My name is Bond, Market Bond

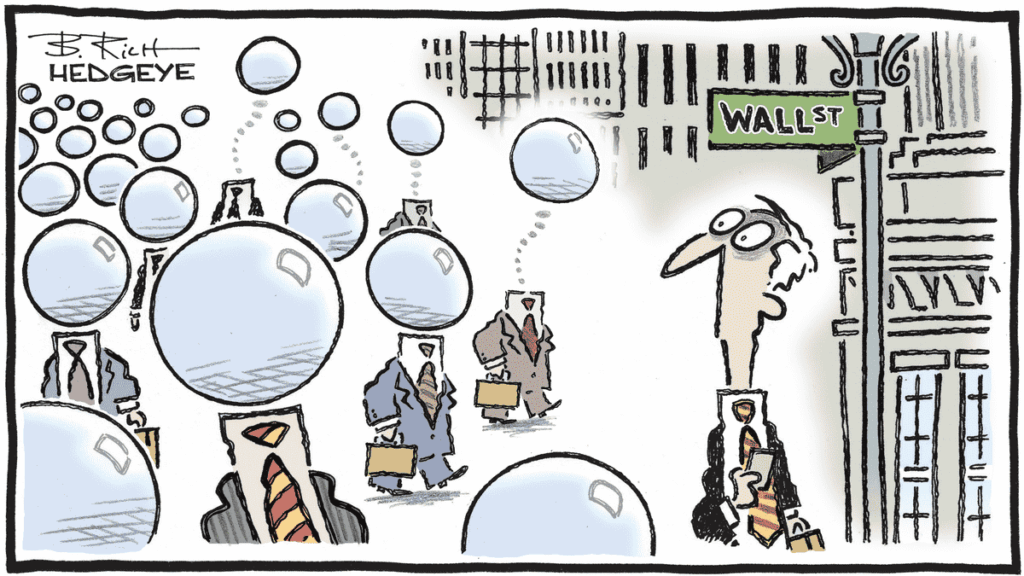

Have you noticed? No, I mean: “Have you noticed that for a week now no one’s talking about CUSTOMS DUTIES anymore (or almost)?” That for a week, we’ve all become bond market experts and that it’s becoming a full-blown obsession? Have you noticed how, every time yields rise a bit too much, everyone starts clutching their cheeks and screaming: “Oh my God, oh my God,” just because we suddenly realized that U.S. debt – well, it just keeps rising… and now we’re shocked that governments show no intention of paying it back. How could they do this to us?

I admit I’m fascinated by how we went from trade wars to debt explosion in less time than it takes to say “DEFAULT.” Well, when I say “fascinated,” it’s mostly to sound sophisticated and pretend I’m shocked. But what’s really worth noting is that ever since no one wanted to lend to the Japanese earlier this week – and then again with the U.S. 20-year two days ago – we’ve seen a kind of rare awakening in the magical world of global economics. A sudden realization making us ask how the hell we got here and how we managed to see NOTHING COMING!

So let me put the Treasury auction right back in the center of the village: countries’ debts have been blowing up for a long time – okay, not here in Switzerland, because we don’t want to make a fuss and we’re terrified of not being able to repay – but for the rest of the world, it’s a madhouse. And in this madhouse, you’ve got Japan and the U.S. Sure, we know Bruno Le Maire wrecked things with France’s debt and now gives lessons on how to crush the Russian economy – but with a debt-to-GDP ratio over 113%, France is still a lightweight compared to the U.S. or Japan – the all-time world champ.

Then suddenly, while we were busy calculating the impact of tariffs on inflation and how that could influence Jerome Powell’s key rates – all while updating the countdown on the 90-day moratorium of the “rest of the world” and realizing that July 9 is almost tomorrow – everyone suddenly focused on THE DEBT, the AUCTIONS, and the fact that nobody wants to lend to anyone anymore.

And then, one burning question BRUTALLY took center stage: HOW DID POLITICIANS let the debt get this high and – bonus question – WHY aren’t they doing anything to reduce it???

Because, quite frankly, they don’t care!

