Yesterday, New York Faced a Truth We’d Been Ignoring

Yesterday, New York came to terms with something that had been visible for a while, but we preferred to ignore it to keep climbing without asking questions. The return to reality was brutal, as the U.S. market took a massive beating — and for once, it wasn’t due to tariffs or an offhand comment from Donald Trump. Yesterday, the U.S. stock market got slammed, hard — the kind of blow you don’t see coming… or maybe you do see it coming but hope it misses you. Except this time, it didn’t miss. And this morning, the 20-year Treasury suddenly became our worst enemy.

Europe and the Time Lag (Again)

Going back briefly to what happened yesterday before the auction of U.S. Treasury bonds, it’s worth noting that Europe didn’t do much in an otherwise cautious week that’s short on economic data. Germany still managed to notch a third consecutive all-time high at the close, showing its uncanny ability to focus only on the good news. Since the rebound in April, the DAX has been wearing blinders and sees only the glass half full with every piece of news. We ignore what’s not going well under the assumption that things will improve someday, especially with the new government printing money in the Bundesrat’s basement. On the other hand, anything that even remotely resembles good news gets amplified and flaunted to encourage investors.

This morning’s open might be less cheerful, but yesterday, when the Americans started to catch wind of the 20-year Treasury issue, the Europeans had already packed up and gone home, proud of a job well done.

France closed down 0.4%, the DAX managed to gain 0.36%, and Switzerland slipped 0.22%, dragged down by Julius Baer, who once again blew up the bank — with 130 million francs in net losses due to toxic loans and a moldy mortgage portfolio. No link this time to their ex-BFF René Benko from Austria, but the stock still dropped nearly 5%. And because bad news never comes alone, the bank is now describing this as a “transition year” — translation: it’s going to be long, painful, and probably not very profitable.

Meanwhile, in Ukraine, with no peace deal in sight and everyone dragging their feet, European military budgets are soaring like it’s the Cold War all over again. With Macron playing a hybrid of Napoleon and General de Gaulle, French defense stocks are enjoying the ride: Thales, Dassault Aviation, and Dassault Systèmes are all climbing steadily.

But the ECB is starting to cough. Yesterday, Lagarde’s team warned that we should probably be careful not to spend recklessly. Because spending like crazy without economic growth is the perfect recipe for a debt spiral. And when it comes to debt in Europe, a few countries are already hanging by a thread. We’ll talk more about that — maybe not today, but it’s not going away. For now, it’s time to focus on the new star of the day: the 20-year U.S. Treasury.

The Forgotten One

Usually, nobody talks about it. The 20-year Treasury is the ugly duckling of the magical world of bonds. Not as popular as the 10-year, not as majestic as the 30-year. It hangs out in the playground corner with its hands in its pockets, hoping to be invited to play with the big kids.

But yesterday, it decided to play. And since it wasn’t used to it, not only did it not ask for permission, but it also broke everyone’s toys.

Indeed, while Wall Street was cruising not far from all-time highs, daydreaming about a time when China and the U.S. might go on vacation together, the U.S. government chose the spring vibe to try and sell $16 billion worth of these famous 20-year bonds.

And then… SUDDENLY… nobody wanted them. Or rather, to get buyers, they had to promise a 5.047% yield — breaking through the psychologically critical 5% barrier. That’s when everything went off the rails.

Quick Lesson on Rates for Dummies (But Not Too Much)

Before diving back into the current market narrative, let’s take a quick educational detour — “finance for those who want to understand” style. Even for me, a refresher won’t hurt.

SO: the yield on a Treasury bond is like a promo offer to lure in buyers. The higher the yield, the more interest you’ll get. But if the government has to offer a higher rate than usual, it means one very simple thing: investors aren’t interested. And to get them moving and finally buying, you have to pay them more. In the wonderful world of finance, when yields go up, bond prices go down. It’s a love story gone wrong: yields and prices just can’t rise together. It’s a dysfunctional couple. So yesterday, when the 20-year yield shot past 5%, the entire bond market panicked. And when the bond market panics, equities usually don’t hold up for long.

Domino Effect, Tsunami, and a Chill Down the Spine

As soon as the auction ended, the reaction was immediate. The 10-year yield jumped to 4.595%, and the 30-year surged to 5.089% — its highest level since last October. Imagine the poor guy who bought bonds last week at 4.5% — must feel like paying full price for an iPhone the day before the new model comes out, and this one even makes coffee. But this isn’t just technical stuff. A 5% yield on a 20- or 30-year bond sends a message — almost a distress signal. It means investors now demand a “risk premium” to lend long-term to the U.S. government. And why, you ask? Because, let’s be honest, America lives on credit. More than ever.

