You all know that for quite a few months – if not years – investors’ outlook has gradually narrowed to the very short term. The overwhelming amount of information we’re bombarded with every day makes us focus much more on the short term, or even the immediate, rather than holding on to a long-term vision and building over many years. No. Today, we want everything—and preferably, yesterday.

As a result, our behavior has changed, and we no longer live by visions of the future, but rather by expectations of what will happen this week—or better yet, today.

We live from one figure to the next, and this Wednesday morning, more than ever.

Waiting, Always Waiting

This start of the week perfectly embodies what we’ve been experiencing for months in the wonderful world of finance: we’re waiting for a number or a major announcement as if it would definitively shape the construction of our portfolios. Every macroeconomic announcement—or worse lately, geopolitical news—is treated as a game changer that will define the trajectory of our lives for the next 20 years.

The trajectory of our investor lives—let’s be clear. When it comes to making life choices as human beings, thankfully we still have social media and artificial intelligence. Speaking of which, yesterday proved just how helpless we’ve already become without AI. ChatGPT went down, and many of us had to use our brains again, suddenly realizing we’d become junkies addicted to our “digital slave,” and that without it, our productivity immediately tanks.

But that’s not the point. What I wanted to say this morning is that we’ve been waiting for two things over the past two days:

The outcome of the China–U.S. negotiations—to see how they plan to resolve their trade dispute and whether these 48 hours of talks will have any impact on inflation, and if so, by how much.

The inflation figures themselves.

Of course, the negotiations won’t have an immediate effect on the numbers coming out later today, but depending on what leaks from the London meeting, we’ll try to cross-reference both bits of info to figure out what to do with our portfolios.

To be fair, during these two days of waiting (one for us in Switzerland, coming off a three-day weekend stuffed with lamb), we’ve learned at least one thing: in times of uncertainty—when your head’s in a bag and you have no idea what the next 24 hours will bring—our instinct is to buy.

Doubt Still Lingers

Now we have to see if the combination of the post-London meeting statements and this afternoon’s data will allow us to keep pushing forward—or not. What you should know this morning is that U.S. indices are inching closer to their all-time highs. Today marks the 78th trading session since those record levels. We’re now just 1.8% away from that goal…

Will the inflation numbers and trade announcements be enough to seal the deal by tonight? That’s far from certain.

What we currently know about the negotiations isn’t much. After months of tension and two days of talks in London, U.S. and Chinese negotiators seem to have found a “framework” to implement the Geneva agreement reached last month. And I say seem because we’ve been given practically zero information about the substance of the deal.

All we’ve got is a “feel-good” photo of smiling negotiators.

Howard Lutnick, U.S. Secretary of Commerce, and Li Chenggang, Chinese Vice Minister, confirmed that both parties had reached “an agreement in principle,” particularly on the rare metals issue. But again—no details. The agreement still needs to be validated by Trump and Xi before taking effect.

As of Wednesday, June 11th, 5:00 a.m. Geneva time, no concrete details had leaked. Futures are down 0.25%, and markets remain skeptical. They’ve rallied for two days on the hope that the agreement is “good news” and a show of goodwill—but now they want something tangible. Not just a photo op with six guys laughing where you can barely tell who’s American and who’s Chinese—though we have a few clues.

One thing’s for sure: there’s not much diversity in the delegation. Judging by the photo, gender balance was clearly not a priority.

In short: we don’t know anything. We hope it’s enough to justify the recent rally and that maybe we can finally start doing some math and projecting further than just the end of the day.

In conclusion: yes, there’s an agreement headed in the right direction, but it still needs to be signed off by the top bosses—and apparently, it can’t be done over Zoom, since everyone wants to go home and check with their superiors first before committing.

We, however, would really appreciate something concrete.

Justifying Speculation

Let’s not forget that over the past 77 trading days, we got slammed on LIBERATION DAY, only to rebound 25% from the lows.

Yes, 25%—or 1,236 points up since April 7th—this is the third-strongest rally in history over such a short time frame.

Now we’ll have to justify it with more than just: “We have a vague framework for a deal, but no idea what’s in it, how it’ll be implemented, or what it’ll cost in terms of inflation.”

Anyway, we’re at least happy they didn’t rip each other’s heads off over the past two days. That’s something.

Now, we just wait. Again.

