Just as the week was barely over, we almost immediately got what looked like some good weekend news: the White House announced that smartphones, laptops, integrated circuits, transistors, semiconductor storage devices, and machines used for semiconductor manufacturing would be exempt from certain tariffs. It felt a bit like Tim Cook might’ve made a few calls and started looking into relocating Apple to a slightly more cooperative country. People were already thinking the week would kick off with a bang… but, of course, it’s not that simple. Quite the opposite, in fact.

Turn the other cheek

The joy was short-lived — because clearly, it’s not that simple, and things actually seem to be getting more complicated (especially in terms of uncertainty — something the market absolutely HATES, as a reminder). Shortly afterward, Commerce Secretary Howard Lutnick clarified that these products would be subject to separate tariffs in the coming months. And President Donald Trump added fuel to the fire on social media, stating that there were no tariff exceptions and that everyone would be hit, plain and simple.

If we go by weekend signals, markets should have opened sharply higher — but the closer we get to the open, the less obvious that becomes. At times, it even seems like we might open lower, simply because investors are fed up with being pulled in every direction in a state of total confusion, unable to trust anyone, all amid the most absolute uncertainty.

A Complicated Week

Before diving into this week’s agenda, there’s no need to revisit last week in detail — but it’s worth reminding that nothing has been resolved, and volatility seems to be settling in for the long haul. Market participants are practically paralyzed by the mere thought of Trump tweeting something new, something that could ONCE AGAIN completely reshape the market landscape. No need to rehash the whole of last week, but since we could barely manage two consecutive sessions moving in the same direction, and almost every day had swings of more than 2% — up or down — there’s not much more to analyze: the market is totally lost, and nobody is able to take a step back and make rational decisions anymore.

Let’s be honest: Trump’s management style isn’t exactly easy to handle, and drawing any kind of solid conclusion from it is a fool’s errand — technically, everything changes every 24 hours. With new updates on tariffs followed by sudden 180-degree reversals on announcements made just 72 hours prior, it’s hard to know what the President is running on, but it must be seriously potent stuff. In any case, I’m not risking much by saying that this week is likely to be spectacular again — and that words like confusion, uncertainty, and complete mess will be featured heavily in the media over the next few days.

The Return of the FED

Yes, uncertainty will be with us once again. Because alongside Trump’s economic and political twists and turns, the market will also face its first week of quarterly earnings reports, some economic figures — which frankly don’t matter much anymore, as we saw with last week’s CPI and PPI data — and, on top of all that, we’ll hear from Jerome Powell. He might either save our skins or drive a stake through our hearts while hurling cloves of garlic to make sure we don’t get back up.