Between Congress planning to pile on another $3.3 trillion in debt with tax cuts and a budget that includes no real spending cuts, markets are starting to wonder: who’s going to pay the bill? It’s not a new question, but yesterday’s signal was loud and clear — investors want more to lend to a borrower who lives beyond its means and refuses to tighten its belt.

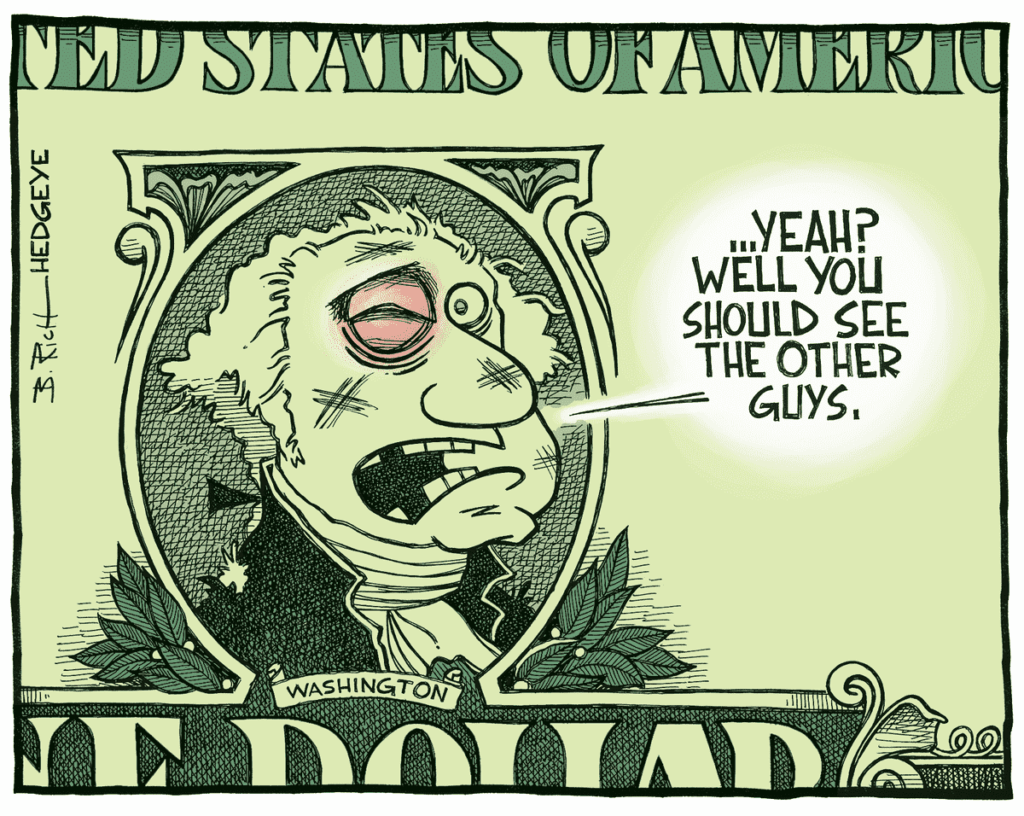

And that’s not all. Remember last Friday, Moody’s downgraded U.S. debt. Even if no one was surprised, it’s yet another sign that the blind trust investors have had in the U.S. for decades is starting to crack. This wasn’t unexpected — we’ve seen a few warning signs already — but the 20-year breaking above 5% was one more nail in the coffin. It’s a wake-up call that will force us to pay closer attention to interest rates. And don’t forget, two people are apparently glued to those rates: Trump and Bessent. The former President can’t afford to see yields rise like this while he’s on a crusade to bring them down. Expect retaliation.

And What About Wall Street?

Well, Wall Street doesn’t like surprises. Or 5% yields. When bond yields rise, equity returns need to be more competitive. And since companies aren’t about to double their profits out of the blue, the only way to realign the stars is for stock prices to fall. So, people sell. They sell stocks, they sell old bonds (which now pay less), and everyone watches rates like a pressure cooker about to blow. The 10-year, the 20-year, the 30-year — it’s Game of Thrones in the bond world. And the Iron Throne is that 5% line.

A 20-year bond above 5% isn’t just a minor market event. It’s a sign that investors no longer blindly trust. It also suggests that despite all the talk about resilience, full employment, and the post-Covid party, the economy is starting to make people nervous. Add tariff tensions, a ballooning budget deficit, and unclear fiscal policies, and you’ve got a pot ready to boil over. What we saw yesterday wasn’t just “a bad day” on Wall Street. It was a warning shot. A reminder: the era of free money is over. U.S. debt is no longer sacred. And when long-term yields rise above 5%, it’s not just a number — it’s the market screaming in our faces.

