Maersk : Bond de 70%

Maersk, the Danish giant in maritime transport and a true barometer of global trade, surprised the markets with a remarkable 70% increase in its net profit for the first quarter of 2025. In an economic climate still shaken by geopolitical tensions, logistical disruptions, and persistent inflation, this performance stands out. It reflects a powerful strategic adaptation to headwinds that many thought would be long-lasting. This growth is largely explained by the surge in freight rates, particularly on key routes between Asia, Europe, and the United States, exacerbated by conflicts in the Red Sea and security risks in the Bab el-Mandeb Strait. Forced to avoid certain areas, ships have to lengthen their routes, which has naturally driven up transport prices. Maersk capitalized on this new reality by adjusting its routes and optimizing its capacity while maintaining tight control over operating costs. Global demand remains more resilient than expected in crucial sectors such as energy, raw materials, and intermediate goods. This dynamic is reflected in the group’s financial results: a revenue of $13.3 billion, up 7.8% year-on-year, EBITDA of $2.71 billion, a strong increase, EBIT of $1.25 billion compared to just $177 million in 2024, free cash flow turning positive at $806 million, and an average container rate rising by 38% to $2,659. Beyond the numbers, Maersk sends a clear message to the global economy. Trade is not slowing down as quickly as anticipated. Global supply chains continue to run despite obstacles, showing that the international economy remains more dynamic than general sentiment suggests. All eyes are now on the group’s prospects for the rest of the year, particularly its ability to maintain margins in the face of market fluctuations and new environmental constraints. Maersk has already announced significant investments in energy transition, including the development of ships powered by green methanol and reducing its carbon footprint on the most polluting routes. The first quarter of 2025 may well mark a turning point for the shipping industry, and Maersk intends to stay ahead of the curve. “It’s not the size of the dog in the fight, it’s the size of the fight in the dog.” — Mark Twain Philippe Thomas Ceo -Soleyam Finance

Digital Currency or Control?

Digital Euro or Control? As the world accelerates toward a cashless future, a deeper conversation is quietly brewing beneath the surface: Are we building systems of convenience or tools of control? From the digital euro to mass surveillance tech and Bitcoin’s uncertain role, the years before, during, and after the COVID-19 pandemic have marked a turning point in the global digital and financial landscape. Before COVID: The Infrastructure Was Already Taking Shape Even before 2020, a shift toward centralized digital infrastructure was in motion: Central banks were researching digital currencies to modernize payment systems. Countries like China had already begun piloting a digital yuan, integrated with surveillance mechanisms. 5G networks were being rolled out, providing the bandwidth needed for real-time data transfer — essential for high-resolution surveillance, smart cities, and mass facial recognition systems. Facial recognition was being deployed in airports, public squares, and even shopping centers in countries like the US, China, and parts of Europe. The pandemic didn’t create these tools — it accelerated their adoption. During the COVID-19 pandemic (2020–2021): Speed and Silence Several countries proceeded with satellite launches, advancing their space programs despite global lockdowns. These activities included both civilian and military satellites, contributing to various applications such as communication, Earth observation, and surveillance.As countries entered lockdown, new technologies were quietly normalized: Surveillance cameras were upgraded or installed in many cities under the banner of “public health and safety.” Contact tracing apps tracked individual movements with Bluetooth, GPS, and QR code systems. 5G-powered smart cameras with facial recognition were deployed to detect mask compliance, quarantine violations, and crowd density. Meanwhile, satellite launches continued uninterrupted. Countries including: These satellites improved global surveillance, geolocation, and digital communication infrastructure — many of which are dual-use for both civilian and defense purposes. Countries that launched satellites during the pandemic include: United States: Continued satellite launches through NASA and private companies like SpaceX, including missions for Earth observation and communication. China: Launched satellites such as Xingyun-2 01 and 02 in May 2020 to test space-based Internet of Things (IoT) communications technology.Testbook Russia: Conducted multiple launches, including deploying 34 OneWeb satellites in March 2020 to expand global internet coverage.TASS+1Copernical+1 India: Resumed satellite launches after initial pandemic-related delays, focusing on Earth observation and communication satellites. France: Launched the CSO-2 military reconnaissance satellite in December 2020 and the Syracuse 4A military communications satellite in October 2021, enhancing national defense capabilities.France 24+1Copernical+1 European Union: Through the European Space Agency (ESA), launched the Sentinel-6 Michael Freilich satellite in November 2020 as part of the Copernicus program for Earth observation.Phys.org+2Copernicus+2European Space Agency+2 United Arab Emirates: Launched the Hope Mars Mission in July 2020, marking the Arab world’s first interplanetary mission.Agenzia Nova Turkey: Launched the Turksat 5A communication satellite in January 2021 to improve national broadcasting and internet services.Agenzia Nova Saudi Arabia: Announced increased investments in its space program as part of the Vision 2030 reform plan, aiming to develop local satellite production and launch capabilities.Agenzia Nova Post-COVID: The Rise of the Digital Euro With much of the digital groundwork laid, the European Central Bank (ECB) has been moving forward with its digital euro project: 2020: ECB releases its first comprehensive report on a potential digital euro. 2021: Launch of the investigation phase. 2023: Preparation phase begins — technical planning, legislative drafts, infrastructure. 2025: A final decision on issuing the digital euro is expected. The official goals are: Payment efficiency Financial inclusion Digital sovereignty (less reliance on private tech giants) Future-proofing the eurozone economy But this raises a set of critical questions: Will programmable digital money allow or restrict how you spend? Who decides what transactions are allowed — or blocked? Can your financial access be influenced by behavior, similar to a social credit score? Bitcoin: The Digital Euro’s Opponent or Ally? Unlike the digital euro, Bitcoin was designed as a decentralized, borderless currency, free from control by any government or central bank. Its founding principles: Scarcity (limited supply) Freedom from centralized control Transparency via blockchain This has made Bitcoin a symbol of financial freedom, especially in countries with high inflation or political repression. But central banks and governments are watching closely: Some countries ban or restrict crypto (e.g., China). Regulatory pressure is increasing in the EU, US, and other regions — especially around KYC/AML rules. Institutions are entering the space (BlackRock, Fidelity), blurring the line between decentralization and central control. This prompts a key question: Is Bitcoin a tool for financial freedom — or is it slowly being co-opted? What’s Next: A Future Worth Are we moving toward a financial system that rewards conformity? Will cash — and financial privacy — eventually disappear? Could a low “social score” mean your payment gets denied? Is Bitcoin the only exit, or will it be brought under control? We live in a world where technology offers both liberation and control. Which direction we take depends not only on policy-makers and corporations — but also on whether we, as citizens, stay informed, ask the right questions, and demand transparency. Happy Easter!

