A Toast to 200% Tariffs!

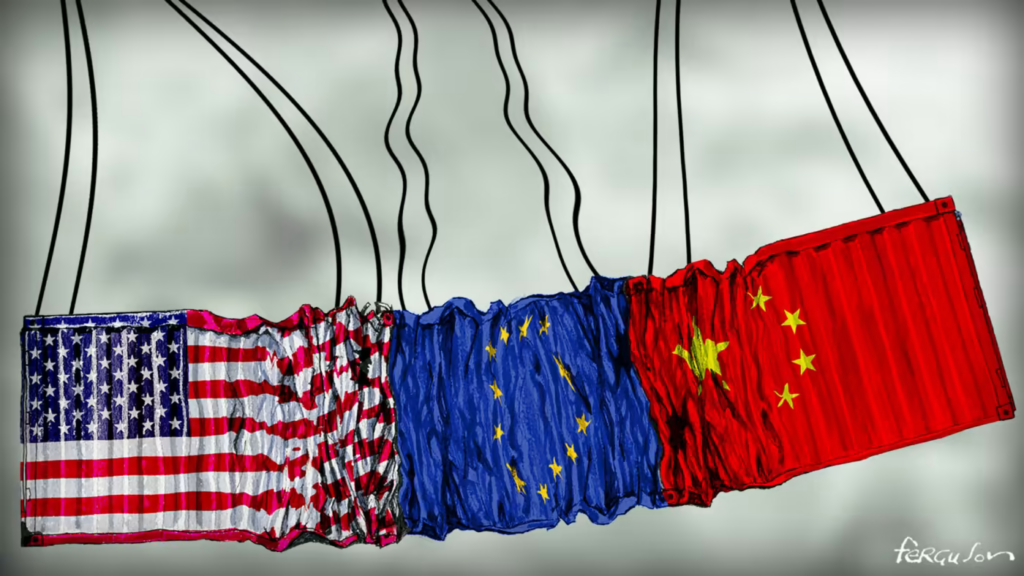

On his Truth Social platform, Donald Trump threatened to impose a 200% tariff on all alcoholic products from European Union countries in retaliation for the 50% tariffs imposed by the EU on whiskey. “This will be great for wine and champagne businesses in the United States,” he wrote. No Inflation, So No Stagflation in the U.S. (For Now) The Producer Price Index (PPI), considered a leading indicator of inflationary pressures, remained unchanged over the month after rising 0.6% in January, according to seasonally adjusted figures. Economists surveyed by Dow Jones had expected a 0.3% increase. A 0.2% decline in service prices offset a 0.3% rise in goods prices. Two-thirds of the increase in goods came from a 53.6% surge in egg prices, according to the Bureau of Labor Statistics (BLS). Egg prices spiked partly due to the avian flu affecting supply, although signs indicate that prices dropped in March as outbreaks slowed. Excluding food and energy, the core PPI fell 0.1%, against expectations of a 0.3% increase, marking its first negative reading since July. Core prices, excluding trade services, rose 0.2%, also below the expected 0.3% increase. Year-over-year, producer prices increased 3.2%, still well above the Fed’s 2% target, but lower than January’s 3.7%. The core PPI rose 3.4% in February, 0.4 percentage points lower than in January. Europe Feels the Impact of Trump’s Announcements In Switzerland, the SMI closed down 0.25%. Nestlé (+0.2%) supported the index, while Roche (-1.4%) dragged it down. In Paris, the CAC 40 lost 0.64%. Germany’s DAX fell 0.63%. The FTSE 100 in the UK stood out with a 0.02% gain, supported by the defensive healthcare sector. French spirits companies took a hit from Trump’s latest threats: Pernod Ricard lost 3.97% Rémy Cointreau dropped 4.67% LVMH fell 1.11% In the bond market, Germany’s 10-year Bund yield fell 3.5 basis points to 2.855%, after reaching a 17-month high of 2.938%. Meanwhile, the German Parliament has begun debating a €500 billion special fund and the reform of the “debt brake” policy. Trade War Still Weighing on U.S. Markets The Dow Jones dropped 1.30%, while the Nasdaq declined 1.96%. The broad-based S&P 500 fell 1.39% to 5,521.52 points, entering correction territory, meaning it has lost 10% from its yearly high on February 19. The “Magnificent Seven” tech stocks all declined: Tesla (-2.99%) Alphabet (-2.53%) Amazon (-2.51%) Meta (-4.67%) Apple (-3.36%) Microsoft (-1.17%) Nvidia (-0.15%) Software giant Adobe plummeted 13.85%, despite better-than-expected Q1 earnings, as investors found its quarterly forecast disappointing. Meanwhile, Intel soared 14.60% after appointing Lip-Bu Tan as CEO, a move seen as a potential turnaround for the struggling company. In the bond market, the yield on 10-year U.S. Treasury bonds eased to 4.27%, down from 4.31% the previous day. Gold remained stable at $2,986.45 per ounce, after hitting a record high of $2,989.46. Silver fell 0.3% Platinum rose 0.3% Palladium gained 0.7% Commodities Remain Weak Concerns over economic outlook and global oil supply-demand forecasts pushed oil prices lower: Brent crude fell 0.94% to $70.28 per barrel West Texas Intermediate (WTI) dropped 1.18% to $66.87 Soybean and corn futures in Chicago declined slightly on Friday, both on track for weekly losses. Trade disputes and ample supply from South America weighed on prices. Wheat also retreated but remained set for a weekly gain due to expectations of lower Russian exports. This Morning in Asia Optimism over a likely U.S. government shutdown avoidance boosted Asian markets in early trading. Senate Democrat Chuck Schumer announced he would vote to advance a Republican stopgap funding bill. The MSCI Asia-Pacific index (ex-Japan) gained 0.2% Japan’s Nikkei reversed early losses to rise 0.12% Hong Kong’s Hang Seng climbed 1%, though it was set for a 2.3% weekly decline China’s CSI300 rose 1.4%, heading for a 0.6% weekly gain One key reason for optimism? Cheap Chinese stocks: Chinese stocks trade 30% below their 2021 highs The Hang Seng Index is valued at 7x forward earnings, compared to 20x for the S&P 500, according to LSEG data The U.S. dollar regained some ground: The euro edged down 0.1% to $1.0841 The British pound slipped 0.05% to $1.2944 The dollar rose 0.3% against the yen to 148.25 Have a nice day! Thomas Veillet Financial Columnist

