The IMF and World Bank: Structure, Role, and Official Functions

Background and Creation

The International Monetary Fund (IMF) and the World Bank were both established in July 1944 during the Bretton Woods Conference in New Hampshire, USA. Their creation was led by 44 Allied nations aiming to rebuild the international economic system after World War II and to prevent future global financial collapses. The IMF officially began operations in 1945, with 29 member countries.

The World Bank, initially called the International Bank for Reconstruction and Development (IBRD), started in 1946.

Today, both institutions are headquartered in Washington, D.C., and operate under the umbrella of the United Nations system, although they are governed and funded by their member countries.

IMF (International Monetary Fund)

Official Purpose

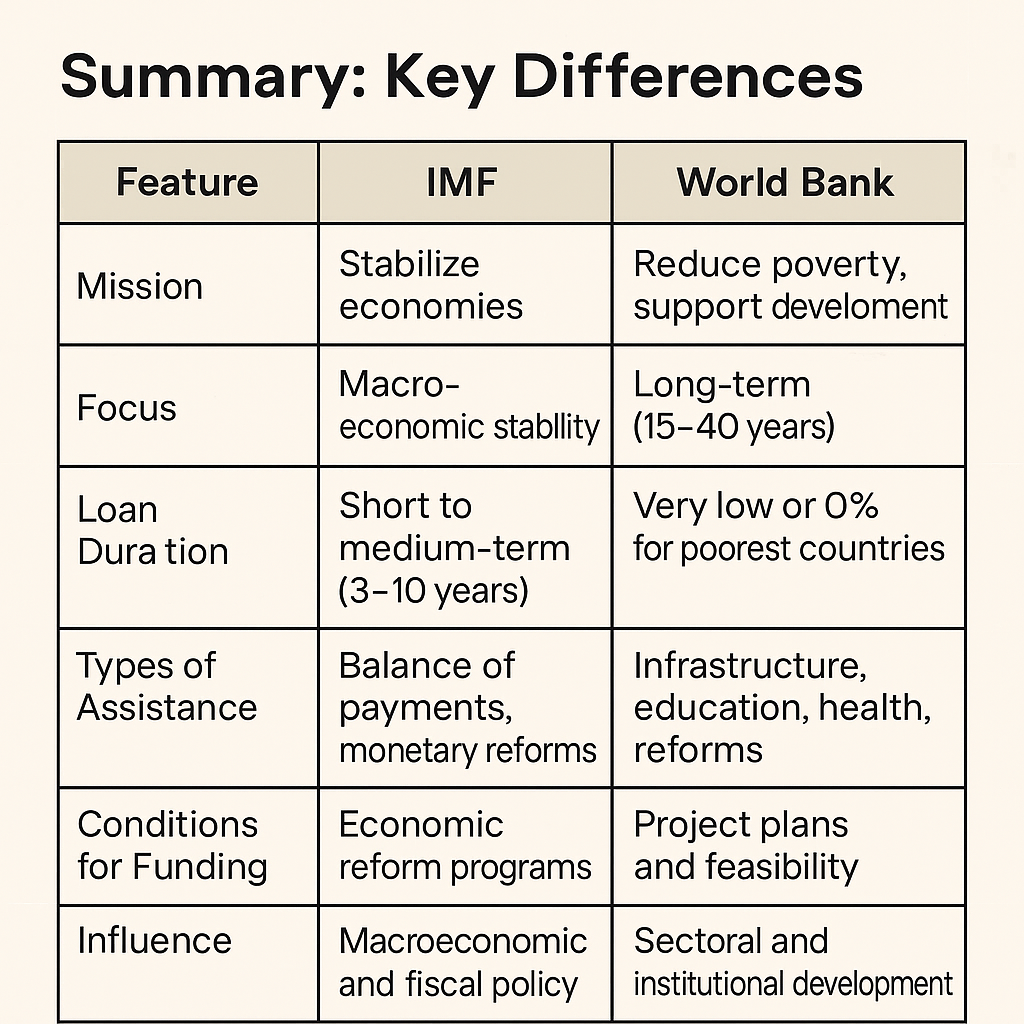

The IMF’s mission is to ensure global monetary cooperation, stabilize exchange rates, facilitate balanced growth, and provide resources to countries in financial trouble.

Structure

189 member countries, each with voting power linked to their financial contributions (quotas). Governed by the Board of Governors, Executive Board, and Managing Director. The IMF’s capital is provided by its members through financial quotas, revised periodically.

How It Helps Countries?

Lending

IMF provides short- to medium-term loans to countries facing balance of payments problems, currency instability, or economic crises. These loans are tied to specific economic reforms agreed with the IMF. Main lending tools include: Stand-By Arrangements (SBA) for temporary balance of payments needs. Extended Fund Facility (EFF) for longer-term structural challenges. Rapid Financing Instrument (RFI) for urgent needs (e.g., disasters, pandemics).