Markets Tumble

In March 2025, the S&P 500 index declined by 5.7%, marking its worst monthly performance since December 2022. This decline was primarily driven by escalating fears of a global trade war, following President Donald Trump’s announcement of new tariffs targeting aluminum, steel, automobiles, and all goods from China. These measures heightened concerns about a potential recession in the United States, prompting analysts, including those at Goldman Sachs, to increase the probability of a recession to 35% within the next year. Despite a slight rebound of 0.55% in the last trading session of March, the S&P 500 closed the month at 5,850.31 points, down from 6,207.54 points at the end of February. The Nasdaq-100 index experienced a significant decline of 8.2% in March, also recording its worst monthly performance since December 2022. The technology sector was particularly affected by the trade tensions, with major tech stocks experiencing substantial losses. For instance, Nvidia’s shares plunged by 6% on March 27, contributing to a monthly decline of over 13%. Tesla’s stock also tumbled by 5.6% on the same day, adding to its monthly losses. The Nasdaq Composite index closed at 17,889.01 points on March 27, reflecting the broader impact on technology stocks. The Dow Jones Industrial Average (DJIA) fell by 5.28% in March, closing the month at 42,001.76 points, down from 44,544.66 points at the end of January 2025. This decline was largely attributed to the implementation of 25% tariffs on imports from Canada and Mexico, announced by President Trump to take effect on April 2, 2025. These tariffs intensified fears of a global trade war, leading to significant market volatility. Despite a 1% rebound during the last session of March, the DJIA’s gains were insufficient to offset the month’s accumulated losses. The tariffs also had a pronounced impact on specific sectors; for example, major U.S. automakers like Ford and General Motors experienced significant stock declines due to their reliance on supply chains in Mexico and Canada. In summary, the major U.S. stock indices experienced significant declines in March 2025, reflecting investor concerns over escalating trade tensions and an uncertain economic outlook. The technology and automotive sectors were notably affected, with substantial losses in major companies’ stock values. These developments underscore the growing fears of a potential recession in the United States. Have a nice day! Philippe Thomas Financial Columnist

