We are definitely living in remarkable times. In just a few weeks, we’ve gone from panic over rates, the anxiety of exploding inflation, to a certain calm that tells us that, after all, things will be fine because everyone believes it’s just a matter of time; Trump will strike a deal with China. Within 85 days. And since then, nothing scares the market anymore. The President has brought back billions of cash Made in the Middle East, inflation seems to be slowing down, and all that remains is to survive Moody’s downgrade — but at the same time, since when has a rating agency ever been right about a downgrade? Apart from never?

The Friday Night News

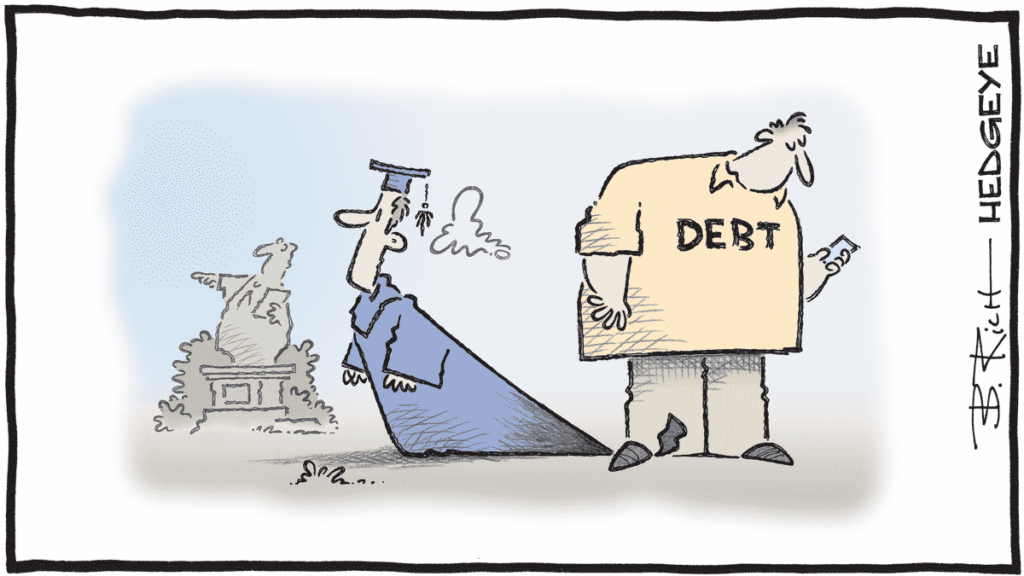

Last Friday, Moody’s downgraded the U.S. debt. Yes, again. And this time, it’s serious: from AAA to Aa1. Translation: according to the last of the three major agencies still pretending to believe in it, the United States is no longer top-notch when it comes to sovereign debt. You’d admit that’s moderately unsurprising — what’s more surprising is remembering that the US still had a triple-A rating somewhere. The biggest question we want to ask is: Why now? Well, simply because the Moody’s folks finally understood what everyone already knew since 2009: America spends more than it earns, and on top of that, Trump wants to cut taxes. If that passes, it would add 4 trillion dollars to the deficit over the next 10 years. All this without any concrete plan to balance the books, except selling MAGA hats or begging in Doha.

Moody’s points out that under these conditions, the United States will no longer be able to maintain an interest payment ratio comparable to other AAA-rated countries. Well yeah, as the saying goes, “the pitcher goes so often to the well that it finally breaks.” But the most interesting thing about this — aside from futures opening down nearly 1% on Sunday night — is that we generally forget that these rating agencies like Moody’s, S&P, or Fitch have the particularity of downgrading debts when no one believes in them anymore for quite some time. These guys just make an assessment of the situation at instant “T” and have absolutely no pretension of predicting the future. You should never take a debt downgrade as a forecast, but rather as a present-day observation or an alert message that we’re starting to have our feet in the water. And when you dive into 150 years of financial and macroeconomic analysis history, you quickly realize that THOSE WHO CLAIM TO PREDICT THE FUTURE are about right only half the time — about as reliable as someone flipping a coin for their future. So those who only “observe” and ring the alarm bell aren’t much better. And in Trump’s administration, they got that very well.

Let the show begin.

