Trump didn’t post anything on “X” or Truth Social calling Powell an idiot. The Fed officials who spoke yesterday DID NOT say it would be easy to cut rates this year. They didn’t say it would be easy to raise them either. No number came out showing inflation is plummeting or that employment is in bad shape. Tesla didn’t unveil a gas-powered car to revolutionize the sector, and Apple is still selling the iPhone 16 as if it’s a revolution. And Israel might be preparing to bomb Iran — but no one seems to care. Yesterday was boring.

Nothing

I must confess that in my job as a “stock market columnist and financial explainer” — yes, yes, it’s a real job apparently — some days are easier than others. I have to admit that when Trump appears on TV to call Powell an idiot and says he’ll replace him with one of his buddies who worked in finance back in the day, or when the same TRUMP posts on social media that he’s going to hike tariffs on China by 885%, it’s much easier to write a column explaining what’s going on. On the other hand, on days like yesterday, when the only thing we can say is that “we’re experiencing a CONSOLIDATION phase because markets have rallied quite a bit over the past two weeks,” I’ll admit, the first thing that comes to mind is crawling back into bed and waiting for Trump to lose it over someone, something, or preferably a whole country — like China — just so something happens. Something spectacular. So that volatility shoots back over 30% and we get some action.

Because yesterday, except for the fact that the Germans ONCE AGAIN managed to hit record highs and EVEN closed above 24,000 points for the first time in their history — and justified it because of, and I quote: “hope for a resolution to global trade disputes triggered by Donald Trump, a solid earnings season, and a multi-billion euro stimulus package from the German government, as well as expectations of a rate cut in the eurozone” — not much happened. And honestly, regarding Germany, those ETF-buying excuses are a bit stale, if not outright reheated. And it’s not just in Germany that markets went up for those same reasons that are well past their expiration date. This narrative of “taking everything that’s not terrible and could maybe get better in six months, and buying based on that” also helped France flirt with 8,000 — but not break through — and pushed Switzerland above 12,400.

But not in the US

In the US, it was a different story. All indices ended in the red without any real reason to sell everything. Trump didn’t really go off on anyone; he’s just doing standard American politics, trying to push Congress to cut taxes to make life a little easier for some families. But he didn’t give any update on China, nor on his plans for the war in Ukraine or that giant parking lot he’s planning to build in Gaza. I think yesterday was an “off day” for Donald Trump, and since we’re not used to that, nothing “sexy” happened in global markets.

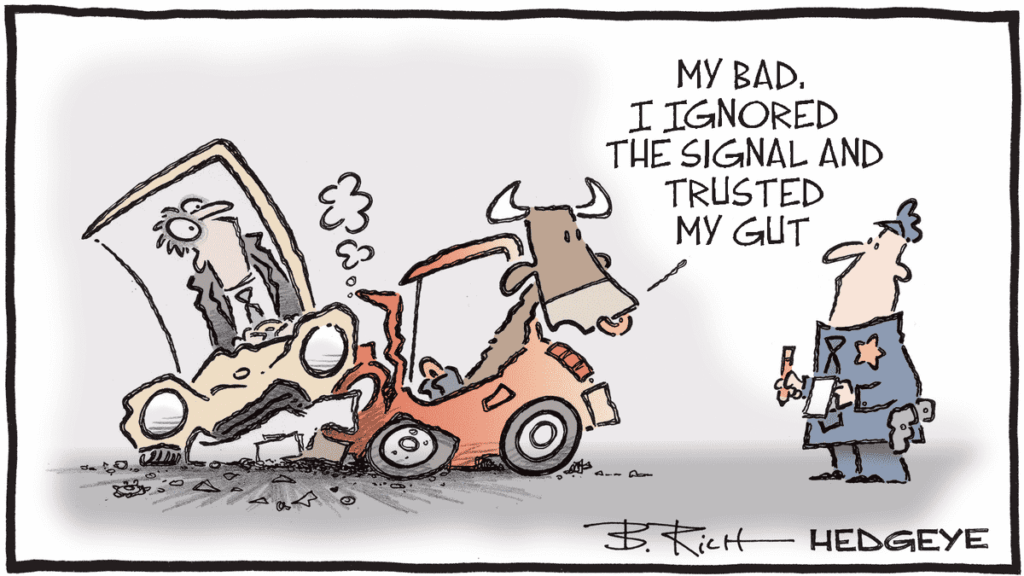

Yes, because — as you’ve probably realized — since late January, financial markets have stopped functioning based on the usual three pillars: macroeconomics, corporate earnings, and geopolitics. NO. Since the end of January — maybe even a bit earlier — we’ve been operating almost exclusively on GEOPOLITICS, and sometimes — dare I say it — solely on Donald Trump’s statements. And then, when there’s really nothing to say on the geopolitical front, we shift back to macro. And when there’s nothing to say on the macro side, we shift to quarterly earnings. And when we’re in a week where macro news boils down to nothing — like the German PPI coming in at -0.6% vs. -0.3% expected — I won’t lie, NOBODY GIVES A DAMN, and it’s certainly not the reason you’re going to break your kid’s piggy bank to buy Rheinmetall stock. Long story short: yesterday was boring on a world-class level, and when boredom hits that hard, it’s even harder the next day for guys like me who are supposed to tell you something that might, just might, make your morning more interesting — especially when there’s absolutely nothing to say except that global indices moved up in Europe for reasons we already know and that US indices dipped for the first time in six sessions, for reasons we’ve already heard for three weeks straight.

