The further we move forward, the harder it is for me to remember “what it was like when Trump was President the first time.” It seems we were quite attached to his “tweets,” but we weren’t nearly as dependent as we are today. Observing the markets over the past 24 hours, I can only note the drop in volume and the sudden disappearance of that deep interest we once had in the markets. Either people have stepped to the sidelines, waiting for the next tariff-related story, or last week’s frenzy is over and we’re slipping back into our macro routine until the next crisis comes along.

Lying in Wait

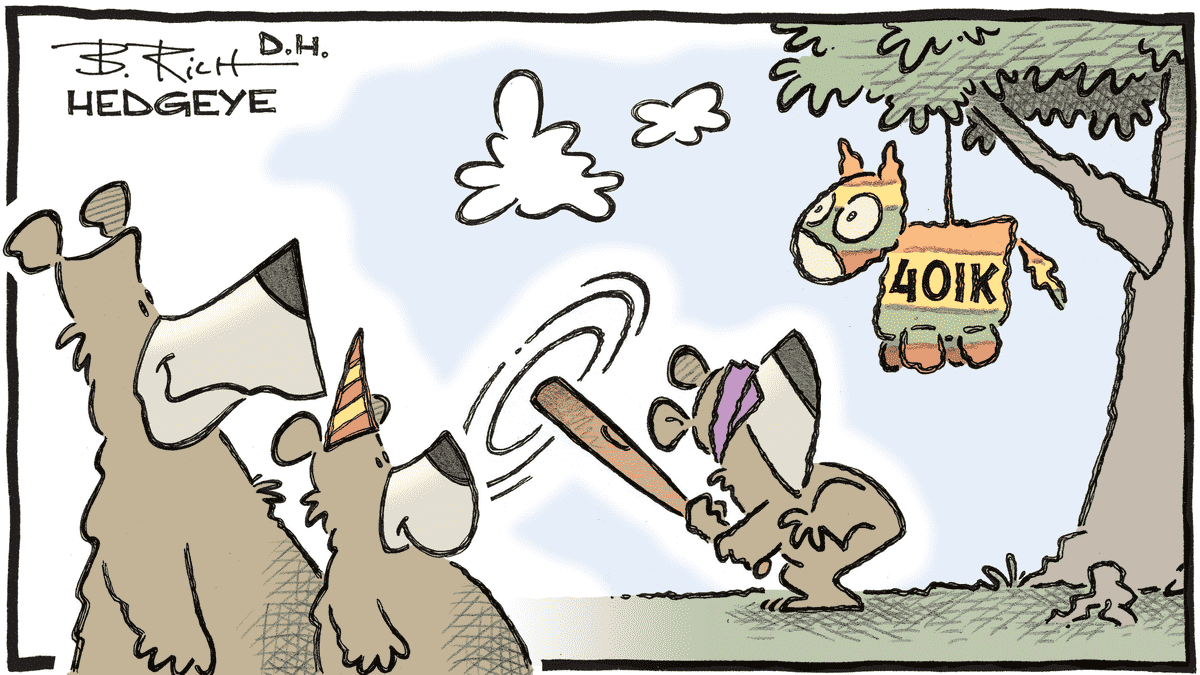

But to be honest, it feels more like we’re lying in wait, ready to either sell and short everything or to buy it all back and make FOMO our motto again. It seems unlikely that Trump will just stop and let time pass — he needs to be in the spotlight, and he desperately needs a concrete result so he can tell the press: “See, I told you so!”

Still, yesterday’s session was sad and dreadfully boring, with volumes so low it felt like the weekend had already begun. Then again, technically, tomorrow is Friday since the week ends early in the U.S.

But just because it was quiet and Trump didn’t say or do anything major doesn’t mean nothing happened. We still had to deal with the car sector, as the President had shown a desire to ease restrictions there. The sector reacted well, especially in Europe, where most automakers gained 2%, although there was still a sense of caution — investors know Trump can change his mind in a heartbeat.