Blowing Hot and Cold

The president had announced new tariffs with Canada before backtracking that same evening… Australia will not enter a trade war with the United States but is requesting an exemption from tariffs on steel and aluminum. Meanwhile, Europeans are once again bringing up tariffs similar to those imposed during the president’s first term. The same old song, over and over again. For now, markets have focused on the CPI figures. Today’s news: Donald Trump announced on Wednesday that American negotiators would head to Russia “immediately”… while waiting for all the players to gather around the liar’s poker table. Inflation stabilizes in the United States The Consumer Price Index (CPI), which measures overall economic costs in the U.S., rose by 0.2% in seasonally adjusted data for the month, bringing the annual inflation rate to 2.8%, according to the Department of Labor. The overall CPI had increased by 0.5% in January. Excluding food and energy prices, core CPI also rose by 0.2% for the month, reaching 3.1% over 12 months—the lowest rate since April 2021. Core CPI had increased by 0.4% in January. Economists surveyed by Dow Jones had expected increases of 0.3% for both overall and core CPI, with annual rates of 2.9% and 3.2%, meaning all rates came in 0.1 percentage points below forecasts. During the European session In Paris, the CAC 40 closed with a gain of 0.59%. The British FTSE advanced by 0.41%, while Germany’s DAX rose by 1.52%. The EuroStoxx 50 index gained 0.87%, and the FTSEurofirst 300 was up 0.84%. The Stoxx 600 ended a four-session losing streak, climbing 0.81%. Rheinmetall, a key beneficiary of Europe’s major defense investment push, surged by 9.62%, while Inditex plunged by 7.95% following the group’s announcement of a weak first quarter, with sales rising only 4%. In Switzerland, the SMI rebounded by 1.39%. Roche gained momentum as the pharmaceutical giant signed an exclusive agreement with Danish Zealand Pharma to co-develop and co-market petrelintide as a therapy for individuals struggling with overweight and obesity. Roche shares closed significantly higher, up 3.6% at 307.30 francs. German bonds (Bunds) climbed back above 2.9% (+2.8 bps), while French OATs eased by -2 bps to 3.57%. Notably, the OAT/Bund spread narrowed to under 68 bps (-5 bps), as Chancellor Merz attempted to convince potential allies to approve a debt plan (500 + 500 billion euros over five years) to revive growth and modernize Germany’s defense sector. The dollar index gained 0.13% against a basket of reference currencies, poised to end a seven-session losing streak. The euro edged up 0.06% to $1.0925, after reaching a five-month high of $1.0947 earlier in the session, as the Kremlin stated on Wednesday that it was awaiting further clarification from the U.S. regarding the proposed ceasefire in Ukraine. The British pound gained 0.25% to $1.2980, after hitting a four-month high of $1.2990. The Canadian dollar strengthened by 0.56% against the greenback to C$1.44 per U.S. dollar, while the U.S. dollar weakened by 0.03% against the Swiss franc to 0.882. When in doubt, rely on oil According to data from the U.S. Energy Information Administration (EIA), crude oil inventories in the United States rose by 1.4 million barrels compared to the previous week, reaching 435.2 million barrels. Despite this, WTI crude rebounded by +1.3% to $67.5 per barrel, while Brent gained 1.2%, rising to $70.7. Meanwhile, other commodities mostly trended downward, except for copper. Copper on the LME gained 0.5%, aluminum remained stable, lead dropped by 0.1%, as did tin, while nickel was unchanged. Whether due to ongoing tariff threats, the South American harvest, or the approaching U.S. planting season, bearish sentiment drove most grain prices lower midweek. Corn prices took the biggest hit, dropping by more than 1.5%. Soybeans also posted moderate losses, while wheat prices ended with mixed but mostly negative results. In the precious metals sector, gold rose by 0.2% to $2,938.24 per ounce. Silver gained 0.2% to $33.29 per ounce, platinum increased by 0.2% to $985.18, and palladium rose by 0.6% to $954.63. Mixed performance for U.S. stock markets The Dow Jones declined by 0.20%, while the Nasdaq gained 1.22% and the broader S&P 500 rose by 0.49%. Most tech giants advanced on Wednesday: Meta climbed 2.29%, Microsoft rose 0.74%, Alphabet gained 1.82%, Amazon increased by 1.17%, and Nvidia soared by 6.43%. The only major loser was Apple (-1.75%). Intel jumped 4.6% amid reports that TSMC had offered Nvidia, Advanced Micro Devices, and Broadcom stakes in a joint venture to operate the American semiconductor maker’s factories. Airline stocks struggled throughout the session. American Airlines dropped 4.62%, JetBlue fell 3.57%, United Airlines lost 4.73%, and Delta declined 2.96%. In the bond market, the yield on U.S. 10-year Treasury notes climbed to 4.31%, up from 4.28% on Tuesday. Expert insights Goldman Sachs revised its year-end target for the S&P 500 downward, while JPMorgan raised its forecast for a U.S. economic recession. This morning in Asia In Japan, the benchmark Nikkei 225 index rose by 0.98%, while the broader Topix index increased by 0.82%. South Korea’s Kospi index gained 0.81%, while the small-cap Kosdaq index climbed 0.37%. Hong Kong’s Hang Seng index edged down 0.14% at the open, whereas mainland China’s CSI 300 index increased by 0.23% in volatile trading. Australia’s S&P/ASX 200 index remained flat, reversing gains from earlier in the day. Since March 13, 2025, Trump has decided to venture into fashion by launching his own clothing line: “Make Fashion Great Again.” (ChatGPT’s comment) Have a nice day! Thomas Veillet Financial Columnist