Ubisoft & Tencent Subsidiary

What Will Change… Ubisoft recently announced the creation of a new subsidiary dedicated to its major franchises, such as Assassin’s Creed, Far Cry, and Tom Clancy’s Rainbow Six, with a strategic investment of €1.16 billion from the Chinese giant Tencent. This transaction values the new entity at €4 billion, highlighting the importance of Ubisoft’s licenses and their long-term economic potential. Ubisoft specifies that this subsidiary will focus on developing evergreen and multiplatform gaming ecosystems. This means the publisher aims to extend the lifespan of its franchises through a business model based on frequent updates, enriched multiplayer experiences, free-to-play games, and increased integration of social features. This strategy aims to maximize player engagement and diversify revenue sources, a shift toward more sustainable models in the face of increasing competition in the gaming space. From a financial perspective, this transaction strengthens Ubisoft’s balance sheet and enhances its investment capabilities, potentially preventing it from becoming a takeover target. This move comes after a period of uncertainty for the publisher, including disappointing sales of certain titles and speculation surrounding a potential sale of the company. Additionally, Bloomberg reported that Tencent was even considering taking Ubisoft private in collaboration with the Guillemot family, the company’s founders, a plan that could further reshape the publisher’s structure. This strategic repositioning allows Ubisoft to adapt to market developments, where player expectations are rapidly evolving. The focus on the quality of single-player narrative experiences and the expansion of multiplayer modes reflects a desire to strengthen the appeal of its games in the face of increasingly fierce competition, particularly as other publishers have already embraced this model of live-service games. Tencent’s investment in this new Ubisoft subsidiary marks a key step in the French publisher’s restructuring. This partnership could provide Ubisoft with additional financial and technological resources to develop its flagship franchises while further expanding into the Chinese market. Tencent’s influence may also help Ubisoft navigate the complex regulatory environment in China, where gaming content is subject to strict censorship laws. Moreover, Tencent’s deep understanding of local market dynamics and its established relationships with regulators could open new opportunities for Ubisoft’s games in China, traditionally a challenging market for foreign publishers. While Tencent’s influence is sure to bring financial and technological benefits, there may be concerns about the extent to which the publisher will maintain its creative autonomy. As a company known for its strong narrative-driven titles, Ubisoft will need to carefully balance its creative vision with the demands of the evolving gaming landscape, which increasingly leans toward multiplayer-focused, monetization-heavy models. The direction of Ubisoft’s games in the coming years may reveal the true extent of this new strategic partnership and its impact on the company’s long-term identity. Have a nice day! Thomas Veillet Financial Columnist

Foxconn: AI Growth, Profit Drop

Foxconn Expects Strong Growth in Q1 Despite Profit Decline Taiwanese electronics giant Foxconn anticipates a significant increase in revenue in the first quarter, driven by strong demand for artificial intelligence (AI) servers. Despite a 13% drop in net profit in the last quarter of 2023, the company remains optimistic about the future. Foxconn, the main manufacturer of iPhones for Apple, reported a net profit of 46.33 billion Taiwanese dollars, falling short of analysts’ expectations. This decline is mainly attributed to foreign exchange losses and investments in Japan. However, despite this short-term setback, the company achieved a full-year net profit of NT$142.1 billion, marking a 16-year high. The rise of artificial intelligence is fueling the company’s growth. AI servers are expected to account for more than 50% of server revenue this year, thanks to increased production for Nvidia. To support this surge, Foxconn is building the world’s largest AI server manufacturing facility in Guadalajara, Mexico, where it will produce Nvidia’s latest GB200 Blackwell AI servers. Additionally, the company is expanding its collaboration with Nvidia beyond manufacturing, integrating AI technology into next-generation data centers, autonomous vehicles, and robotics. Foxconn is focusing on cloud computing and networking to diversify its revenue streams. The company forecasts a 98% increase in profits for the first quarter compared to the previous year, with AI server sales expected to double. However, trade tensions between the U.S. and China could impact its outlook. With manufacturing operations in China and Mexico, Foxconn is particularly affected by tariffs. The company is also monitoring potential new U.S. tariffs on Chinese-made technology, which could influence its production strategies. In response to Donald Trump’s policy of relocating production, Apple announced a partnership with Foxconn in December to assemble servers in the United States. Foxconn claims to have strengthened the resilience of its supply chain, allowing it to better navigate market fluctuations. While the company remains cautious about U.S. government policies, it is prepared to adapt and sustain growth. Despite an uncertain economic environment, Foxconn is confident in its ability to capitalize on the AI revolution. Have a nice week end! Philippe Thomas Ceo – Soleyam Finance

How Serious Is the U.S. Debt Crisis?