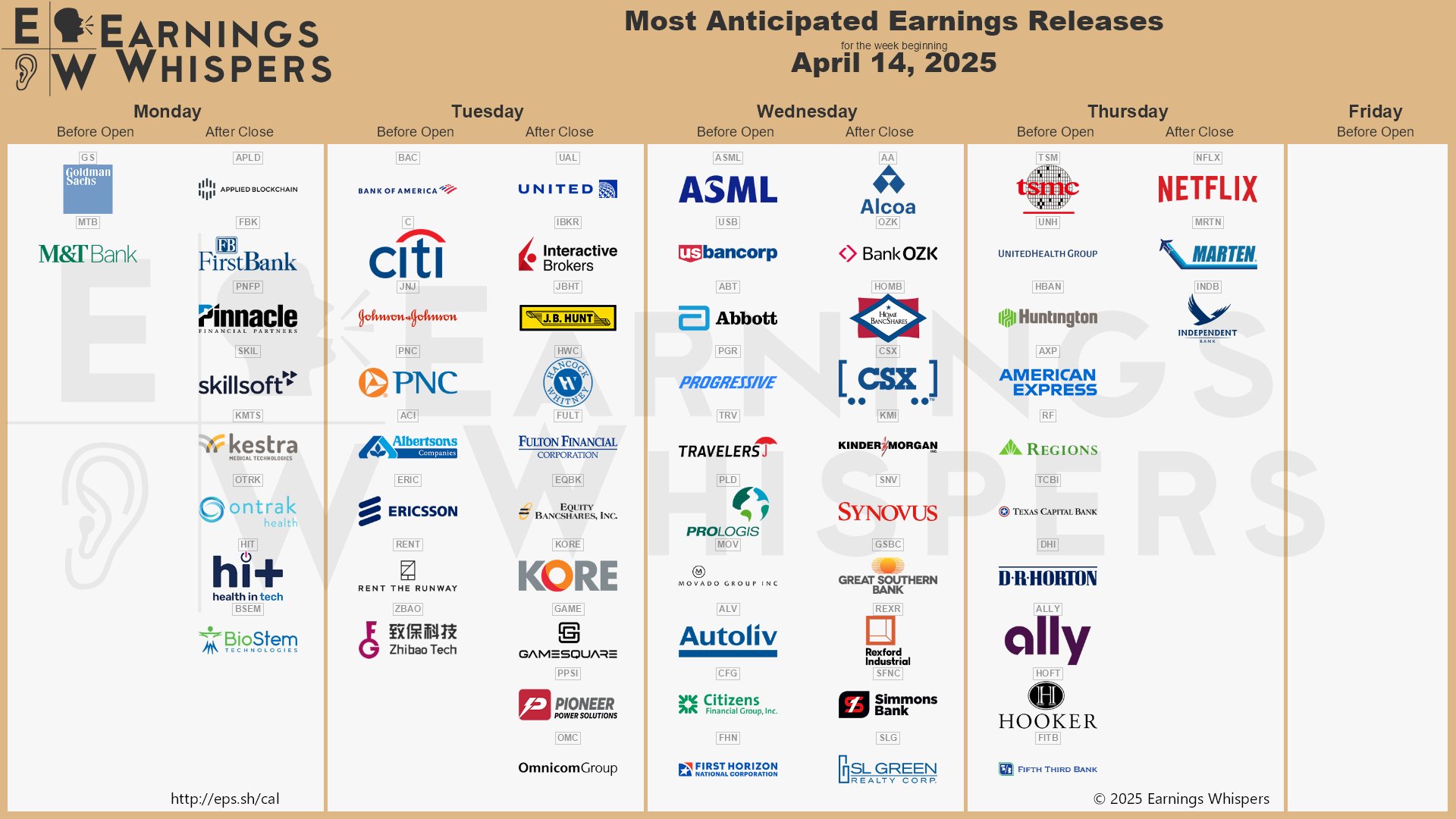

Indeed, the Fed Chair’s statements will be watched closely, and the slightest hint that the Fed might align itself with Trump’s desires could give financial analysts plenty more material to work into their forecasts — especially as they try to determine whether the odds of a recession are increasing. As for quarterly results, there’s some heavy-hitters lined up. Goldman Sachs will lead the charge, and things should go well — especially since the sector performed better than expected last Friday. Over the weekend, Goldman even raised its gold target from $3,300 to $3,700, warning that “in case of serious market risk and worry,” gold could even spike to $4,500. The analyst then went on to make the weather forecast for the New York region: possibly rain or snow, unless the wind dies down and the weather shifts north — in which case we might get sunshine with temperatures ranging between -5 and +42 degrees. Anyway…

In addition to Goldman Sachs, we’ll get results from Citigroup, Johnson & Johnson, ASML, and TSMC. There will be others, but these ones matter.

Market Expectations

Looking at current market expectations — which have been revised to rock-bottom levels — it’s likely that downside surprises will be few and far between. But the real risk lies in management comments and future outlooks. Given the current climate, any cautious projection — or worse, any statement suggesting that the rest of the year will be tough “given the current geopolitical and trade environment” — could cost companies an arm and a leg. We’ll talk more about that when the time comes.

One thing is certain: this week will begin under the sign of tariffs, just like the past few weeks. One more thing is guaranteed: market stress isn’t going away any time soon. The many erratic and unclear statements from U.S. authorities will continue to destabilize not just the markets, but also investors and consumers. Until things are clearly defined, it will be extremely difficult to find any real stability — and even harder to rebuild trust.

Bipolar Reflection

But if we were to take a moment and lay things (a bit) flat at the start of the week, it’s worth noting that, according to analysts (who change their minds every three days, let’s remember), what Trump is currently doing could either trigger a minor cramp in American growth… or a full-on cardiac arrest. In the best-case scenario, we’re talking sluggish growth, and in the worst-case, we’ll have to utter the word that must not be spoken: the word RECESSION.