The Apprentice…Sorcier

Once again, Trump launches a new attack on Canada over tariffs. The apprentice sorcerer casts a spell on financial markets, which may one day grow weary of his media experiments and assess the economic impact of the American president’s enchantments. As you can read, tensions are rising between Canada—through its new minister—and the U.S. president, who repeats his usual refrain via his network: “Ontario, Canada, having imposed a 25% tariff on ‘electricity’ entering the United States, I have instructed my Secretary of Commerce to add an additional 25% tariff, bringing it to 50%, on all steel and aluminum entering the U.S. from Canada—one of the highest tariffed nations in the world. This measure will take effect TOMORROW, March 12. Furthermore, Canada must immediately drop its outrageous agricultural tariff of 250% to 390% on various American dairy products, which has long been considered scandalous. I will soon declare a national emergency regarding electricity in the threatened area. This will allow the U.S. to take swift action to counter Canada’s abusive threat. If Canada does not drop other glaring and long-standing tariffs, I will significantly increase, on April 2, tariffs on cars entering the U.S., which will effectively shut down the Canadian auto industry for good.” And, for fun, he adds: “Additionally, Canada pays very little for national security and relies on the United States for military protection. We subsidize Canada by more than $200 billion a year. WHY? This can’t continue. The only thing that makes sense is for Canada to become our beloved 51st state. In that case, all tariffs, and everything else, would disappear completely. Canadians’ taxes would be significantly reduced, they would be safer—militarily and otherwise—than ever before, there would be no more northern border issue, and the world’s greatest and most powerful nation would become even greater, better, and stronger—with Canada as an integral part of it. The artificial dividing line drawn many years ago would finally disappear, and we would have the safest and most beautiful nation in the world—and your brilliant anthem, ‘O Canada,’ would still play, but now representing a GREAT AND POWERFUL STATE within the greatest nation the world has ever known.” And what about financial markets, which, for Trump, were once a measure of success? Well, he no longer talks about them since they are dropping. It’s a Mess in Europe… In Switzerland, the SMI closed down 2.47%. Novartis (-5.6%, excluding a dividend of 3.50 francs) ended as the worst performer, behind Roche (-3.6%), while the third heavyweight, Nestlé (-2.1%), did slightly better than the index. Elsewhere in Europe, red dominates. The CAC 40 lost 1.31%, the DAX fell 1.34%, and in London, the FTSE 100 dropped 1.21%. Travel and leisure stocks suffered Tuesday (-3.6%) after disappointing outlooks from U.S. airline Delta. In Paris, Air France-KLM plunged 9.2%, and Lufthansa lost 5.2%. Unsurprisingly, the auto sector fell 2.1%, hit by fears over U.S. tariffs. The yield on the German 10-year Bund climbed nearly 5 basis points to 2.872%. And in the U.S. as Well The Dow Jones fell 1.14%, the Nasdaq declined 0.18%, and the broader S&P 500 dropped 0.76%. On the data front, Wall Street barely reacted to the U.S. Labor Department’s JOLTS report, which showed a slightly higher-than-expected increase in job openings for January. Though, to be fair, the figures have never been very reliable. More important is today’s release of February’s CPI. Just like in Europe, airline and travel sector stocks plunged—Airbnb (-5.08%), Expedia (-7.28%), and Booking (-2.19%) were among the hardest hit. And Trump buys a Tesla… red like his tie. “I’m going to buy one” because it’s “a very good product” and because Elon Musk has been “treated very unfairly,” said the president. Tesla shares jumped 3.79%—hopefully, the American president bought some call options before his announcement. In the bond market, the yield on 10-year U.S. Treasury bonds rose to 4.28%, up from 4.21% on Monday. A Modest Rebound for Most Commodities Three-month copper on the London Metal Exchange (LME) rose 0.03%, aluminum climbed 0.22%, lead gained 0.19%, while tin fell 0.05%, zinc lost 0.02%, and nickel dropped 0.15%. Chicago soybean futures rose Wednesday for the first time in four sessions, with bargain buying supporting prices, though gains were limited by abundant South American supply and uncertainty over the trade war’s impact on U.S. sales. Wheat and corn prices also rose, recovering some of Tuesday’s losses. Oil prices saw a modest recovery, with Brent crude rising 0.39% to $69.83 per barrel, and WTI climbing 0.44% to $66.54 per barrel. Ukraine Favors a One-Month Ceasefire This was the big overnight news, and Asian markets are showing some resilience. The MSCI Asia-Pacific ex-Japan index was up 0.2%, while markets in Hong Kong and China remained broadly stable, as did Japan’s Nikkei. Since the start of the year, the Nikkei has lost 7.8%. But the real winner was the euro. It reached its highest level since October in New York at $1.0947 and remained stable in Asia at $1.0913. The Russian ruble also hit a seven-month high overnight. However, the Canadian dollar fell to a one-week low before rebounding to $1.443 CAD per USD. Gold remained steady at $2,916.69 per ounce, silver lost 0.5% to $32.76 per ounce, platinum rose 0.4% to $978.60, while palladium slipped 0.6% to $940.53. Now, all that’s left is to convince the Russians so that the markets can pretend to celebrate. Have a nice day! Thomas Veillet Financial Columnist