Poverty Reduction and Growth Trust (PRGT) concessional loans for low-income countries.

Surveillance

The IMF monitors the global economy and national policies, providing policy advice and risk analysis through tools like the World Economic Outlook (WEO) and Article IV consultations.

Capacity Development

Helps countries build financial institutions, tax systems, budgeting frameworks, and central banking expertise through training and technical assistance.

How Countries Borrow

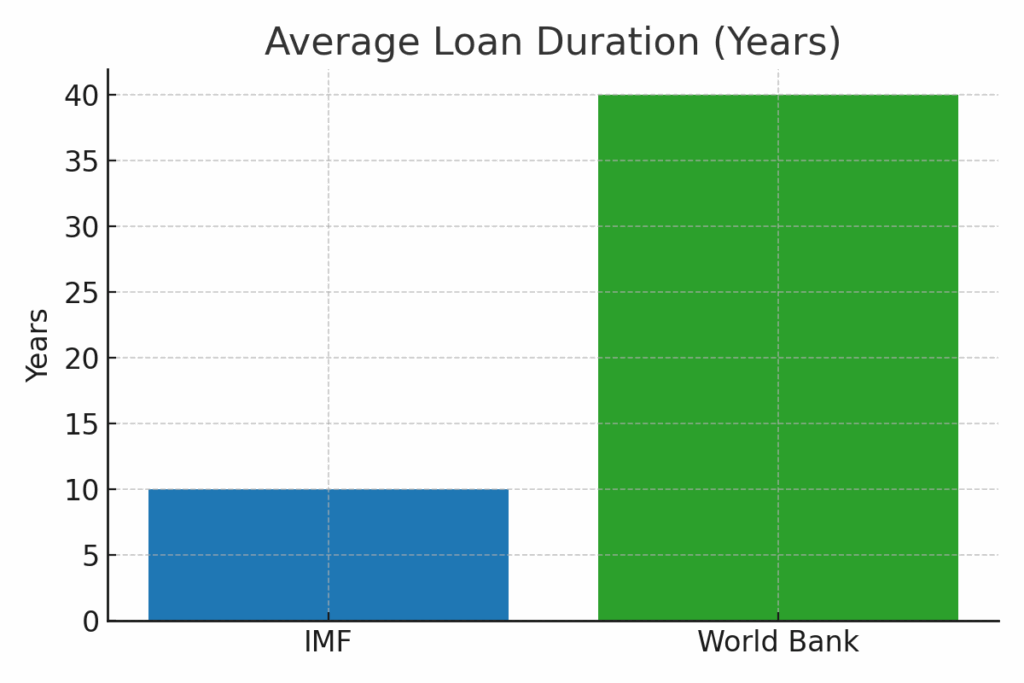

A country submits a request for assistance. The IMF reviews the country’s economic program. If approved, funds are disbursed in tranches, tied to performance targets and reforms. Repayment typically begins after 3–5 years, with full repayment within 10 years.

Loans are denominated in SDRs (Special Drawing Rights), and interest rates vary based on SDR interest rates and surcharges.

Influence

IMF involvement often reshapes national economic policy, as countries must adopt fiscal reforms, budget cuts, or monetary controls. The IMF can influence taxation, spending, interest rates, and even public sector wages in borrowing nations.

The World Bank

Official Purpose

The World Bank’s mission is to reduce global poverty and support long-term economic development through project financing and technical support.

