes in the United States The Consumer Price Index (CPI), which measures overall economic costs in the U.S., rose by 0.2% in seasonally adjusted data for the month, bringing the annual inflation rate to 2.8%, according to the Department of Labor. The overall CPI had increased by 0.5% in January. Excluding food and energy prices, core CPI also rose by 0.2% for the month, reaching 3.1% over 12 months—the lowest rate since April 2021. Core CPI had increased by 0.4% in January. Economists surveyed by Dow Jones had expected increases of 0.3% for both overall and core CPI, with annual rates of 2.9% and 3.2%, meaning all rates came in 0.1 percentage points below forecasts. During the European session In Paris, the CAC 40 closed with a gain of 0.59%. The British FTSE advanced by 0.41%, while Germany’s DAX rose by 1.52%. The EuroStoxx 50 index gained 0.87%, and the FTSEurofirst 300 was up 0.84%. The Stoxx 600 ended a four-session losing streak, climbing 0.81%. Rheinmetall, a key beneficiary of Europe’s major defense investment push, surged by 9.62%, while Inditex plunged by 7.95% following the group’s announcement of a weak first quarter, with sales rising only 4%. In Switzerland, the SMI rebounded by 1.39%. Roche gained momentum as the pharmaceutical giant signed an exclusive agreement with Danish Zealand Pharma to co-develop and co-market petrelintide as a therapy for individuals struggling with overweight and obesity. Roche shares closed significantly higher, up 3.6% at 307.30 francs. German bonds (Bunds) climbed back above 2.9% (+2.8 bps), while French OATs eased by -2 bps to 3.57%. Notably, the OAT/Bund spread narrowed to under 68 bps (-5 bps), as Chancellor Merz attempted to convince potential allies to approve a debt plan (500 + 500 billion euros over five years) to revive growth and modernize Germany’s defense sector. The dollar index gained 0.13% against a basket of reference currencies, poised to end a seven-session losing streak. The euro edged up 0.06% to $1.0925, after reaching a five-month high of $1.0947 earlier in the session, as the Kremlin stated on Wednesday that it was awaiting further clarification from the U.S. regarding the proposed ceasefire in Ukraine. The British pound gained 0.25% to $1.2980, after hitting a four-month high of $1.2990. The Canadian dollar strengthened by 0.56% against the greenback to C$1.44 per U.S. dollar, while the U.S. dollar weakened by 0.03% against the Swiss franc to 0.882. When in doubt, rely on oil According to data from the U.S. Energy Information Administration (EIA), crude oil inventories in the United States rose by 1.4 million barrels compared to the previous week, reaching 435.2 million barrels. Despite this, WTI crude rebounded by +1.3% to $67.5 per barrel, while Brent gained 1.2%, rising to $70.7. Meanwhile, other commodities mostly trended downward, except for copper. Copper on the LME gained 0.5%, aluminum remained stable, lead dropped by 0.1%, as did tin, while nickel was unchanged. Whether due to ongoing tariff threats, the South American harvest, or the approaching U.S. planting season, bearish sentiment drove most grain prices lower midweek. Corn prices took the biggest hit, dropping by more than 1.5%. Soybeans also posted moderate losses, while wheat prices ended with mixed but mostly negative results. In the precious metals sector, gold rose by 0.2% to $2,938.24 per ounce. Silver gained 0.2% to $33.29 per ounce, platinum increased by 0.2% to $985.18, and palladium rose by 0.6% to $954.63. Mixed performance for U.S. stock markets The Dow Jones declined by 0.20%, while the Nasdaq gained 1.22% and the broader S&P 500 rose by 0.49%. Most tech giants advanced on Wednesday: Meta climbed 2.29%, Microsoft rose 0.74%, Alphabet gained 1.82%, Amazon increased by 1.17%, and Nvidia soared by 6.43%. The only major loser was Apple (-1.75%). Intel jumped 4.6% amid reports that TSMC had offered Nvidia, Advanced Micro Devices, and Broadcom stakes in a joint venture to operate the American semiconductor maker’s factories. Airline stocks struggled throughout the session. American Airlines dropped 4.62%, JetBlue fell 3.57%, United Airlines lost 4.73%, and Delta declined 2.96%. In the bond market, the