Recession? Never heard of it

The expected slap has arrived. Worse than DeepSeek, worse than the initial implementation of tariffs, the fact that Trump did NOT say the word “RECESSION,” but ABOVE ALL, that he did not deny the POSSIBILITY of a RECESSION, has crushed all the beautiful theories of infinite growth, the money-printing machine that is artificial intelligence, the idea that ROBOTAXIS will push Tesla to $1,500, and that tech—at these levels—is still cheap! Not to mention the belief that “The Fed is our friend, and they will (soon) cut rates!!!” The market just had its worst day in three years, and I’m not EVEN on the plane yet!!! The Magnificent Seven… Not So Magnificent Anymore We’re not in full-on CRASH mode just yet—and probably won’t be anytime soon—since fear levels are through the roof, volatility is flirting with 30%, and that’s usually the level where people start “buying the dip.” But let’s just say yesterday’s MASSIVE SLAP in the face served as a reminder that YES, the market can still go down. After nearly 18 months of defying sellers, with buyers confidently scooping up every 5% dip—because, come on, it’s cheap!—the Nasdaq just plunged violently into correction territory. And given yesterday’s carnage, financial media is already throwing around the term BEAR MARKET. Just as a reminder: a correction means a 10% drop from the highs, while a bear market starts at a 20% decline. Right now, the Nasdaq 100 is down 12.6% from its peak, the Composite has lost 13.5%, and the SOX (semiconductor index) has crashed 25% since its July highs. But the real problem in this tech bloodbath is that the Magnificent Seven got absolutely wrecked. And since these seven giants make up such a massive chunk of the market, we’re getting a practical lesson in just how dangerous over-concentration can be. This isn’t exactly news, but now we’re REALLY feeling it. Nvidia is down 28% since early January—and that’s despite delivering stellar earnings in February. Imagine what would’ve happened if they had issued a profit warning. Microsoft also reported fantastic numbers, but it’s still down 18% from the highs. Meta is down 19%, Apple 12%, Amazon 20%, and Google 19%. As for Tesla? It’s a full-on bloodbath. The company, which was supposed to flood the world with self-driving robo-taxis, has collapsed 53% since December. Just yesterday, Tesla tanked another 15% after UBS slashed its sales expectations by 20%, as nobody wants a Tesla anymore. In fact, “I Bought a Tesla Before Elon Went Crazy” bumper stickers are selling like hotcakes—so owners can justify their purchase. Recession Fears Long story short, tech got obliterated yesterday. The Magnificent Seven alone lost over $750 billion in market cap—that’s a hell of a lot of yachts and Bugattis up in smoke overnight. And the rest of the market crumbled right alongside them. Banks got hammered—because, of course, they’d be the first to suffer in a recession. Delta Airlines basically issued a profit warning, saying consumer confidence is eroding. Novo Nordisk’s new obesity drug, CagriSema, disappointed investors because it only leads to a 15.7% weight loss over 68 weeks—instead of the expected 20%. That’s right, their stock plunged 10% because someone weighing 120 kg would “only” lose 18.84 kg in 16 months instead of 24 kg. If you needed proof that this market is insane, this might be it. Since the start of the year, between crypto and U.S. equities, $5.5 trillion in market cap has been wiped out. And all because of two things: Tariff uncertainty—nobody knows what Biden is actually trying to achieve, or when he’ll stop flip-flopping on trade policy. Sudden “recession fears.” Yesterday’s market meltdown was largely triggered by Trump’s latest interview. He refused to say we’re heading into a recession… but also refused to say we aren’t. And since markets hate uncertainty, everything spiraled. But let’s be real—there wasn’t some earth-shattering new development that tanked the market. It’s more like investors are exhausted. Everyone’s sick of this back-and-forth on tariffs, with policies that change every other day. One moment, tariffs are on, then they’re off, then they’re back on again. It’s like some weird trade-policy hokey pokey, and markets have had enough. What Now? More Pain or a Rebound? After getting absolutely crushed, markets are now drenched in red. Tech is in shambles, the Nasdaq has dropped 12% in just 13 trading days, put volumes are hitting all-time highs, and volatility is off the charts. So, are we setting up for a massive short squeeze? Interestingly, since yesterday’s close, Nasdaq futures have bounced nearly 350 points into positive territory. Without jumping to conclusions, it seems like yesterday’s sell-off was more about frustration than fundamentals. The tariff mess is exhausting, and Trump’s vague comments were just an excuse to panic. The rest of the week will give us more clarity, but I have a feeling my vacation will mostly involve watching my screen—just in case there’s another wild story to tell. Germany, the Economic Support Fund, and the Greens While the Americans were turning into bears and simulating total panic, Europe also had its own problems to deal with. And one of Europe’s problems was Germany’s economic support fund. You know, that famous fund that was announced with great fanfare last week. Well, since yesterday, doubts have been growing about whether it can actually be implemented, as the new German government needs a two-thirds majority in parliament to approve the signing of the €500 billion check. And since yesterday, the Greens have dug in their heels, arguing that the project is poorly put together. Without the Greens, the right-wing’s grand plan could remain stuck in the pipeline. Needless to say, if the promised €500 billion meant to “make Germany great again” isn’t put on the table as planned, it could be a painful blow for some investors who were counting on it to justify the valuations of certain German stocks! Yesterday, Germany fell “only” 1.69%, and we’re eager to follow the next episode of the drama unfolding in the Bundestag.