The United States is facing a growing debt crisis, with net interest payments reaching a staggering 18.7% of federal revenues in January, the highest level since the 1990s. This figure is just 20 basis points below the all-time record of 18.9% set in 1992. Moreover, this share has DOUBLED in just 18 months as interest costs have soared. Over the past 12 months, interest expenses hit a record $1.2 trillion, making it the second-largest federal expenditure after Social Security. Projections indicate that the burden will continue to rise. Net interest costs as a percentage of federal revenues could reach 34% by 2054, assuming no recession occurs during this period. By 2026, annual interest payments are expected to exceed $1 trillion, and by 2035, they could reach $1.8 trillion. As a share of revenues, interest payments may climb to 22.2% by 2035, further limiting the government’s ability to fund other critical programs. The Congressional Budget Office (CBO) warns that federal deficits will expand significantly, reaching 8.5% of GDP by 2054, exacerbating the debt crisis. Net interest costs are projected to grow at an average annual rate of 6.5% between 2025 and 2035, potentially crowding out essential spending. Experts caution that without substantial fiscal reforms, the U.S. could face serious economic consequences. Investor Ray Dalio has even warned that the country might experience a financial “heart attack” if the debt problem remains unaddressed. Given these alarming trends, fiscal responsibility advocates emphasize the urgent need for reforms to stabilize national finances and mitigate risks to the economy. Philippe Thomas Ceo Soleyam Finance