One thing is certain—and I must say it:

When you look at the press release after the trade talks—both in form and content—you really wonder if it would’ve been better to just shut up and keep waiting. Because right now, we know less than we did yesterday—and even less than we knew on Sunday night.

And yet I’ve written two pages about it.

So I’ll do the noble thing: I’ll shut up.

But… One Thing We Can Talk About

There is one area where we don’t know much, but we’re still allowed to put in our two cents: U.S. inflation, which is coming out shortly.

But before anything else, let’s see what the experts in the wonderful world of finance are expecting:

• Headline CPI (May):

+0.2% month-over-month

+2.5% year-over-year (vs. 2.3% in April)

• Core CPI (excluding food & energy):

+0.3% month-over-month

+2.9% year-over-year

Beyond the numbers, it’ll be interesting to see how the market interprets the impact of tariffs.

Let’s not forget that even though we’re currently under two moratoriums, tariffs are still being collected. That means cash is flowing into Washington’s coffers and retailers’ margins are under pressure.

Some “soap sellers” have been magnanimous and decided not to pass the costs onto consumers—for now. But between noble promises and accounting realities, “not yet” can quickly turn into “effective tomorrow.”

So, to put it simply: this afternoon, the key will be how the data is interpreted.

One thing’s for sure:

If the CPI matches expectations, we’ll be told tariffs “are starting to be felt,” and that there’s no way the Fed can lower rates under these conditions.

It’s almost certain there won’t be a rate cut next week—let alone in July. But if Core CPI hits 3% year-over-year, we’ll hear talk of “maybe in 2026” for a rate cut, and some aggressive voices might even mention the possibility of a rate hike.

Enough with Speculation and Vague Theories

This day is shaping up to be one of those sessions—where everyone expects everything to change by tomorrow.

Spoiler: nothing is less certain—and quite the opposite, really.

We waited yesterday. We waited the day before.

And today, we’ll KNOW.

Then we’ll interpret.

Then we’ll say: “Best to wait for next week’s Fed meeting.”

And so we’ll wait for next Wednesday night to find out.

While the market keeps rising in the meantime, of course.

On the Other Side of the Planet

This morning in Asia, people are interpreting the red-carpet smiles from London and looking “fairly confident.” Asian markets are mostly up, led by China, following the announcement of a preliminary agreement with the States — we’ve heard this tune before. No details yet, but the mood seems positive, judging by the three major indices. China is up 0.44%, Hong Kong climbs 0.76%, and Japan mirrors China’s performance. The Japanese, for their part, still don’t have a deal with Donald.

It’s worth noting, though, that S&P 500 futures are down this morning because an appeals court upheld Trump’s tariffs pending further review. Yes, in case you forgot — with all that’s happened in the last two weeks — American judges had previously ruled the tariffs illegal. Well, they’re legal again… for now. Unless, of course, judges start turning up “suicided” with 12 bullets in their back and their feet encased in concrete blocks…

The big takeaway is that China is banking heavily on this deal to revive the semiconductor sector.

Speaking of which, TSMC (Taiwan Semiconductors) posted record sales for May, hitting $10.7 billion — up nearly 40% year-over-year. In just two months, the company has already achieved 75% of its second-quarter sales targets. TSM confirms the strong demand driven by AI (what a surprise), particularly for data center chips, and there’s also growing demand for silicon. Overall, this is an encouraging sign for the semiconductor sector and especially AI (yes, again).

Elsewhere, gold stands at $3,362, oil is pulling back after a “negative” U.S. report forecasting lower oil consumption in 2026. Right, we can’t even predict next week’s inflation figures, but we’re making calls for the next 24 months? Credibility rating: somewhere just below French PM François B’s popularity — so probably close to absolute zero. WTI is at $64.93, Bitcoin is just under $110,000, and the 10-year yield is at 4.468%. So far, so good…

Fresh News

Outside of geopolitics and macro, we’re seeing a flood of very cautious articles about the future of the stock market. For instance, massive bond manager PIMCO says equity markets haven’t looked this expensive compared to bonds in 25 years — a warning signal. Others argue we’ve risen a lot and it might be hard to find new catalysts to climb higher. Especially if inflation picks up again and the Fed is forced to raise rates.

Basically, after a spectacular rebound, caution is setting in. We’ve also seen strong selling volumes from retail investors — many are locking in profits. Honestly, if this pessimism keeps building, I’m going to start feeling ultra-bullish and get myself tattooed with bulls all over. Oh wait, I already did. Oops.