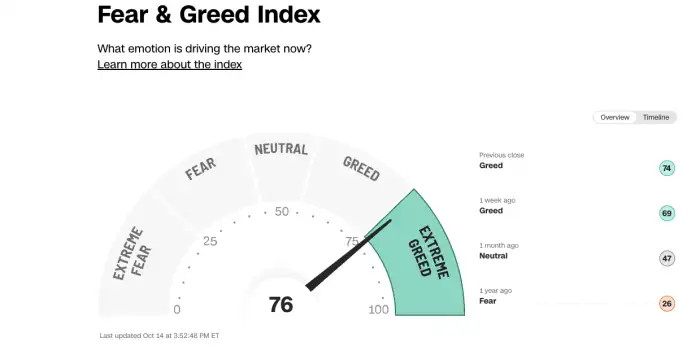

Greed and Fear

Last week, the Nasdaq tested its “correction zone” but managed to recover. The S&P 500 repeatedly dipped below the 200-day moving average. Employment is showing signs of weakness, but the market is choosing to ignore them—for now. Volatility hit its highest level of the year at 26.56%, and the “Greed and Fear” index remains in “extreme fear” territory. No matter how you look at it, something is brewing, and while buyers are still jumping in to seize opportunities, investors are no longer as confident as they were a few months ago. Doubt Over Tariffs If we believe what we see and hear, the main concern right now seems to be tariffs and the impact of Trump’s “magical” policies on the global economy. Everyone is trying to guess what this tariff policy will look like in a week or a month. The problem? It’s nearly impossible to predict, because, once again, even Trump himself doesn’t seem to know where things are headed or who the U.S. will be at odds with next. And this isn’t just criticism of his policies—it’s simply the reality. He changes his mind every three minutes, moving forward and backward at the same time. These tariff issues are concerning for several reasons. First, they could increase costs for businesses that rely on importing foreign goods, impacting profits and, consequently, stock prices—not to mention employment and wages, which seem to be just a footnote in this equation. Second, these price increases will be passed on to consumers, putting them under financial strain and limiting their shopping sprees. It’s been said over and over again: the American consumer is the engine of economic growth. Without them, it’s not hard to imagine the potential consequences. You don’t need to be a genius to understand that the combined impact on consumers and businesses has some fearing that tariffs could trigger a recession. Yes, I know—we’re not supposed to say “recession” because it’s practically a sin in the wonderful world of finance and economics, where people prefer markets that rise every day. But it’s a reality that must be acknowledged. Even in his weekend interview, when asked whether he expected a recession in 2025, the indefatigable President Trump said: “I hate predicting these things. But there’s a transition period because what we’re doing is huge. We’re bringing wealth back to America. That’s important. It just takes time.” So no, he didn’t explicitly say, “There will be a recession.” But he also didn’t say, “There won’t be a recession.” He’s fully aware that his plans will take time, cost money, and have economic consequences. For now, he’s feeling his way through it—just like the rest of us. To wrap up the tariff discussion, these price increases could hit at a time when the economy is still dealing with residual inflation. Additional price shocks could make it harder for the Fed to cut rates again. Or twice. We’re starting the week in an extremely delicate position for the markets, and Trump’s recent interview has already put pressure on futures, which are looking rough—despite European markets not yet being open and nearly 12 hours to go before Wall Street opens. (Yes, as I write this, it’s 3:30 AM.) The Rollercoaster (Again) We begin the week on a rollercoaster—just like the one we just finished. Tariffs and the uncertainty surrounding them are the dominant topic—aside from the ongoing European rearmament efforts, which are consuming economic and political resources. People are fixated on upcoming tariff decisions. That’s a fact. And we’ll have to live with it. But for how long? That’s another question entirely, and one that only adds more uncertainty. And uncertainty, more than anything, weighs on sentiment. People don’t like not knowing. Sometimes, it’s better to get either good or bad news—something tangible to interpret—rather than being left in limbo. Take last Friday’s job numbers, for example. To keep it simple: 151,000 jobs were created in February—the first full month under Trump 2.0—compared to the 170,000 that were expected. That’s a noticeable miss. On top of that, the previous month’s numbers were revised down by 19,000, and the unemployment rate came in at 4.1%, whereas Wall Street had predicted it would stay at 4%. In a normal world, these numbers would be considered disappointing. Not disappointing enough to short the markets and tattoo “RECESSION” across our foreheads, but still—let’s be honest, “it was not great news.” It confirmed that the job market is still slowing down and that we’re not yet in full “Make America Great Again” mode. But that’s the beauty of finance—somehow, the market managed to spin it as “not too bad because it wasn’t as terrible as feared!” Fear Can’t Be Controlled And there it is! We set expectations for the job report, but deep down, we weren’t confident. You could practically see economists’ hands shaking as they filled out their Non-Farm Payroll (NFP) forecasts. They were nervous, sensing economic trouble ahead. They guessed 170,000, but feared it might be only 35,000 instead. When the number came out at 151,000—sigh of relief! We survived another month! It’s almost magical. And it’s what kept us from closing below the 200-day moving average, which would have been disastrous. However, looking at the futures this morning, I’m not sure we can stay above this thin line of support for long. One thing is clear: analysts and economists want to believe everything will be fine, but deep down, they know something is rotten in the kingdom of the U.S. economy. Even Trump admits it’ll take time to Make America Great Again. Let’s just hope he succeeds—without too much collateral damage on our end. In Summary We’re starting the week with the same uncertainty we had last Friday. Tariffs are an ongoing headache, making it impossible to feel at ease. But after six or seven weeks of Trump 2.0, we’ve realized that this won’t be smooth sailing. If anyone thought they had already seen it all during his first term, they were wrong. It’s going to

The Tariffs Waltz

This time, it’s official. The Nasdaq has entered correction territory. It narrowly avoided punishment two days ago, but now it’s done. Once again, blame it on tariffs and blame it on one company—Marvell—which didn’t release an optimistic enough guidance, triggering a broad sell-off in the AI sector and the Magnificent Seven. So, naturally, when the BIGGEST SUPPORTS of the market let you down, there’s not much to hope for. However, when you lean back in your office chair and take a step back, you realize that the market is completely insane and should probably seek professional help. Unless it’s Trump who should be consulting a specialist. The Weathervane Yes, no, because let’s be honest. The President doesn’t know what he wants when it comes to tariffs—he changes his mind every three minutes, and in the end, we don’t even know if it’s “good” or “bad” news. Uncertainty takes over, and when uncertainty dominates, people generally sell everything and wait for things to calm down. That’s pretty much what happened yesterday with tariffs—especially in the U.S. And that’s what we’re going to try to make sense of. Because, to be honest, if I rely on the latest updates from the White House, Trump had ONCE AGAIN put some tariffs on hold. That should have been positive news. But I think people are just fed up with the President’s constant flip-flopping—he treats us like his puppets. Fundamentally, the market isn’t exactly thrilled about Trump slapping tariffs on 194 other countries because it could slightly drive inflation up. But at least we can handle it when it’s a clear government decision that we have to work around. Of course, we’d prefer if he didn’t impose tariffs at all—that would be even better. But what we’re struggling with more and more is the constant reversals. At first, he changed his mind twice a week. Now, it’s almost twice a day. Let’s quickly recap the situation regarding tariffs on Mexico and Canada. At first, he slapped a 25% tariff on them—no discussion. Forty-eight hours later, he delayed implementation by 30 days. Both countries made efforts, but not enough, and 30 days later, he enforced the tariffs—this was on Tuesday. On Wednesday, he made a U-turn and exempted car manufacturers. Yesterday, he exempted fertilizer imports. Then, he spoke with the Mexican President—and flipped again. Once more, tariffs on Mexico were postponed until April. But not Canada. At least not right away, because after so many exemptions on Canadian goods, it’s basically like he made a U-turn there too. And then, just recently, he reiterated his intention to tax steel. IN THE MARKETS, THERE’S ONE THING WE CAN’T STAND: instability and nonsense headlines coming from all directions. A Weathervane on a Carousel on a Boat in the Middle of a Storm If you want an example of uncertainty, just look at the global markets. Depending on Trump’s statements, Europe closed higher at 5:30 PM because investors were happy he loosened the grip on tariffs. Then, by 10:00 PM, the U.S. markets got crushed because Trump changed his mind another 22 times, and traders decided to throw in the towel before taking a beating—something like Apollo Creed getting destroyed by Ivan Drago in Rocky IV. Now, to be perfectly fair, the U.S. market didn’t drop only because of tariff chaos. Marvell’s earnings report hit the tech sector hard. That wasn’t uncertainty—it was just investors overreacting. And I say “overreacting” because, looking strictly at Marvell’s numbers and expectations, the results were either better than expected or in line with estimates. But the problem? Marvell’s guidance was in line, while experts expected it to be better! Well, maybe you should have said your expectations were higher, GENIUS! It’s like telling everyone your dream salary is $300,000 a year, then getting hired at that amount but going home miserable because you hoped for more! Everyone wants to slap you for that kind of attitude! In the end, Marvell lost 20%, and the entire tech sector took a hit just because Marvell was good—but apparently, it would have been better with one less “L” in its name and a more “Captain America” guidance… And at this point, as I often say: why didn’t I study psychology instead of finance?! I’d probably be more useful analyzing the Nasdaq on my couch than on my trading screens. Because if we go back to yesterday’s tariffs, fundamentally, Trump’s latest announcement isn’t that bad. It’s just that we’re exhausted from the constant back-and-forth, knowing full well that another round of tariff decisions will come in a month anyway. We’re simply FED UP with this nonsense and hesitation. It’s affecting volatility and everything else. Right now, we just want to go on vacation and check back later when we can have rational trading days based on macroeconomics—not the neuroses of a politician who doesn’t even know who he wants to be mad at anymore. Right now, tariff policy feels like getting a band-aid ripped off—except instead of one quick pull, it’s peeled off slowly, then halfway through, it’s stuck back on, and we start all over again! I think we can officially say that the market has had “ENOUGH” of these tariffs. And that’s the polite version! Still a Party in Europe Meanwhile, in Europe, it’s still party time. Especially in Brussels, where the valiant knights of the European roundtable gathered in Belgium to worship and glorify the almighty Zelensky. And, of course, so that Macron and Zelensky could have some “quality time” together. So, the European markets handled yesterday’s session relatively well and weren’t as shaken by Trump’s temporary tariff adjustments. To be fair, we should also note that the ECB did cut interest rates, which should help buy a few more guns and cannons. But then Lagarde came out and said that all these massive infrastructure and rearmament expenses “COULD” bring inflation back. Yeah, no kidding! It’s almost funny—governments are about to blow a fortune rebuilding the Maginot Line and reenacting La Grande Vadrouille

