Intel’s Next Move

The Probability of a Merger Between Intel, TSMC, and Broadcom Context and Strategic Objectives Intel is aiming to regain its leadership in the semiconductor industry after years of lagging behind competitors like AMD and NVIDIA. The company has made significant efforts to strengthen its manufacturing capabilities with new foundry plants and to diversify into other sectors, such as server processors and AI technologies. TSMC is the world leader in foundries, providing manufacturing services for companies like Apple, NVIDIA, AMD, and many others. TSMC plays a crucial role in supplying cutting-edge chips. Economic and Financial Factors Potential Synergies between these companies would be considerable. Intel could leverage TSMC’s expertise in advanced manufacturing, while Broadcom could expand its product portfolio with manufacturing or vertical integration capabilities. However, strategic differences in R&D and long-term goals could limit these synergies. Geopolitical Risks TSMC’s location in Taiwan makes it a strategic concern amid geopolitical tensions between the United States and China. Integrating TSMC into an American group could raise concerns in China and negatively impact international relations. Impact on Competition and the Market A potential merger would disrupt the competitive landscape. Intel’s dominance in both semiconductor design and manufacturing could reshape the industry. Conclusion Despite potential synergies, regulatory, geopolitical, and organizational challenges make this merger unlikely in the short term. However, changes in global relations, technological innovation, and acquisition strategies could shift this dynamic in the future. “In the world of semiconductors, alliances shape the future—but merging giants face mountains, not molehills.” Philippe Thomas Ceo -Soleyam