MEH!

In conclusion, yesterday the global markets in the wonderful world of finance ended mixed and were in CONSOLIDATION mode. Now let me tell you: “consolidation” is an absolutely fabulous term. It means the market has gone up a lot — sometimes for questionable fundamental reasons — and now we’re struggling to find motivation to keep buying. Because saying for 8 sessions in a row that we should buy because things might go well with China is starting to sound like reheated pasta leftovers from Sunday night — just because we don’t know what else to cook. And it’s exactly at that very moment that someone trots out the term “consolidation.”

And this term works for pretty much anything in financial markets. Well, it works for everything when we don’t know what to say anymore and struggle to justify why the S&P lost 0.38% yesterday, even though absolutely nothing changed in the macroeconomic-geopolitical-Trump-financial environment. If you bought the market on Monday because China might work out or because inflation could turn out to be less bad than expected OR simply because you didn’t care about the US debt downgrade, you could’ve easily kept buying yesterday. Or just done nothing. But since US markets slipped a bit, we needed a justification. And that’s why, after nearly two pages of hot air, I’m finally giving you THE REASON for a slight dip in US markets and a slight rise in European ones:

WE ARE IN A CONSOLIDATION PHASE

And brace yourselves for a bit more boredom, because earnings season is nearly over — we’re just waiting on Nvidia in 7 days — and this week is a totally POINTLESS MACRO WEEK, with no interesting data releases. The 14 Fed members who spoke, are speaking, or will speak this week are only dishing out bland statements like: “We’ll wait and see before we decide anything, and in the meantime, we’re not touching rates.”

In conclusion: Only Trump can make the rest of this week interesting. And if he does nothing, I’ll be forced to talk about cooking or macramé tomorrow, because there will be absolutely nothing to say about the wonderful world of finance.

As for the rest

Asia refused to ride the rollercoaster this morning—probably for consolidation reasons. It barely moved, except in Japan where exports are sulking due to tariffs. Australia, on the other hand, is soaring because the Central Bank cut rates—but honestly, who’s really invested in Australia? On Wall Street, futures are down 0.2%, giving off a “coffee break” vibe. As for China, they cut rates too, but it hasn’t yet sparked the tsunami the Communist Party was hoping for. Meanwhile, Korea is up 1%, Singapore is down, and India is still wondering whether it should get off the couch. In short: IT’S BORING.

Luckily, something’s happening with oil.

Well, I say “luckily” loosely, because if WTI is flirting with $63 this morning, it’s not because “the economy is picking up and people will consume more SO the barrel price MUST go up.” No, it’s because U.S. intelligence services told the press that, according to their sources, the Israelis are on the verge of bombing Iran. Now, two things come to mind:

– First of all, I thought Israel was busy in Gaza, and it seemed a bit complicated to go build another parking lot in Tehran at the same time.

– And secondly, I thought the term “SECRET SERVICES” was based on the idea that they didn’t tell everyone who they were, what they were doing, and where. I was also CONVINCED that the first thing you learned in spy school was more about “how to make a terrorist talk” than “how to write a good press release to drop our TOP SECRET info in CNN’s prime time slot…”

Turns out I was wrong, and James Bond must be rolling over in his grave seeing his successors have become TikTok and X influencers… Anyway, if the CIA’s official sources are accurate, Israel is about to bomb Iran. And so oil prices go up. A bit. Gold is at $3,315, and Bitcoin is at $107,400—flirting with its all-time high.

In today’s news

In today’s highlights, we’ll note that Home Depot missed expectations, has no forward guidance, but has decided to absorb tariff costs themselves—because if they pass them on to customers, Trump will throw a fit. Meanwhile, Tesla was up because Musk gave an interview in Qatar saying he’ll still be Tesla’s CEO in five years and that the first Robotaxis will launch in Austin, Texas by June. And, get this, these Robotaxis will initially be driven by humans. So basically, we’ve had five years of hype about Robotaxis, but when they finally arrive—they’re just regular taxis. Still, the stock went up. No one holds grudges apparently.

Also, D-Wave Quantum jumped 26% after launching its sixth-generation quantum computer in the cloud. The tech promises insane performance on complex problems like logistics and resource allocation. In short: stuff that’s too hard for traditional machines. The company’s pitching it as a game-changer for industry, and investors are buying in… for now. Personally, when I read what Quantum Computing is supposed to do—and if you combine that with ChatGPT—we’re basically heading straight into the final chapter of Terminator, and there won’t be a sequel this time.

Let’s also note that inflation just came out in the UK, and it’s way hotter than expected. Forecast was 3.3%, but it came in at 3.5%.

Numbers

As for today’s numbers: there will be NONE! Much like this chronicle, whose whole point was to talk about maximum boredom and a galactic void. Okay, fine—there is the “Non-monetary policy meeting of the European Central Bank.”

That’s a meeting where they don’t talk about interest rates, but rather about things like regulation, banking supervision, or the technical ins and outs of how the institution works. In short, another snoozefest.

So with that, I’m heading back to bed. I wish you a wonderful day, and I’ll see you tomorrow to talk about nothing again—unless something actually happens. Unless Trump gets back his login credentials for X and Truth Social, or eats an Imperial Chicken from the Red Dragon Palace and has some digestion issues…

Oh, and sorry for the late edition—my alarm broke during the night…

See you tomorrow.