Groundhog Trade

I usually wake up between 3:30 and 4:00 a.m. to read everything and tell you exactly what to think or know about the financial markets by 7:00 a.m. But with everything happening lately, I might have to rethink my schedule—or just give up on sleep altogether—to make sure I don’t miss anything and stay sharp in the morning. The problem? Every day feels like a rerun. The same market manipulations from the White House, the Élysée’s Adjudant-Chef Chaudard charging into battle, and the Germans once again getting their hands on the Bundestag’s checkbook. It’s the same show on repeat—just with different headlines. Disneyland and Its Rides Let’s try to summarize yesterday’s events as simply as possible. There was a time when we could almost try to anticipate what would happen after, but right now, it’s hard to even imagine an after—because in the span of three days, we can flip our stance four times, change our opinion eight times, rebalance our portfolios every five minutes, and consider 14 different investment strategies per half-hour. And all of this while knowing that it would take just one of the clowns in power somewhere in the world to lose it for reasons unknown, forcing us to completely rethink our carefully considered forecasts from just 30 minutes earlier. Just look at what’s happened to the U.S. indices over the past two weeks! The only thing that comes to mind when looking at the S&P 500 charts is that WE’RE LUCKY MARKETS CAN ONLY GO UP AND DOWN—because if they could also move left and right, I’ll let you imagine the complete disaster that would create. In just two weeks, volatility shot up from 14% to 26%, and now we’re back at 21%, which seems to be the “new normal.” The Greed and Fear Index is all over the place and doesn’t make any sense anymore. As for the S&P 500, it’s clinging to the 200-day moving average but mostly looks capable of flipping from total panic to “bull market forever” in a matter of three minutes. All it takes is someone from the White House coughing or sneezing, and we’re back on the rollercoaster. During Trump’s previous term, it was already a spectacle, but now that he’s back, we’ve had to install defibrillators in every trading room, and checking your blood pressure is mandatory every time you grab a coffee. There’s Band-Aids in the Air For once, let’s start with the U.S. this morning. To put things in context, on Tuesday night, we collectively freaked out when we realized that the one-month reprieve Trump had given the Canadians, Mexicans, and Chinese had just ended. Yes, it’s ALREADY been a month—but at the same time, it was an insanely short month. February is always a short month, but this time, we really felt it. SO. The reprieve was over, meaning it became ABSOLUTELY necessary to RE-PANIC, just as we had done a month earlier. The markets got wrecked, and the S&P 500 miraculously held its 200-day moving average. Then, on Wednesday, we went back to RE-TEST it. Just for fun. Kind of like when you wave your hand over the fondue burner to see if it’s on, because like an idiot, you forgot if you already checked. And just when the markets decided to play the let’s scare ourselves again game, Trump pulled his Chinese torture device back into play, and the market rebounded just enough to save face. But with volatility still at 21%, it’s safe to say that traders haven’t fully accepted that we’ve made it out of the woods—or rather, out of the hole at the bottom of the woods. Trump’s Chinese Torture Device If you’re wondering what that is, well, it’s simply Trump announcing brutal, violent, massive rules that will inevitably have economic and especially inflationary consequences. Rules that force you to panic and step out of your comfort zone. Then, just when you’re starting to consider slitting your wrists with a butter knife, opening a bed-and-breakfast in the South of France, or buying an RV to start producing meth, the President of all Americans reverses his decision and explains that tariffs, YES—but not on car manufacturers. Well, not for the next month, anyway. So, you can go ahead and schedule the next panic for the auto sector on April 4, 2025—unless, in the meantime, all the manufacturers have relocated or built factories in the USA to make America Great Again, yada yada, you know the drill… Discounted Tariffs So yes, Trump revised his stance on car tariffs, and everyone realized it was suddenly much easier to breathe without that weight on their chest. Trump is basically the guy who drives a nail into your hand, and while you’re screaming in pain, he gives you a morphine injection so you don’t feel anything anymore. But deep down, you know that as soon as the morphine wears off—in a month—the pain will return just the same, with an infection on top. Either way, the little game of “it goes away, and it comes back”—which was originally invented by a French electrician who tried changing a lightbulb while sitting in his bathtub just to see if it conducted electricity—was once again played by Uncle Donald, who is never late when it comes to stirring things up on Wall Street. In addition to tariffs, we also got some macroeconomic reports that were more or less good, depending on your perspective. First, the ISM Services Index came in above expectations. This showed that the economy was still doing well in that area, but we were still warned that people were worried about upcoming tariffs, which could lead to unwanted inflation in the medium term. Since yesterday’s session was all about optimism, we took the news positively, while storing it in the “cautious, but let’s not think about it until Monday” section of our prefrontal cortex—the part that handles short-term memory. That way, we’re sure to forget about it over the weekend. Then, after