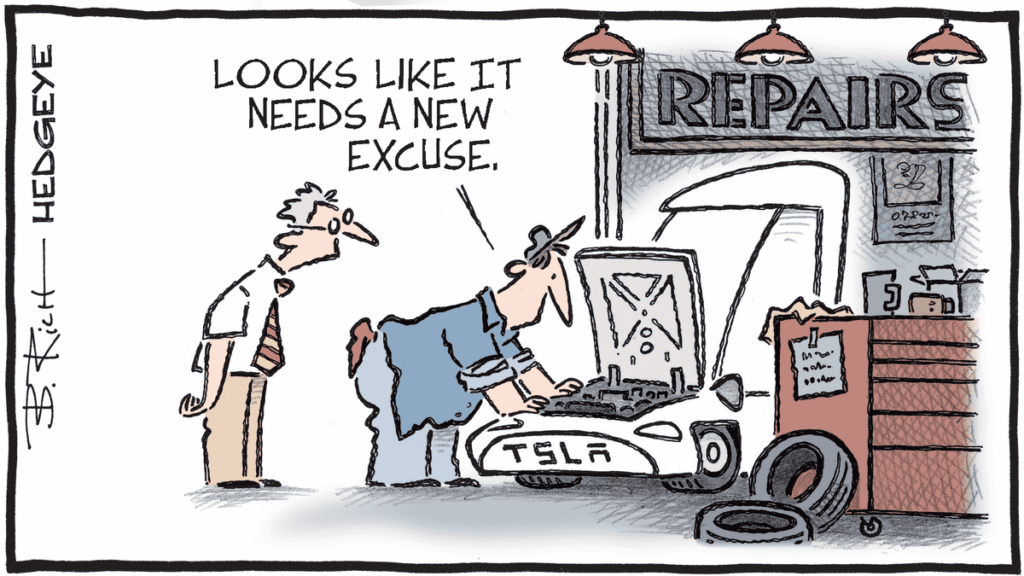

On another note, Tesla is back in the headlines. The stock jumped another 5.7% yesterday despite a rough start — thanks to Trump. Yes, despite their recent public spat, Donald suddenly changed his tone, saying he wishes Musk the best. Not enough? He also said he wouldn’t sell his red Tesla bought in March.

The cherry on top: Trump praised Starlink — SpaceX’s satellite internet service — and confirmed the White House plans to keep using it. Add to that the sighting of two Robo-taxis cruising around Austin, Texas, and you’ve got another explosive day for Tesla. Just 12% more and everything will be forgiven.

And finally, the World Bank just did its own version of the “ice bucket challenge,” dumping cold water on markets. It sharply revised its global growth forecast for 2025 down to just 2.3%, from 2.7% previously. According to the visionary wizards behind this report, this year should see the slowest global growth since 2008 (excluding full-blown recessions). U.S. growth expectations fall from 2.3% to 1.4%, the Eurozone drops to 0.7% from 1%.

The culprit? Tariffs, of course. The Bank’s chief economist claims that halving tariffs could “boost” growth by 0.2%. Don’t get too excited now! Just remember, World Bank or not, these forecasts are about as reliable as any economist’s: roughly a 50% success rate. Heads it goes up, tails it goes down.

Today’s Numbers

As for today’s data, forget everything. Forget what you know about financial markets, because after today’s CPI numbers, NOTHING WILL EVER BE THE SAME. Or not. Maybe we’ll just wait for the Fed. Or maybe there’ll be a leak from the China-U.S. negotiations. Basically, there’s a 50% chance something happens. Heads it goes up, tails it goes down.

In Conclusion

The trade agreement framework announced after talks in London seems positive, especially in view of potentially easing China’s rare earth export restrictions. But the lack of concrete details tempers market enthusiasm. CPI will act as judge and jury at 2:30 pm — unless Trump loses it on X before then…

Have a great day — and a quick note to apologize for yesterday’s technical hiccup that crashed the site. Yesterday’s column wasn’t visible for long, so I’m reposting it this morning, because honestly, it wasn’t half bad. I could’ve just changed the date and recycled it today — but ChatGPT was down. Just like Investir.ch — hmm… coincidence? I don’t think so!!!

Have a great day and see you tomorrow!