Structure

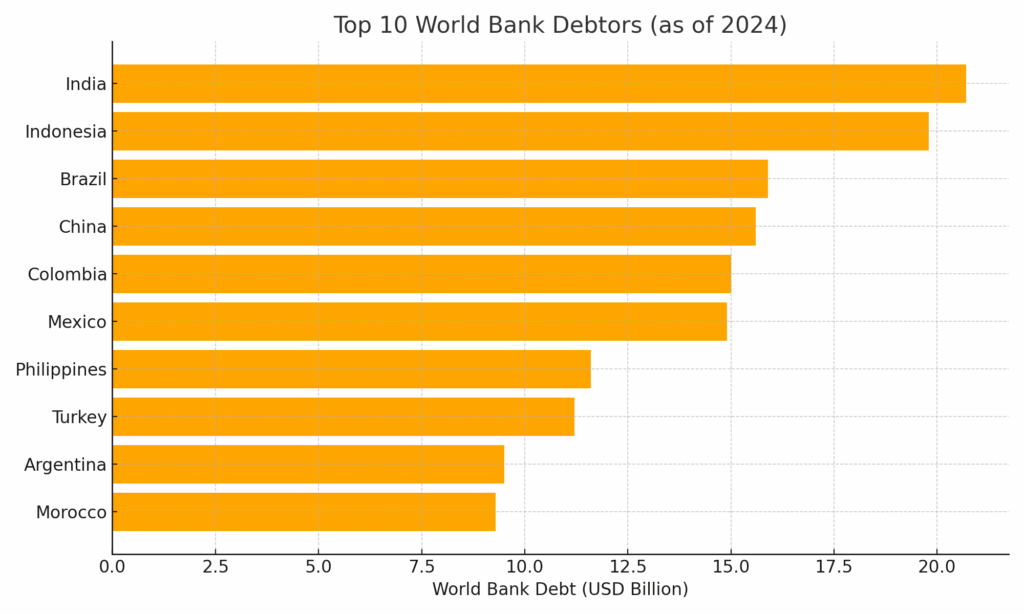

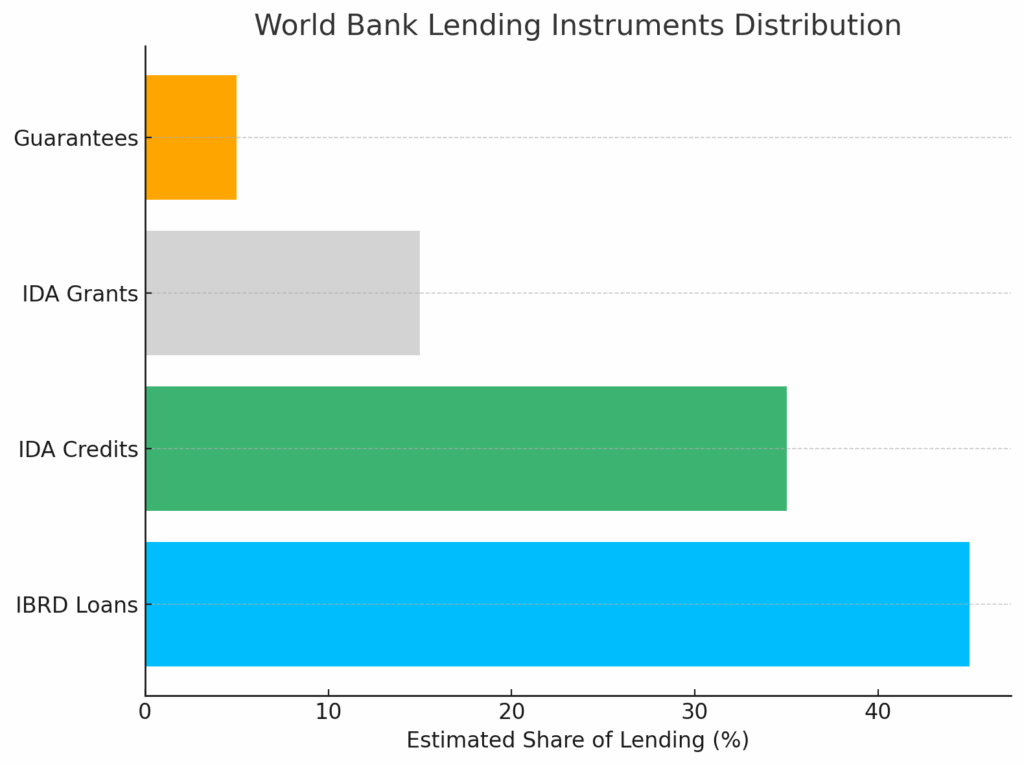

The World Bank Group is made up of five institutions, with the most prominent being: IBRD – lends to middle-income and creditworthy low-income countries. IDA – provides interest-free loans and grants to the poorest countries. Each country’s voting power is based on shareholding, which reflects financial contributions.

Development Loans

Funds large-scale infrastructure and development projects in: Transportation (roads, ports).Health (hospitals, vaccines).Education (schools, teacher training). Energy (power grids, solar farms). Governance and digital infrastructure.

Grants

Provides non-repayable financing to the world’s poorest countries, particularly through IDA.

Technical Assistance & Research

Delivers expert guidance, policy frameworks, and global development reports to improve governance and policy implementation.

How Countries Borrow?

Countries submit a proposal for a specific development project. The Bank evaluates feasibility, environmental impact, and socio-economic returns. If approved, funds are disbursed gradually, often with long grace periods (5–10 years) and repayment over 15–30 years. IDA loans often have 0% interest, while IBRD loans are at low interest based on market conditions.

Influence

World Bank-backed projects often involve reforms in education, healthcare, environmental policy, and regulatory practices. The Bank may condition funding on improved governance, transparency, or institutional development.

IMF

Funded by quotas from member countries. Quotas are pooled into a general resources account used for lending. Quotas are calculated based on GDP, reserves, trade, and economic stability. The IMF also earns interest on loans, surcharges, and investment income.