What’s Next?

That will depend on upcoming bond issuances, budget policy decisions, and above all: will investors keep giving Uncle Sam the cold shoulder? Or will they come back — but with mobster-like demands? Time will tell. But for now, one thing’s clear: the market got slapped hard yesterday, and we’re left wondering if it was just a bump in the road… or something more worrying — and more lasting. Even if yesterday’s drop is just a “routine correction in a bull market,” the pressure from the bond market should give us pause.

What’s Next?

So, what about the rest? Well, this Thursday morning, Asian markets turned red in Wall Street’s wake, weighed down by fears of a faltering U.S. economy and ballooning public debt. Tech stocks took the biggest hit, especially with rising bond yields and ongoing semiconductor tensions between Beijing and Washington. In Japan, the economy is clearly struggling, dragged down by U.S. tariffs. The only exception in the gloom: China, which slipped a bit less on hopes that Beijing might step in with fresh stimulus. One can always dream. The Nikkei fell 0.89%, the Hang Seng dropped 0.84%, and China limited the damage to a modest 0.3% dip.

As for oil, crude prices declined for the second session in a row: the rumor of an Israeli strike on Iran has fizzled out, and the market is coming back down to Earth. Oil, gasoline, and diesel inventories are rising in the U.S., while gasoline demand is currently slipping… for now. But with Memorial Day weekend around the corner and 45 million Americans expected to hit the road, that could change quickly. For now, WTI is at $61.65 and gold is trading at $3,336. Meanwhile, Bitcoin is hitting an all-time high — in almost total silence. The crypto superstar is sitting at $111,400 as we speak…

Today’s Headlines

As for the top news of the day — beyond the 20-year yield trust issues — we note that Wolfspeed has completely collapsed, heading straight for the abyss, down 60% to $1.28 after rumors of an imminent bankruptcy filing. The Wall Street Journal reports a Chapter 11 may already be in the works, with support from a majority of creditors — the Christmas tree’s already ordered.

Target plunged 5.2% after posting quarterly results that missed expectations: adjusted earnings were weak and revenue dropped 2.8% year over year. The company now expects sales to decline for the year — a sharp U-turn from the modest growth it was still promising not long ago. Like every other retailer these days: ZERO VISIBILITY.

After its rebound the day before, UnitedHealth nosedived 5.7% — downgraded across the board, with price targets slashed in every direction. It’s giving major hangover-after-party vibes. The CEO quit last week, the company suspended its 2025 guidance, and to top it off, it’s now under DOJ investigation for possible Medicare fraud. Yes — all that in one week. Oh, and allegedly, UNH paid nursing homes to avoid sending patients to the hospital too quickly, just to save costs. Classy move — sounds as charming as our health insurers here in Switzerland.

Alphabet Rallies, Retailers Struggle, and Jamie Dimon Sounds the Alarm

Alphabet jumped nearly 3% following its developer conference, where Google unveiled a barrage of announcements centered around AI. The highlight of the event: “AI Mode,” which, according to Sundar Pichai, is set to completely reinvent online search. Lots of promises for now — but we’ll have to wait a few months to see it all in action.

In retail, Lowe’s dipped 1.7% despite posting better-than-expected results. The company reaffirmed its annual guidance, but the CEO pointed to headwinds in the housing market. Translation: they’re moving forward — but with a limp.

At VF Corp, the parent company of Timberland and The North Face, it was a bloodbath: down 16% after reporting falling revenue, a disappointing quarter, and guidance revised down by 3 to 5%. Winter is looking harsh.

Palo Alto Networks reported solid earnings and even raised its full-year guidance — but the market didn’t like the tepid forecast for the next quarter. The result? A 6.8% drop. Proof that in cybersecurity, even a slightly dull crystal ball can disappoint investors.

Meanwhile, Jamie Dimon just won’t stop talking. According to the JPMorgan CEO, stagflation is not off the table in the U.S. With mounting geopolitical tensions, runaway deficits, and sticky inflation, he sees more of a minefield than a “sweet spot.” Still, he supports the Fed’s strategy: observe, stay calm, and above all… don’t panic. Not exactly the kind of message Uncle Donald wants to hear.

PMI Day

As for today’s data — things are a bit busier, with PMI figures coming in from across the globe, along with the ECB’s latest meeting minutes. For now, futures are holding steady, but Europe is expected to open lower. All eyes remain on the bond market — and on Donald Trump — over the coming days to figure out if we’re facing a full-blown tornado or just a summer storm.

Have a great day — and see you right back here, same time, same place, tomorrow!