So, the European markets had a fairly positive session, but with pathetic volumes that suggested everyone was on the defensive. In the end, if we remove Trump from the equation, only two topics remained:

LVMH’s disappointment, losing its spot as the largest market cap in France, overtaken by Hermès, which apparently isn’t feeling the same industry stress as its rival. Experts explained yesterday that while LVMH is luxury, Hermès is “more luxury than LVMH.” So since Hermès is more exclusive, people with more money haven’t yet cut back on their lifestyle.

Bottom line: LVMH fell 7%, and to think that just a year ago people would’ve killed to buy it at €880… It’s yet another reminder of how little we actually understand in finance and in valuing a company.The second issue that rattled European investors was the ECB.

To put it simply, while Madame Christine was still considering not cutting rates a few weeks ago — right after the March meeting — yesterday it became clear the ECB will cut rates again this week. The Trump method is weighing too heavily on European growth, which is already teetering on the edge, and the ECB can’t afford not to act — especially since inflationary pressures are no longer a concern. France even reported a CPI drop to 2.2% yesterday.

If even Bayrou — with the blood pressure of a sloth — can bring inflation down, anyone can, and inflation clearly isn’t a problem anymore.

So yes, the ECB will cut rates, but its messaging will remain “less dovish” while still keeping every option on the table — economic visibility in the Trump era is about as clear as a foggy London morning in October.

Trump and the Metals

While Europe mourned Bernard Arnault’s decline, welcomed rate cuts, and wondered if Trump could be trusted on the auto front, the U.S. President had already moved on.

Since yesterday — and into this morning’s open — his main focus has been tariffs on rare earth metals. Trump just launched a new offensive: an investigation into potential tariffs on all critical minerals imports. The goal? Reduce U.S. dependence on China, which remains the dominant force in strategic metals (rare earths, cobalt, nickel, uranium…).

In case you’re wondering: what’s a critical metal? It’s a metal the modern economy can’t live without but that no one really produces domestically.

We need them for smartphones, EVs, fighter jets to defend against Putin, and for charging Teslas… but we usually have to get them from someone else — and often, that someone is China.

A metal is considered “critical” if it meets two conditions:

It’s essential to strategic sectors (defense, energy, electronics, green transition, etc.).

It’s high-risk: either because very little is produced, or supply depends on unstable or uncooperative countries (like Russia or China).

Washington is finally waking up to the fact that its economy runs on materials it doesn’t control. The causes? Massive industrial lag, fragile supply chains, and just one rare earth mine on U.S. soil. Meanwhile, Beijing controls most of the world’s refining and is already retaliating by restricting exports.

America’s realizing — a bit late — that it let vital resources slip away… and now Trump wants to impose tariffs to claw back lost ground.

This marks another stage in his war with China. Trump also offered China the chance to “step up” with proposals to resolve the conflict. Suddenly, he seems eager to extend an olive branch — but the problem? Xi doesn’t seem interested… for now.

This new move on critical metals did move mining stocks a bit, and they’re still active in Australia this morning. But truthfully, it hasn’t had much impact on the overall market.

U.S. indices closed slightly down yesterday, as if we wanted to push higher, but something was holding us back. Fear, most likely — fear of another Trump tariff misstep.

Nvidia’s Backlash

Right now, nothing moves in the U.S. without being filtered through the lens of potential Trump impact. Want proof? Just look at what happened to semiconductors after the market closed yesterday.

NVIDIA announced a $5.5 billion impairment charge. Why?

Because they had recently developed chips called H20 — specifically designed to circumvent Biden’s restrictions on China. But now, those chips require an export license… and OF COURSE, Washington has no intention of granting it.

Result: unsold inventory, canceled orders, and obsolete stock. China still made up 13% of their revenue. And now? BAM!!! That’s pretty much gone.

Meanwhile, Huawei is rubbing its hands — the Chinese market is being handed to them on a silver platter.

Ironically, as NVIDIA gets shut out of China, it’s announcing a massive $500 billion investment in the U.S. — just to stay in the good graces of Washington and Trump.