yield on U.S. 10-year Treasury notes climbed to 4.31%, up from 4.28% on Tuesday. Expert insights Goldman Sachs revised its year-end target for the S&P 500 downward, while JPMorgan raised its forecast for a U.S. economic recession. This morning in Asia In Japan, the benchmark Nikkei 225 index rose by 0.98%, while the broader Topix index increased by 0.82%. South Korea’s Kospi index gained 0.81%, while the small-cap Kosdaq index climbed 0.37%. Hong Kong’s Hang Seng index edged down 0.14% at the open, whereas mainland China’s CSI 300 index increased by 0.23% in volatile trading. Australia’s S&P/ASX 200 index remained flat, reversing gains from earlier in the day. Since March 13, 2025, Trump has decided to venture into fashion by launching his own clothing line: “Make Fashion Great Again.” (ChatGPT’s comment) Have a nice day! Thomas Veillet Financial Columnist

The Apprentice…Sorcier

Once again, Trump launches a new attack on Canada over tariffs. The apprentice sorcerer casts a spell on financial markets, which may one day grow weary of his media experiments and assess the economic impact of the American president’s enchantments. As you can read, tensions are rising between Canada—through its new minister—and the U.S. president, who repeats his usual refrain via his network: “Ontario, Canada, having imposed a 25% tariff on ‘electricity’ entering the United States, I have instructed my Secretary of Commerce to add an additional 25% tariff, bringing it to 50%, on all steel and aluminum entering the U.S. from Canada—one of the highest tariffed nations in the world. This measure will take effect TOMORROW, March 12. Furthermore, Canada must immediately drop its outrageous agricultural tariff of 250% to 390% on various American dairy products, which has long been considered scandalous. I will soon declare a national emergency regarding electricity in the threatened area. This will allow the U.S. to take swift action to counter Canada’s abusive threat. If Canada does not drop other glaring and long-standing tariffs, I will significantly increase, on April 2, tariffs on cars entering the U.S., which will effectively shut down the Canadian auto industry for good.” And, for fun, he adds: “Additionally, Canada pays very little for national security and relies on the United States for military protection. We subsidize Canada by more than $200 billion a year. WHY? This can’t continue. The only thing that makes sense is for Canada to become our beloved 51st state. In that case, all tariffs, and everything else, would disappear completely. Canadians’ taxes would be significantly reduced, they would be safer—militarily and otherwise—than ever before, there would be no more northern border issue, and the world’s greatest and most powerful nation would become even greater, better, and stronger—with Canada as an integral part of it. The artificial dividing line drawn many years ago would finally disappear, and we would have the safest and most beautiful nation in the world—and your brilliant anthem, ‘O Canada,’ would still play, but now representing a GREAT AND POWERFUL STATE within the greatest nation the world has ever known.” And what about financial markets, which, for Trump, were once a measure of success? Well, he no longer talks about them since they are dropping. It’s a Mess in Europe… In Switzerland, the SMI closed down 2.47%. Novartis (-5.6%, excluding a dividend of 3.50 francs) ended as the worst performer, behind Roche (-3.6%), while the third heavyweight, Nestlé (-2.1%), did slightly better than the index. Elsewhere in Europe, red dominates. The CAC 40 lost 1.31%, the DAX fell 1.34%, and in London, the FTSE 100 dropped 1.21%. Travel and leisure stocks suffered Tuesday (-3.6%) after disappointing outlooks from U.S. airline Delta. In Paris, Air France-KLM plunged 9.2%, and Lufthansa lost 5.2%. Unsurprisingly, the auto sector fell 2.1%, hit by fears over U.S. tariffs. The yield on the German 10-year Bund climbed nearly 5 basis points to 2.872%. And in the U.S. as Well The Dow Jones fell 1.14%, the Nasdaq declined 0.18%, and the broader S&P 500 dropped 0.76%. On the data front, Wall Street barely reacted to the U.S. Labor Department’s JOLTS