How Serious Is the U.S. Debt Crisis?

The United States is facing a growing debt crisis, with net interest payments reaching a staggering 18.7% of federal revenues in January, the highest level since the 1990s. This figure is just 20 basis points below the all-time record of 18.9% set in 1992. Moreover, this share has DOUBLED in just 18 months as interest costs have soared. Over the past 12 months, interest expenses hit a record $1.2 trillion, making it the second-largest federal expenditure after Social Security. Projections indicate that the burden will continue to rise. Net interest costs as a percentage of federal revenues could reach 34% by 2054, assuming no recession occurs during this period. By 2026, annual interest payments are expected to exceed $1 trillion, and by 2035, they could reach $1.8 trillion. As a share of revenues, interest payments may climb to 22.2% by 2035, further limiting the government’s ability to fund other critical programs. The Congressional Budget Office (CBO) warns that federal deficits will expand significantly, reaching 8.5% of GDP by 2054, exacerbating the debt crisis. Net interest costs are projected to grow at an average annual rate of 6.5% between 2025 and 2035, potentially crowding out essential spending. Experts caution that without substantial fiscal reforms, the U.S. could face serious economic consequences. Investor Ray Dalio has even warned that the country might experience a financial “heart attack” if the debt problem remains unaddressed. Given these alarming trends, fiscal responsibility advocates emphasize the urgent need for reforms to stabilize national finances and mitigate risks to the economy. Philippe Thomas Ceo Soleyam Finance

Trade War & HOPE

Cleaned out, wiped, liquidated, and erased. That’s how one could describe the performance of the U.S. market since the November election. We’re back to square one, and the S&P 500 has even retested the 200-day moving average for the FIRST time in 16 months! No one is talking about rate cuts to boost the economy anymore; the entire strategy that brought us here is being questioned. And those who believed that Trump would care about stock market performance to justify his record are realizing they were completely mistaken. Yesterday, the mood was grim, but this morning, hope is reborn. Behind Our Backs Once again, yesterday’s session was a catch-up session for Europeans. Indeed, the blow that the U.S. market took on Friday evening—when we realized that Trump would no longer negotiate on tariffs—had yet to make its impact felt on European markets. By the time Wall Street had taken its nosedive, we were already home, putting dinner on the table. When it came to Europe catching up, we were not disappointed. If on Monday, EU members were on cloud nine, signing arms deals with the €800 billion announced by Brussels—despite nobody knowing where they’d find a single cent of it, considering that most of the region’s countries are on the brink of financial collapse—things took a drastic turn by Tuesday. The equation was quite simple: if Trump refused to negotiate with Canada, China, and Mexico, there was absolutely no reason he would do so with Europe. Europe is probably the next in line to get slapped in the face by Washington. But in the meantime, since we all know that Europe is heavily dependent on the health of global trade, we preemptively reacted as if “Trump had just dropped a bomb in front of the European Union offices in Brussels,” attacking anything that might take a hit. The first casualties were car manufacturers, who got absolutely slaughtered—as if they needed that right now—followed by the banks. The “experts” figured that if the tariffs led to a global slowdown, it was inevitable that banks and brokers would suffer the consequences. Banks are the canaries in the coal mine when things improve, but they are also the first to collapse when the economy slows down. And yesterday, we were clearly in “the economy is slowing down, and we’re all going to die” mode. Even the prospect of the ECB cutting rates tomorrow didn’t ease yesterday’s bloodbath. Awareness, Doubt, and Fear Looking at the numbers, the most notable event was the DAX finally taking a serious hit. This index, which had resisted everything and set 822 all-time highs in recent weeks, finally cracked. The German index dropped by 3.54%, marking its worst day in over three years—a nice way to welcome the right-wing government to power. And the worst part? Yesterday’s massive drop barely even shows up on the chart. To return to the longer-term trend of the past two years, we would still need to see the index lose another 3,000 points. In France, the losses were limited to 1.8%, while Italy performed slightly worse than Germany with a 3.41% decline in Milan. Meanwhile, Switzerland held up better thanks to the three heavyweights in the SMI, which all finished in positive territory, keeping the defensive SMI down by only 1.21%—although UBS got absolutely wrecked as fears of an economic slowdown returned. What’s interesting is how all the bold claims about tariffs being nothing more than a negotiation tactic between Trump and the rest of the world have now gone out the window. Suddenly, everyone is hating Trump for what he’s doing and failing to understand why he’s doing it. But one thing is for sure: these tariffs will make America greater, stronger, better, and Great Again. Honestly, I didn’t study economics much, so I won’t pretend to analyze Donald Trump’s economic doctrines, but let’s just say the market doesn’t buy into them for a second. Confidence in the future is fading fast. It’s clear that this isn’t an easy market, and the geopolitical uncertainty we’re dealing with right now is anything but simple to navigate, understand, or translate into market behavior. To sum it up: If you were a car manufacturer yesterday, you had a hell of a bad day. If you were a supplier selling parts to those manufacturers, it was even worse. For a brief moment, in Europe, we stopped talking about World War III, about the €800 billion rearmament plan, and even Rheinmetall was down. Speaking of that European Union defense loan, I’d love to know how they plan to raise that kind of money. Considering their credibility is about as solid as a corrupt politician in a Banana Republic, and von der Leyen has about as much trustworthiness as a Colombian drug trafficker caught behind the wheel of a 30-ton truck loaded with coke—claiming it wasn’t his truck and that he was just helping a friend—I have my doubts. Honestly, if you gave me the choice between lending money for Europe’s rearmament or smashing my own kneecaps with a hammer, I’d be heading straight to the garage for that hammer. But that’s not the point. Yesterday, we didn’t talk about the war in Ukraine, we didn’t talk about armed forces—we simply realized that these tariffs are no joke. It was a massacre. But, as always, there is hope. Looking Back Over in the U.S., things weren’t necessarily better, but they were “less bad.” The concerns were the same: Worries about the impact of tariffs Anxiety over the 100,000 federal employees Trump wants to fire Nervousness as Canada, China, and Mexico all announced retaliatory measures against Trump’s decisions In this environment, the market reaction was essentially the same as in Europe: Car stocks got hammered, especially those with factories in Mexico Banks took a beating because if the economy slows, financial transactions decrease, and banks make less money We might be jumping the gun on economic cycles, but since we’re all “visionaries,” we won’t miss the opportunity to