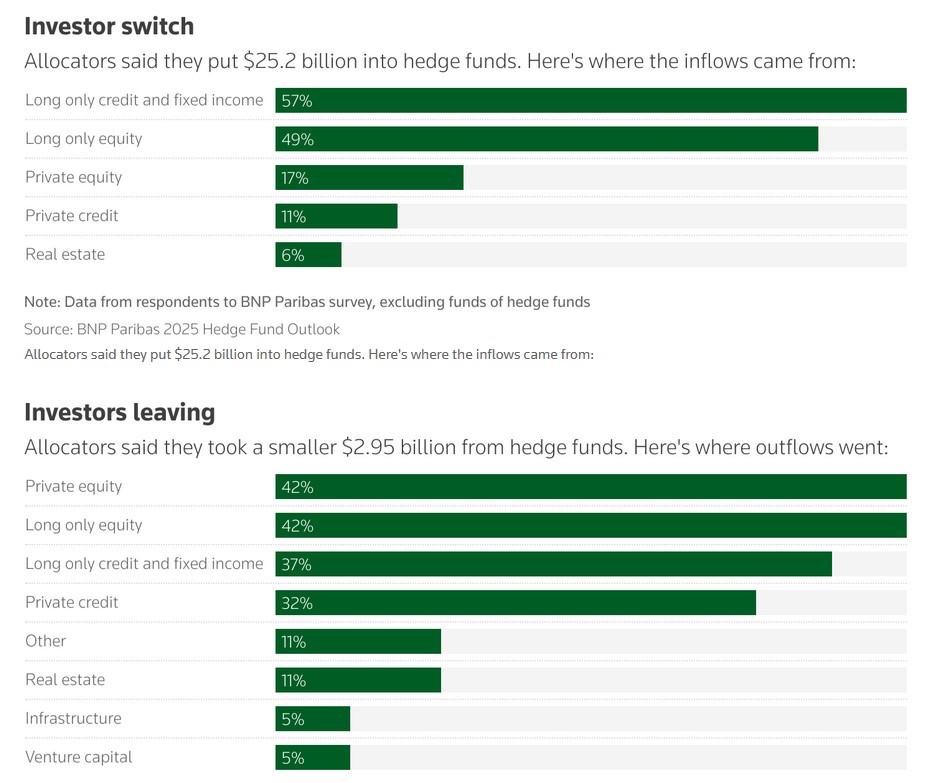

Shift to Hedge Funds

Private Equity To Hedge Funds Investors are favoring hedge funds over reinvesting in private equity after closing deals, as M&A activity has slowed in recent years, according to BNP Paribas. “The markets have transitioned from a pre-inflationary world where everything was rising. Rates were low, stocks were soaring, and investors moved away from active management in favor of passive management,” said Marlin Naidoo, Global Head of Capital Introduction at BNP Paribas in London. The type of deals private equity relies on to generate returns has not made a comeback. Global private equity and venture capital transactions totaled $35.28 billion in January, a decline of $70 million compared to January 2024, according to a report by S&P Global Market Intelligence published last week. Investors surveyed by BNP Paribas reported adding a net total of $22.2 billion in assets to their portfolios. Nearly one-fifth of last year’s hedge fund inflows came from private equity investors. Investors have also moved away from long-only equity and long-only bond investments in favor of hedge funds. About two-thirds of the 290 investors surveyed said they would increase their allocations to hedge funds. “When deals slow, smart money hedges.” Philippe Thomas Ceo Soleyam

Stock Picking Strategy

Dear Investors, Thank you for choosing us as your trusted advisor in the world of stock trading and investments. Our mission is to provide you with expert recommendations, personalized strategies, and the insights you need to achieve your financial goals. Insight By reading this, you will gain insight into our method of selecting and managing U.S. stocks to build a strong and profitable portfolio. First, after identifying potential stocks, we monitor them daily. We set reasonable objectives based on a thorough analysis of financial developments in similar companies. Our approach primarily involves studying quarterly and annual earnings reports, trading volumes, and the economic outlook for various sectors. This ensures diversification and minimizes risk. We avoid putting all our eggs in one basket! Additionally, we never allocate more than 15% of our capital to a single stock. Stock Strategy Trigger Price Confirmed Price Target 1 Target 2 Stop Loss X Price ($) X Price ($) +8-10% +15-20% -8-10% Our Trade Strategy A simple, step-by-step approach to help you make informed decisions in the market. 1. Set Price Targets & Stop Loss For each stock, define the following levels: Target 1 (T1): +8 / 10% Target 2 (T2): +15 / 20% Stop Loss (SL): -8-10% 2. Actions at Target 1 (T1) When the price reaches Target 1 (T1), sell 70% of your stock position. 3. Actions at Target 2 (T2) Once Target 2 (T2) is reached, sell the remaining 30% of your stock position. 4. Stop Loss Adjustment After reaching Target 1 (T1), you have two options for adjusting your stop-loss for the remaining 30%: Leave your stop-loss at the original level. Raise the stop-loss to lock in 3.5% profit and minimize risk. Buying and Selling Strategy This graphic illustrates a practical example of how to implement the buying and selling strategy using market trends and price triggers. It serves as a visual guide to help you understand the key actions for effective stock trade management. Watch the Video – Stock Strategy in Action https://www.soleyam.ch/wp-content/uploads/2025/01/fixed-Soleyam-stock-advisor-video.mp4 Conclusion While this may be a tough time for those who are relatively new to the stock market, the process of clearing (Stop) is a necessary step that helps us hold strong positions while eliminating the weakest ones. In fact, completing a “clean” is often the signal to become more aggressive. This is exactly how a successful portfolio is built! As seasoned investors know, a powerful portfolio isn’t built overnight. After all, no portfolio, no matter its size, can hold too many positions for long. However, investors who don’t let their emotions take over and stick to the plan will be the winners! The stock market has many cross currents, which can often weigh it down. Investors are still confused and hesitant to commit more money. The market lacks a true catalyst, so be patient and let the market settle while sticking to the plan. Don’t drown in the rip tide of indecision. Above all, always wear your life jacket and practice good risk management (never put all your eggs in one basket). Risk Warning Trading may expose you to risks of losses exceeding your deposits and is suitable only for informed clients with the financial means to bear such risks. Only risk a very small portion of your capital, particularly an amount you can afford to lose without any financial impact on your daily life. You should seek advice from an independent financial advisor and ensure that you have a certain risk tolerance. Past performance is not indicative of future results.