World Bank

Raises money by issuing bonds in international capital markets (AAA credit rating). Receives capital contributions from member states. Repayments and interest from past borrowers provide revolving funds. IDA is partly funded by donor countries, through replenishment rounds every 3 years.

Criticism:

How IMF and World Bank Loans Contribute to Economic Struggles

…The flip side of the coin….

While the IMF and World Bank are positioned as global development partners, critics argue their approach to loans can entrench debt cycles and weaken the financial autonomy of borrowing countries. Here’s a deeper dive into the specifics of these criticisms:

Trapped in Debt: The Cycle of Borrowing

Countries often take IMF and World Bank loans to stabilize short-term financial crises or fund long-term projects. However, the costs of these loans—particularly the interest rates and conditions—can lead to unsustainable debt. Instead of a one-time solution, many countries are forced into a cycle of borrowing, as they rely on new loans to pay off previous debts.

Rising Debt: For instance, Zambia’s national debt skyrocketed due to multiple IMF-backed programs. The need for continuous loans to meet previous debt obligations drains national resources, leaving less funding for public services like healthcare, education, and infrastructure.

Debt Dependency: Critics argue that these loans are a temporary fix—they don’t solve structural economic issues, leaving countries perpetually dependent on foreign financial aid.

Austerity: The Hidden Costs of Economic Stabilization

A key condition for receiving loans from the IMF is austerity measures—public spending cuts, tax hikes, and privatization. While these measures are promoted as ways to balance national budgets, their social consequences can be devastating for the poorest populations.

Social Unrest: In Greece and Argentina, these reforms led to increased unemployment, lower wages, and cuts to vital services. The result? Widespread protests, social unrest, and rising inequality.

Long-Term Effects: Countries may achieve short-term fiscal balance, but long-term economic stability is often elusive. With vital sectors like education, healthcare, and social welfare eroded, the poverty gap widens, and social cohesion deteriorates.

Privatization and Sovereignty: Who Benefits?

One of the most controversial aspects of IMF and World Bank-backed loans is the privatization of state-owned assets. In many cases, public resources—such as utilities, transportation, and natural resources—are sold off to foreign multinational corporations.

Foreign Takeover: For example, in Latin America, numerous national assets were privatized, benefiting foreign companies but leaving local populations with higher costs and less control over their own economy. This undermines national sovereignty, as countries lose control over key economic sectors that should support their long-term development.

Economic Model Conflicts: Critics contend that the Western economic model promoted by the IMF and World Bank doesn’t always fit the unique needs of developing countries, leading to policies that serve global capital interests rather than fostering sustainable domestic growth.

Reforms: Empowering Growth or Enforcing Globalism?

IMF and World Bank loans often come with a package of economic reforms, but there’s an important question: Are these reforms designed to promote self-sufficiency in developing countries, or are they simply imposing a globalist agenda that benefits international financial markets at the expense of local economies?

One-Size-Fits-All Model: Economic reforms, like the emphasis on gender equality programs or LGBT rights initiatives, may have benefits in certain regions, but they often clash with local cultural values. While these initiatives may be seen as promoting progress, they sometimes fail to acknowledge the unique challenges faced by individual nations.

Global vs Local: Countries that accept IMF loans may be forced to adopt Western economic and social models that don’t always align with their local realities. For instance, countries with conservative or traditional values may find it difficult to implement reforms that conflict with their cultural norms, despite the promise of financial support.

IMF and World Bank’s Role in the Global Debt Economy: The Debate Over Sustainable Solutions

Despite the criticisms, developing nations continue to turn to the IMF and World Bank, mainly because alternatives are often scarce. These institutions are seen as lenders of last resort, offering critical funding when no one else will. However, this reliance raises further concerns about long-term dependency.

Debt Forgiveness Programs: While debt relief initiatives like the Heavily Indebted Poor Countries (HIPC) Initiative exist, they are not a cure-all. Many countries remain in debt long after their “forgiven” debts are paid off. Greece, after its bailouts, is still struggling with high levels of debt despite receiving debt relief.

Global Power Dynamics: The IMF and World Bank’s position as dominant global lenders gives them considerable political leverage. This has led to accusations that they are imposing a set of policies that do not prioritize sovereign autonomy but instead favor global financial stability—often at the cost of local development priorities.

Delicate Balance

The IMF and World Bank undoubtedly provide necessary financial support to countries facing economic crises. However, the conditions attached to these loans and the long-term consequences of their reforms remain a source of significant debate. While some argue that these reforms are vital for global financial stability, others question whether they truly serve the needs of the most vulnerable populations or contribute to a cycle of dependency.

The question remains: Are the IMF and World Bank truly promoting development, or are they consolidating global financial power at the expense of sovereign autonomy?