Trumpcession and a Rough Awakening

It is extremely interesting to watch the world splitting into multiple parts. I’m not sure if that’s “reassuring,” but one thing is certain: it leaves no one indifferent. Yesterday was the perfect representation of the global mess we are sinking into at the speed of a galloping bear. Between leaders printing money like there’s no tomorrow and spending it all on weapons, making the defense sector explode while gleefully heading to the front lines, and Trump kicking off the steamroller of tariffs while cutting off aid to Ukraine, the equation is becoming seriously complicated. Putting Things in Order To avoid mixing everything up and to make sure we don’t forget anything, let’s take things step by step. Let’s start with what happened in Europe yesterday. In the morning, everyone was excited about the concept of the U.S. cryptocurrency reserve, which sent the sector soaring—but that wasn’t all. There was also the prospect of massive investments in the defense sector, as European leaders now see themselves as Navy SEALs, all dressing like Zelensky to look more like “soldiers.” Every politician in Europe has switched to the warrior side of the force, constantly preaching about a UNITED Europe (a concept that exists only in the adolescent dreams of some). A UNITED Europe that, according to them, would have a military stronger than Russia, stronger than the U.S., and soon even stronger than China. Well, the only difference between these regions of the world is that the U.S. is a country, Russia is a country, China is a country, and Europe is a club of countries that don’t all agree with each other. They can’t even decide on the regulations for selling Greek jam in a German supermarket, yet they want us to believe they can unite against Russia—a Russia that, according to some delusions, is already positioning itself in the Parisian suburbs. Regardless of one’s opinion on the matter, it’s essential to consider Bayrou’s speech yesterday. The guy showed up before the National Assembly to explain, with a few well-calculated additions, that Europe has the strongest army in the world (if they can agree) and that by spending billions, it will be easy to crush Putin. Coming from a guy who never did his military service and was exempted because his ears wouldn’t allow him to wear a helmet, this is immediately reassuring. Personally, it makes me want to enlist… But back to the financial markets. Yesterday, just the idea of massive investments in the defense sector—which had already been hinted at two weeks ago, but less so, because this time, the London meeting made everyone realize it was “for real”—made ESG investors completely change their tune. ONCE AGAIN, they rushed into defense stocks. It was the same story all over again: Thales surged 16%, Dassault Aviation 15%, BAE Systems followed suit. Rheinmetall soared like a missile, up over 13%, Hensoldt gained 22%, Saab more than 11%, and Leonardo jumped 16%. I won’t list them all, but since November, Rheinmetall alone has nearly tripled in value. Clearly, the European arms industry is thriving, and the idea of going to war seems to excite politicians more than ever. Yesterday’s European session was explosive—both literally and figuratively—with the DAX closing up 2.64%, at an all-time high, just like Switzerland, which remains a neutral island while awaiting its F-35s, which, at this delivery pace, may end up in a museum before ever seeing Emmen. And Then Came Trump After Europe’s conscription day—where world leaders handed themselves military ranks and decided on the colors of their medals—we closed the markets in full-on war euphoria. At times, we almost expected Macron, Starmer, and von der Leyen to break into a HAKA dance to demonstrate their warrior spirit. And then the Americans arrived. Or rather, I should say: TRUMP arrived. Because right now—and since January 27—there isn’t a single day when the markets don’t revolve around him. The problem is, no one knows what fuels this guy, because to create this much chaos in the markets every five minutes, he must have an unbreakable cardio. A quick reminder: Trump’s last act of faith was announcing the “crypto reserve” on Sunday night. We won’t go back to that—for now. Instead, yesterday’s Trump-made topic was the announcement of new investments in the U.S. and a return to the subject of tariffs. On the investment side, things looked promising: TSMC is investing $100 billion in the U.S., and Honda, which had planned to build a factory in Mexico, will now do it in the U.S. At that very moment, we were still thinking: “Well, this isn’t bad. Trump is bringing business back to the U.S., which will inevitably create jobs and growth. Maybe these tariff policies aren’t so crazy after all.” I have to admit, the joy didn’t last long, because right after that, we came back to the topic of tariffs. But before going further, let’s remember that throughout yesterday, traders were thinking: “Well, we’re not too worried about tariffs. Trump will surely show some flexibility and give Canada and Mexico more time to negotiate. We all know tariffs are just a massive bargaining tool, and everything will turn out fine.” Actually: NOT AT ALL… The U.S. President decided that tariffs would take effect immediately—end of discussion. At that point, if you remember how the markets reacted when tariffs were first announced… well, it was the same story. The markets plunged into freefall, just as we’ve seen before. Cryptos crashed again because Trump didn’t provide ENOUGH DETAILS about his federal crypto reserve. Tech stocks collapsed because hedge funds are reducing their exposure to the MAGNIFICENT SEVEN and looking for more defensive alternatives. Volatility exploded by 24%, and suddenly, articles began appearing with headlines like: “Options Traders Are Preparing for a Stock Market Crash.” And to top it all off, the Atlanta Fed released its GDPNow indicator, suggesting that the U.S. could be heading toward a recession—largely due to tariffs. Well, “recession” is a bit of a dirty word nowadays,