We got that because Trump has already reacted by implying that the Moody’s people just don’t like him personally and that it’s all a personal thing. Scott Bessent, the new Treasury Secretary (who is still a former hedge fund manager and actually knows what he’s talking about), came out of hiding this Sunday morning while you were going to get your bread and in an interview on NBC, the guy served us a punchline worthy of a New York stand-up comedy night, saying:

“Rating agencies are lagging indicators.”

And BAM!!! Take that, Moody’s. So the idea is that they rate what we already knew, but six months late. And it’s TRUE, it’s not the first time this kind of thing happens. There was even a time when we started thinking that when a rating agency downgraded something, it should be taken as a buy signal — a signal that the worst is behind us. It’s like calling the firefighters when the house is already in ashes and telling them to check the smoke detector. So we spent the weekend waiting for Sunday night futures to open, to see if Moody’s downgrade would spoil the party of the American indices that are euphoric since Trump reached out to the Chinese and unlocked the tariff issue. Yes, because while Moody’s was doing its calculations, last week the S&P500 closed 6.5% higher than on April 2nd, the cursed day when we foolishly thought we were all going to die. The SOX is 14% higher and Nvidia is 23% higher. So yes, I confirm to you, futures opened in the hole on Sunday night. At the time of writing — that is 5:31 AM — futures are down 0.96%. It feels like a slap at the open. But at the same time, what’s new in this story???

Are you honestly surprised? Moody’s is the last of the big three agencies to remove the Triple A, and do you really think no one expected this? That it’s a surprise??? What’s happening today is nothing but a big announcement effect, and in 48 hours, we’ll have moved on. I’m not a fan of Scott Bessent — to be honest, before he joined Team Trump, I didn’t even know he existed. But I have to say I agree with him: rating agencies are lagging indicators and should be given the credit they deserve. Which is to come after the rain to tell us that water is wet and fire burns. So yes, with exploding debt, a runaway deficit, a trade war far from settled, and a President playing Monopoly with taxes, it’s starting to smell strongly like an unstable scenario. But, without being pro-Trump, you have to recognize that despite all we can blame him for, he’s not the only one who got the US into this mess, so maybe we should give him the benefit of the doubt before crying wolf. But at the same time, rating agencies only know how to do one thing: cry wolf when everyone has known for months that the wolves are among us and that man is a wolf to man… Whoa, I’m getting carried away.

So where do we stand?

While Moody’s is doing its thing, the markets ended the week with a bang. Markets are soaring… and so are the reasons to worry. For now, it’s going up, up, up (well, it was going up, up until Friday night). And while the bulls are galloping on Wall Street as if someone had discovered oil under the White House, the old question of “how far can this go?” is knocking at the door again. Because behind investors’ smiles and strategists’ victory declarations, the fundamentals are starting to raise some serious questions. So, here’s a little recap to start the week…

The S&P 500 has erased all of its 2025 losses and is up 1.3% for the year.

Same story for the Dow Jones and the Nasdaq.

The DAX is up 19% since January 1st — actually, 2025 seems more like “Deutschland wieder groß machen” (Germany made great again) than “Make America Great Again,” if you just look at the numbers.

Speaking of numbers, Q1 2025 results aren’t that bad — sure, we know the impact of tariffs hasn’t really hit yet, and we’ll have to wait until Q2 or even Q3 to see that, but earnings reports have been solid (92% of S&P companies have reported so far, with 78% beating profit expectations and 62% beating revenue expectations).

A 90-day truce on new tariffs was negotiated between Washington and Beijing — and that’s boosting investor optimism who are now shouting: “WHAT COULD POSSIBLY GO WRONG NOW?”… Note that there are only 85 days left on that truce. And for the rest of the world, just 50 days remain.

Lastly, last week’s inflation figures show some improvement (though again, we don’t have much hindsight yet on the tariffs’ effects), calming bond markets while Powell remains steady and impassive.

But beware, there’s a flip side to this party. And that price is that the stock market is starting to get too expensive. The forward P/E ratio of the S&P 500 has risen to 21.5 — it was 18.0 in early April. That’s above the 5-year average (20.25), and it’s starting to feel “too pricey.” Meanwhile, earnings expectations for 2025 are dropping, with consensus now at $263 per share versus $271 in mid-March. So basically, we’re paying more for less profit. Not exactly great, right? That said, let’s be cautious — analysts base their expectations on company guidance, and right now, most companies basically say they see nothing ahead, with the future looking like a thick fog you could cut with a knife.