The answer is incredibly simple and supremely logical: “THEY JUST DON’T GIVE A DAMN!!!” They care as much as they do about their first bribe, and it hasn’t kept them up at night for ages. I mean, come on – take Trump. When he came into office, U.S. debt was around $19 trillion. By the time he left – or was kicked out (according to him) – it was at $22 trillion. Today, after four years of a senile guy remote-controlled by the White House staff, we’re now at $36.883 trillion. And at the speed the US DEBT CLOCK is spinning, we’ll hit $37 trillion any second now.

Bottom line: in under 4 years, Trump will be gone and it won’t be his problem anymore. And that’s how it is for all politicians: they want power and want the public to think they’re brilliant. But no one has ever entered government saying: “Let’s tighten our belts and make budget cuts to save money.” You have to admit it’s way easier when you can just grab the taxpayer’s credit card and buy champagne for all your ministers. So let’s get real and stop acting like shocked virgins: “Politicians around the world couldn’t care less about national debt. They know that in a few months or years, they’ll be out, and chances are – they’ll be cashing in a pension to do nothing for the rest of their lives…”

That’s done

So. That said, we have to admit that SUDDENLY, over the past week, it seems like “The People” who lend money to governments all woke up – not for a Danette – but to voice their anger and say they’re getting tired of throwing cash around and seeing no effort to change. And good for them. But sadly, this won’t change how politicians manage debt. I’ll say it again: “THEY DON’T CARE” – and if you want proof, just look at what happened in the U.S. On Wednesday night, markets got crushed because nobody wanted to lend at 20 years for less than 5% – basically a giant red flag: “Guys, you’re out of control and it’s starting to show.” And then, just 24 hours later – Congress approves a tax cut plan that will cost between $2 and $4 trillion over 10 years – THEY’RE NOT EVEN SURE HOW MUCH IT’LL COST…

So if you still think politicians care about debt after that, you must really believe in these “so-called elites who govern us.” That said, we are definitely reaching a pivot point – a kind of critical zone. The infamous “above 5% on the 20-year” or “above 4.5% on the 10-year.” Basically, the takeaway is that at these yield levels, equities struggle to compete with bonds and it’s harder to push the S&P500 up by 1,000 points a month or the DAX by 5,000… The legitimate fear now is realizing that if yields keep rising BECAUSE NOBODY WANTS TO LEND ANYMORE, it’ll quickly become very difficult for stock markets to perform. That doesn’t mean it’ll be easier doing just bonds – it mostly means that part of the system is seriously malfunctioning. And – if I may reuse the Japanese Prime Minister’s analogy the other day, who said Japan’s situation is worse than Greece’s – I can already tell you that if we get Greek-style swings like in the 2011 debt crisis but with Japan, we better start stockpiling anti-nausea pills…

No panic – just doubt

To sum up, we’re in a pretty complex situation. There’s a trade war that’s FAR FROM OVER – even if authorized circles like to think the Chinese and Americans messaged each other on WhatsApp as a sign of détente – we’ve got an economy that’s not doing great, whether in the U.S. or Europe. Growth is anemic in Europe, the U.S. is at risk of recession, inflation isn’t fully under control if we believe Powell and the tariffs – and now, on top of this four-variable equation, we throw in the issue of bonds and people with money who just don’t want to lend it unless you offer interest rates worthy of a New York back-alley loan shark who’ll break your arm if you miss a payment…

You’ll admit there’s enough here to raise a few eyebrows – if not cause a bit of worry.

The good news in all of this is that markets seem unable to handle more than one issue at a time. For now, we’re focusing on bonds, and since yesterday “things are looking better” as 10-year yields pulled back slightly to 4.533%, and the US 20-year yield stopped climbing. Yes, I know – we’re easily pleased. But given our 12-minute outlook and long-term investment horizon of the next 24 hours, we’ll have to make do.

Yesterday, global stock markets didn’t do much. Especially in the US, where we barely managed to close flat. In Europe, we ended lower because we missed the US correction from the day before and – according to EVERY single article this morning – PARTICIPANTS were worried about US debt levels and deficits that seem out of control. So, as I said at the beginning: for the last 48 hours, we’ve all become bond market specialists, and suddenly inflation, recession, and trade wars are no longer messing with our heads.