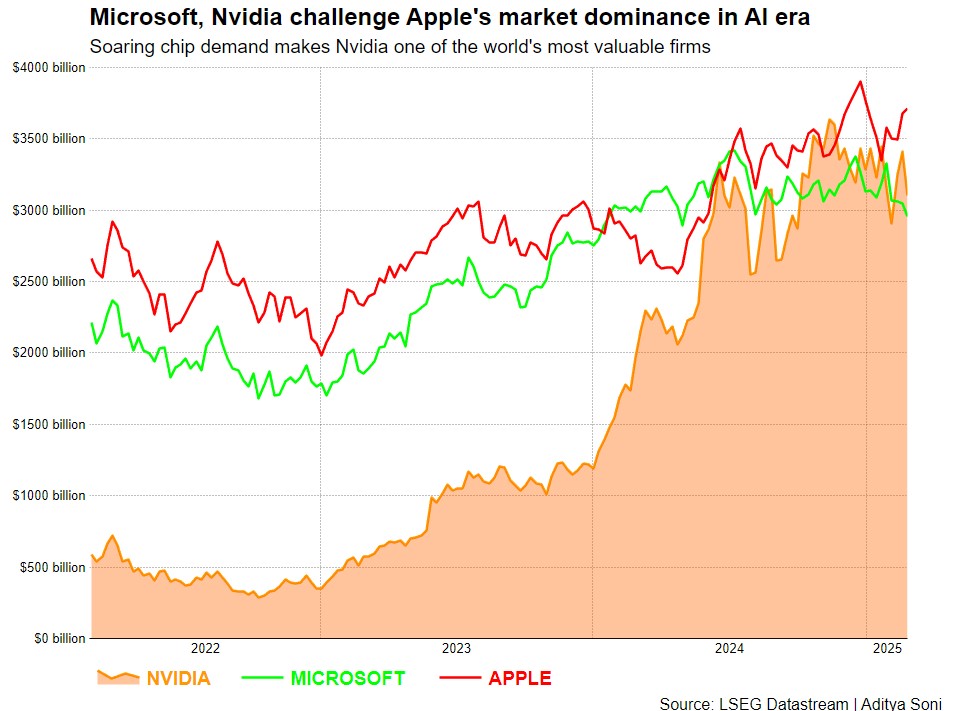

Microsoft and Nvidia Challenge Apple’s Dominance in the AI Era

The growing demand for chips has made Nvidia one of the most valuable companies in the world, solidifying its place as a leader in the AI-driven technological revolution. However, the emergence of low-cost AI models, such as those from #DeepSeek, has triggered concerns that spending on Nvidia’s high-end chips could decline. These fears have caused a massive drop of over half a trillion dollars in Nvidia’s stock value in just one day. These worries were further intensified by reports suggesting that Microsoft was reducing its leasing of certain data centers. The stock performance of the “Magnificent Seven,” which includes Nvidia, has dropped from their 2024 highs, with a decline of more than 11% for the Roundhill Magnificent Seven ETF. Despite strong performance in the past two years, Nvidia is seeing slower revenue growth due to tough comparisons with the previous year. However, its continued leadership status and massive investments from tech giants like Meta ensure that demand for its high-end chips remains strong. Since the launch of #ChatGPT in late 2022, the “Magnificent Seven” companies have collectively added $11 trillion in market capitalization, with $2.7 trillion of that coming from Nvidia alone, making it the second most valuable company in the world. Over the last five years, Nvidia’s stock has surged by an astonishing 1,800%, while the entire “Magnificent Seven” has tripled, far outpacing the S&P 500’s 65% growth. Nvidia’s Continued Innovation: Nvidia has been a leader in AI chip design for years, but it faces growing competition as other companies, such as AMD and Intel, intensify their efforts to create AI-specific processors. However, Nvidia’s GPUs, like the A100 and H100 series, remain industry standards for high-performance AI applications. The company’s dominance in the gaming and data center markets also gives it a diversified revenue stream, which supports long-term growth. Nvidia’s continued focus on developing GPUs for AI, machine learning, and autonomous driving could allow it to maintain its competitive edge in the industry. Microsoft’s AI Push: Microsoft’s role as a cloud service provider is significant in the AI space. The company’s Azure cloud platform is heavily integrated with Nvidia’s GPUs, enabling enterprises to scale their AI capabilities. Microsoft has made strategic acquisitions in AI, such as its purchase of OpenAI, the creator of ChatGPT. Microsoft’s AI strategy also includes software products like Microsoft 365 and its integration with AI to enhance productivity tools, making it a strong player in both consumer and enterprise markets. Apple’s Position in AI: While Apple is not as heavily involved in AI-focused infrastructure as Nvidia and Microsoft, its investment in machine learning and AI integration in consumer products like the iPhone, iPad, and Mac is growing. The company continues to expand its AI capabilities in its chips, like the M1 and M2, optimizing machine learning performance on the device level. Apple’s strategy of focusing on consumer-driven AI could allow it to remain competitive, but without making the same kind of heavy investments in data centers and AI infrastructure that Nvidia and Microsoft are pursuing, it might lag behind in the enterprise AI space. The Impact of Generative AI: With the rise of generative AI, such as OpenAI’s models like GPT-3 and GPT-4, the demand for more computing power is skyrocketing. Nvidia’s hardware is central to the development of these models, and the company’s partnerships with AI research labs and cloud providers position it to benefit from this trend. As generative AI technologies expand into industries like healthcare, finance, and entertainment, Nvidia is expected to play a major role in supplying the computational power needed to bring these innovations to life. Challenges in the Chip Market: The global semiconductor market is experiencing a supply-demand imbalance. While Nvidia’s chips are in high demand for AI, gaming, and data center applications, global supply chain disruptions and geopolitical tensions could potentially threaten Nvidia’s growth. Additionally, the shift towards AI could lead to an oversupply of certain types of chips while diminishing the demand for traditional processors. Nvidia will need to remain agile and adapt to these changing market dynamics to stay ahead of competitors. Investment Trends in AI and Tech Stocks: Investors are increasingly bullish on companies with strong AI capabilities, and this is reflected in the market capitalization of Nvidia, Microsoft, and Apple. With AI set to be a driving force in technology over the next decade, stocks in this sector could see continued growth, but investors should be mindful of market volatility and the risks of overvaluation. Analysts predict that Nvidia’s stock could continue to rise due to its pivotal role in the AI ecosystem. However, some caution that there may be short-term setbacks as the company faces increased competition and fluctuations in demand for high-end chips. Have a nice day! Philippe Thomas Ceo Soleyam