And that’s not all…

Long-term rates are rising: the US 10-year yield passed 4.50%, and the 30-year is flirting with 5%. It’s like borrowing heavily at zero rates because the Fed told you inflation was transitory and under control.

And there’s more…

Companies keep talking about “tariffs” nonstop: out of the 500 S&P companies, 411 mentioned “tariffs” during their earnings calls. That’s an all-time 10-year record — okay, tariffs have been a theme every quarter for the past decade, but still… Proof that behind reassuring numbers, there’s serious worry backstage.

And that’s still not all…

Right now, no one really expects a recession. For a while, we thought it was coming, but since Trump buddy’d up with the Chinese, no one even considers it. Yardeni said the other day: “When there’s a recession, P/Es drop below 10. We’re at 21.5. Nobody buys the crash thesis.”

Yet somehow, it feels like everything is in place for the rally to derail:

Valuations are stretched.

Earnings growth is slowing.

Rates are under pressure.

Consumers are strained; we saw this Friday with the University of Michigan’s consumer confidence report — historically the second worst reading ever. Meanwhile, even Walmart says it’s raising prices because its margins are too thin.

And this week, other retailers (Home Depot, Lowe’s, Target) will tell us if they sense the same overheating or not.

Simply put: markets soar on good news and hopes… but the foundations are becoming shaky. It’s fun dancing on the ship’s deck, but we still haven’t checked if there’s water in the hold.

So starting this week:

Either we keep riding the wave and hope it holds,

Or we start thinking this rally needs a reality check.

In this kind of environment… it just takes one spark to blow everything up, but I’m not sure that spark is Moody’s.

Asia kicks off the week

The mood was gloomy in Asia this morning: the plunge in US futures cooled markets down. China’s numbers? Mixed: industrial production beat expectations, but retail sales and investments struggled. Result: Chinese indexes are in the red but limiting losses. Australia is holding its breath ahead of a probable RBA rate cut, while Japan continues to digest a disastrous GDP report. Japan is down 0.7%, Hong Kong down 0.5%, and China down 0.1%. Oil is at $61.68, still eyeing Tehran. Gold is at $3,216, and Bitcoin is trading around $103,000.

On the morning news front, it’s pretty quiet. Everyone talks about the FAMOUS DOWNGRADE — and that’s it. It should calm down by tomorrow, maybe even tonight. But there is one thing we need to discuss: US authorities are about to slash capital requirements for banks. They’re easing the “Supplementary Leverage Ratio” (SLR) — the rule put in place after the 2008 crisis to prevent a repeat of 2008. But now, with Trump’s approach, we’re massively deregulating, and banks will be able to take more risks with less safety. Banking lobbyists are already popping champagne — they’ve been fighting this rule for years, saying it stops them from borrowing like it was 2007, just because they hold too many Treasury bonds.

The Wall

And since Trump loves his best clients, he’s giving them a highway to more trading, more debt, and fewer constraints. The hidden goal? Lower the cost of US debt. And for that, nothing beats fat banks buying Treasuries like it costs nothing. The skeptics will remind you that doing this in the middle of economic chaos, with markets as fragile as an 8-week-old labrador’s mental stability, might not be the best idea. But hey… contradictions have become routine.

In short, we’re removing one of the most important brakes put in place after 2008, under the pretext that “things are better,” “markets are solid,” “banks know how to manage themselves,” and above all that they’ve LEARNED from their MISTAKES!! Don’t make me laugh so early in the morning, because every time we’ve loosened the reins on banks, they’ve rushed headlong toward the abyss like that eight-week-old labrador chasing its food bowl. So this time, don’t come crying if everything blows up because we wanted to pile hybrid structured products on the debt of Tesla customers leasing their cars, while hedging by selling futures contracts on how much snow will fall in Verbier next winter… All that just because it makes money and fat bonuses.

In conclusion: markets are booming, rating agencies are six months behind, and Trump is deregulating left and right. We’ve seen this movie before, and it never ends well. But hey… as long as the stock market climbs and gold hits $5,000, who wants to read the fine print at the bottom of the contract?

Have a great day everyone, and see you tomorrow!