In Asia

This morning, Asia woke up smiling – albeit a bit stiffly. Markets bounced back, especially in Japan, despite inflation figures that are starting to look scary – 3.5% versus the expected 3.4%. Still, there was relief, because US Treasury yields finally stopped climbing like steroid-fueled mountaineers – as previously mentioned. I’m telling you, this morning it’s all about bonds.

Wall Street took a breather, but it’s still down for the week – with tax issues and US debt flashing red in the rearview mirror. Japan doesn’t care (for now): the Nikkei is up 0.46%, wages are rising, consumers are spending, and the BoJ might toughen its stance (or not). China’s having a good week, thanks to rumors of easing trade tensions with the US and some support from Beijing. The index is up 0.08%, while Hong Kong is following the same path, climbing 0.57% – even though results from Chinese tech giants aren’t exactly dazzling.

On the oil front, crude prices are skimming along the ground: geopolitical tensions have taken a back seat, and the threat of a new OPEC+ production boost for July is causing concern. According to some analysts, it all depends on Iran talks (which resume this Friday in Rome) and the war in Ukraine: oil could shoot up to $70 or crash into the $50s – very helpful, like a weather forecast that says “it might be sunny, or not, but we can’t rule out rain or even snow.” For now, it’s sliding gently: WTI at $61.20, Brent at $64.44. Gold is at $3,311 and Bitcoin is hovering just above $111,000.

In today’s news

Even though no one cares right now – and even though it was the only thing anyone talked about a month ago – the US Supreme Court ruled on Powell and what Trump can or can’t do to him. The Court reminded everyone that the Fed isn’t just any government agency: it’s a hybrid beast, half-public, half-private – so pretty much untouchable… or almost. Trump’s grumbling, wants Powell gone, but legally, it won’t be easy – and the markets are breathing a little easier. With bipartisan support and Fed officials speaking out, the message is clear: messing with the Fed’s independence is like juggling Molotov cocktails over a powder keg. That said, don’t expect Trump to back off easily, especially since he NEEDS those rates to come down. But for now, round one goes to Powell.

Let’s also note that Snowflake exploded +14% after crossing the mythical $1 billion mark in quarterly revenue, with numbers smashing expectations. Fannie Mae and Freddie Mac soared 47% and 43% after Trump suddenly floated the idea of taking them public again – 16 years after the subprime crisis.

On the flip side, health insurers like Humana and CVS got hammered due to a major regulatory crackdown on Medicare audits. In the solar sector, it’s a total meltdown: Sunrun plunged 37% following news of a faster-than-expected end to tax credits. Nike rebounded by patching things up with Amazon after five years of sulking. Urban Outfitters jumped 23% thanks to strong sales across all its brands, while Analog Devices took a beating despite solid forecasts. And finally, Advance Auto Parts surged +57% after a quarter that wasn’t as bad as feared.

And let’s not forget: Relief Therapeutics received FDA designation for its anti-infectious spray RLF-TD011 as a treatment for a rare pediatric disease, having already been granted orphan drug status. Aimed at patients with epidermolysis bullosa, a super-rare genetic disease causing blisters, the treatment showed a 25% drop in staph bacteria over eight weeks. A significant breakthrough for the Geneva-based biotech, which is gaining ground in the rare disease space. The stock jumped 50% yesterday – yes, even in Switzerland we have stocks that move like quantum computing plays.

Today’s numbers

We wrap up this light economic week with even less than the previous days. We’ll get Germany’s GDP, but no one cares because the new government’s going to spend like there’s no tomorrow anyway. In the US, we’ll see building permits and new home sales.

Also, don’t forget: US markets are closed on Monday for Memorial Day, and everyone there is heading off for the long weekend starting tonight. Monday’s volumes will be terrible, but over here in Europe we’ll pretend we can live without them – even though we all know that’s nonsense…

For now, futures are flat and everyone’s eyes are glued to the 10-, 20-, and 30-year yields – because, yes, we’ve all become bond experts overnight. Even I pretend to care.

Have a great day and see you Monday – enjoy the Geneva Open Wine Cellars weekend!