The cause of all this stress? Customs tariffs, of course. Import taxes that are either exploding or about to explode off the charts—though no one really knows if it’s true or not, or whether the moratorium can be trusted. For now, tariffs are at 145% on Chinese goods and 10% for the rest of the world… and that could change in a heartbeat if Trump feels disrespected. Meanwhile, China is responding with all the subtlety of a tank (and honestly, who could blame them).

The result:

• Confidence is in freefall

• Investments are frozen or postponed to the Greek calends

• SMEs are freaking out

• Consumers are slowing down and scared

• Not to mention Wall Street, which seems to have caught a case of long COVID

The real risk in all this?

A panic spiral. If people start thinking things are going south, they spend less. So businesses sell less. So they lay people off. So people spend even less and some end up unemployed. The cycle feeds itself. And that’s when we get a real recession. For now, the only thing holding up is employment. But that’s for now. If that starts shaking too, then we get the full package: stagflation, recession, and Powell forced to play superhero again with his “Super Banker” costume to put out the fire. But can he really pull it off? And the real question is: how long will the markets tolerate this circus? Because in the end, they will be the ones to say STOP. And if Wall Street takes a nosedive, Trump could very well reverse course (again). He already did it last week when the bond market started grumbling… As the saying goes: “The markets will be the ultimate judge.”

What if, what if…

Now, we’ve all gotten the memo: Trump is the villain, Trump only does dumb stuff, and Trump is a certified idiot. But while the markets panic, economists scream recession, and finance pundits hyperventilate, what if we considered that all of this was intentional? What if the real strategy was simply to drag China and the rest of the world to the negotiating table and force them to find fast and lasting solutions?

Trump brought out the heavy artillery: 145% tariffs, threats flying left and right, slashing supply chains… It all sounds insane. No one would use this as a logical, rational strategy. But maybe a twisted mind would—just to shake things up, knowing full well it’s not sustainable.

The signs are there:

• A 90-day moratorium for everyone except China: classic divide-and-conquer to negotiate one-on-one

• No immediate implementation of pharma tariffs: it’s all bark, no bite

• Novartis announced billions in US investments: the big players are moving, unwilling to risk waiting. And even though they deny it’s because of the tariffs, it’s still a win for the White House.

Today, when you read the press, everyone assumes the tariffs are permanent. But if—hypothetically—it’s just a temporary tool, a negotiation lever, then the whole analysis falls apart.

• The real impact on prices will be limited, even nonexistent

• Inflation won’t spike as expected (in fact, judging by last week’s CPI, that’s exactly what’s happening)

• Growth will slow… but no crash (and worst-case, the Fed can just lower rates to support the economy—they’re good at that, much better than fighting inflation)

• And above all: if that’s the case, then this is an undeniable buying opportunity

Trump’s not an economist—we can agree on that. But he can negotiate. He wrote The Art of the Deal. He creates fear to gain concessions. And it works. Markets overreact, because markets hate uncertainty. But if Trump gets a “win-win” deal with China tomorrow, and tariffs vanish as quickly as they appeared… the rebound will be brutal. And those who kept a cool head will be the real winners.

So instead of focusing on economists screaming and this month’s disaster forecasts, what if we looked at the situation for what it really is: a giant negotiation in progress?

What if Trump is using chaos as a diplomatic tool?

What if we’re actually in the best time to invest against the crowd, while everyone else is curled up in fear?

Because in markets, it’s not the one who panics first who wins. It’s the one who understands what the other guy is really trying to do.

And now, the week can begin!

After this little Monday morning reflection—which felt important to lay out—we can kick off the week with our usual level of stress and see how far the markets are willing to take us. We’re starting the week with a new round of tariffs, but they’re temporary, and at least for today, that’s helping Apple and Nvidia. For now, all of Asia is up celebrating: Japan is up 1.6%, Hong Kong is soaring nearly 2.7%, and China is climbing 1%, while futures are showing a 0.9% rise and have been bouncing all over the place since 3 AM. Predicting tonight’s close? Good luck with that…

Meanwhile, oil is at $61.24, gold is at $3,245, and Bitcoin is worth $85,000. And as for everything else, the probability that we’ll hear about tariffs and Donald Trump today is roughly 350%.

Have a great day, keep an eye on the Treasury yields because they’re moving and scaring everyone, and I’ll see you tomorrow morning for more adventures.

See you tomorrow!