The stock dropped 6% in after-hours trading, dragging AMD and Broadcom down with it.

Analysts will now have to revise their models to see how this affects the next 10 years — and it’ll likely be revised downward.

Short term: painful. Medium term: even worse. Because this marks a shift in the paradigm — the message is clear: U.S. tech must now choose between selling globally or staying cozy with the White House. Unless, of course, Trump pulls a 180 before Labor Day.

And that’s why futures are down 1% this morning and why all of Asia is in the red — Japan down 0.8%, Hong Kong nearly 3%, and China off by 0.9%.

Yep, if you thought the tariffs and trade war were over — I hope you got some rest, because it’s far from finished.

China is doing better… but that was before

China just released its GDP and it’s actually pretty good: +5.4% growth in the first quarter, much better than expected. Everyone’s clapping… except the markets, which are sulking as if they were served lukewarm rice and vegan steamed dumplings instead of shrimp.

Behind the fireworks, there’s a painful reality: YES, THEM AGAIN – Trump’s tariffs – because those haven’t hit yet and have no impact on the numbers just released. Which means – if things don’t change fast – the next figures may not have the same flair, and we could be heading straight for a Category 4 or 5 hurricane.

For now, retail sales are soaring (+5.9%), industry is in full swing (+7.7%) – showing that the government’s stimulus measures are working – but economists are already warning: “That was BEFORE.”

So, what now? Well, exports could plunge, and growth with it.

The future is very blurry, and stimulus is becoming urgent. Beijing might turn on the money printer or slash rates to avoid ending the year with just 3% growth – like an old diesel engine coughing its way up a hill. But will it be enough? And more importantly: will Trump drag them that far down? For now, this might just be the last ray of sunshine before a long winter… unless a solution is found.

Meanwhile, life beyond tariffs, rare earth metals, and semiconductors does exist – and it’s called: earnings season.

Yesterday we had Citigroup, Bank of America, and Johnson & Johnson.

For Citigroup, we could sum up the quarter like this: “When volatility scares investors… it makes traders rich.” Citigroup rode the rollercoaster of Q1, with trading commissions exploding and profits beating expectations. Moral of the story: when the boat rocks, someone’s selling life jackets. The stock ended higher – but no fireworks either.

Bank of America? Doing just fine, thanks. Profits up 11%, consumers still standing (for now), and a sweet $7.4 billion flowing into the coffers. The market liked it, and the stock rose nearly 3%.

As for Johnson & Johnson, legal problems aside, they’re still making money. Better-than-expected results, and their $15 billion acquisition of Intra-Cellular Therapies should help wrap up the year nicely after integration. They even raised their annual revenue forecast to $91.8 billion. The market, however, didn’t care much – a bit like the general mood yesterday: people want in, but they’re hesitant.

The Rest

Also worth noting: Jefferies lowered their S&P 500 target from 6,000 to 5,300. Not the first, won’t be the last. You can feel uncertainty starting to weigh on annual forecasts. Deutsche Bank is still at 7,000 by year-end, but feel free to place bets on when they’ll revise downward.

Today, we’ll get ASML’s earnings, where weakness is expected, but the real concern will be their outlook for the rest of the year. Again, this quarter it’s less about the results – we already expect the worst – and more about the vision ahead.

Also, Alcoa will release earnings tonight – always interesting given the current dance at the White House. Plus, Alcoa numbers are often seen as a barometer for the U.S. economy.

Elsewhere, we’ve got CPI in Europe, retail sales and industrial production in the U.S., business inventories, oil stock data, and the Atlanta Fed’s GDP NOW.

And above all else – at 7:15 PM tonight, Powell speaks… I don’t need to spell out what that could trigger. We know he won’t be swayed by Trump’s jabs, but he will have to address declining inflation with still-high rates. Saying tariffs will just re-fuel inflation won’t cut it…

One thing’s for sure: we’ll have plenty to talk about tomorrow!