report, which showed a slightly higher-than-expected increase in job openings for January. Though, to be fair, the figures have never been very reliable. More important is today’s release of February’s CPI. Just like in Europe, airline and travel sector stocks plunged—Airbnb (-5.08%), Expedia (-7.28%), and Booking (-2.19%) were among the hardest hit. And Trump buys a Tesla… red like his tie. “I’m going to buy one” because it’s “a very good product” and because Elon Musk has been “treated very unfairly,” said the president. Tesla shares jumped 3.79%—hopefully, the American president bought some call options before his announcement. In the bond market, the yield on 10-year U.S. Treasury bonds rose to 4.28%, up from 4.21% on Monday. A Modest Rebound for Most Commodities Three-month copper on the London Metal Exchange (LME) rose 0.03%, aluminum climbed 0.22%, lead gained 0.19%, while tin fell 0.05%, zinc lost 0.02%, and nickel dropped 0.15%. Chicago soybean futures rose Wednesday for the first time in four sessions, with bargain buying supporting prices, though gains were limited by abundant South American supply and uncertainty over the trade war’s impact on U.S. sales. Wheat and corn prices also rose, recovering some of Tuesday’s losses. Oil prices saw a modest recovery, with Brent crude rising 0.39% to $69.83 per barrel, and WTI climbing 0.44% to $66.54 per barrel. Ukraine Favors a One-Month Ceasefire This was the big overnight news, and Asian markets are showing some resilience. The MSCI Asia-Pacific ex-Japan index was up 0.2%, while markets in Hong Kong and China remained broadly stable, as did Japan’s Nikkei. Since the start of the year, the Nikkei has lost 7.8%. But the real winner was the euro. It reached its highest level since October in New York at $1.0947 and remained stable in Asia at $1.0913. The Russian ruble also hit a seven-month high overnight. However, the Canadian dollar fell to a one-week low before rebounding to $1.443 CAD per USD. Gold remained steady at $2,916.69 per ounce, silver lost 0.5% to $32.76 per ounce, platinum rose 0.4% to $978.60, while palladium slipped 0.6% to $940.53. Now, all that’s left is to convince the Russians so that the markets can pretend to celebrate. Have a nice day! Thomas Veillet Financial Columnist

Recession? Never heard of it

The expected slap has arrived. Worse than DeepSeek, worse than the initial implementation of tariffs, the fact that Trump did NOT say the word “RECESSION,” but ABOVE ALL, that he did not deny the POSSIBILITY of a RECESSION, has crushed all the beautiful theories of infinite growth, the money-printing machine that is artificial intelligence, the idea that ROBOTAXIS will push Tesla to $1,500, and that tech—at these levels—is still cheap! Not to mention the belief that “The Fed is our friend, and they will (soon) cut rates!!!” The market just had its worst day in three years, and I’m not EVEN on the plane yet!!! The Magnificent Seven… Not So Magnificent Anymore We’re not in full-on CRASH mode just yet—and probably won’t be anytime soon—since fear levels are through the roof, volatility is flirting with 30%, and that’s usually the level where people start “buying the dip.” But let’s just say yesterday’s MASSIVE SLAP in the face served as a reminder that YES, the market can still go down. After nearly 18 months of defying sellers, with buyers confidently scooping up every 5% dip—because, come on, it’s cheap!—the Nasdaq just plunged violently into correction territory. And given yesterday’s carnage, financial media is already throwing around the term BEAR MARKET. Just as a reminder: a correction means a 10% drop from the highs, while a bear market starts at a 20% decline. Right now, the Nasdaq 100 is down 12.6% from its peak, the Composite has lost 13.5%, and the SOX (semiconductor index) has crashed 25% since its July highs. But the real problem in this tech bloodbath is that the Magnificent Seven got absolutely wrecked. And since these seven giants make up such a massive chunk of the market, we’re getting a practical lesson in just how dangerous over-concentration can be. This isn’t exactly news, but now we’re REALLY feeling it. Nvidia is down 28% since early