Intel’s Next Move

The Probability of a Merger Between Intel, TSMC, and Broadcom Context and Strategic Objectives Intel is aiming to regain its leadership in the semiconductor industry after years of lagging behind competitors like AMD and NVIDIA. The company has made significant efforts to strengthen its manufacturing capabilities with new foundry plants and to diversify into other sectors, such as server processors and AI technologies. TSMC is the world leader in foundries, providing manufacturing services for companies like Apple, NVIDIA, AMD, and many others. TSMC plays a crucial role in supplying cutting-edge chips. Economic and Financial Factors Potential Synergies between these companies would be considerable. Intel could leverage TSMC’s expertise in advanced manufacturing, while Broadcom could expand its product portfolio with manufacturing or vertical integration capabilities. However, strategic differences in R&D and long-term goals could limit these synergies. Geopolitical Risks TSMC’s location in Taiwan makes it a strategic concern amid geopolitical tensions between the United States and China. Integrating TSMC into an American group could raise concerns in China and negatively impact international relations. Impact on Competition and the Market A potential merger would disrupt the competitive landscape. Intel’s dominance in both semiconductor design and manufacturing could reshape the industry. Conclusion Despite potential synergies, regulatory, geopolitical, and organizational challenges make this merger unlikely in the short term. However, changes in global relations, technological innovation, and acquisition strategies could shift this dynamic in the future. “In the world of semiconductors, alliances shape the future—but merging giants face mountains, not molehills.” Philippe Thomas Ceo -Soleyam

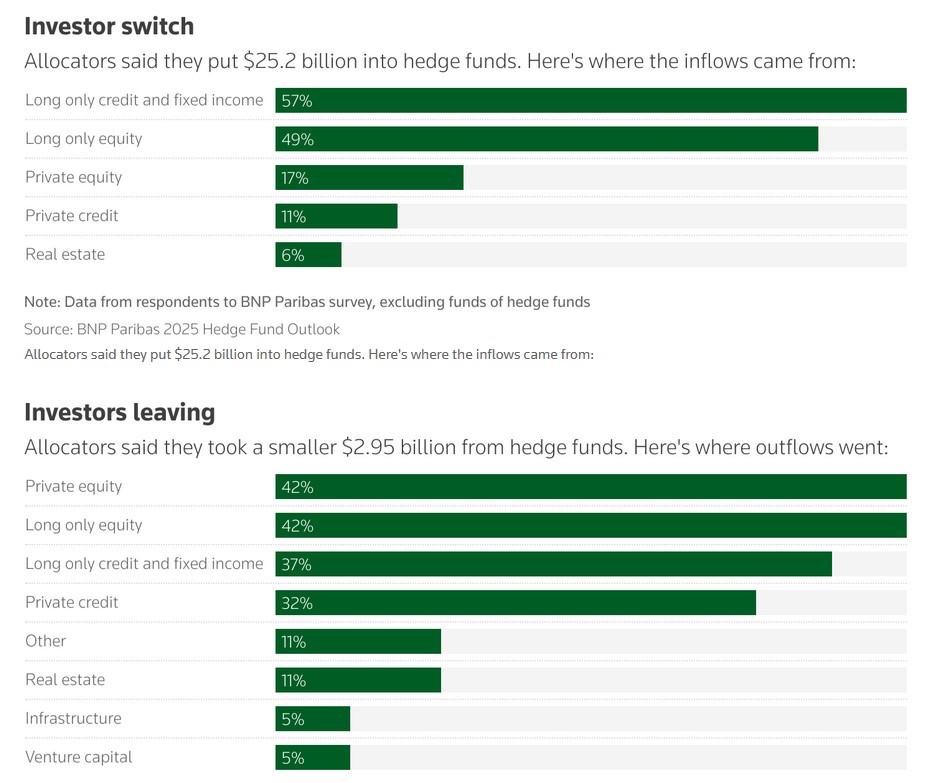

Shift to Hedge Funds

Private Equity To Hedge Funds Investors are favoring hedge funds over reinvesting in private equity after closing deals, as M&A activity has slowed in recent years, according to BNP Paribas. “The markets have transitioned from a pre-inflationary world where everything was rising. Rates were low, stocks were soaring, and investors moved away from active management in favor of passive management,” said Marlin Naidoo, Global Head of Capital Introduction at BNP Paribas in London. The type of deals private equity relies on to generate returns has not made a comeback. Global private equity and venture capital transactions totaled $35.28 billion in January, a decline of $70 million compared to January 2024, according to a report by S&P Global Market Intelligence published last week. Investors surveyed by BNP Paribas reported adding a net total of $22.2 billion in assets to their portfolios. Nearly one-fifth of last year’s hedge fund inflows came from private equity investors. Investors have also moved away from long-only equity and long-only bond investments in favor of hedge funds. About two-thirds of the 290 investors surveyed said they would increase their allocations to hedge funds. “When deals slow, smart money hedges.” Philippe Thomas Ceo Soleyam