January—and that’s despite delivering stellar earnings in February. Imagine what would’ve happened if they had issued a profit warning. Microsoft also reported fantastic numbers, but it’s still down 18% from the highs. Meta is down 19%, Apple 12%, Amazon 20%, and Google 19%. As for Tesla? It’s a full-on bloodbath. The company, which was supposed to flood the world with self-driving robo-taxis, has collapsed 53% since December. Just yesterday, Tesla tanked another 15% after UBS slashed its sales expectations by 20%, as nobody wants a Tesla anymore. In fact, “I Bought a Tesla Before Elon Went Crazy” bumper stickers are selling like hotcakes—so owners can justify their purchase. Recession Fears Long story short, tech got obliterated yesterday. The Magnificent Seven alone lost over $750 billion in market cap—that’s a hell of a lot of yachts and Bugattis up in smoke overnight. And the rest of the market crumbled right alongside them. Banks got hammered—because, of course, they’d be the first to suffer in a recession. Delta Airlines basically issued a profit warning, saying consumer confidence is eroding. Novo Nordisk’s new obesity drug, CagriSema, disappointed investors because it only leads to a 15.7% weight loss over 68 weeks—instead of the expected 20%. That’s right, their stock plunged 10% because someone weighing 120 kg would “only” lose 18.84 kg in 16 months instead of 24 kg. If you needed proof that this market is insane, this might be it. Since the start of the year, between crypto and U.S. equities, $5.5 trillion in market cap has been wiped out. And all because of two things: Tariff uncertainty—nobody knows what Biden is actually trying to achieve, or when he’ll stop flip-flopping on trade policy. Sudden “recession fears.” Yesterday’s market meltdown was largely triggered by Trump’s latest interview. He refused to say we’re heading into a recession… but also refused to say we aren’t. And since markets hate uncertainty, everything spiraled. But let’s be real—there wasn’t some earth-shattering new development that tanked the market. It’s more like investors are exhausted. Everyone’s sick of this back-and-forth on tariffs, with policies that change every other day. One moment, tariffs are on, then they’re off, then they’re back on again. It’s like some weird trade-policy hokey pokey, and markets have had enough. What Now? More Pain or a Rebound? After getting absolutely crushed, markets are now drenched in red. Tech is in shambles, the Nasdaq has dropped 12% in just 13 trading days, put volumes are hitting all-time highs, and volatility is off the charts. So, are we setting up for a massive short squeeze? Interestingly, since yesterday’s close, Nasdaq futures have bounced nearly 350 points into positive territory. Without jumping to conclusions, it seems like yesterday’s sell-off was more about frustration than fundamentals. The tariff mess is exhausting, and Trump’s vague comments were just an excuse to panic. The rest of the week will give us more clarity, but I have a feeling my vacation will mostly involve watching my screen—just in case there’s another wild story to tell. Germany, the Economic Support Fund, and the Greens While the Americans were turning into bears and simulating total panic, Europe also had its own problems to deal with. And one of Europe’s problems was Germany’s economic support fund. You know, that famous fund that was announced with great fanfare last week. Well, since yesterday, doubts have been growing about whether it can actually be implemented, as the new German government needs a two-thirds majority in parliament to approve the signing of the €500 billion check. And since yesterday, the Greens have dug in their heels, arguing that the project is poorly put together. Without the Greens, the right-wing’s grand plan could remain stuck in the pipeline. Needless to say, if the promised €500 billion meant to “make Germany great again” isn’t put on the table as planned, it could be a painful blow for some investors who were counting on it to justify the valuations of certain German stocks! Yesterday, Germany fell “only” 1.69%, and we’re eager to follow the next episode of the drama unfolding in the Bundestag.